Get the free Fr Y-9c

Get, Create, Make and Sign fr y-9c

Editing fr y-9c online

Uncompromising security for your PDF editing and eSignature needs

How to fill out fr y-9c

How to fill out fr y-9c

Who needs fr y-9c?

A Comprehensive Guide to the FR Y-9C Form

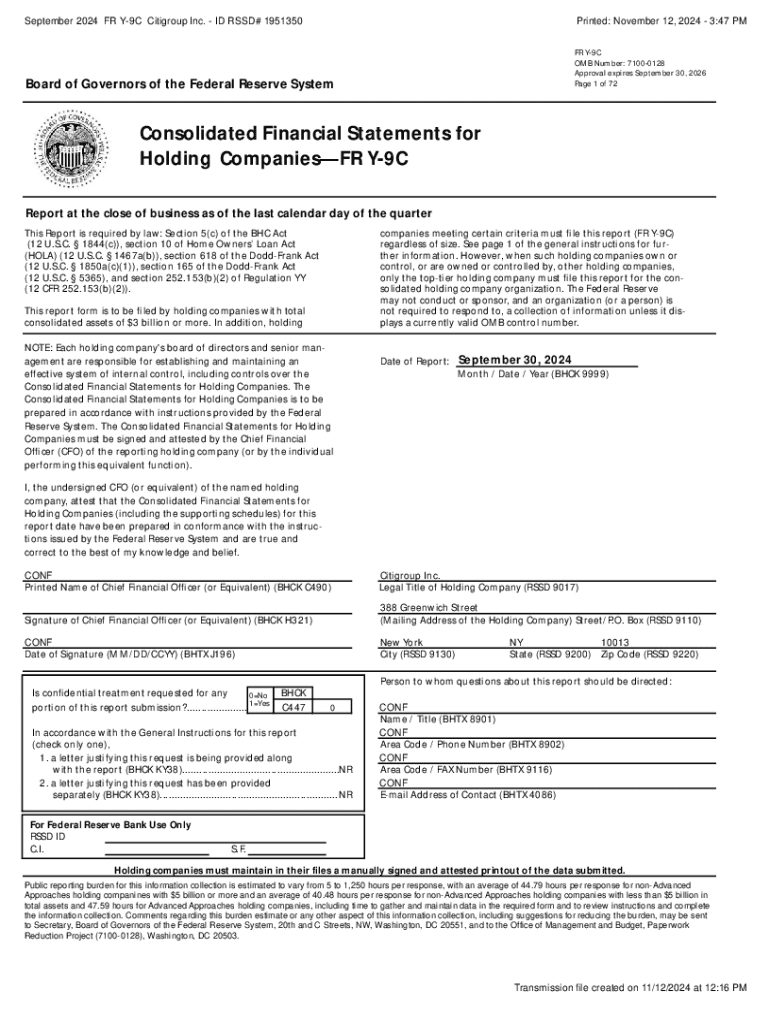

Overview of the FR Y-9C form

The FR Y-9C form is a critical report designed for bank holding companies in the United States. It provides regulators like the Federal Reserve with a comprehensive snapshot of a holding company’s financial condition, including its balance sheet, income statement, and changes in equity. The main purpose of the FR Y-9C is to facilitate the ongoing assessment of the financial health and compliance of these companies, which is vital for maintaining the overall stability of the financial system.

The importance of the FR Y-9C cannot be underestimated. It serves not only as a tool for regulatory oversight but also enables bank holding companies to maintain transparency regarding their financial status. This transparency is crucial for shareholders, potential investors, and the broader financial community.

Understanding the components of the FR Y-9C form

The FR Y-9C form consists of several key sections that together provide a detailed financial portrait of the holding company. Each section contains information that regulators and analysts rely on to evaluate the company’s stability and compliance with financial regulations.

These sections include a balance sheet detailing assets and liabilities, an income statement showcasing revenue and expenses, a statement of changes in equity reflecting any adjustments to shareholders’ equity, and notes that explain the financial statements and provide additional context on figures. Understanding these sections is crucial for accurate reporting and compliance.

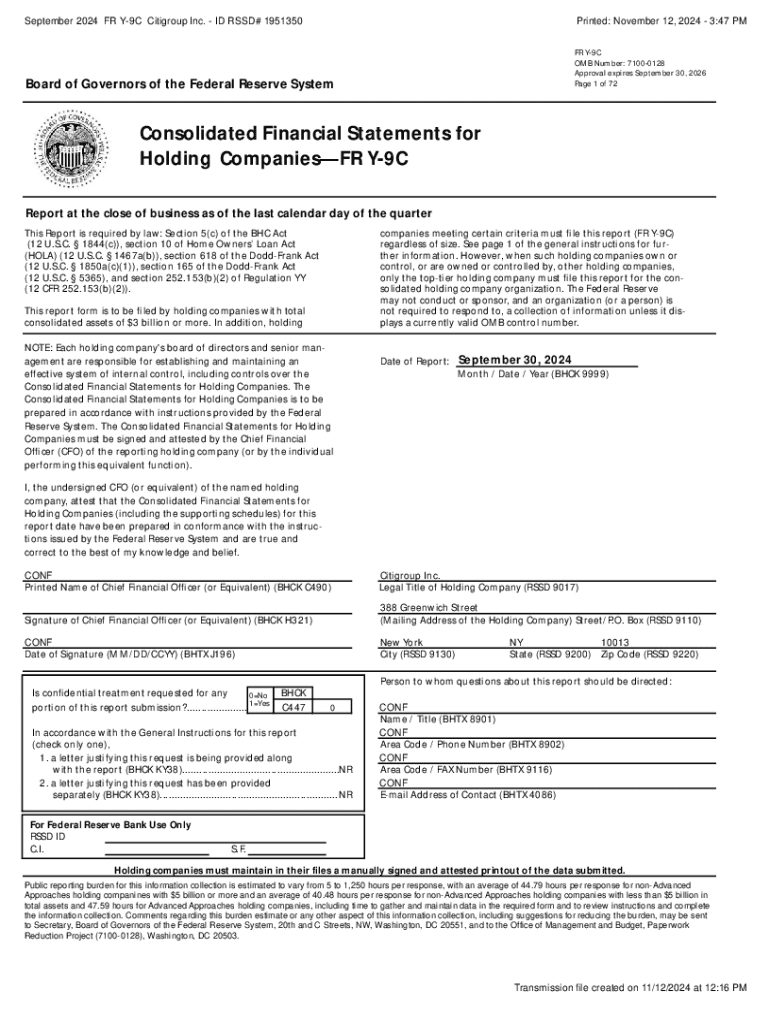

Filling out the FR Y-9C form

Filling out the FR Y-9C form requires careful preparation and attention to detail. Before starting the form, it is essential to gather all necessary financial data, including previous filings, accounting records, and up-to-date financial statements. This preparation will ensure a smoother and more accurate completion process.

Each section demands precise reporting, particularly in terms of assets and liabilities. Accuracy in income reporting is equally important to avoid discrepancies that could raise red flags during regulatory reviews. Making sure that all data is consistent and matches with internal records is a crucial step in completing the form.

Common errors while completing the FR Y-9C include misreporting figures, neglecting to include required schedules, and failing to adhere to the latest regulatory updates. Extra caution is needed to ensure all numbers align with underlying financial documentation.

Editing and reviewing the FR Y-9C form

Utilizing tools such as pdfFiller can enhance the editing and reviewing process of the FR Y-9C form. To start, users can easily upload their completed forms into pdfFiller’s platform, where a variety of editing tools are available. These tools include text boxes for notes, options to sign documents electronically, and the ability to make corrections as needed.

Collaborative features in pdfFiller allow multiple team members to work on the form simultaneously, facilitating real-time collaboration. This teamwork can be invaluable in ensuring the accuracy and completeness of the submission. By leveraging these interactive features, banks can streamline their filing process significantly.

Submitting the FR Y-9C form

The submission of the FR Y-9C form is typically done electronically through the Federal Reserve’s reporting platform. It is crucial to meet all submission deadlines, as late filings could incur penalties or draw scrutiny from regulators. Keeping a calendar of important dates can help maintain compliance.

After the submission, confirmation is necessary to ensure everything was filed correctly. Besides checking the confirmation email from the Federal Reserve, keep a backup copy of the submitted form for your records. If there are errors or issues with the submission, addressing them promptly is essential to avoid further complications.

Managing and storing your FR Y-9C form

Effective document management is vital for handling the FR Y-9C form and related submissions. Using a platform like pdfFiller, companies can create folders to archive past filings, making it easy to reference historical data when required. Additionally, implementing version control can help track changes over time and ensure all team members are working from the most current version of the form.

Since the FR Y-9C involves sensitive financial information, ensuring document security is paramount. pdfFiller employs advanced security measures that safeguard documents against unauthorized access and data breaches. Understanding the importance of securing financial data will contribute to overall compliance and protect the company's reputation.

Tools and information for FR Y-9C reporting

pdfFiller offers a variety of interactive tools designed to simplify the FR Y-9C form filing process. Users can take advantage of templates that help guide them in completing the form correctly, alleviating some of the stress associated with potential compliance issues. The platform also features examples that can serve as a reference point for accurately reporting financial data.

In addition to tools offered, staying connected with regulatory resources and support is essential. Many regulatory bodies provide contact information for inquiries regarding the FR Y-9C form, making it easier to get assistance when needed. A well-rounded understanding of the filing process often incorporates access to FAQs that address common concerns and challenges.

Keeping up to date with regulatory changes

Regulatory changes can have a significant impact on the requirements for the FR Y-9C form. Staying informed about updates is crucial for compliance and avoiding penalties. Regularly checking the Federal Reserve's website or subscribing to financial regulatory newsletters can be effective strategies for staying updated.

In addition to regulatory websites, several industry associations and online forums provide insights into changes in reporting requirements. Engaging with these resources can help bank holding companies remain proactive in their compliance efforts and understand broader trends affecting financial reporting.

FAQs about the FR Y-9C form

Common queries surrounding the FR Y-9C form often include questions related to deadlines, required information, and common errors encountered during the filing process. It’s essential for filers to comprehend which specific data is required in each section and how to avoid frequent pitfalls during submission.

Many users also seek guidance on how to interpret data reported in previous quarters and the implications of changes in financial conditions on the current filing. Addressing these FAQs helps create a more informed filing environment and enhances compliance efforts.

Stay connected with pdfFiller

Remaining connected with pdfFiller allows users to keep abreast of updates and innovations within the platform that can enhance the filing experience. Following pdfFiller on social media and engaging with the community are effective ways to learn more about tips, tricks, and new features as they become available.

Moreover, user feedback plays a vital role in improving the platform and ensuring it meets users’ needs. Engaging in community forums can provide valuable insights into real-world filing experiences, further empowering users to navigate the complexities of the FR Y-9C form effectively.

User empowerment

At pdfFiller, users are empowered with comprehensive solutions that allow them to manage their FR Y-9C form more effectively. The cloud-based platform enables seamless editing, e-signing, collaboration, and document management, which is essential for individuals and teams involved in the filing process.

This empowerment translates into greater efficiency in the preparation and submission of regulatory forms like the FR Y-9C, ensuring compliance with the necessary requirements. Overall, pdfFiller stands out as a leading solution for users seeking to navigate the intricacies of financial reporting with ease and professionalism.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my fr y-9c in Gmail?

Can I create an eSignature for the fr y-9c in Gmail?

How do I edit fr y-9c straight from my smartphone?

What is fr y-9c?

Who is required to file fr y-9c?

How to fill out fr y-9c?

What is the purpose of fr y-9c?

What information must be reported on fr y-9c?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.