Get the free Form 990

Get, Create, Make and Sign form 990

Editing form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Understanding Form 990: A Comprehensive Guide for Nonprofits

Understanding Form 990

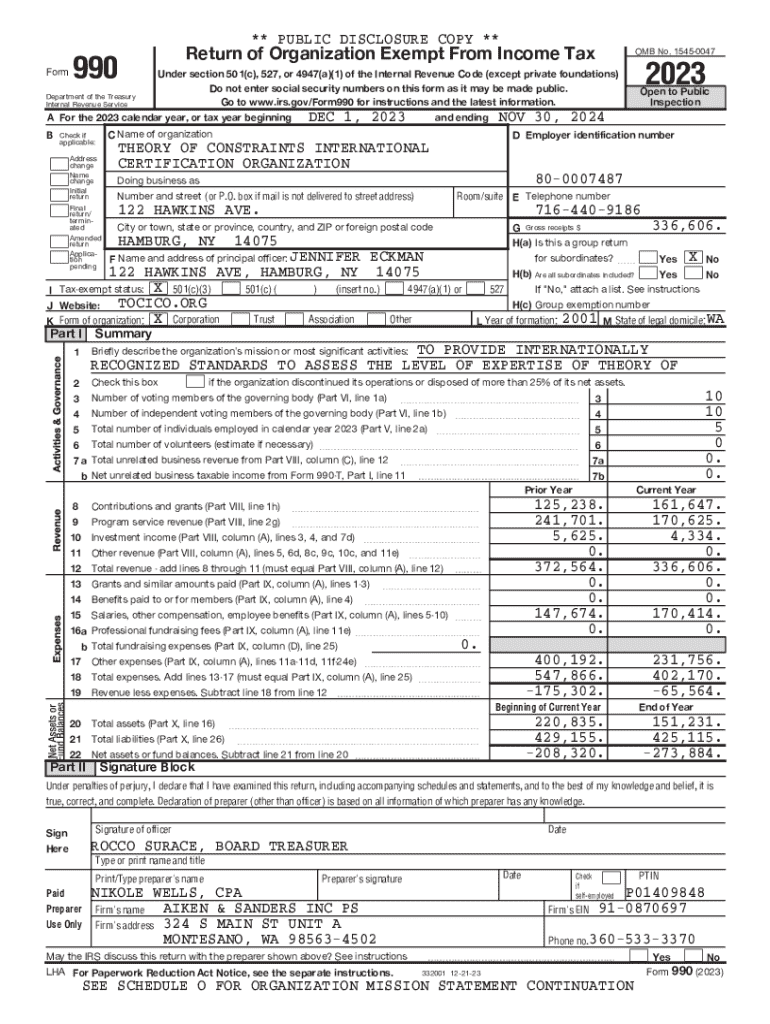

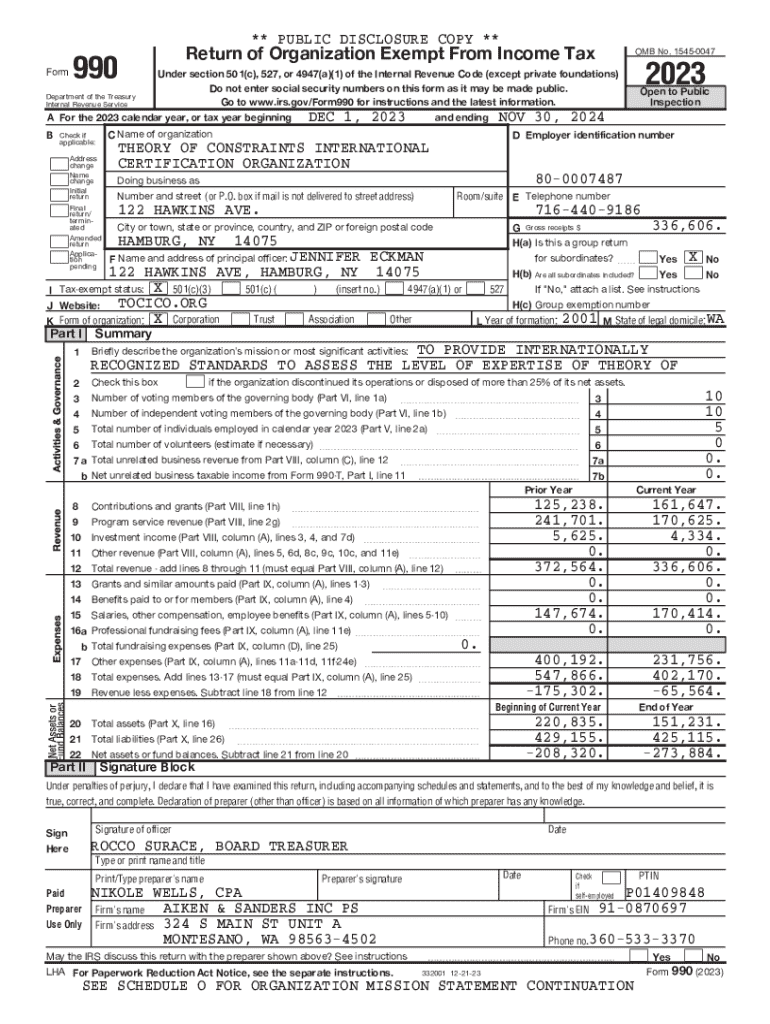

Form 990 is a critical financial document that nonprofit organizations must file annually with the IRS. Its primary purpose is to provide the government and the public with information about the organization’s activities, governance, financial condition, and adherence to tax-exempt regulations. For nonprofits, filing Form 990 is more than just a legal obligation; it is an opportunity to communicate transparency and accountability to donors, prospective funders, and the community.

The importance of Form 990 cannot be overstated. It serves as a report card on an organization’s financial health and operational compliance, which can influence donor decisions and public perception. Nonprofits rely on this form not only for IRS compliance but also for maintaining credibility and trust within their respective communities.

Historical context

Form 990 originated in 1943 as a way to ensure that501(c)(3) organizations were operating within the bounds of their tax-exempt status. Over the years, the form has evolved significantly in response to changing regulations and the need for greater accountability in the nonprofit sector. The IRS has made numerous modifications, introducing new schedules, and questions aimed at enhancing transparency and efficiency.

In the late 2000s, major reforms were introduced to deepen the level of detail required in reporting. This was largely in response to public outcry over nonprofit scandals and malpractices, underscoring the necessity for better financial oversight. As such, Form 990 has become a cornerstone of nonprofit governance, reflecting the ongoing commitment to public accountability.

Who needs to file Form 990?

Not all nonprofit organizations are required to file Form 990. Generally, it is demanded of organizations categorized under various sections of the Internal Revenue Code, such as 501(c)(3), 501(c)(4), and others. However, the specific type of form to be filed often depends on the organization’s annual income, structure, and activities.

For instance, organizations with gross receipts exceeding $200,000 or total assets over $500,000 typically file the standard Form 990. Meanwhile, smaller organizations with gross receipts under $200,000 can opt for Form 990-EZ, and those below $50,000 may use Form 990-N, also referred to as the e-Postcard.

Different variants of Form 990

Understanding the different variants of Form 990 is crucial for ensuring the correct form is filed. The standard Form 990 is comprehensive and designed for larger organizations that need to disclose detailed financial and operational information. However, the IRS provides simplified alternatives to accommodate smaller nonprofits.

For instance, Form 990-EZ allows mid-sized organizations to provide less information while still complying with IRS requirements, making it more accessible. The Form 990-N, or e-Postcard, caters to very small nonprofits that can file a simplified version, thus reducing their administrative burden and cost.

Filing requirements for Form 990

Nonprofits must adhere to specific filing requirements when submitting Form 990. Primarily, the annual filing deadlines are set for the 15th day of the 5th month after the end of the organization’s fiscal year. Thus, if a nonprofit’s fiscal year ends on December 31, the Form 990 must be submitted by May 15 of the following year. Organizations can request a six-month extension on their filing deadlines, but it is crucial to adhere to these timelines to avoid penalties.

Furthermore, nonprofits need to prepare detailed financial statements, individual compensation disclosures, and specific data about their mission and programs. The significance of accuracy and thoroughness in this documentation cannot be overstated, as incomplete or erroneous filings could raise red flags and trigger audits.

Detailed instructions for completing Form 990

Filling out Form 990 requires attention to detail and a thorough understanding of its structure. The form consists of various sections, including financial reporting, governance information, and program service accomplishments. Each section must be completed accurately, representing a true picture of the organization’s activities and financial position.

When approaching Form 990, nonprofits should break it down section by section. For example, organizations must report income from contributions, grants, and other sources, ensuring they provide accurate aggregate amounts. Alongside financial data, organizations need to convey how they govern themselves, detailing board composition and management practices.

Penalties for non-compliance

Failure to file Form 990 by the established deadline can result in significant penalties. For organizations that miss the deadline, the IRS imposes a penalty of $20 per day, capped at a maximum of $10,000 for organizations with gross receipts under $1 million. For larger organizations, fines can escalate further, with daily rates reaching up to $100 or a maximum of $50,000.

Beyond financial penalties, non-compliance can severely impact a nonprofit's ability to secure funding. Donors and foundations often check a nonprofit’s Form 990 before making contributions, and discrepancies or failures in reporting can lead to a loss of trust, making future fundraising significantly more challenging.

Public inspection regulations for Form 990

Transparency is a cornerstone of the nonprofit sector, and public access to Form 990 reinforces this principle. Organizations are required to make their Form 990 available for public inspection, typically for three years from the date of filing. This commitment to transparency allows potential donors, funders, and the general public to evaluate the organization’s financial health and operational integrity.

Nonprofits can fulfill this requirement by providing copies of Form 990 upon request, or they can publish the form on their website. Maintaining a proactive approach towards transparency can bolster an organization’s image and promote trust among stakeholders.

Using Form 990 for charity evaluation and research

Form 990 is not just a compliance document; it serves as a valuable tool for evaluating the financial health of nonprofit organizations. Researchers, funders, and analysts utilize the information contained within Form 990 to assess organizational performance, sustainability, and the impact of programs. The data can reveal trends in revenue, expenses, and program effectiveness, helping stakeholders make informed decisions.

When analyzing Form 990, it’s important to focus on key indicators such as the ratio of administrative expenses to total expenditures, the proportion of funds allocated to program services, and changes in revenue sources over time. These metrics can provide insights into how effectively an organization utilizes its resources to achieve its mission.

Navigating the Form 990 submission process

Submitting Form 990 can be done through various modalities, depending on the size of the organization and preferences. Nonprofits have the option to file electronically or through traditional paper submission. Many organizations opt for electronic filing due to its efficiency, ease of tracking, and ability to minimize errors.

While navigating the submission process, nonprofits can leverage consultation services, legal advice, or accounting expertise. Partnering with professionals familiar with Form 990 can facilitate accurate completion and compliance, particularly for complex organizations with multiple financial streams.

Third-party sources for Form 990

Numerous platforms provide templates and tools for filling out Form 990, enhancing the overall ease of the process. Online service providers such as pdfFiller offer valuable resources that enable users to fill out, edit, and even eSign Form 990, allowing for seamless collaboration among team members.

Utilizing such platforms can save organizations time and streamline the process, particularly as features often include version tracking, sharing options, and integrated document management. Engaging third-party assistance is particularly beneficial when navigating complex filings or ensuring adherence to current regulations.

Additional considerations

Maintaining adequate records is crucial for effectively managing Form 990. Nonprofits should have systems in place for record-keeping that not only capture financial transactions but also document the outcomes of programs and services. An organized record-keeping strategy strengthens the ability to compile accurate reports and respond effectively to any inquiries or audits.

Moreover, staying updated with changes in regulations regarding Form 990 is vital. Nonprofits should regularly review IRS guidelines, attend workshops, and participate in webinars that discuss evolving reporting requirements. Engaging actively in learning helps organizations maintain compliance and enhances their operational effectiveness.

Conclusion: Final thoughts on Form 990

In conclusion, Form 990 is an essential component of nonprofit transparency and compliance. Ensuring accuracy in filings is not only about adhering to regulations but also about fostering trust and credibility in the eyes of the donors and the community. Utilizing resources such as pdfFiller can simplify the management of Form 990 and help nonprofits to carry out their missions effectively.

By understanding and leveraging the insights from Form 990, nonprofit organizations can not only fulfill their legal obligations but also proactively enhance their reputation and impact within the community they serve.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify form 990 without leaving Google Drive?

How can I send form 990 to be eSigned by others?

How do I execute form 990 online?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.