Get the free W-9

Get, Create, Make and Sign w-9

How to edit w-9 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out w-9

How to fill out w-9

Who needs w-9?

W-9 Form How-to Guide

Understanding the W-9 Form

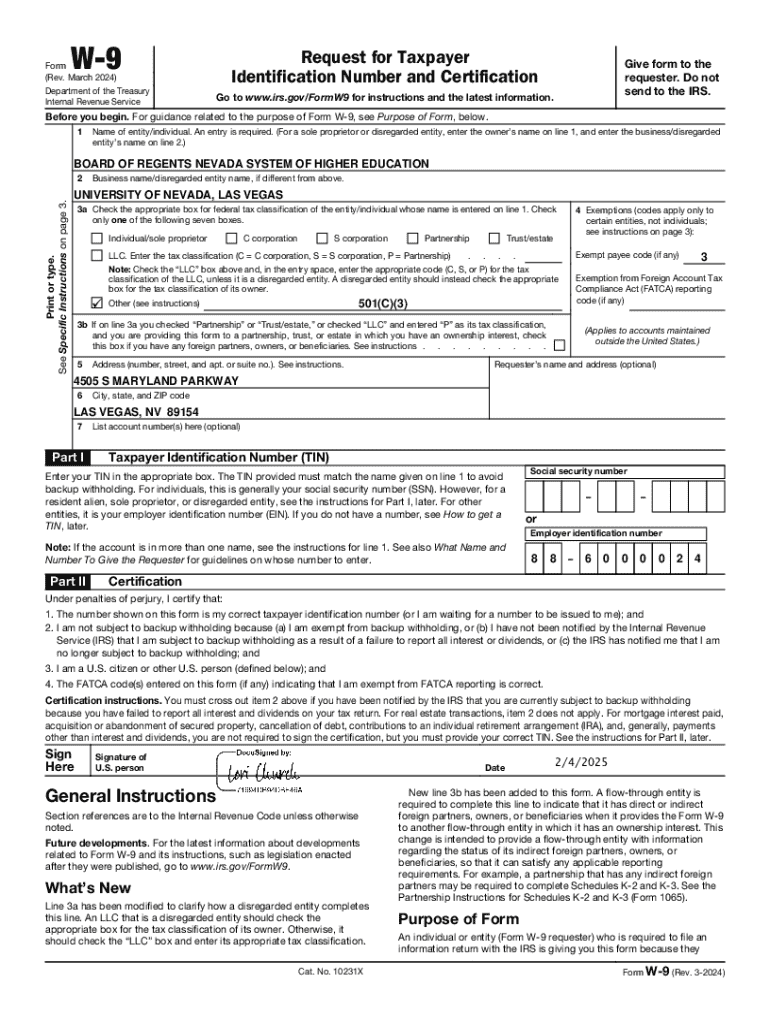

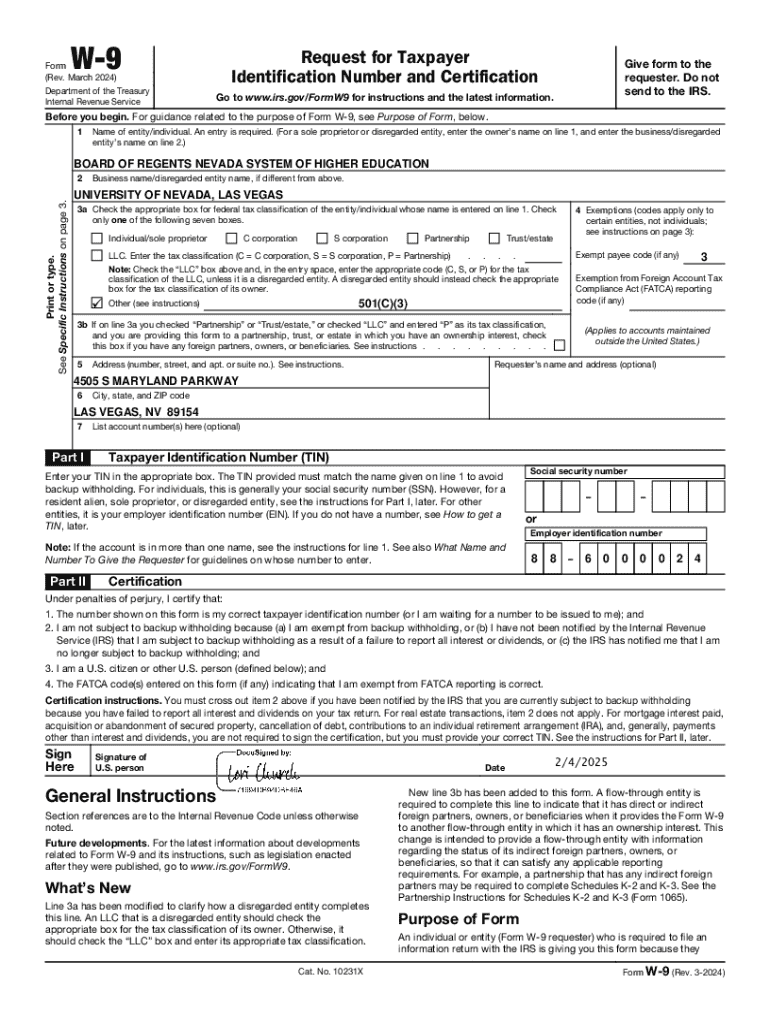

The W-9 form, officially titled 'Request for Taxpayer Identification Number and Certification,' is an essential document used primarily in the United States for tax purposes. Its primary role is to collect the necessary information from individuals and entities who will be compensated so that proper tax reporting can occur. For tax professionals, business owners, and independent contractors, understanding the W-9 is crucial to ensure compliance with IRS requirements.

One of the unique aspects of the W-9 form is its necessity for almost everyone engaged in a financial transaction that requires reporting to the IRS. This encompasses individuals and businesses of various structures, including sole proprietors, partnerships, corporations, and limited liability companies (LLCs).

Detailed breakdown of the W-9 form components

Understanding the components of the W-9 is critical for accurate completion. The form consists of several lines that specifically ask for information about the taxpayer, including:

When and why to use the W-9 form

The W-9 form is used in various scenarios where tax identification is necessary. Here are some common use cases to consider:

Additionally, financial institutions utilize the W-9 to report interest income to the IRS, making it even more important in various sectors. Understanding these situations helps you stay compliant and prepared.

Completing the W-9 form: A step-by-step guide

Preparation is key when filling out the W-9 form. Here’s a step-by-step approach to ensure accuracy:

Now, it’s time to fill out the form. Take your time to complete each section accurately. Upon finishing, double-check your entries to avoid any mistakes that might lead to problems down the line.

Tips for avoiding common mistakes

Mistakes on the W-9 can lead to delays in payment processes and tax reporting issues. Here are some common errors to avoid:

A good practice is to verify your TIN with the IRS before submitting your W-9. This proactive measure ensures that you are accurately reported by businesses that rely on your documentation.

Signing and submitting the W-9 form

The signature on the W-9 form is more than just a formality; it serves to certify that the information provided is accurate. The person who signs the form must match the TIN provided.

After completing the W-9, you can submit it through various methods. Depending on the requestor's preferences, you may send it via email, traditional mail, or digital submission methods approved by the receiving entity.

Managing your W-9 forms efficiently

Proper storage and management of your W-9 forms are essential for any business or individual. Keeping these documents organized helps with future transactions, audits, and tax reporting.

An organized approach not only streamlines your processes but also alleviates the stress related to tax season. Keeping electronic copies securely stored means you can access them from anywhere.

Understanding backup withholding

Backup withholding refers to the IRS's requirement that a business withhold a percentage of payments made to individuals who do not provide their correct TIN. If your tax classification indicates you're subject to backup withholding, businesses must deduct 24% from your payments.

The W-9 form plays a critical role in this process. By submitting a correctly filled W-9 with your TIN, you inform the payer that you’re exempt from backup withholding. This makes it all the more important to ensure your information is accurate and up-to-date.

FAQs about the W-9 form

Many questions arise concerning the W-9 form. Here are some answers to commonly asked questions:

Digital and electronic signatures for W-9

With the rise of digital interactions, electronic signatures have become increasingly common for forms like the W-9. pdfFiller facilitates this process by providing tools for users to sign documents securely and efficiently.

The ease of electronic signatures means that both requestors and providers can save time, streamline workflows, and enhance security protocols when managing W-9 forms.

Key resources and tools for navigating your W-9 needs

The IRS offers comprehensive resources to assist in understanding the W-9 form better. pdfFiller also provides a user-friendly platform that allows seamless handling of W-9 forms, ensuring you can edit, sign, and manage these documents effectively.

Utilizing these resources empowers individuals and businesses to handle their tax paperwork proficiently while ensuring compliance with IRS regulations.

Contact information for further support

For any inquiries regarding the W-9 form or assistance with using pdfFiller, their support team is available to help. They provide expert guidance, ensuring you get the most out of the platform tailored to your needs.

User testimonials highlight the effectiveness of pdfFiller’s tools in simplifying document management, proving invaluable for individuals and businesses alike.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in w-9 without leaving Chrome?

Can I create an eSignature for the w-9 in Gmail?

How can I fill out w-9 on an iOS device?

What is w-9?

Who is required to file w-9?

How to fill out w-9?

What is the purpose of w-9?

What information must be reported on w-9?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.