Get the free W-9

Get, Create, Make and Sign w-9

How to edit w-9 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out w-9

How to fill out w-9

Who needs w-9?

W-9 Form: A Comprehensive How-to Guide

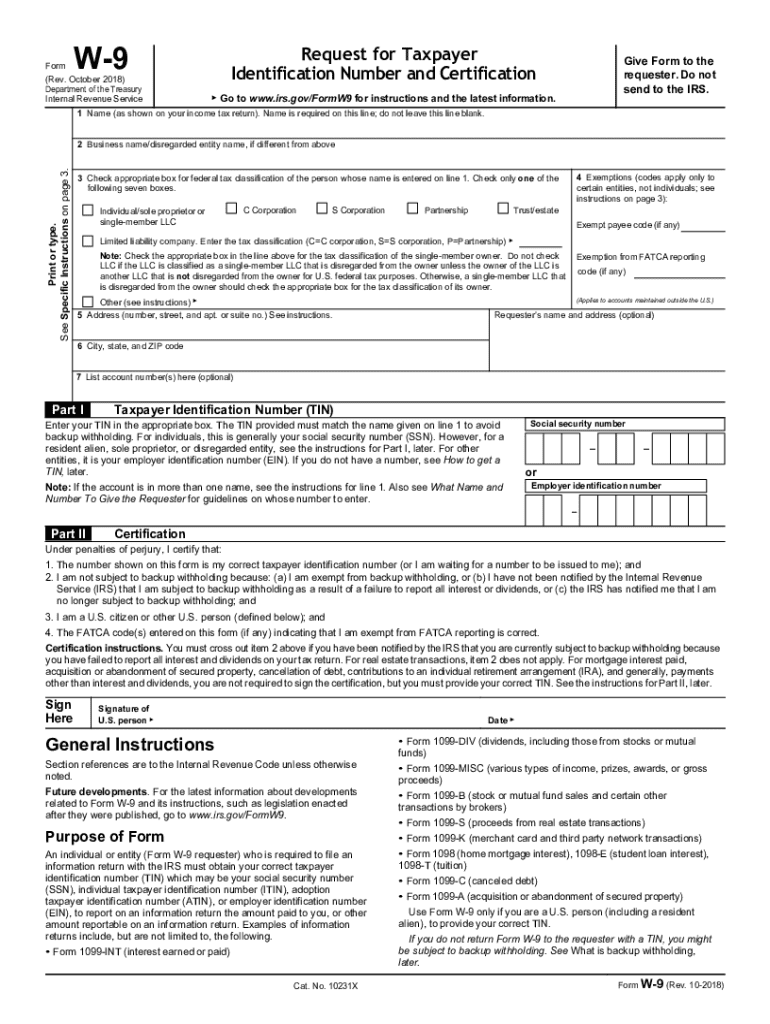

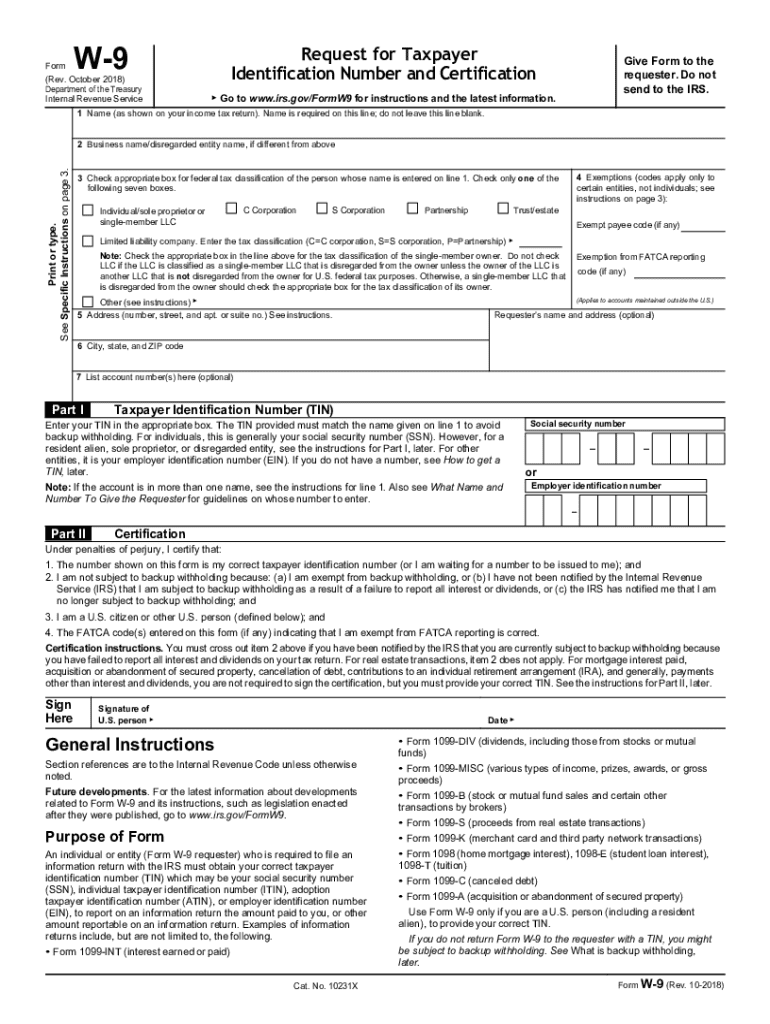

Understanding the W-9 form

The W-9 form is a critical tax document used in the United States for information reporting. Its primary purpose is to provide the correct Taxpayer Identification Number (TIN) to entities that must report income paid to you to the IRS. Whether you’re a freelancer, contractor, or a business owner, filling out a W-9 ensures compliance with federal tax reporting requirements.

The importance of the W-9 form cannot be overstated, as it helps prevent backup withholding. When you provide accurate information, clients and businesses can accurately report the income they’ve paid over the year, which ultimately streamlines the tax filing process for both parties.

Who needs to fill out a W-9 form?

Several entities may need to complete a W-9 form. Individuals, such as freelancers and self-employed persons, typically fill out a W-9 when they receive payments that need to be reported to the IRS. Similarly, businesses—including corporations, partnerships, and Limited Liability Companies (LLCs)—fill out W-9 forms for various tax-related reasons.

Moreover, specific circumstances may trigger the need for a W-9. For example, if you’re hired by a new client or start a new contract that includes payment reporting, providing a W-9 helps ensure proper documentation in the eyes of the IRS.

Step-by-step guide to completing the W-9 form

Completing the W-9 form is straightforward, but it must be done accurately to avoid processing issues. Here is a step-by-step guide to help you.

Common mistakes to avoid when completing a W-9

Common pitfall areas include entering an incorrect TIN, which could match your name inaccurately or using the wrong name entirely. Omitting required sections also leads to delays, necessitating resubmission. Additionally, misunderstanding the certification statement can result in legally binding implications without proper knowledge.

It’s vital to take your time when filling out a W-9 form and consult resources or professionals when you’re unsure about specific sections.

Submitting your W-9 form

Once the W-9 form is completed, you need to submit it to the party that requested it. This can typically be done via email, traditional mail, or even through digital platforms like pdfFiller, which streamlines the process.

Best practices for submission include verifying that you’re sending it to the correct address, ensuring your document is secure, and keeping a copy for your records. Document retention is crucial because it serves as proof of the information you've submitted.

W-9 form use cases

The W-9 form is most commonly used in business transactions, especially when a client or employer requires it for tax reporting. Furthermore, financial institutions may request a W-9 to manage your investments or bank accounts effectively.

Non-profits and organizations may also utilize the W-9 to provide accurate tax documentation for fundraising activities and donor records, ensuring transparency and compliance.

What happens after you submit a W-9?

Once your W-9 form is submitted, the requester uses the information for tax reporting purposes, typically filing a 1099 form to the IRS. This allows for accurate income reporting for the individual or business that filled out the W-9.

However, be aware of backup withholding. If your TIN is incorrect or omitted, the IRS mandates that a percentage of your income be withheld for tax purposes, making accuracy critical to avoid unnecessary deductions.

Digital management of your W-9 form

Utilizing cloud-based tools like pdfFiller offers numerous advantages for managing your W-9 form. With it, you can edit, sign, and store your documents securely in one place. This eliminates the risk of losing your form or having unauthorized access to sensitive information.

You also gain the ability to collaborate with others, allowing for effective sharing of the W-9 without the hassles of printing or scanning. Storing documents digitally ensures that they remain organized and easily accessible whenever you need them.

Frequently asked questions (FAQs) about the W-9 form

One common question is how often a new W-9 form should be filled out. Generally, you only need to make a new W-9 if there are changes to your information, such as a name or address change, or when a new payment arrangement arises.

Another issue that arises is how to address information updates on a W-9. Simply fill out a new form with the updated data and submit it to the requesting party. Always consider the risks of sharing your W-9; ensure you only provide it to trusted entities to protect your identity.

Related forms to consider

When filling out a W-9, it’s helpful to understand how it interacts with other tax forms. The W-2 form, for instance, summarizes an employee’s wages and taxes withheld, whereas the W-9 is primarily about the reporting of income paid to freelancers or self-employed individuals.

Similarly, the 1099-MISC form is closely related as it reports payments made to independent contractors, aligning with the income information provided on a W-9.

Final thoughts on the W-9 form process

Providing accurate tax information through the W-9 form is paramount. Maintaining updated documents ensures compliance and fosters a seamless tax reporting process. By utilizing tools like pdfFiller, you can manage your W-9 and related documents efficiently from anywhere, ensuring a hassle-free experience.

As taxes continue to evolve, being informed about forms like the W-9 and other related documents is key to successfully navigating your financial obligations. Ensuring all details are accurate promotes efficiency, reduces delay, and enhances your overall interaction with tax authorities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send w-9 for eSignature?

How do I edit w-9 online?

Can I edit w-9 on an Android device?

What is w-9?

Who is required to file w-9?

How to fill out w-9?

What is the purpose of w-9?

What information must be reported on w-9?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.