Charitable Contributions Policy Template Form

Overview of charitable contributions policies

A charitable contributions policy outlines the framework within which an organization can support charitable causes. This policy is crucial as it ensures that contributions align with the organization's values, financial strategies, and legal obligations. Establishing such a policy facilitates transparency in the decision-making process surrounding donations, which is essential to foster trust both internally among employees and externally within the community.

The primary objective of implementing a charitable contributions policy includes creating a structured approach to philanthropy that maximizes impact while minimizing risk. Organizations can set clear guidelines on who can request funding, the types of contributions that are permitted, and the processes for approval. Additionally, having a policy ensures compliance with legal standards regarding charitable giving, which may vary across jurisdictions, thus protecting the organization from potential liabilities.

Define what constitutes a charitable contribution and how it aligns with organizational goals.

Ensure transparency in the donation process, promoting accountability.

Facilitate effective decision-making regarding grants or donations.

Comply with external regulations and internal guidelines to avoid legal issues.

Components of a charitable contributions policy

A comprehensive charitable contributions policy consists of several key elements that delineate how contributions should be managed. The first essential component is the purpose statement, which establishes the guiding principles for contributions, underscoring the organization's commitment to social responsibility.

Eligibility criteria is another critical part of the policy. This section defines the organizations or causes that qualify for contributions. Establishing a clear framework for the types of donations—whether cash, in-kind, or volunteer time—ensures that all stakeholders understand what is permissible. Furthermore, the policy must specify the approval process, detailing who within the organization has the authority to approve contributions and what documentation is required.

Purpose statement outlining the organization’s reason for charitable contributions.

Eligibility criteria defining what types of organizations or causes can receive donations.

Types of donations allowed: cash, in-kind contributions, and volunteer time.

Approval process detailing the roles and responsibilities for approving contributions.

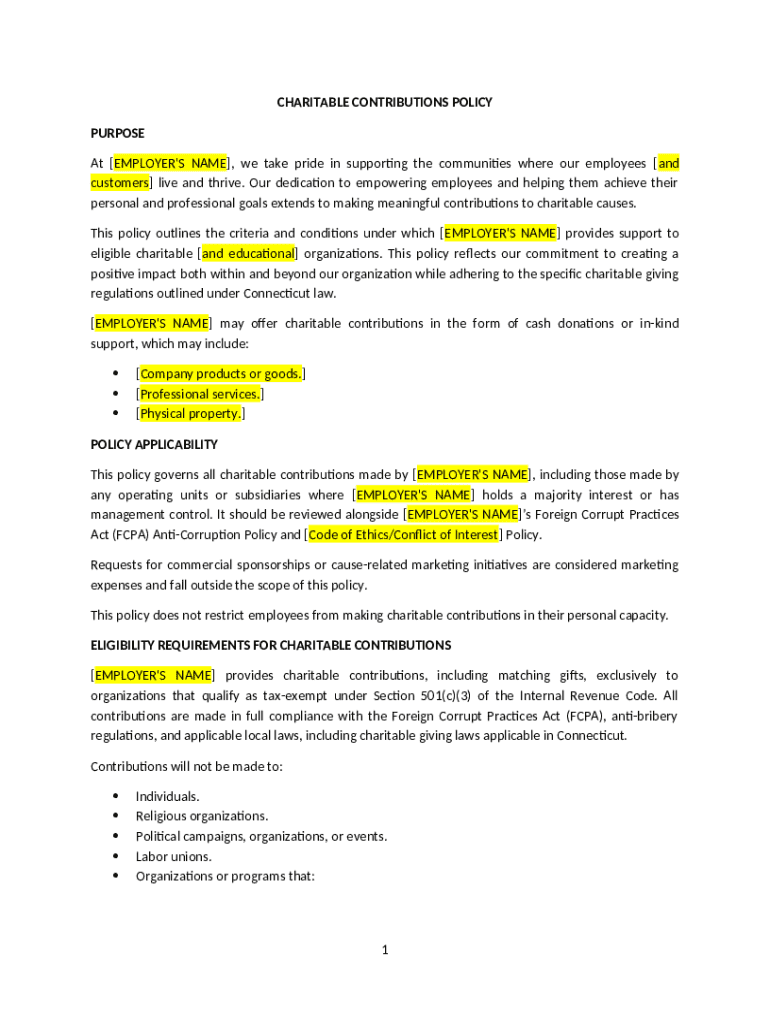

Charitable contributions template form

Obtaining a charitable contributions policy template form can streamline the establishment of your policy. Users can easily download the form from pdfFiller, where the platform offers an editable PDF format, making customization straightforward. The benefits of using this format extend beyond ease of modification; it allows organizations to maintain professional standards while ensuring the document's flexibility.

The sections of the template form include vital details needed to document a charitable contribution. The donor information section captures essential data such as the donor's name and contact details, while the recipient organization field requires the name and address of the organization receiving funds. Clear guidance on the type and amount of the contribution is critical, alongside a section for signature acknowledgment to confirm that both parties agree to the terms outlined in the form.

Donor information including contact details and organization name.

Details of the recipient organization: name, address, and purpose.

Contribution type and amount, clarifying cash vs. in-kind gifts.

Signature acknowledgment confirming the legitimacy of the donation.

Utilizing the template in practice

Filling out the charitable contributions policy template form can be done efficiently by following a structured approach. Start by entering donor information accurately, ensuring all contact details are correct. Then, provide comprehensive details regarding the recipient organization, including its mission and how it aligns with your own organizational values. Indicate the type of contribution—whether monetary or material—and specify the amount where applicable.

Common pitfalls to avoid include incorrect documentation or insufficient details that could delay approval. To further streamline the submission process, utilize digital signature options via pdfFiller. The platform allows for secure eSigning, ensuring that the document is legitimate and legally binding. It’s advisable to review the completed form before submission for accuracy.

Enter accurate donor and recipient information to avoid delays in processing.

Specify the contribution type and amount clearly.

Utilize digital signature features for secure and valid submissions.

Review the form thoroughly to prevent common errors.

Managing and storing charitable contributions records

Proper record-keeping is essential for tracking charitable contributions over time. Digital storage solutions like those provided by pdfFiller offer secure environments to store these records, enabling organizations to easily retrieve them when needed. Tracking contributions allows for monitoring charitable impact and ensures that your organization stays compliant with any reporting requirements.

Regular audits of charitable contributions can help maintain accountability. Establishing a schedule for reviewing records—potentially quarterly or semi-annually—ensures that any discrepancies can be promptly addressed. Preparing for external audits requires immaculate record-keeping, where pdfFiller’s capabilities can aid by keeping all documents organized and easily accessible.

Utilize digital storage for ease of access and security of records.

Track contributions and their impact over time to substantiate your charitable efforts.

Establish regular reviews of contributions to maintain transparency.

Ensure readiness for external audits with organized documentation.

Periodic review and policy updates

Maintaining an up-to-date charitable contributions policy is critical to the effectiveness of your philanthropic efforts. Regular reviews should be part of your strategic plan, ensuring that the policy evolves alongside your organization’s goals and changing legal landscapes. A frequency of review at least once a year or following major organizational changes is advisable.

Engaging stakeholders during the review process provides valuable insights into potential areas for improvement. User feedback can optimize the clarity and utility of the policy. With pdfFiller, updating the policy can be seamless—modify the document as required and redistribute updated versions to all relevant parties, ensuring everyone is on the same page.

Schedule regular reviews of the policy to keep it current with organizational goals.

Incorporate stakeholder feedback in policy updates.

Utilize pdfFiller for easy editing and distribution of updated policies.

Ensure alignment of the policy with any legal changes affecting charitable contributions.

Common challenges and solutions

Organizations often encounter challenges related to bias and transparency in charitable contributions. It is crucial to establish procedures that ensure fair allocation of resources among various causes. Implementing a points system or scoring rubric for evaluating donation requests can help minimize subjective biases and ensure a broader impact.

Managing tax implications associated with charitable donations is another common challenge. Organizations should consult with tax professionals to navigate the complexities of tax-deductible donations, ensuring correct reporting practices are followed. Additionally, engaging employees in charitable initiatives can enhance workplace culture and drive participation in volunteer programs, leading to increased morale and community connection.

Create standardized evaluation criteria for donation requests to ensure fairness.

Consult tax experts to manage the complexities of charitable donations.

Engage employees in charitable initiatives to enhance morale and participation.

Monitor feedback to continuously improve the contributions process.

Case studies and examples

Successful implementation of charitable contributions policies can transform nonprofit partnerships into robust community engagements. For instance, a notable organization might showcase how it utilized a charitable contributions policy to bolster its local community through consistent donations to food banks or educational programs. These initiatives, documented through impactful case studies, highlight the measurable outcomes of corporate philanthropy when aligned with organizational values.

Learning from challenges faced by various organizations can also provide insights. A company might have encountered pushback regarding its contributions due to perceived bias or misallocation. Addressing these challenges with transparency initiatives and improved communication has led to more effective strategies and renewed trust within communities. Key takeaways from these case studies emphasize the importance of a structured approach in charitable contributions.

Highlight success stories where policies positively impacted community engagement.

Track challenges faced by organizations and document improvements made.

Use case studies to reinforce best practices in charitable contributions.

Show how a well-crafted policy can lead to measurable positive impact.

Interactive tools and resources on pdfFiller

pdfFiller offers a range of interactive features that enhance the management of documents including charitable contributions policies. Collaborating on documents in real-time allows team members to contribute their input seamlessly, making the process more efficient. The platform also provides templates for other organizational policies, enabling consistent documentation standards across your organization.

Getting started with pdfFiller involves creating an account and exploring its features, from editing PDFs to eSigning documents. Users are encouraged to take advantage of the platform's advanced search functionalities and organization tools that enhance efficiency in document management. With pdfFiller, managing your charitable contributions policy is streamlined and accessible from anywhere.

Utilize pdfFiller's collaborative features for efficient document management.

Take advantage of templates for consistent policy documentation.

Explore advanced search functionalities for easy retrieval of important documents.

Set up your account for enhanced document management efficiency.