Get the free Debit-order Form

Get, Create, Make and Sign debit-order form

Editing debit-order form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out debit-order form

How to fill out debit-order form

Who needs debit-order form?

Debit-order form: A comprehensive guide

Understanding debit-order forms

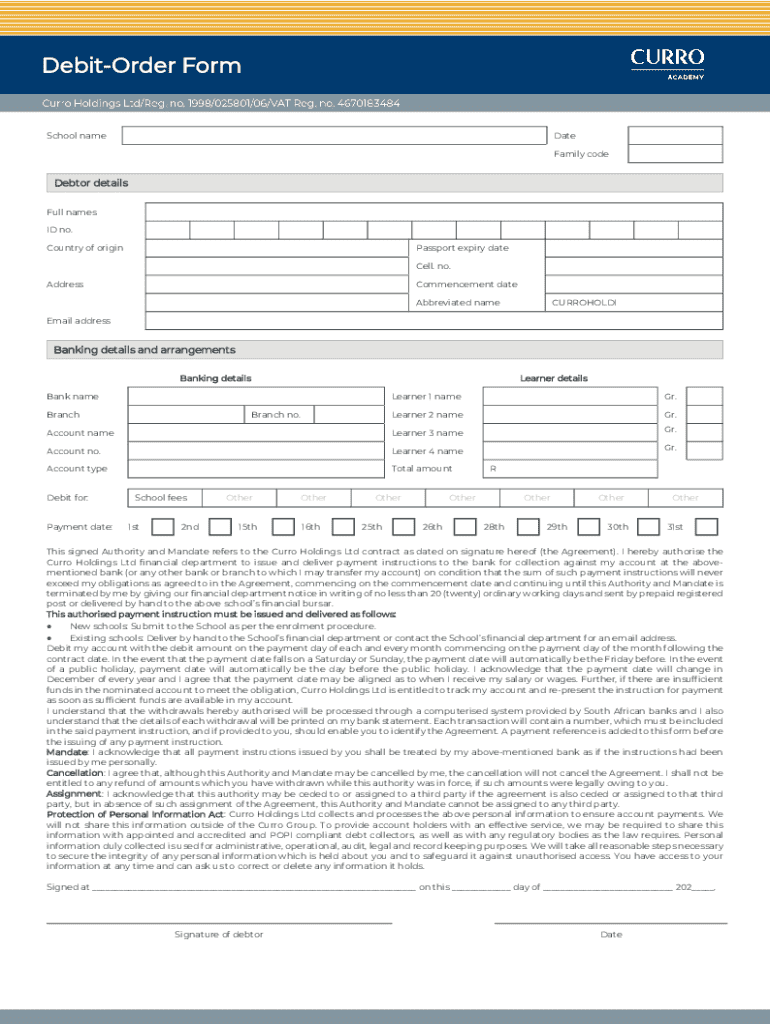

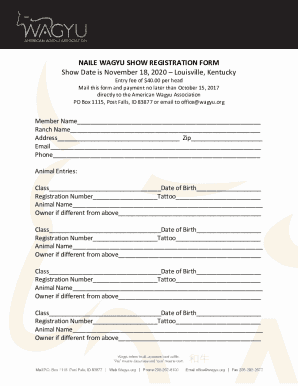

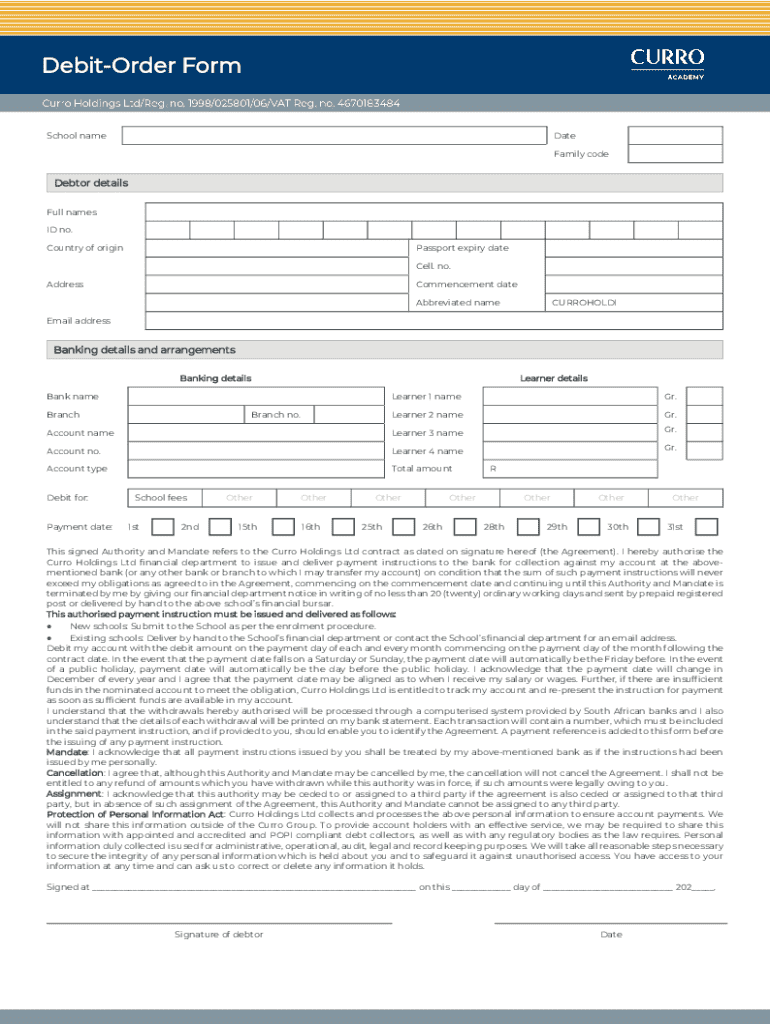

A debit-order form is a document that allows an individual or business to authorize a third party to withdraw money directly from their bank account on a specified date. These forms are commonly used for recurring payments such as utility bills, loan repayments, or subscription services, providing users with a simple way to manage their finances.

Benefits of using a debit-order form

Using a debit-order form offers numerous advantages. For one, it provides convenience and automation, freeing individuals and businesses from the hassle of making manual payments each month. This is particularly useful for those with busy schedules who may forget payment deadlines.

Additionally, it aids in budgeting and bill management as payments are usually consistent and can be easily tracked. This transparency allows individuals to allocate and manage their finances better, leading to improved cash flow. Ultimately, the efficiency of debit-order forms makes them an essential tool in modern financial management.

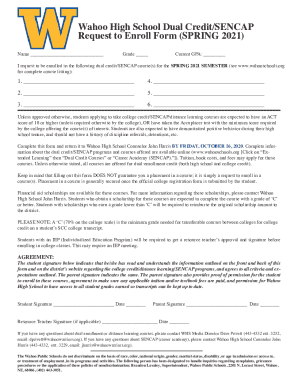

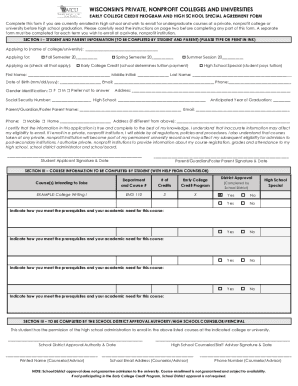

Components of a debit-order form

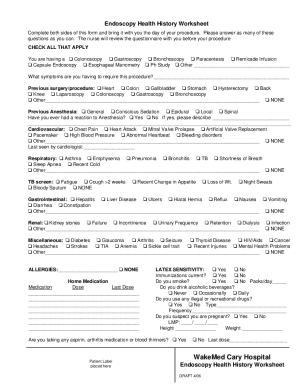

A standard debit-order form requires specific information to function effectively. Essential fields include the name of the account holder, the bank account number from which debits will occur, and the payment amount. Additionally, the frequency of payments, starting date, and any specific terms are vital components that ensure clarity and mutual agreement between parties.

While the above features are necessary, optional fields can enhance the form’s utility. These may include an email address for confirmations, a contact number, and any relevant notes that help clarify payment arrangements. Careful consideration of these components can facilitate smoother transactions and prevent errors.

When to use a debit-order form

Personal scenarios where a debit-order form can be effective include paying regular bills like utilities, internet services, and subscription fees for monthly services like Netflix or Spotify. This ensures that these payments do not slip through the cracks, reducing the risk of late fees.

On the business side, debit-order forms are beneficial for recurring invoices. Companies can employ them for employee payroll deductions or membership fees. Since these transactions can create significant operational efficiencies, businesses often find their cash flow improves with predictable income streams.

How to fill out a debit-order form

Filling out a debit-order form correctly is crucial. The first step is to gather necessary information, including your bank details and any account numbers related to the payment. Having these at hand simplifies the process and minimizes errors.

The next step is to fill in your personal or business details accurately. This may include your full name, contact details, and the bank account number. Specify the payment amount and schedule, whether it’s weekly, monthly, or annually. Finally, don't forget to sign and date the form to authorize the transaction. Completing these steps carefully ensures smooth processing of your payments.

Tips for accurate completion

Before submitting your debit-order form, double-check all the information for accuracy. Common mistakes include incorrect account details, the wrong amounts, or neglecting to sign the form. Any discrepancies can delay payments or lead to financial setbacks, so ensuring everything is correct is vital.

Editing and customizing your debit-order form with pdfFiller

To make adjustments to your debit-order form easily, pdfFiller provides a user-friendly platform. First, access the debit-order form template in the pdfFiller library. This means you don’t have to start from scratch; simply customize an existing form.

When editing the form online, you can add custom fields such as additional notes or alternate billing amounts. Utilize pdfFiller's editing tools to enhance the clarity and utility of your document, enabling you to cater to your specific requirements before finalizing.

Saving and exporting options

After making the necessary changes, pdfFiller offers several saving and exporting options. You can save your updated form directly to your cloud storage for easy access later, or export the document in various formats such as PDF or Word, making it versatile for any situation.

Signing your debit-order form

The signature on a debit-order form adds a layer of legal validity and authorization. It's essential to understand that without a signature, the form may not be considered legally binding, leading to complications in the payment process.

Using the eSignature features available in pdfFiller simplifies this step. You just follow the intuitive process to add your eSignature. If you need to add multiple signers, pdfFiller allows for this too, making it easy for both parties to authorize the debit arrangements.

Managing your debit-order agreements

Understanding what happens after you fill out a debit-order form is critical. You hold the right to revoke or amend the debit order as per your agreement with the service provider. This means you need to communicate any changes promptly to ensure smooth transactions.

Effective payment tracking can significantly reduce stress. With tools such as those offered by pdfFiller, you can set reminders for payment dates, ensuring that you are always aware of your financial commitments and helping maintain a good credit score.

FAQs about debit-order forms

It's common for users to have questions regarding debit-order forms. For instance, what should you do if a payment fails? In such cases, it's best to contact your bank and the service provider promptly to rectify the issue, which may often involve rescheduling the payment.

Another frequent inquiry revolves around the processing time for debit orders. Typically, payments may take a few days to reflect, depending on the bank's processing speed. Lastly, it is important to investigate any potential fees associated with these transactions, as different financial institutions may have varying policies.

Troubleshooting common issues

Common problems include incorrect amounts being deducted, which can cause financial strain. If this occurs, reviewing your debit-order agreement and contacting your financial institution should be the immediate steps taken to resolve the discrepancies. Additionally, understanding the cancellation process for unwanted debit orders is essential; knowing how to revoke an agreement can provide peace of mind.

Compliance and legal considerations

As with any financial agreement, understanding your rights as a consumer is essential. Familiarize yourself with consumer protection regulations regarding debit orders, ensuring that service providers communicate clearly about terms and conditions. Transparency helps in building trust between customers and institutions.

Furthermore, it's critical to keep your information secure. Employ best practices for safeguarding personal and financial data, as identity theft can lead to serious repercussions. PDFfiller takes significant measures to ensure security and compliance, providing peace of mind while managing your documents.

Advanced features of pdfFiller for debit-order management

To enhance collaboration, pdfFiller offers collaboration tools that enable sharing of forms with team members or stakeholders easily. This feature can facilitate real-time feedback and edits, making it a powerful tool for organizations looking to streamline document workflows.

Integrating your debit-order forms with other software, such as accounting systems, can further enhance efficiency. Automation in processing these forms reduces the chance for human error and aligns financial practices within your business, ultimately saving time and improving productivity.

User testimonials and success stories

Many users have discovered how pdfFiller has simplified their document management processes. For example, a small business may share how using debit-order forms through pdfFiller allowed them to manage payments effortlessly, improving their cash flow management and client satisfaction.

User reviews frequently highlight the ease of use and functionality provided by pdfFiller, showcasing how it empowers individuals and teams to handle debit-order forms efficiently while ensuring compliance and security.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit debit-order form on a smartphone?

How do I fill out debit-order form using my mobile device?

How do I edit debit-order form on an iOS device?

What is debit-order form?

Who is required to file debit-order form?

How to fill out debit-order form?

What is the purpose of debit-order form?

What information must be reported on debit-order form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.