Get the free W-9

Get, Create, Make and Sign w-9

How to edit w-9 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out w-9

How to fill out w-9

Who needs w-9?

The W-9 Form: A Comprehensive How-To Guide

Understanding the W-9 form

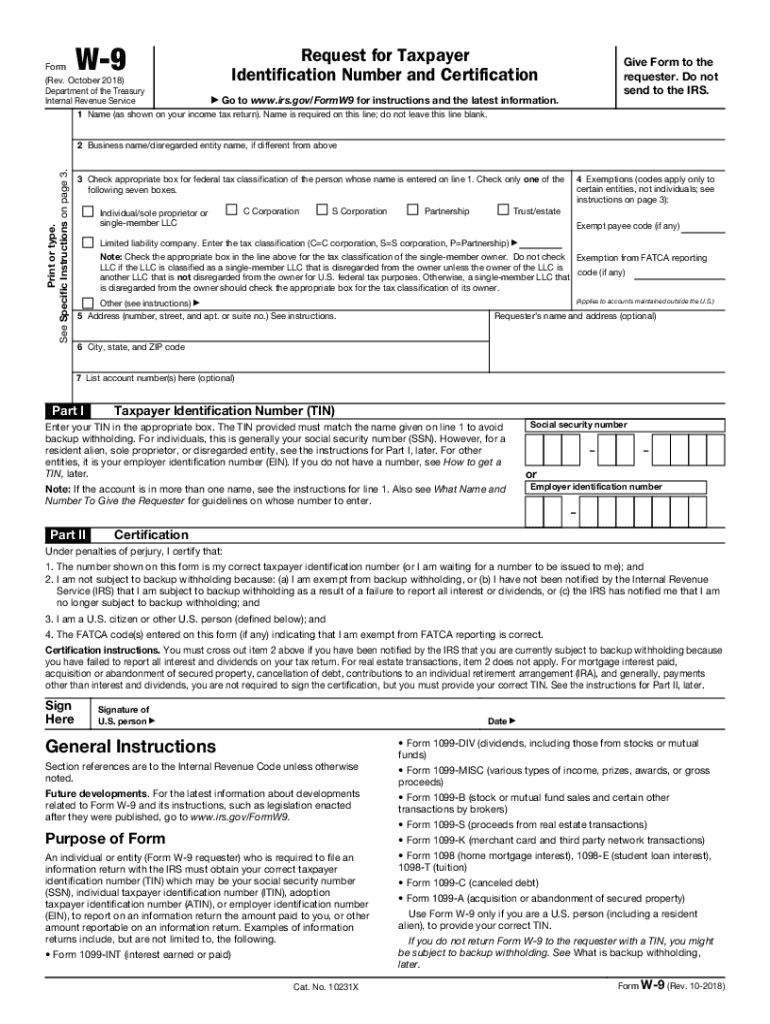

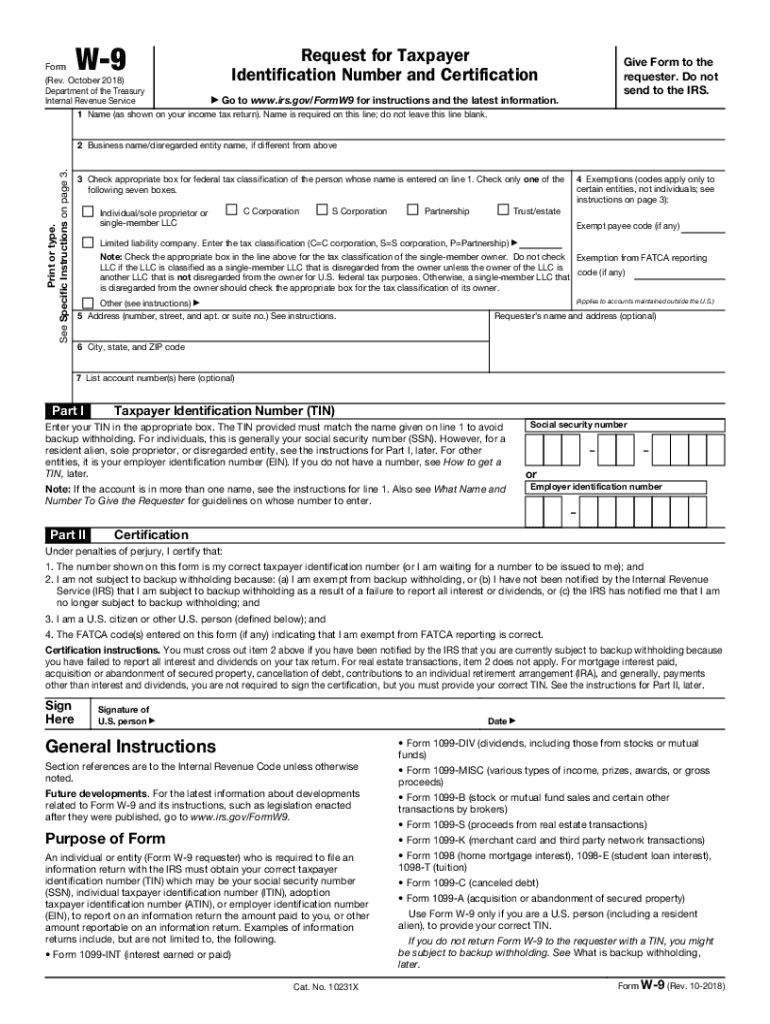

The W-9 form is a vital document in the realm of tax reporting, primarily used by individuals and businesses in the United States. This form, officially known as the 'Request for Taxpayer Identification Number and Certification,' serves to collect the taxpayer identification number (TIN) of a payee, ensuring accurate reporting and compliance with IRS regulations. Understanding its role is essential for freelancers, contractors, and companies who engage in business transactions.

Filling out a W-9 correctly is crucial since it provides necessary tax information to the payer, facilitating the accurate reporting of payments made throughout the tax year. Stakeholders like independent contractors, freelancers, and companies engage in transactions that require the completion of this form. Thus, understanding who needs to fill out a W-9 is equally important.

Who needs to fill out a W-9?

Components of the W-9 form

The W-9 form consists of several key components, each carrying substantial weight in the realm of accurate tax reporting. Starting with basic identification, the form asks for your name and any business name under which you operate, ensuring clarity for the payer. It's crucial to provide the correct tax classification, which may involve understanding your entity type – whether you're an individual, a corporation, or a partnership.

Additionally, you will need to supply your address and the corresponding zip code. Most importantly, the W-9 requests your taxpayer identification number (TIN), which can be your Social Security number (SSN) or an Employer Identification Number (EIN) for businesses. Ensuring accurate and complete entries in these sections can mitigate future tax-related headaches.

Common mistakes to avoid

Filling out the W-9 form

Completing the W-9 form is a straightforward process, but it’s essential to approach it systematically. First, gather your necessary information, such as your full name, business name (if applicable), permanent address, and taxpayer identification number. Having all this on hand will streamline the process and reduce the risk of missing any critical details.

You have the option to fill out the W-9 form online via pdfFiller or download a PDF version to print and complete manually. When completing the form, pay attention to each section, ensuring that your TIN is accurate, as this is often a source of errors.

Common pitfalls in filling out the W-9

Tips for accurate submission

Submitting the W-9 form

Once the W-9 form is completed, the next step is submission. There are two primary methods for submitting your W-9: electronically via email or physically through the mail. With the increase in digital transactions, sending your completed form via email is often preferred for its speed and convenience.

However, it's crucial to maintain best practices when submitting your form, especially when dealing with sensitive information, such as your TIN. Always ensure that the recipient of the W-9 is legitimate and that you utilize secure methods of sending personal data.

Best practices for secure submission

The importance of the W-9 in different arrangements

The use of the W-9 form varies greatly depending on the nature of the business arrangement. For example, in an employer-employee relationship, a W-9 is not typically used since employees receive a W-2 instead. However, when freelancers or independent contractors are engaged, the W-9 is essential for tax purposes, ensuring the employer can accurately report payments made to the contractor.

In contractor-business arrangements, the W-9 serves to establish independent contractor relationships, which is crucial for correctly handling tax matters and compliance. Likewise, in financial institution interactions, a W-9 may be required for opening accounts or obtaining loans, reinforcing the form's significance not just within the realm of taxes but also in broader business transactions.

Employer-employee relationship

Special considerations

Filling out the W-9 form not only impacts tax reporting but also involves specific implications regarding backup withholding. Backup withholding may apply if the taxpayer fails to provide a correct TIN or if the IRS notifies the payer of discrepancies. Understanding your obligations can help prevent unexpected tax liabilities down the road.

Furthermore, it’s important to grasp the regulations surrounding digital signatures, especially if using platforms like pdfFiller. Electronic signatures are generally accepted but must comply with federal and state regulations to ensure validity.

Tax implications of the W-9 form

Frequency of submitting the W-9

The W-9 form isn't a one-time submission for the entire duration of a business relationship. It's essential to update your W-9 periodically based on specific changes such as a shift in your address, changes in tax classification, or any changes in personal information that may affect your tax reporting.

How often should a W-9 be updated?

Navigating common challenges with the W-9 form

Mistakes can happen while filling out the W-9 form, and knowing how to address them swiftly is crucial. If you make a mistake, promptly correct the W-9 to ensure payments made are reported correctly to the IRS. The corrections process isn't burdensome but requires that you complete a new form reflecting accurate information.

Handling requests from businesses or clients for your W-9 should be approached with care. Always confirm the legitimacy of the request, especially when unsolicited. If approached for a W-9, ensure the entity requesting it has a valid business reason for needing it.

What to do if you make a mistake?

Resources for further assistance

Navigating the ins and outs of the W-9 form can be made easier with tools found on pdfFiller. This platform offers templates and interactive features that simplify the completion and submission process. Users can track submissions, ensuring they've sent the correct forms to the right parties without confusion.

For additional guidance, accessing IRS resources can clarify specific queries regarding your W-9 form. It's always a good practice to stay informed about current regulations and requirements surrounding tax forms to ensure compliance.

Helpful tools and interactive features on pdfFiller

Quick links for related documents

In addition to mastering the W-9 form, it can be helpful to familiarize yourself with other related IRS forms, such as the W-2 or 1099. Understanding these forms aids in grasping your tax obligations more fully. The IRS website is an excellent resource to access these documents and find comprehensive tax guidance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send w-9 for eSignature?

How do I make edits in w-9 without leaving Chrome?

Can I edit w-9 on an Android device?

What is w-9?

Who is required to file w-9?

How to fill out w-9?

What is the purpose of w-9?

What information must be reported on w-9?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.