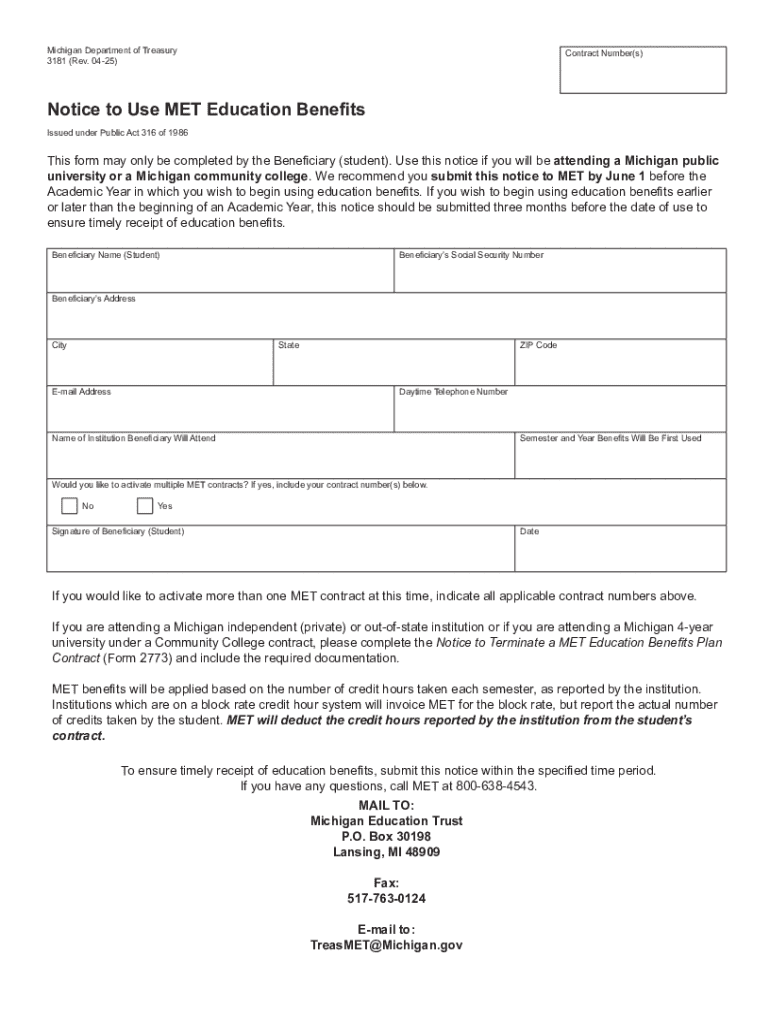

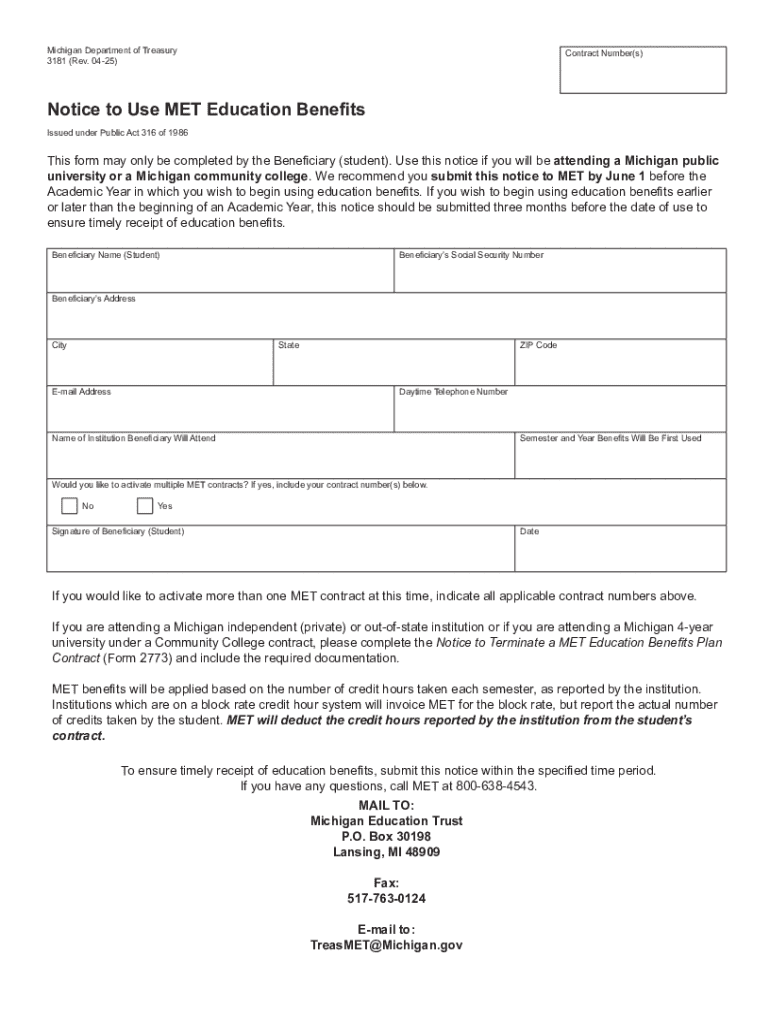

Get the free Michigan Department of Treasury 3181

Get, Create, Make and Sign michigan department of treasury

How to edit michigan department of treasury online

Uncompromising security for your PDF editing and eSignature needs

How to fill out michigan department of treasury

How to fill out michigan department of treasury

Who needs michigan department of treasury?

A comprehensive guide to Michigan Department of Treasury forms

Overview of Michigan Department of Treasury forms

Michigan Department of Treasury forms play a pivotal role in the state’s tax and financial landscape. These documents are essential for residents and businesses to report income, claim credits, appeal property taxes, and communicate financial information to the state. Understanding the various forms available helps ensure compliance with state regulations and maximizes potential tax benefits.

For Michigan residents, using the correct forms is not just a matter of legality; it often influences financial outcomes significantly. Tax credits, deductions, and exemptions depend on accurate submissions of the appropriate forms. Hence, being familiar with the range of required documents can invariably lead to more informed financial decisions and potentially reduced tax liabilities.

Common Michigan Department of Treasury forms

Among the myriad of Michigan Department of Treasury forms, several are widely used. Each serves a specific purpose and is critical in processing tax information accurately.

Navigating the Michigan Department of Treasury website

The Michigan Department of Treasury website is a valuable resource, allowing users to access crucial forms and resources easily. Whether you're looking for individual, property, or corporate tax forms, the website's structure facilitates efficient navigation.

Users can utilize the search functionality to find specific forms or filter forms by categories. This targeted approach helps streamline the process of locating the exact documents needed for effective tax filing.

Moreover, the website features an intuitive layout comprising sections and navigation menus, making it user-friendly for individuals seeking specific documents. Interactive tools are also available, enhancing the user experience and aiding in efficient form management.

Step-by-step instructions for filling out common forms

Filling out forms accurately is critical for tax compliance. Below are detailed walkthroughs for two commonly used forms: the MI-1040 and the MI-1040CR.

Detailed walkthrough: -1040

Completing the Property Tax Credit Form (-1040CR)

Editing and managing your forms with pdfFiller

pdfFiller equips users with powerful document management capabilities, allowing for seamless editing and management of Michigan Department of Treasury forms. Users can easily upload forms to the platform for enhancement.

eSigning Michigan Department of Treasury forms

eSigning is crucial for ensuring forms are submitted in a timely manner and in compliance with state requirements. With pdfFiller, users can effortlessly eSign their documents.

Collaborating on forms with teams

Collaboration is simplified on pdfFiller, making it easy for teams to work on Michigan Department of Treasury forms together. Team members can be invited to review or edit documents.

Frequently asked questions (FAQs)

Understanding the nuances of Michigan Department of Treasury forms is essential. Here’s a compilation of frequently asked questions that can help clarify common issues.

Additional tools and resources available

Various tools are available that can further assist users with their financial reporting and obligations. Interactive calculators and helpful links provide added value.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit michigan department of treasury in Chrome?

How do I edit michigan department of treasury on an iOS device?

How can I fill out michigan department of treasury on an iOS device?

What is Michigan Department of Treasury?

Who is required to file Michigan Department of Treasury?

How to fill out Michigan Department of Treasury?

What is the purpose of Michigan Department of Treasury?

What information must be reported on Michigan Department of Treasury?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.