Get the free Form 990

Get, Create, Make and Sign form 990

Editing form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Form 990 Form: A Comprehensive Guide

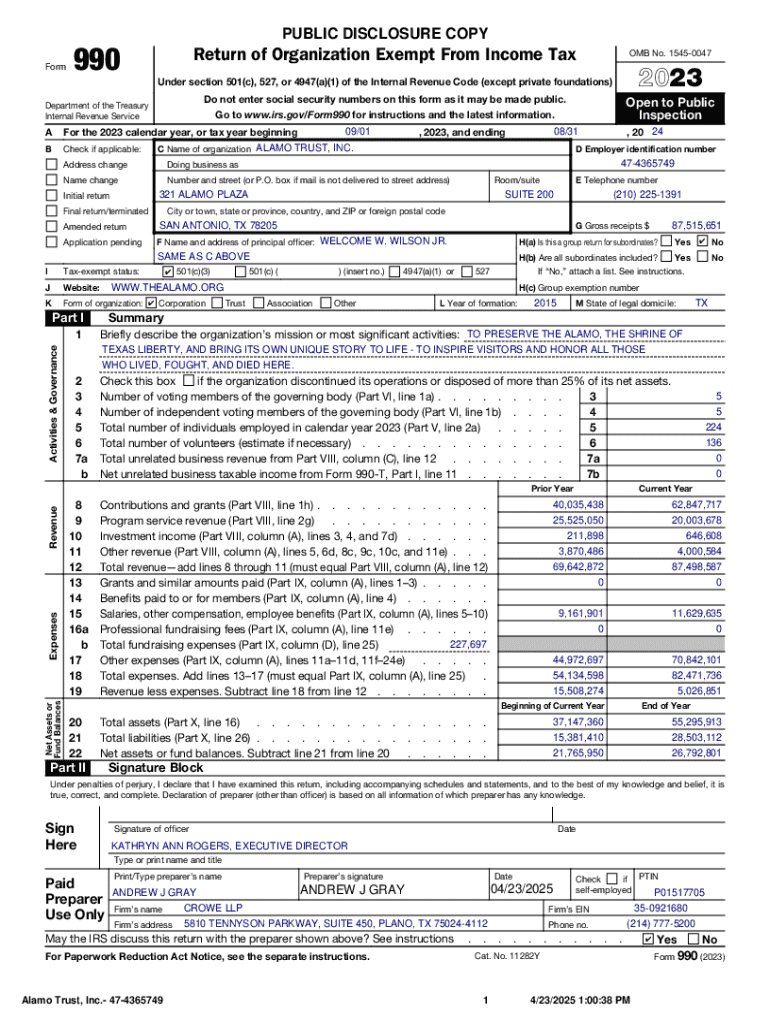

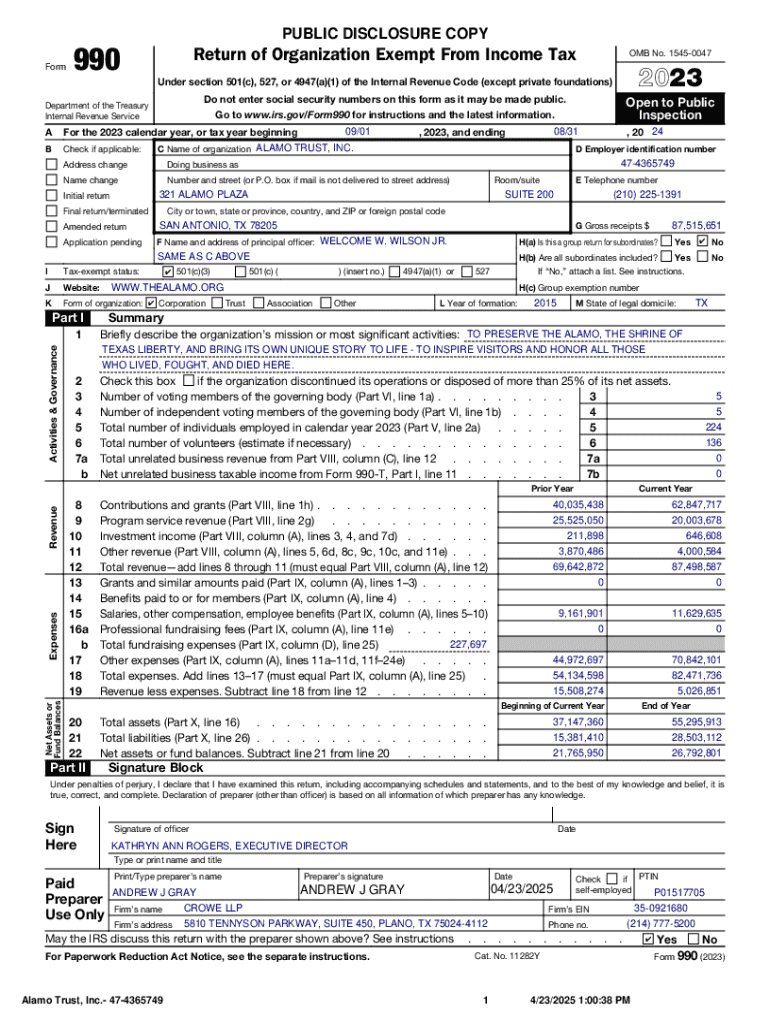

Overview of Form 990

Form 990 is a critical document that the Internal Revenue Service (IRS) requires nonprofits to file annually. It serves as a vital tool for transparency, helping the IRS and the public assess an organization’s financial health, governance, and compliance with tax regulations. As a nonprofit organization, navigating the requirements of Form 990 is essential not only for maintaining tax-exempt status but also for fostering trust with donors and stakeholders.

The primary purpose of Form 990 is to provide detailed financial information about a nonprofit organization’s activities, programs, and financial performance. By making this information accessible, Form 990 enhances accountability and supports informed decision-making by donors and the general public regarding charitable giving.

Key components of Form 990

Understanding the structure and required information on Form 990 is essential for accurate reporting. Form 990 is divided into several sections, each designed to capture specific aspects of an organization's operations and finances. The primary sections include summaries of the organization's mission, services, and financial condition, alongside important schedules and attachments that provide additional detail.

Here’s a closer look at the key sections of Form 990:

Filing requirements for Form 990

Determining whether your organization is required to file Form 990 is crucial for compliance and maintaining your tax-exempt status. Most tax-exempt organizations with gross receipts over $200,000 or total assets exceeding $500,000 must file the full Form 990. However, smaller organizations may qualify to file the simplified Form 990-EZ or even the postcard version, Form 990-N.

Filing can be done through various modalities, including online submissions or paper filings. Utilizing electronic platforms such as pdfFiller streamlines this process, allowing organizations to fill out and submit forms quickly and accurately.

Understanding the penalties associated with Form 990

Penalties associated with Form 990 can have severe repercussions for organizations, impacting both their financial standing and their reputation. The IRS has established several categories of penalties based on the nature of the non-compliance, which can include both late and inaccurate filings. Understanding these penalties is critical to ensuring compliance and averting unnecessary costs.

Common categories of penalties include:

To mitigate penalties, organizations should focus on accuracy and compliance. Utilizing tools such as pdfFiller can significantly reduce errors through features that aid in document management, thereby promoting a more streamlined filing process.

Public inspection regulations

Form 990 is a public document, meaning that organizations must make it available for inspection by the public. This transparency is essential for the nonprofit sector, offering potential donors and stakeholders insights into how donations are being utilized. However, while substantial information is made public, there are limitations on how this data can be disseminated.

Key points regarding public inspection include:

Utilizing Form 990 for charity evaluation and research

Form 990 serves as a valuable resource for evaluating nonprofit organizations and understanding their financial health. For potential donors, reviewing Form 990 can help assess how well an organization utilizes its resources and fulfills its mission. Additionally, researchers can leverage Form 990 data for various purposes, including grant applications and sector studies.

Key metrics to assess nonprofit performance through Form 990 include:

Historical context and evolution of Form 990

Form 990 has undergone several regulatory changes since its initial introduction. Over the years, updates have been implemented to improve transparency, enhance compliance, and align with contemporary reporting practices. Understanding the history of these changes can provide insight into the evolving landscape of nonprofit accountability.

Significant amendments to Form 990 include:

Practical tips for completing Form 990

Filling out Form 990 can be a complex and detailed process. To ensure accuracy and compliance, consider following these step-by-step instructions:

Resources for completing Form 990

For organizations preparing to file Form 990, several resources can facilitate the completion process. These include interactive templates, FAQs, and troubleshooting guides available on platforms like pdfFiller.

Making use of such resources ensures organizations can address common filing questions effectively, reducing the likelihood of errors.

Exploring alternatives and variants of Form 990

Not all organizations are required to file the extensive Form 990. Several variants exist, including Form 990-EZ and Form 990-N, designed for smaller organizations or those with simpler reporting needs. Understanding when to use these alternative forms can simplify compliance for many nonprofits.

Criteria for choosing the right form include:

Looking ahead: trends and future of Form 990

As the regulatory environment continues to evolve, so too does Form 990. Emerging trends in nonprofit reporting include an increased focus on transparency and accountability, coupled with the anticipated changes in IRS regulations to reflect best practices in the nonprofit sector.

The role of Form 990 in an increasingly digital world also presents opportunities for enhancements, such as improvements in the e-filing process and an emphasis on data accessibility. Nonprofits are encouraged to stay ahead of these changes to abide by compliance requirements and leverage Form 990 as a tool for engagement and donor trust.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my form 990 in Gmail?

How do I execute form 990 online?

Can I create an electronic signature for signing my form 990 in Gmail?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.