Get the free in-kind Donation Form

Get, Create, Make and Sign in-kind donation form

Editing in-kind donation form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out in-kind donation form

How to fill out in-kind donation form

Who needs in-kind donation form?

In-Kind Donation Form: A How-to Guide Long-Read

Understanding in-kind donations

In-kind donations are gifts of goods or services instead of money. This form of donation encompasses a wide range of contributions—from office supplies to event space, and even professional services like legal or consulting assistance. For example, a local business might donate food items to a charity event, or a graphic designer could offer their design services for free to a nonprofit organization.

In-kind donations play a crucial role in supporting nonprofits and communities. They help organizations reduce operational costs, thereby redirecting more funds toward their mission. Donors benefit too; they can claim these donations on their taxes, and they often find a sense of fulfillment and connection with their communities by contributing directly to causes they care about.

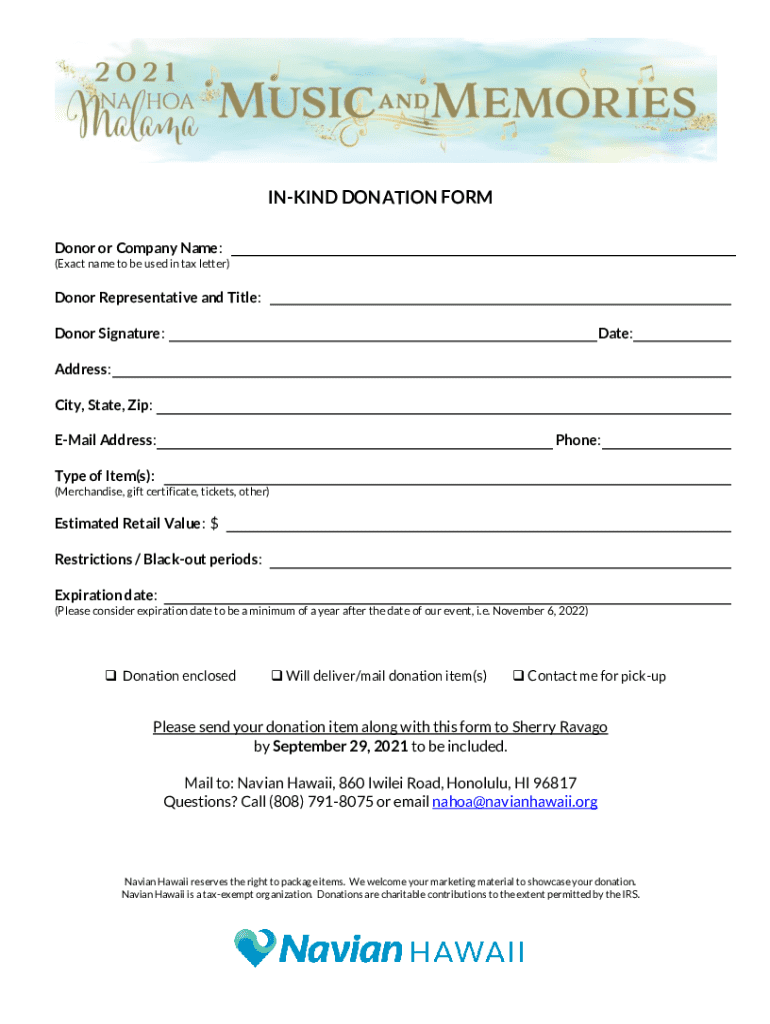

Overview of the in-kind donation form

Organizations use an in-kind donation form to document donations of goods or services. This form serves multiple purposes: it provides legal documentation for tax purposes, tracks contributions, and helps assess the organization's inventory of services and supplies. Without this crucial compliance tool, organizations might struggle to maintain accurate records or demonstrate accountability to donors and regulatory bodies.

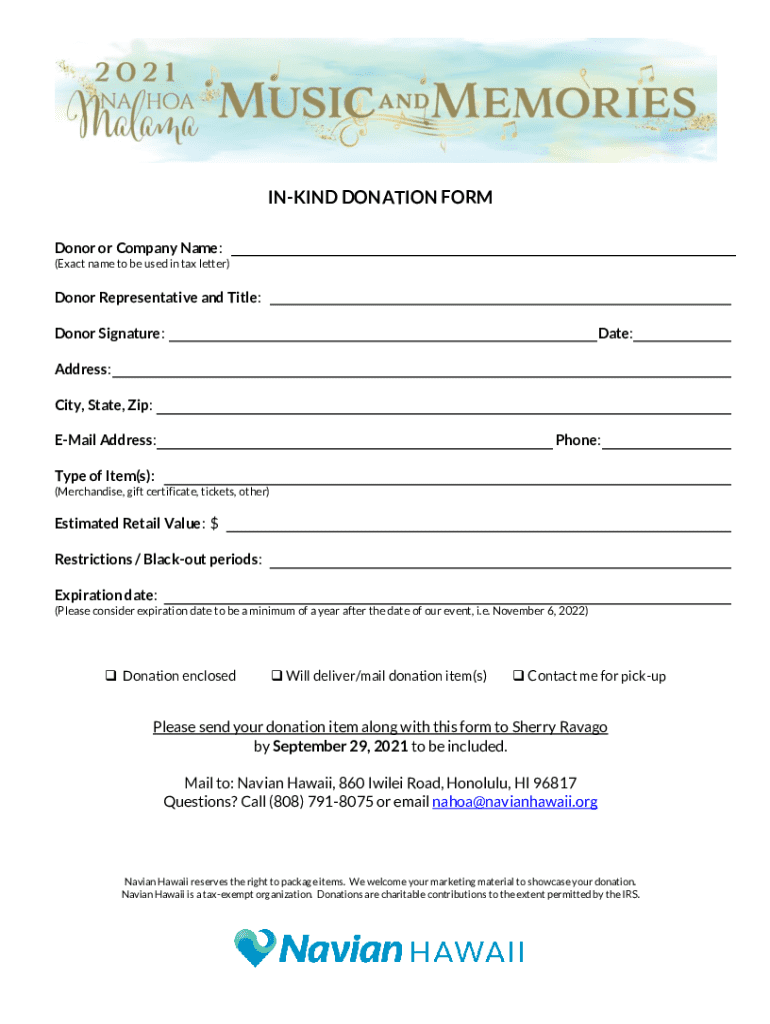

Typically, an in-kind donation form includes several key components: donor information, detailed descriptions of the donated items or services, and an estimated fair market value of the contributions. Collecting this information ensures all parties have clarity about the transaction, which can prevent discrepancies and enhance transparency.

Steps to complete the in-kind donation form

Completing an in-kind donation form isn’t difficult, but it requires careful attention to detail. Here’s how to do it in four simple steps.

Managing in-kind donations

Effective management of in-kind donations ensures that organizations make the most out of the resources they receive. A key aspect of this is tracking donations, which can be facilitated through software or spreadsheets specifically designed for donation management.

Maintaining accurate records is vital, not just for internal auditing, but in preparing required reports for external stakeholders. Moreover, issuing acknowledgment letters promptly can strengthen donor relations. According to IRS guidelines, these letters must include the name of the organization, a description of the donated property, and a statement whether or not any goods or services were received in return.

Special cases of in-kind donations

In-kind donations of high value—those exceeding $5,000—come with additional considerations. Such donations typically require a qualified appraisal to substantiate the value claimed on tax returns. It’s crucial for both the donor and recipient to understand these requirements, as failing to provide necessary documentation could lead to issues with tax compliance.

Additionally, specific types of in-kind donations such as motor vehicles, boats, or airplanes often require specialized forms that adhere to regulatory standards. Consequently, it's essential for donors to familiarize themselves with the unique documentation requirements pertinent to these types of high-value donations.

Resources to support your in-kind donations

Navigating the world of in-kind donations can be easier with the right tools. pdfFiller offers interactive features specifically designed to streamline the in-kind donation form process. Users can customize, edit, and share documents effortlessly. Collaboration tools make it even easier for teams to work together, regardless of their physical locations.

Additionally, common questions related to in-kind donations can be addressed through FAQs provided by organizations and platforms like pdfFiller. This ensures donors and recipients are equally informed about their rights and responsibilities while completing the donation process.

Utilizing in-kind donations effectively

Organizations can maximize the impact of in-kind donations through careful planning and strategic outreach. By sharing success stories of how previous in-kind donations have made a difference, organizations can engage potential donors more effectively, showing them the tangible benefits of their contributions.

Moreover, leveraging social media platforms to promote these initiatives can significantly enhance visibility. Examples include creating dedicated campaigns that encourage community involvement, sharing testimonials from beneficiaries, and implementing hashtags centered around specific events related to in-kind donations.

Understanding legalities and policies

Donating in-kind gifts comes with its set of legal considerations. Donors should understand the tax implications, including deductions that may apply to charitable contributions. Most importantly, it’s vital to keep in mind that donors are responsible for determining the fair market value of their in-kind donations, which needs to be documented properly.

Additionally, donor rights and responsibilities involve knowing what types of donations are acceptable, understanding tax ramifications, and having clarity on how the organizations will utilize the donations. This transparency not only fulfills legal requirements but also establishes trust between donors and recipients.

Contacting support for questions

Should you encounter challenges while filling out the in-kind donation form or have questions about the process, various support options are available through pdfFiller. Customer support teams can assist you in navigating the platform, ensuring you have the necessary resources to complete your documentation efficiently.

Additionally, exploring links to additional help resources within the pdfFiller platform can provide you with insights on best practices and tips for managing your in-kind donation forms effectively, making the entire experience seamless.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in in-kind donation form without leaving Chrome?

How do I fill out the in-kind donation form form on my smartphone?

How can I fill out in-kind donation form on an iOS device?

What is in-kind donation form?

Who is required to file in-kind donation form?

How to fill out in-kind donation form?

What is the purpose of in-kind donation form?

What information must be reported on in-kind donation form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.