Get the free W-9

Get, Create, Make and Sign w-9

How to edit w-9 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out w-9

How to fill out w-9

Who needs w-9?

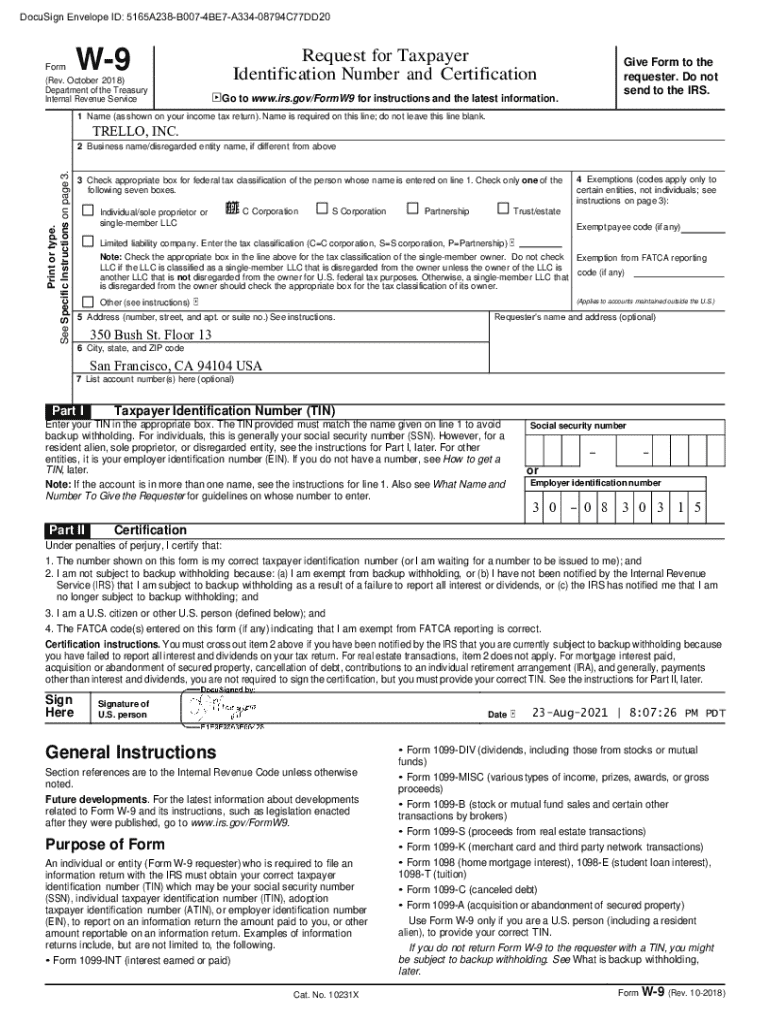

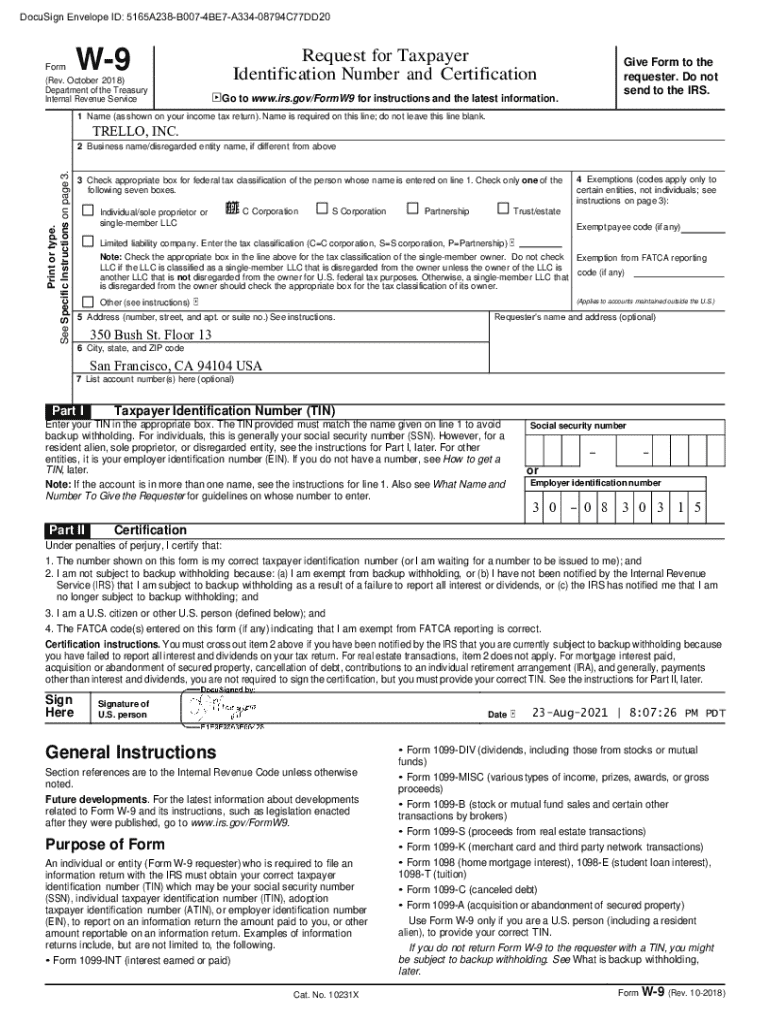

A Comprehensive Guide to the W-9 Form

Understanding the W-9 form

The W-9 form, officially known as the Request for Taxpayer Identification Number and Certification, is a critical document in the realm of tax reporting in the United States. This form is utilized by entities, such as individuals or businesses, to provide their correct taxpayer identification number (TIN) to another party, typically for income reporting purposes.

The purpose of the W-9 form is twofold: firstly, to ensure that accurate tax information is maintained for various reporting requirements and, secondly, to fulfill compliance obligations set forth by the IRS. By submitting a W-9, individuals and businesses empower their clients to report income accurately, thereby maintaining transparency in financial transactions.

The W-9 form is often required in various situations, predominantly when a business hires independent contractors or freelancers. Payment amounts may trigger a necessity for this form, particularly when payments exceed $600 in a tax year, which would lead to the issuing of a Form 1099.

Use cases for the W-9 form

Understanding the various applications of the W-9 form can clarify when and why you need to submit it. For individual contractors and freelancers, the W-9 form is crucial for providing clients with the necessary information to file tax documents accurately. Should a freelancer earn over $600 in a year from a client, the client will require the W-9 form to issue a 1099.

For businesses hiring independent contractors, the W-9 form serves as a safeguard against IRS penalties stemming from improper tax reporting. Businesses need this form to maintain compliance and properly report the payments they make on IRS forms. Furthermore, financial institutions may ask for a W-9 form when an individual opens a new account or applies for credit, ensuring that the institute correctly reports interest income to the IRS.

How to fill out the W-9 form

Filling out the W-9 form accurately is essential to avoid delays in payment processing and potential tax issues. Here is a step-by-step guide to completing the form correctly.

To avoid common mistakes, double-check your entries for accuracy. Mismatches in the name or TIN can lead to backup withholding, increased scrutiny by the IRS, or delayed payments.

Filing and submitting the W-9 form

After filling out the W-9 form, determining where to send it is vital. Typically, the completed form is submitted directly to the individual or business that requested it, not the IRS. In cases where electronic submissions are permitted, this can streamline the process significantly.

Businesses and contracting parties should be aware of any deadlines concerning the W-9, particularly when they are set to make payments. Timing can play a critical role in ensuring compliance and avoiding backup withholding situations.

Legal and tax implications

The IRS may enforce backup withholding on payments if a W-9 form isn't submitted or if the information provided has discrepancies. Backup withholding generally means that a specified percentage of payments is withheld by the payer for tax purposes, thus protecting the IRS's interest.

Failure to provide a W-9 form when required can lead to financial consequences, including penalties and fines. Businesses must understand their responsibilities regarding tax reporting, as failure to adhere can translate into both legal issues and financial liability.

Signature requirements

A W-9 form requires a signature to validate the information provided. It's important to note that a handwritten signature is typically acceptable, but many digital platforms now support electronic signatures, aligning with modern business practices.

Depending on the platform used for submission, ensure that your signature meets the required standards. Familiarizing yourself with both digital and handwritten formats can ease the process.

Managing the W-9 process

Organizations should periodically request updated W-9 forms to ensure that they have the latest information on file. Business laws and personal information may change, warranting an up-to-date document to avoid discrepancies during tax reporting.

Tips for using pdfFiller for W-9 form management

pdfFiller offers a comprehensive platform for managing W-9 forms efficiently. Users can edit and customize their forms directly within the system, making adjustments as needed.

Quick links for W-9 form resources

Accessing reliable resources is essential for navigating tax documentation, including the W-9 form. Individuals and businesses can find the official IRS W-9 form by visiting the IRS website directly.

FAQs about the W-9 form

FAQs surrounding the W-9 form often revolve around common concerns such as privacy, security, and the implications of providing personal information. Individuals may worry about how their information is used and what happens if they don’t complete the form correctly.

Related forms and documentation

Understanding the context and relationship between various IRS forms is crucial when dealing with tax documentation. Besides the W-9 form, related forms include the 1099, which is used to report income distributions for independent contractors, and the W-4, which is utilized for employee tax withholding information.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the w-9 in Chrome?

Can I create an electronic signature for signing my w-9 in Gmail?

How do I fill out the w-9 form on my smartphone?

What is w-9?

Who is required to file w-9?

How to fill out w-9?

What is the purpose of w-9?

What information must be reported on w-9?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.