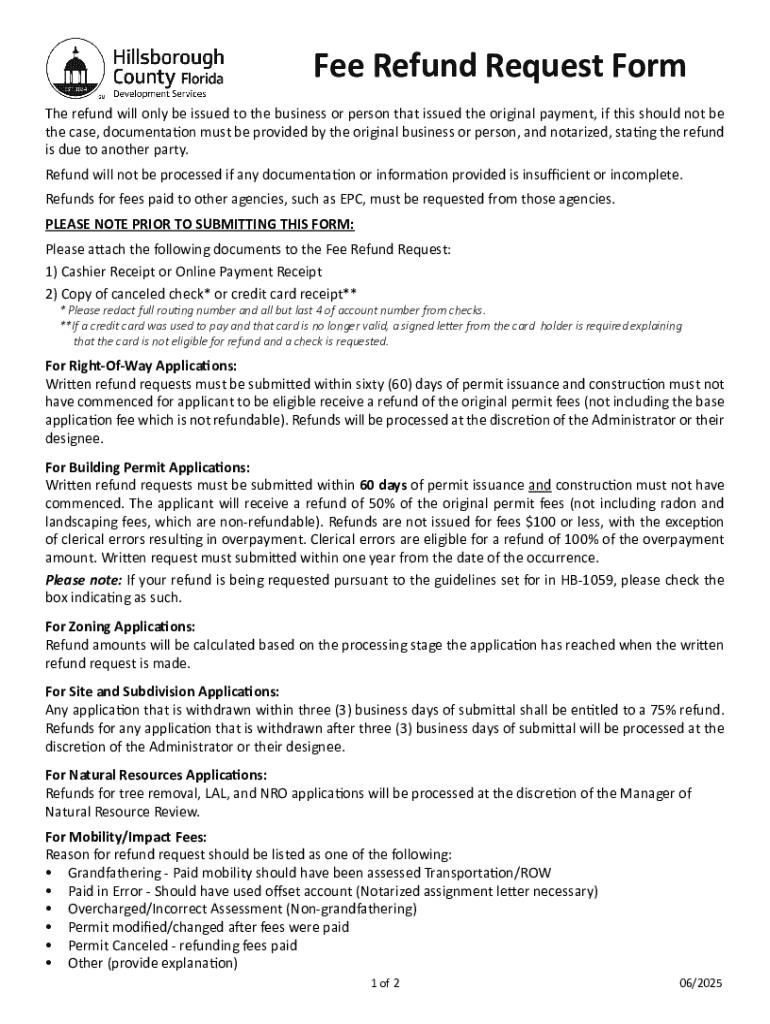

Get the free Fee Refund Request Form

Get, Create, Make and Sign fee refund request form

How to edit fee refund request form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out fee refund request form

How to fill out fee refund request form

Who needs fee refund request form?

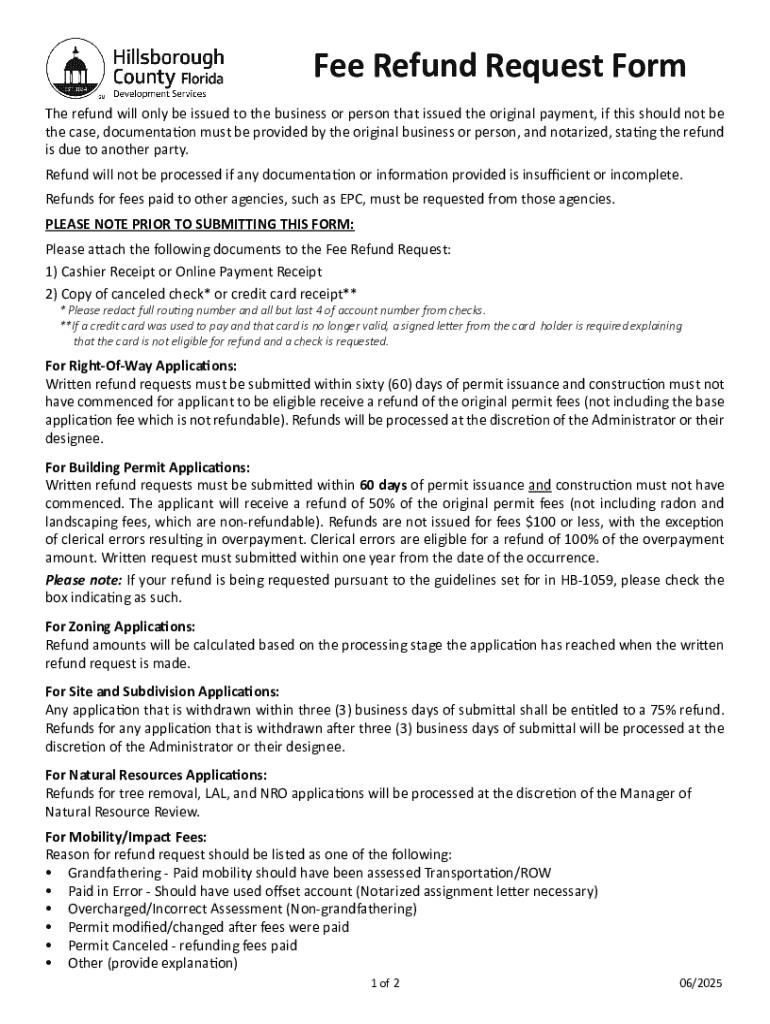

Comprehensive Guide to the Fee Refund Request Form

Understanding fee refunds

A fee refund refers to the return of payments made towards services or transactions that are no longer fulfilled or rendered as expected. Understanding fee refunds is essential for consumers, as it empowers individuals and organizations to reclaim their money in circumstances where services are not provided as promised. Knowing your rights regarding fee refunds is crucial; it helps in advocating for oneself during disputes over refunds.

Common scenarios that usually qualify for a refund include cancellation of a service, overpayment, or a service that was not delivered. For instance, if you purchased a ticket for an event that was later canceled, or if you accidentally paid double for the same service, you might be eligible for a fee refund. Understanding these situations can prepare you for initiating a successful refund request.

Eligibility criteria for fee refund requests

Eligibility for fee refunds often varies based on your payment method. Knowing the specific criteria tied to different payment methods is essential. If you paid online, many companies have streamlined online refund processes, where eligible requests can be submitted directly through their websites. Alternatively, payments made at a bank or through embassies often have separate requirements for refunds.

Moreover, verifying your eligibility often requires specific documents such as receipts, transaction IDs, or proof of payment. These documentation pieces bolster your claim and ensure a smoother refund process.

Preparing to submit your fee refund request

Before submitting your fee refund request, gather all the required information. Effective preparation significantly increases your chances of success. Start by collecting personal information including your full name, contact details, and any account numbers that may be relevant to your transaction.

Next, compile pertinent payment details. This includes the amount paid, date of transaction, and payment method used. Having receipts or transaction IDs ready is also critical, as this proof of payment reinforces your request. It is crucial to be aware of the timeline for submission since some companies or organizations have strict deadlines for refund requests.

Step-by-step process to fill out the fee refund request form

When it's time to fill out your fee refund request form on pdfFiller, ensure you navigate to the request form page efficiently. The form is designed to gather the necessary information in a structured manner. Start with the personal information section; here, enter your name, contact information, and any relevant identifiers correctly.

Move on to the payment information section where you will input details about the transaction. It is essential to be precise with the payment amount and method to avoid any discrepancies. Lastly, articulate your reason for the refund clearly in the corresponding section, providing any necessary context that supports your request. As you complete each part of the form, double-check for accuracy and completeness to reduce the chances of delay.

Special instructions depending on payment methods

Requests for fee refunds can differ based on how you made your payment. For those who paid directly online, refund requests can often be initiated through the company's online portal, requiring minimal additional documentation. In contrast, refunds for payments made at a bank can require printed documentation submitted physically at the bank branch.

Submitting your fee refund request

Once you have completed your fee refund request form, it’s time to submit it. There are various submission methods available. Most companies allow for electronic submission through their online portals or via email, which can expedite the review process. Alternatively, mailing your request can also be an option, though it is typically slower.

After submission, you should receive a confirmation email or notification confirming that your request is being processed. It's advisable to keep this confirmation for your records. Following up on the status of your application can also be beneficial; some organizations have tracking features that allow you to monitor the progress of your refund.

Understanding the refund processing timeline

The processing timeline for refunds can vary significantly depending on how you submitted your request. Typically, online submissions tend to be processed more swiftly than those sent by traditional mail. In general, expect a timeframe anywhere from a few days to several weeks based on the company's policies.

Several factors can impact your refund timeline including the nature of the service, your payment method, and the company’s workload. If the processing time exceeds the expected duration, don't hesitate to follow up with the organization to inquire about your refund status.

Common issues and FAQs

Despite taking all the right steps, there can still be obstacles in the fee refund process. Common reasons a refund request may be denied include insufficient documentation, requests submitted after the deadline, or reasons that do not align with the company’s refund policy. Addressing these issues proactively can help ensure smoother processing.

Best practices for managing future fee refunds

Managing fee refunds effectively begins by keeping detailed records of every transaction. Save receipts, transaction IDs, and correspondence related to payment and refunds for future reference. This practice not only supports your refund requests but also helps in tracking your financial activities more accurately.

Developing a habit of digital record-keeping can additionally mitigate similar issues in future transactions. Familiarizing yourself with companies' refund policies prior to making purchases can prevent misunderstandings and delays down the line. By proactively managing your financial interactions, you can streamline the refund request process considerably.

Interactive tools and resources on pdfFiller

pdfFiller offers users a range of interactive tools designed to simplify form management, including the fee refund request form. Users can access features that allow them to edit, sign, and collaborate on documents in real-time, which is particularly advantageous for teams working together on refund requests.

Additionally, pdfFiller provides ample support tools, facilitating a hassle-free document creation and management experience. Whether you’re looking to create new forms or manage existing ones, pdfFiller empowers users to handle all aspects of document management from one cloud-based platform, making it a preferred choice for individuals and organizations alike.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify fee refund request form without leaving Google Drive?

How do I execute fee refund request form online?

How can I fill out fee refund request form on an iOS device?

What is fee refund request form?

Who is required to file fee refund request form?

How to fill out fee refund request form?

What is the purpose of fee refund request form?

What information must be reported on fee refund request form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.