Get the free Emergency Capital Investment Program Instructions

Get, Create, Make and Sign emergency capital investment program

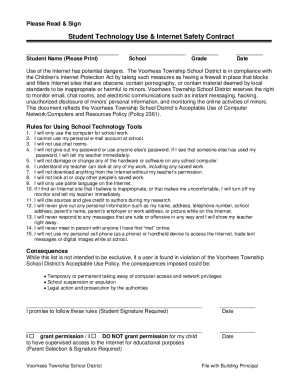

Editing emergency capital investment program online

Uncompromising security for your PDF editing and eSignature needs

How to fill out emergency capital investment program

How to fill out emergency capital investment program

Who needs emergency capital investment program?

Understanding the Emergency Capital Investment Program Form: A Comprehensive Guide

Overview of the Emergency Capital Investment Program (ECIP)

The Emergency Capital Investment Program (ECIP) was established to bolster economic growth and support financial stability in underserved communities facing financial challenges. By providing funding opportunities to community development financial institutions (CDFIs) and minority depository institutions (MDIs), the ECIP aims to enable these organizations to extend their services to high-demand areas. It is imperative for applicants to understand the eligibility requirements that accompany these funding opportunities to maximize support.

The ECIP specifically targets low-income and economically distressed areas, ensuring that local businesses have the necessary resources to sustain their operations and thrive during adverse situations. By revitalizing communities through accessible capital, the program fosters job creation, social equity, and economic development.

Importance of the Emergency Capital Investment Program Form

Accurate completion of the Emergency Capital Investment Program Form is vital for organizations seeking to access funding. By ensuring that the information provided is clear and precise, applicants can significantly enhance their chances of approval. This form serves as the gateway for financial institutions and businesses alike to secure the necessary investments that can propel their growth and foster community well-being.

Moreover, the form is more than just a document; it facilitates access to essential capital that can stabilize and sustain local economies. Properly filled out forms lead to streamlined processes, enabling quicker responses from funding bodies, thereby allowing businesses to act promptly on investment opportunities. The direct impact of these funds on local enterprises can be transformative, promoting stability, innovation, and sustainability.

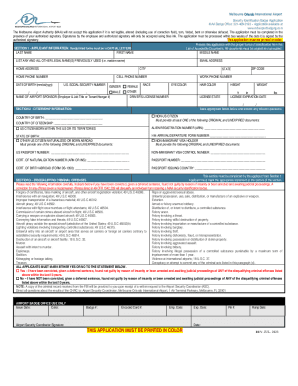

Understanding the ECIP Form Structure

The ECIP form comprises several key sections that applicants must navigate expertly to ensure compliance and smooth processing. Each section is designed to elicit specific information that funding bodies require to make informed decisions about support. The main sections include:

Using interactive tools offered by pdfFiller can greatly aid applicants in completing each section effectively. These tools support users by guiding them through the complexities of the form, offering insights into best practices.

Step-by-step instructions for completing the ECIP form

Completing the Emergency Capital Investment Program Form involves meticulous attention to detail. Here is a thorough step-by-step guide to facilitate the process:

Editing and managing your ECIP form on pdfFiller

Once the ECIP form is completed, editing capabilities become essential for refining and managing submissions. pdfFiller provides users the tools necessary for making changes after the initial completion, ensuring that the final document is flawless before submission.

Collaborative editing features allow teams to work together efficiently, making it simple to incorporate feedback and suggestions. Additionally, pdfFiller’s cloud storage solutions offer seamless document management, ensuring that users can access their forms anytime, anywhere, facilitating efficient and organized workflows.

eSigning the Emergency Capital Investment Program form

The convenience of eSigning enables applicants to finalize their Emergency Capital Investment Program Form swiftly and securely. eSigns eliminate the need for physical paperwork, expediting the process significantly.

To eSign using pdfFiller, follow these straightforward steps: first, navigate to the ‘eSign’ section; second, either draw your signature or upload an image; finally, place your signature on the designated area of the form. Important legal considerations include ensuring that the electronic signature complies with any regulations governing digital policies, which pdfFiller adheres to rigorously.

Troubleshooting common issues with the ECIP form

Completing the Emergency Capital Investment Program Form can present challenges, especially for first-time applicants. Common issues include submission errors due to incomplete fields or inaccuracies in data presentation.

To resolve these problems, conduct a self-check after filling in each section and utilize pdfFiller’s support resources, which offer guidance on specific queries. Correcting minor errors proactively helps to avoid delays in processing, making it crucial for applicants to stay vigilant throughout the form completion process.

Case studies: Successful use of the ECIP form

Numerous businesses have successfully navigated the ECIP application process, leading to significant benefits from received funding. For instance, a small community bank in a high-poverty area leveraged the ECIP to enhance its lending portfolio.

By submitting a thoroughly completed ECIP Form that highlighted its community-centric approach and the economic impact of its services, the bank secured the necessary capital to expand its initiatives. These real-life examples demonstrate how proper form submission can lead to favorable funding outcomes, empowering businesses and fostering local community growth.

Additional ECIP resources and tools available on pdfFiller

Beyond the form itself, pdfFiller offers a variety of interactive tools and resources to aid users in the ECIP process. Financial modeling tools provide invaluable support for assessing funding needs, while access to templates for related documents streamlines the application process.

Community forums also serve as platforms for sharing best practices among applicants, allowing users to exchange insights and strategies for successful submissions.

Ensuring compliance with ECIP requirements

Staying compliant with ECIP requirements is crucial for successful applications. Regularly reviewing compliance checkpoints ensures that the information presented in the ECIP Form aligns with regulatory standards.

pdfFiller plays a vital role in maintaining compliance documentation, providing users with features that track modifications and retain historical records. It is essential for applicants to stay informed about any changes to regulatory guidelines, ensuring that they continuously meet requirements.

Future of the Emergency Capital Investment Program

The future of the Emergency Capital Investment Program appears promising, with ongoing developments expected to enhance its efficacy. As economic needs evolve, trends suggest that the program may expand its focus to encompass a broader range of support mechanisms.

Anticipated changes to the form and application process will likely reflect these trends, aiming to simplify procedures and enhance accessibility. pdfFiller is committed to adapting its offerings to these shifts, ensuring that users can efficiently navigate any updates to the ECIP without disruption.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my emergency capital investment program directly from Gmail?

Can I sign the emergency capital investment program electronically in Chrome?

Can I edit emergency capital investment program on an iOS device?

What is emergency capital investment program?

Who is required to file emergency capital investment program?

How to fill out emergency capital investment program?

What is the purpose of emergency capital investment program?

What information must be reported on emergency capital investment program?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.