Get the free W-9

Get, Create, Make and Sign w-9

How to edit w-9 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out w-9

How to fill out w-9

Who needs w-9?

W-9 Form How-to Guide

Understanding the W-9 form

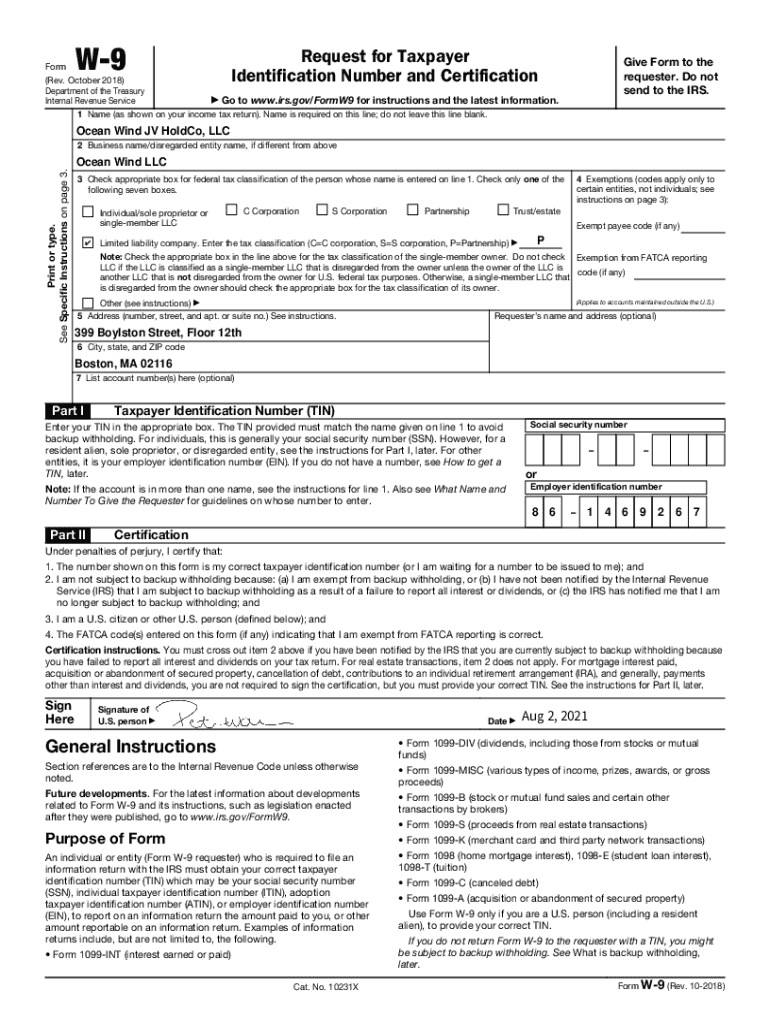

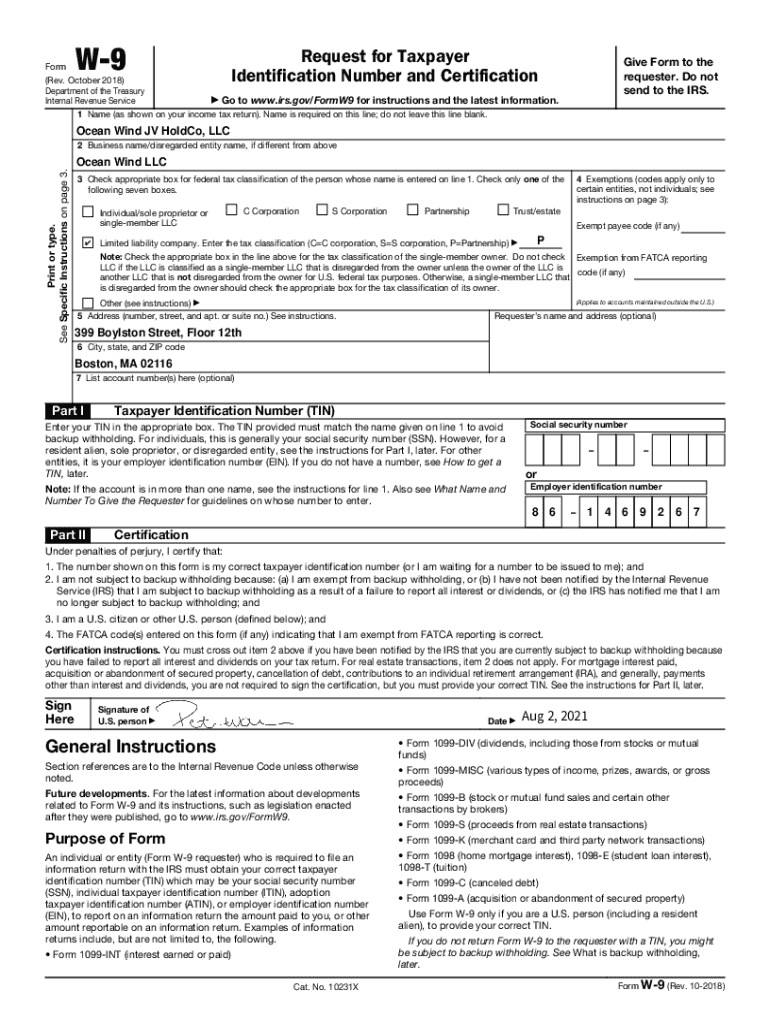

The W-9 form is a crucial document utilized primarily for tax purposes, specifically in the United States. Designed by the Internal Revenue Service (IRS), it enables individuals and entities to provide their Taxpayer Identification Number (TIN) to various requesters, including employers and financial institutions. The form's primary role is to ensure that accurate information is reported to the IRS, facilitating the proper filing of income taxes.

For individuals and businesses, the W-9 form serves as a means to authorize the reporting of income, ensuring that payers correctly report the income paid to these individuals. This is particularly important for freelancers, contractors, and anyone receiving payments without traditional employment benefits. Understanding this form is essential for complying with IRS regulations and avoiding potential penalties.

In essence, the W-9 form stands as a foundation for accurate tax reporting. It is integral not just for the taxpayer but also for the payer, as it protects both parties during the tax reporting process.

Complete guide to filling out the W-9 form

Filling out the W-9 form accurately is vital to ensure that your taxpayer information is correctly recorded. Below is a step-by-step guide to assist you in completing the form efficiently.

By following these steps, you can provide the necessary information required on the W-9 form while minimizing the risk of errors that could lead to complications down the line.

Common mistakes to avoid

Even a minor mistake on the W-9 form can lead to significant issues later. Common pitfalls include providing an incorrect TIN or failing to check the right tax classification box. Ensure that the name and address match those on your tax documents and double-check all entries before submission.

Another mistake to avoid is neglecting to sign and date the form. Without your signature, it may not be considered valid by the requesting party, which could delay payments or create issues with tax reporting.

Tips for accurate completion

To ensure an accurate completion of the W-9 form, consider the following tips:

Filing methods for the W-9 form

After completing the W-9 form, you need to determine the best method for submission. You have the option to file electronically or submit a paper copy, and your choice may depend on the preferences of the requester.

When sending to employers or clients, ensure that their requirements for submission are met, which may vary by organization. For financial institutions, inquire about their preferred submission methods, as some may have digital portals.

Key deadlines and timeframes

Timing is crucial when it comes to the W-9 form. Employers and financial institutions often set specific deadlines for the submission of this form, particularly at the beginning of the tax year.

Stay proactive about completing and returning your W-9 to avoid complications with your income reporting and tax obligations.

W-9 form use cases

The W-9 form plays a pivotal role in various business arrangements and financial transactions. Its implications vary depending on the specific situation.

Documentation related to the W-9 form

Managing W-9 forms requires understanding the associated documentation and regulatory considerations. Digital signatures, for example, carry significant weight in many transactions today.

Understanding these aspects ensures compliance and facilitates the effective management of W-9 forms, especially in a digitally-driven business environment.

Best practices for managing W-9 forms

Managing W-9 forms efficiently requires an organized system for tracking and obtaining updated forms. Here are best practices tailored to streamline this process.

Utilizing a centralized digital solution like pdfFiller not only enhances security but also improves collaboration among team members, making the management of documents like the W-9 form straightforward.

Additional considerations

While handling the W-9 form, it's essential to be aware of additional elements that can impact your tax situation and obligations.

Navigating these considerations proactively can save time and foster smoother financial transactions.

Related forms and documents

In addition to the W-9 form, various other IRS forms are relevant for tax reporting and compliance. Understanding these forms can be invaluable in managing your tax obligations.

Contacting support for W-9 related queries

For questions or issues regarding the W-9 form, knowing where to find help is essential. Several resources and support services can assist you in navigating any challenges.

By utilizing these resources, you can streamline your document management process and address any concerns promptly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send w-9 to be eSigned by others?

How can I get w-9?

How do I edit w-9 on an Android device?

What is w-9?

Who is required to file w-9?

How to fill out w-9?

What is the purpose of w-9?

What information must be reported on w-9?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.