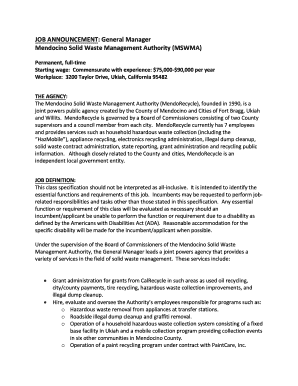

Get the free Tax Property Bidders Form

Get, Create, Make and Sign tax property bidders form

How to edit tax property bidders form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax property bidders form

How to fill out tax property bidders form

Who needs tax property bidders form?

A Comprehensive Guide to the Tax Property Bidders Form

Understanding tax property bidding

Tax property bidding is a process where properties with delinquent taxes are auctioned to recover owed amounts. This practice plays a significant role in the real estate market, often allowing investors and individuals to acquire properties at potentially lower costs than market value. It’s an essential mechanism for local governments to recoup losses from unpaid taxes while providing opportunities for buyers looking to purchase land or buildings.

The bidding process involves various stakeholders, including the bidders, local government officials, and sometimes prior property owners. Bidders place offers on listed properties, with the highest bid winning the auction. Understanding this process and the associated risks is critical for anyone interested in participating in tax property bidding.

Requirements for participation

To participate in tax property bidding, individuals need to meet specific eligibility criteria. Typically, participants must be at least 18 years old and may require proof of residency depending on local regulations. Additionally, bidders should possess a valid identification document, and in some cases, financial qualifications may also be examined.

Legal considerations cannot be overlooked. Each locality has its own laws governing tax property bidding, which may include stipulations regarding bidding deposits, payment timelines, and property transfer procedures. Thoroughly understanding these regulations ensures compliance and helps avoid potential legal complications.

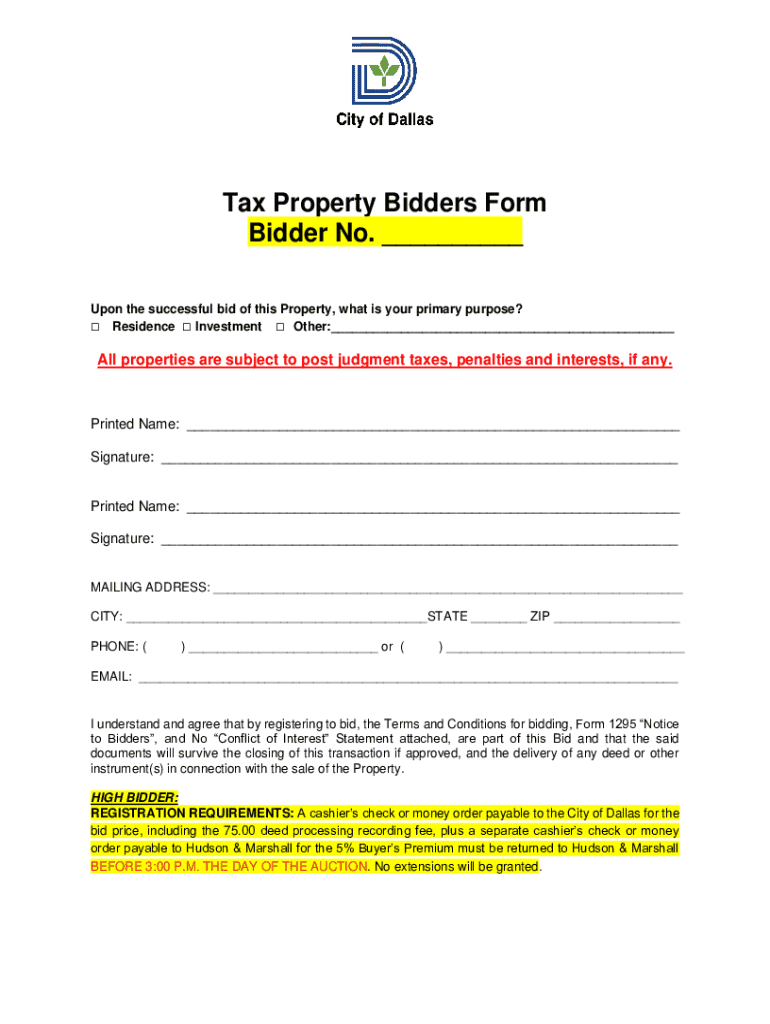

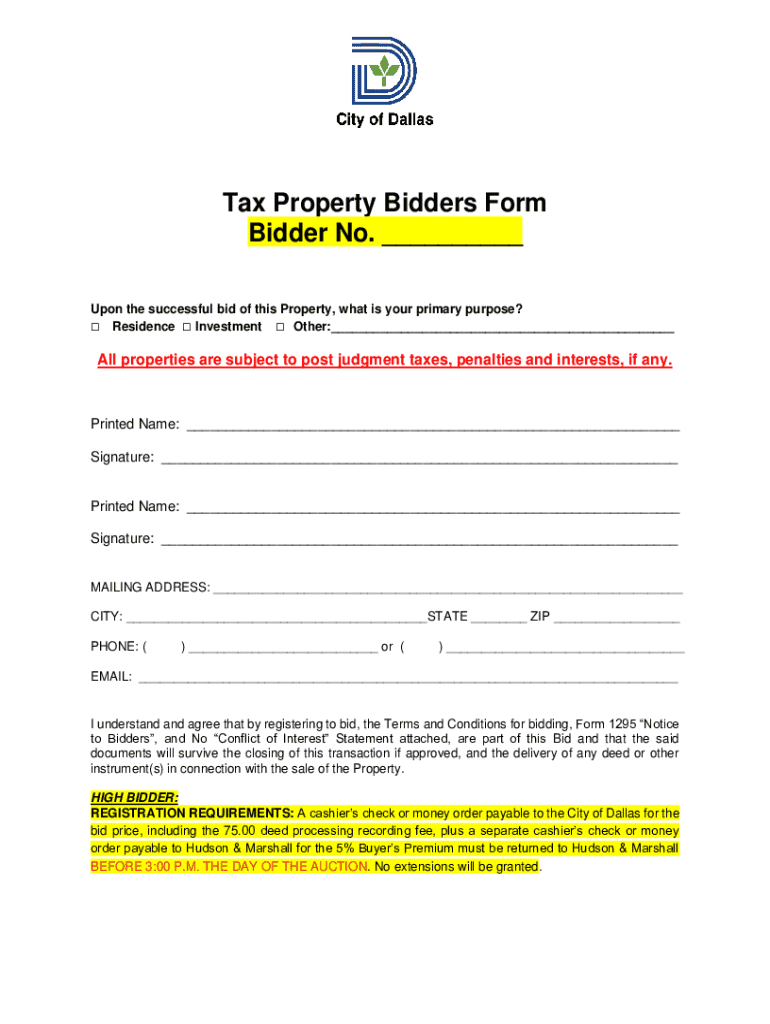

The tax property bidders form

The Tax Property Bidders Form is a vital document required to participate in the bidding process. This form serves multiple purposes; it verifies bidder identity, collects relevant information about the properties being bid on, and facilitates financial transparency. Without this form, participants cannot engage in the bidding activities.

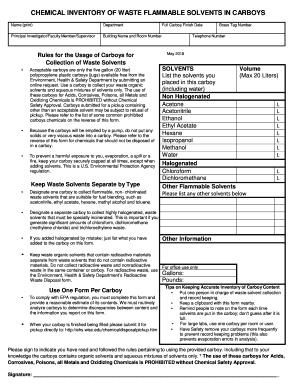

The form typically encompasses several key sections, including:

Filling out the form accurately is crucial, as errors can lead to disqualification from bidding.

Editing and signatures

Utilizing pdfFiller makes editing the Tax Property Bidders Form simple and efficient. Users can easily upload the form to the platform, allowing for straightforward editing and customization. This tool ensures that all information is current and accurate before submission, significantly enhancing the likelihood of a successful bid.

Once the form is filled, electronic signatures (eSigning) are essential. The legal credibility of eSignatures is recognized across jurisdictions, making them a convenient option. To eSign using pdfFiller, users select the designated signature area in the document, follow prompts to create or insert their signature, and finalize the document.

Submitting the tax property bidders form

The method for submitting the Tax Property Bidders Form varies by local authority. Most jurisdictions offer two submission options: online and offline. Online submissions tend to be preferred due to their convenience and speed, while offline submissions might require mailing the form or submitting it in person.

Timeliness is another critical aspect of the submission process. Key deadlines for submission are typically outlined in the auction announcement. Late submissions are usually disqualified, so buyers must be vigilant and ensure forms are submitted well in advance.

Post-submission process

After submitting the Tax Property Bidders Form, bidders can expect a specific timeline for receiving results about their bids. Notifications regarding whether a bid is successful or unsuccessful are usually communicated within a few days to weeks, depending on the local bidding process.

If a bid is won, further steps include fulfilling payment obligations and completing any necessary paperwork to finalize the property acquisition. Conversely, if the bid is not successful, it is crucial to reflect on the process and adjust strategies for future auctions.

Frequently asked questions (FAQs)

Bidders often encounter common concerns that require addressing. Common questions may include inquiries about how to handle a rejected bid, what to do if there is an error on the submitted form, or clarifications on payment methods accepted during auction closing.

For bidders seeking further assistance, several resources are available, including local government offices, real estate advisors, and online forums tailored to property investors. Utilizing these resources can provide additional support and insights beyond the immediate bidding process.

Tools and resources

pdfFiller provides a wealth of interactive tools designed specifically for bidders. These tools allow seamless editing of the Tax Property Bidders Form and other related documents, streamlining the workflow for anyone involved in property bidding.

Access to additional templates and forms enhances a bidder’s chances of success. Dedicated resources help ensure that all necessary documentation is easily available, making the bidding experience smoother and more effective.

Case studies and success stories

Real-life examples of successful bidding highlight various strategies that have led to positive outcomes. Successful bidders often share insights about researching properties, understanding local markets, and staying within budgets to avoid overspending.

Tips from these experienced bidders underscore the importance of thorough preparation, clear financial planning, and approaching each auction with a strategic mindset. Adopting these best practices can significantly enhance a bidder's chances of success in future tax property auctions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in tax property bidders form without leaving Chrome?

Can I create an electronic signature for the tax property bidders form in Chrome?

How do I fill out tax property bidders form using my mobile device?

What is tax property bidders form?

Who is required to file tax property bidders form?

How to fill out tax property bidders form?

What is the purpose of tax property bidders form?

What information must be reported on tax property bidders form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.