Get the free Charging & Equipment Loans Policy

Get, Create, Make and Sign charging equipment loans policy

How to edit charging equipment loans policy online

Uncompromising security for your PDF editing and eSignature needs

How to fill out charging equipment loans policy

How to fill out charging equipment loans policy

Who needs charging equipment loans policy?

Comprehensive Guide to the Charging Equipment Loans Policy Form

Overview of charging equipment loans

Charging equipment loans provide a framework for borrowing essential tools necessary for various electric vehicle initiatives, portable battery systems, and renewable energy projects. These loans facilitate access to equipment such as charging stations and battery packs, which may be too costly to purchase outright. A well-structured loan policy ensures transparency and fairness, making it easier for individuals and organizations to understand their obligations and rights.

By having a comprehensive charging equipment loans policy form in place, borrowers can benefit significantly from streamlined processes, reduced paperwork, and clear communication regarding expectations. This is especially crucial for teams involved in sustainability projects where consistency and accuracy are paramount.

Understanding the charging equipment loans policy form

The purpose of the charging equipment loans policy form is to consolidate all necessary information and agreements related to borrowing equipment. This form typically outlines the terms of the loan, the responsibilities of both the lender and the borrower, and any associated costs. Furthermore, it also serves as a legal contract that defines the implications of the borrowing process.

Key components of this form include personal information of the borrower, detailed descriptions of the equipment, loan duration, and mandatory signatures. Legal implications are significant; failure to adhere to the terms can lead to financial penalties or, in severe instances, legal action. Therefore, it is crucial for users to understand every section clearly.

Steps to access the charging equipment loans policy form

Finding the charging equipment loans policy form on pdfFiller is a user-friendly process. Users should begin by navigating to the pdfFiller website, where a variety of forms are available for individual or team needs. The search bar allows users to quickly locate the charging equipment loans policy form by entering relevant keywords.

For those seeking specific variations of the form, pdfFiller offers multiple versions tailored to various user requirements. Once the appropriate version is found, users can seamlessly download, print, or directly fill it out using online tools.

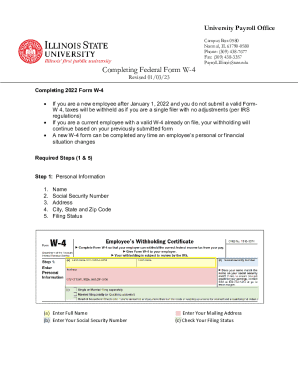

Filling out the charging equipment loans policy form

Completing the charging equipment loans policy form requires attention to detail. The first section generally involves personal information, such as the borrower's full name, address, and contact information. This data is crucial for identifying the applicant and serves as a basis for the loan agreement.

Next, the equipment details section requires a thorough description of the items being borrowed, including their make, model, and technical specifications. Importantly, users need to select their loan duration options and review the terms laid out in the policy. Ensure all entries are accurate to avoid any issues during the approval process.

Editing the charging equipment loans policy form

pdfFiller offers robust editing tools designed to make the filling and managing of forms straightforward. Users can take advantage of text editing features to correct any mistakes or to fill in missing information seamlessly. Furthermore, annotations and comments can be added for collaborative purposes.

Collaboration options are particularly valuable for teams, as pdfFiller allows users to invite team members for review before finalizing the submission. The editing process becomes streamlined, ensuring that all necessary eyes have viewed the document.

E-signing the charging equipment loans policy form

E-signatures have revolutionized the way agreements are finalized, including the charging equipment loans policy form. The benefits of using electronic signatures include enhanced efficiency, reduced paperwork, and quicker turnaround times. With pdfFiller, the e-signing process is intuitive and secure.

Users can follow a simple step-by-step guide to add their signature electronically. This system’s security features ensure that the signature is only accessible to the designated parties, protecting both the borrower and lender during the transaction.

Managing and tracking your charging equipment loan

Managing your charging equipment loans through pdfFiller extends beyond filling out forms. The platform provides excellent document management tools that allow users to track their loans effectively. This includes setting reminders for loan returns, thus minimizing the chances of accidental late returns.

Additionally, pdfFiller supports tracking the status and usage history of the equipment, which can be particularly beneficial for organizations managing multiple loans. This feature ensures accountability and allows for better planning in future projects.

Common questions about charging equipment loans

Many users may have questions concerning the various aspects of the charging equipment loans policy. Common inquiries often pertain to the availability of equipment, the process for securing loans, and understanding potential costs associated with lost or damaged equipment.

Addressing concerns from users about equipment availability and the related policies fosters trust and ensures a smoother borrowing experience. It’s imperative that users read all sections of the policy thoroughly to understand their responsibilities.

Best practices for successful equipment loans

Adhering to the charging equipment loans policy is paramount for successful loan management. Users should familiarize themselves with compliance requirements and expectations set forth by the lender. This includes understanding the conditions for returning equipment and potential liabilities for damages.

Beyond compliance, maintaining the borrowed equipment in good condition not only reflects well on the borrower but also promotes a positive relationship with the lender. Users should document any issues immediately upon receiving the equipment to avoid disputes later.

Sharing feedback on the charging equipment loans policy form

User feedback plays a vital role in enhancing the functionality and effectiveness of the charging equipment loans policy form. Engaging users to share their experiences assists in identifying areas for improvement, which can ultimately lead to a more user-friendly process.

Users should feel encouraged to provide constructive feedback through the pdfFiller platform. This engagement allows pdfFiller to refine its offerings based on real-world usage, thus catering to customer needs better. Additionally, reaching out to customer support for assistance or further information is always recommended.

Contact information for further inquiries

For any additional questions regarding the charging equipment loans policy form, users can easily contact pdfFiller’s customer support. The platform offers multiple channels for communication, from live chat support to dedicated email assistance.

Users can explore these contact options directly through the pdfFiller website. Quick access to support can significantly enhance the user experience for those navigating the equipment loan process.

Additional insights

Keeping abreast of the latest trends in charging equipment loans is vital for organizations. The landscape is rapidly changing with new technologies and refinements in loan policies appearing regularly. Case studies of successful implementations reveal valuable lessons, showcasing the effectiveness of tailored policies in addressing user needs.

Future developments in document management systems, particularly at pdfFiller, promise to make the process of managing charging equipment loans even more efficient. As technology advances, users can expect a more automated, user-friendly experience tailored to support dynamic project requirements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get charging equipment loans policy?

Can I create an electronic signature for signing my charging equipment loans policy in Gmail?

How do I fill out charging equipment loans policy using my mobile device?

What is charging equipment loans policy?

Who is required to file charging equipment loans policy?

How to fill out charging equipment loans policy?

What is the purpose of charging equipment loans policy?

What information must be reported on charging equipment loans policy?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.