Get the free EPLI Underwriting: Key Risk Factors and Policy ...

Get, Create, Make and Sign epli underwriting key risk

Editing epli underwriting key risk online

Uncompromising security for your PDF editing and eSignature needs

How to fill out epli underwriting key risk

How to fill out epli underwriting key risk

Who needs epli underwriting key risk?

EPLI Underwriting Key Risk Form: A Comprehensive Guide

Understanding EPLI underwriting

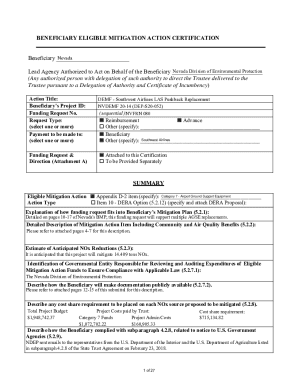

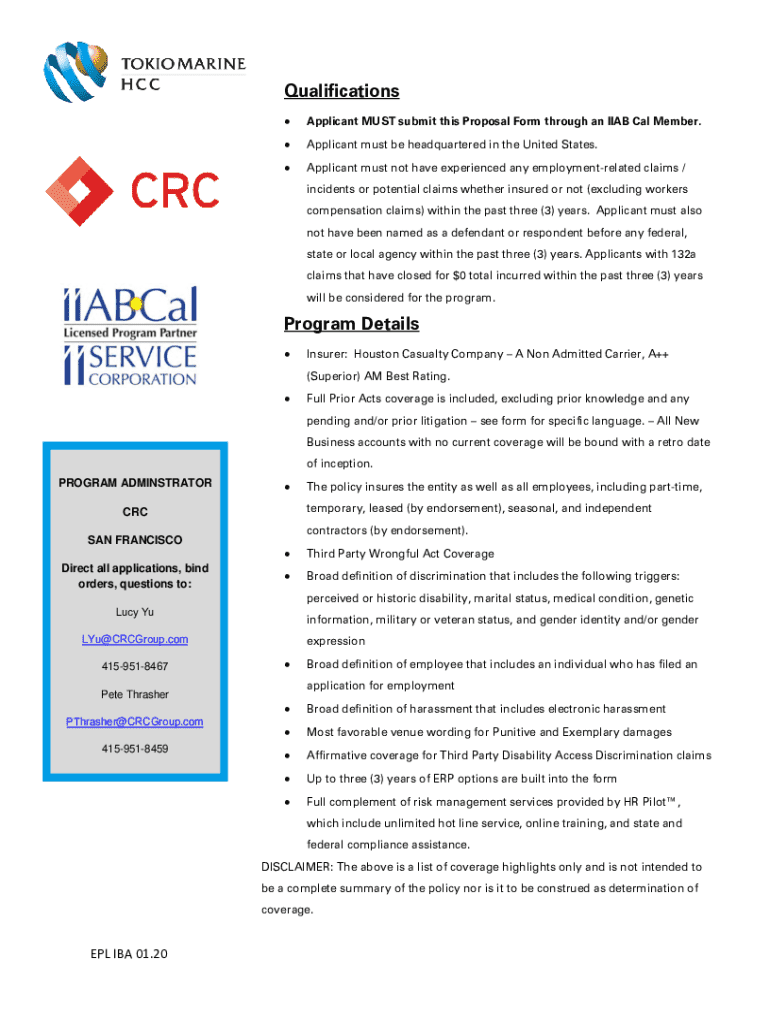

Employment Practices Liability Insurance (EPLI) is designed to protect employers against claims made by employees alleging discrimination, wrongful termination, harassment, and other employment-related issues. As a vital component of corporate risk management, EPLI serves not only as a financial safeguard but also as a strategic tool in maintaining organizational integrity. Proper underwriting is essential in identifying potential liabilities and tailoring coverage to meet specific needs.

EPLI underwriting is crucial in ensuring that organizations are adequately prepared for possible claims, which can incur significant costs and impact company reputation. By assessing a company’s unique risk profile, underwriters can offer customized policies that provide sufficient protection. This process often begins with the creation of an EPLI underwriting key risk form, detailing key risk factors that affect a company's exposure.

Key risk factors in EPLI underwriting

Understanding the key risk factors in EPLI underwriting is vital for creating an effective risk management strategy. These factors typically fall into several categories.

Structuring an EPLI policy

When structuring an EPLI policy, organizations must carefully consider whether to opt for stand-alone coverage or an endorsement to an existing insurance policy. Each approach has its pros and cons.

Organizations also need to familiarize themselves with various coverage options and exclusions within EPLI policies. This understanding allows employers to craft a policy that aligns closely with their unique exposures. Elements such as retentions, deductibles, and coinsurance significantly affect both coverage and cost, further necessitating a tailored approach in EPLI underwriting.

Claims management and liability exposure

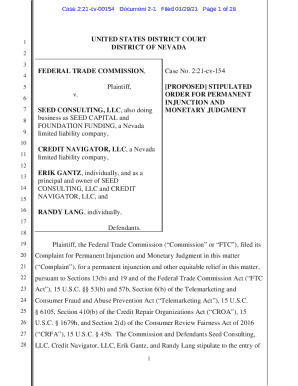

Navigating the claims process for EPLI can be complex, particularly following an alleged incident. Understanding the claims management overview is crucial for organizations to effectively handle EPLI claims.

In addition to potential financial implications, EPLI claims have profound reputational risks. A high-profile claim can tarnish an organization’s image, even if the claim is ultimately dismissed. Organizations must also remain vigilant about legal considerations and obligations under the law, as failing to do so can contribute to liabilities.

Tools and resources for effective EPLI underwriting

Using the right tools can greatly ease the EPLI underwriting process. pdfFiller offers an array of interactive tools specifically designed to create and manage EPLI forms efficiently.

Advanced considerations in EPLI underwriting

As employment practices evolve, so do the intricacies of EPLI underwriting. One advanced consideration is the necessity for third-party coverage. Organizations that interact frequently with contractors or vendors should evaluate whether coverage for claims made by these third parties is needed.

Tailoring the EPLI key risk form

Customization of the EPLI key risk form is essential to accurately reflect the specific needs of an organization. Best practices involve designing questions and sections that pertain directly to the unique aspects of the workplace and workforce.

Finalizing your EPLI underwriting application

Once the EPLI key risk form has been tailored to meet organizational needs, organizations must prepare for the review and approval process. Thoroughly reviewing the completed document helps to ensure compliance with legal standards and accuracy in submitted information.

Continuous education and support

Staying informed is critical for effective EPLI management. Organizations benefit from accessing a Knowledge Center that offers articles, webinars, and guides focused on EPLI trends and best practices.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify epli underwriting key risk without leaving Google Drive?

Can I sign the epli underwriting key risk electronically in Chrome?

Can I create an electronic signature for signing my epli underwriting key risk in Gmail?

What is epli underwriting key risk?

Who is required to file epli underwriting key risk?

How to fill out epli underwriting key risk?

What is the purpose of epli underwriting key risk?

What information must be reported on epli underwriting key risk?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.