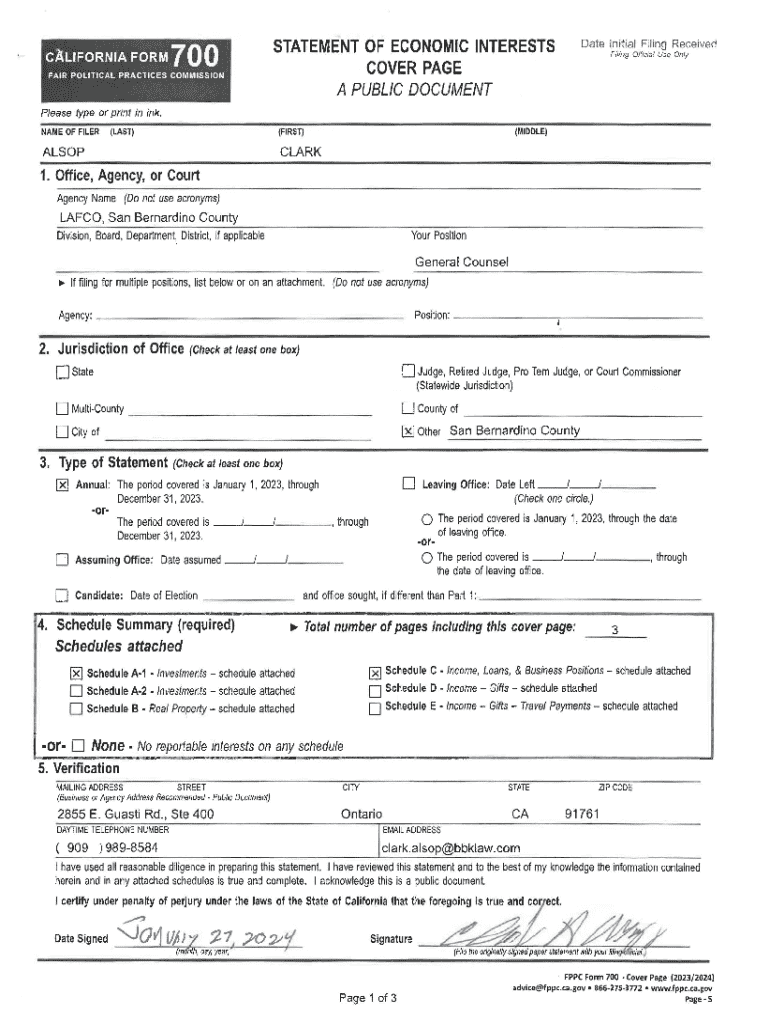

Get the free California Form 700

Get, Create, Make and Sign california form 700

How to edit california form 700 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out california form 700

How to fill out california form 700

Who needs california form 700?

California Form 700: A Complete How-to Guide

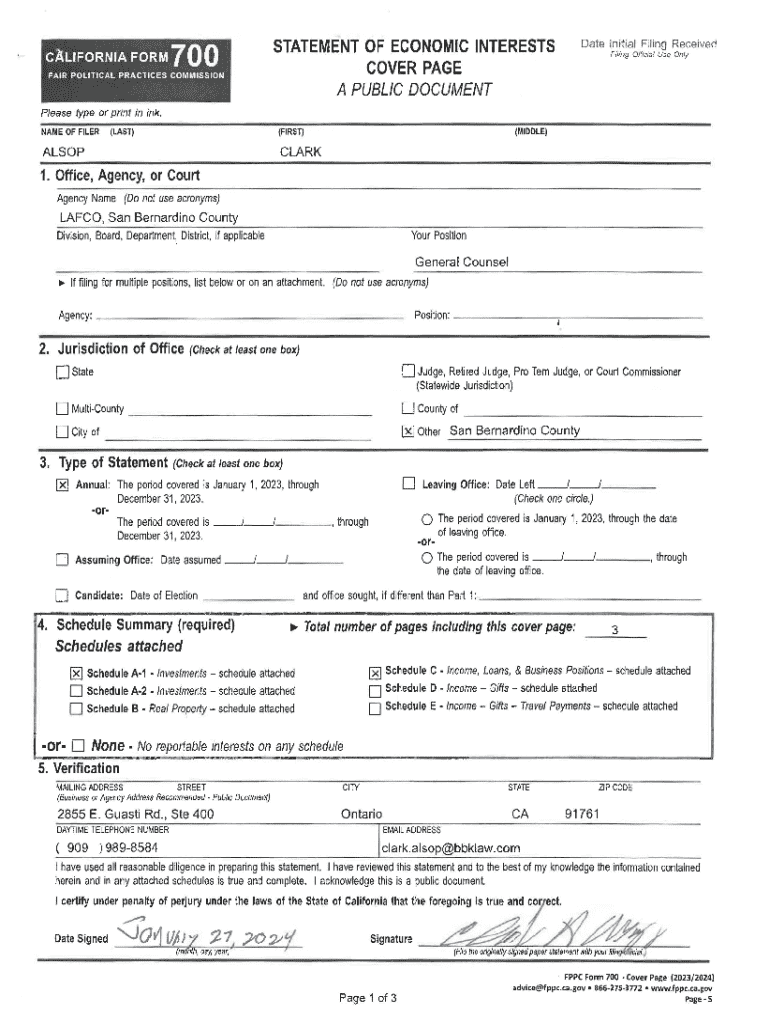

Understanding Form 700: Statement of Economic Interests

The California Form 700, also known as the Statement of Economic Interests, serves a pivotal role in fostering transparency among public officials. This document is essential for ensuring accountability, allowing the public to scrutinize potential conflicts of interest that might arise when individuals in positions of power also have substantial financial ties that could influence their decisions.

Filing this form is not solely a bureaucratic exercise; it's a legal requirement for those designated under certain criteria, and it establishes public trust in governance. It's crucial to understand who must file and what specific economic interests need to be disclosed.

Who must file Form 700?

Understanding who is subject to filing the California Form 700 is imperative for compliance. Individuals who hold positions of authority within governmental structures and those who assist in formulating or influencing policies are required to submit this form. Not only does this include elected officials, but also appointed officials and certain employees within the public sector.

Additionally, candidates for office must file this form, especially during the election cycle. However, it's essential to note there are exemptions which apply to certain officials and roles, allowing for some flexibility in compliance. To ensure clarity, understanding these exemptions is critical to avoid unnecessary filings.

Filling out Form 700

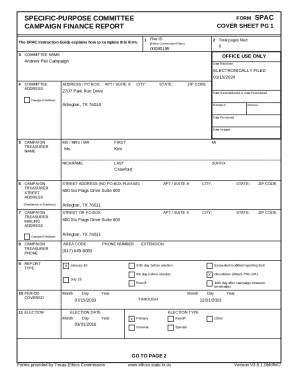

Completing the California Form 700 can seem daunting, but breaking it down into sections makes it manageable. The form consists of several specific sections that require detailed information about various economic interests. It begins with general cover page details, followed by sections dedicated to different types of disclosure, from income to investment holdings.

Each section is vital for capturing comprehensive information necessary for public transparency. A common pitfall is assuming that incomplete disclosures are acceptable; they are not. Ensuring that every required section is filled out accurately—and revisited as personal circumstances change—is crucial.

To enhance the accuracy of filings, it’s important to familiarize yourself with common mistakes. Many filers fail to update their disclosures or misinterpret the requirements. Staying diligent about your economic interests and adhering to filing standards significantly reduces the risk of penalties.

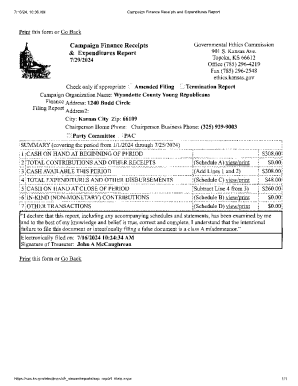

Additional schedules

In some situations, detailed additional disclosure is necessary beyond what the standard Form 700 covers. Various schedules are attached that provide specific formats for disclosing income, gifts, real property, and business positions. Understanding when and how to use these schedules can help ensure that all relevant information is accounted for.

Each schedule serves a distinct purpose and requires specific information, contributing towards a clear picture of the filer's economic interests. Familiarizing yourself with these additional schedules helps streamline the filing process and ensures compliance.

Amendments and updates

Filing an accurate Form 700 is not a one-time task. As financial situations evolve, so too must these filings. Understanding how and when to amend your statement is crucial for remaining compliant with California's regulations. Specific changes, such as acquiring new income sources or gifts, necessitate an update to your Form 700.

The process of amendment also requires prompt action to avoid penalties. Timely submissions not only help ensure compliance but also foster trust and accountability in public office holders. Familiarity with the procedure for submitting amendments is essential, as knowing the correct steps can save considerable time and potential issues.

Special considerations

Consultants and independent contractors face unique challenges when it comes to Form 700 compliance. It is important to identify when these positions may require disclosures as they relate to specific contracts or engagements. Each case may have different filing implications, so clarity on shareholding or decision-making influence is necessary.

In addition to this, individuals must arm themselves with knowledge regarding the limits and regulations on gifts received, particularly in the context of travel expenses. Establishing awareness about what constitutes a reportable gift versus those that do not needs direct attention. Late submissions can have fiscal repercussions, and knowing the steps to mitigate penalties is equally crucial.

Searching and accessing filed Form 700s

Transparency surrounding Form 700 filings is vital for public accountability. Whether you're looking to check an official's filings or assess compliance within a specific governmental body, knowing how to access these documents is imperative. There are online databases available for public viewing that simplify this process, allowing anyone to search for specific filings.

Local jurisdictions may vary in how they handle access to filed forms. Understanding the methods for searching both state-level and local submissions ensures that interested parties can efficiently gather the necessary information regarding disclosures.

Support and resources

Individuals must know where to seek assistance regarding Form 700, whether it's questions about filling out the form or understanding specific regulations. Key contact numbers for inquiries can help expedite the process of clarifying your responsibilities. Furthermore, online resources often provide invaluable information that can aid in navigating complexities.

Using advanced tools like pdfFiller significantly streamlines the form management processes. With capabilities for editing, signing, and collaborating on forms like the California Form 700, individuals and teams can ensure thoroughness and compliance while managing documents from a cloud-based platform. This addresses the core needs of users looking for ease of access and collaboration.

Quick reference tools

Staying organized throughout the Form 700 filing process is made easier with quick reference tools. Having accessible checklists for required disclosures can help ensure compliance, while timelines and deadlines at-a-glance allow for proper planning. Familiarity with relevant terminology is also key to avoiding confusion during the filing process.

Developing a personal or shared glossary of key terms related to Form 700 not only enhances understanding but will also aid in effective communication among peers. Utilizing these tools gives clarity and confidence in fulfilling your obligations.

Sharing and connecting

Creating a culture of awareness about filing obligations can engage a larger audience in understanding the importance of transparency. Leveraging social media platforms to share insights can spark meaningful dialogue around the topic while promoting adherence to the requirements. Community resources can also play a part in educating fellow officials and interested parties about compliance expectations.

Connecting with other filers can be beneficial for sharing tips and addressing common questions. Engaging on forums or platforms fosters a sense of community while enabling users to navigate complexities together. Such interactions benefit all parties involved, enhancing the overall understanding of the filing processes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my california form 700 directly from Gmail?

How do I execute california form 700 online?

How do I edit california form 700 on an iOS device?

What is california form 700?

Who is required to file california form 700?

How to fill out california form 700?

What is the purpose of california form 700?

What information must be reported on california form 700?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.