Get the free Form 8-k

Get, Create, Make and Sign form 8-k

How to edit form 8-k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8-k

How to fill out form 8-k

Who needs form 8-k?

Understanding the Form 8-K: A Comprehensive Guide

Overview of Form 8-K

Form 8-K is a crucial document that publicly traded companies must file with the Securities and Exchange Commission (SEC) whenever they experience significant corporate events. This form serves as a way for companies to communicate important events to shareholders and the public, ensuring transparency in corporate governance.

The primary purpose of Form 8-K is to provide timely information about major events that might affect the financial status of a company or its stock value. These events may include acquisitions, bankruptcy, or leadership changes. By mandating such disclosures, the SEC aims to promote fair trading and protect investors.

Companies must comply with stringent regulations when filing Form 8-K, as stipulated by the SEC rules. The accuracy and timeliness of these disclosures are paramount; therefore, understanding the compliance standards is critical for corporate leaders and compliance officers alike.

When to file Form 8-K

Certain circumstances mandate the filing of Form 8-K, designed to alert shareholders and the public of major corporate decisions and changes. These include:

Timeliness is critical when it comes to filing Form 8-K. Companies typically have four business days to submit the form after an event requiring disclosure. Delays in filing can result in penalties and loss of investor confidence, underscoring the importance of being vigilant and proactive.

How to fill out Form 8-K

Successfully filling out Form 8-K requires a systematic approach. Here are step-by-step instructions to ensure accuracy and compliance:

While filling out the form, it's important to avoid common pitfalls such as unclear language or incomplete information. Clarity and detail can prevent misunderstandings and ensure that stakeholders receive the information they need.

Understanding the structure of Form 8-K

Form 8-K is structured to facilitate the reporting of significant events clearly. The key sections include:

An annotated example of a completed Form 8-K can provide clarity on how to utilize these sections effectively. This also reinforces the importance of meticulousness when compiling information.

Reading and interpreting Form 8-K

Understanding the terminology used in Form 8-K is necessary for accurate interpretation. Common terms such as 'material event' and 'disclosure' could greatly impact financial decision-making.

To effectively analyze the information reported in Form 8-K, focus on the financial implications. Evaluate corporate actions against industry benchmarks and historical data to gauge the potential impact on stock performance.

Additionally, understanding the overall context of the disclosures can help investors make informed decisions. The accompanying narrative can provide nuances not captured in numerical data alone.

Historical context of Form 8-K

Since its introduction, Form 8-K has undergone several changes meant to enhance corporate transparency. Historical requirements were more lenient, reflecting a time when fewer corporate events warranted rapid disclosure.

Notable changes over the years include the expansion of the types of events that require disclosures, effectively broadening the scope of information available to investors. Regulatory adjustments, particularly after major financial scandals, have impacted how companies file Form 8-K, promoting accountability.

This evolution emphasizes the SEC's commitment to modernizing the disclosure framework in light of an ever-changing corporate landscape, ensuring that investors remain informed and protected.

Benefits of filing Form 8-K

Filing Form 8-K offers numerous benefits for companies, primarily revolving around the themes of transparency and compliance. By routinely disclosing significant events, companies foster trust among investors and stakeholders.

Additionally, compliance with Form 8-K requirements mitigates potential legal risks, as timely filings serve as a safeguard against allegations of misinformation. For investors, these disclosures lead to greater awareness and informed decision-making, which can ultimately bolster market stability.

Furthermore, adherence to these regulations enhances a company’s reputation within the market, promoting confidence among current and future investors.

Common questions about Form 8-K

Many individuals have questions regarding Form 8-K, especially concerning compliance and potential repercussions of filing delays. For instance, what happens if Form 8-K is not filed on time? Companies may incur penalties, including fines, and could potentially face scrutiny from regulators.

Additionally, correcting a mistake in a filed Form 8-K is possible by filing an amended version of the form. Understanding these processes, along with expert insights on complex scenarios, can greatly assist companies in navigating the intricacies of corporate filings.

Resources for completing Form 8-K

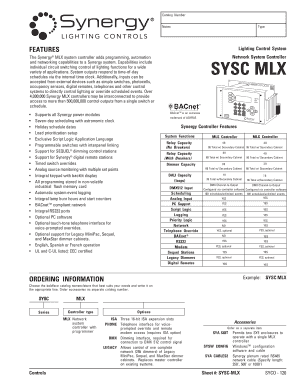

Several resources can aid in the completion of Form 8-K, including interactive tools and templates that guide users through the filing process. Online platforms now exist to create and edit Form 8-K efficiently.

Recommended software solutions can facilitate the process, ensuring that users have access to the right templates and filing mechanisms. For instance, pdfFiller enhances the Form 8-K handling process by providing intuitive editing features, e-signature capabilities, and collaboration tools, specifically designed for cloud-based document management.

Case studies and examples

Real-life applications of Form 8-K highlight its significance across different industries. For example, a healthcare company announcing a major merger via Form 8-K can influence stock prices and investor sentiment significantly.

Additionally, exploring the outcomes of timely versus delayed filings can offer valuable lessons. Companies that filed promptly often showcased a commitment to transparency, while those that delayed faced backlash from investors and regulators alike.

Keeping updated on Form 8-K developments

Staying informed about developments related to Form 8-K is essential for companies and investors alike. Continuous regulatory changes may impact filing requirements or procedures, making it crucial to subscribe for updates and engage with relevant news sources.

Utilizing platforms like pdfFiller provides instant access to updates, ensuring that users manage their documents effectively while staying compliant with the latest regulations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify form 8-k without leaving Google Drive?

How do I fill out form 8-k using my mobile device?

Can I edit form 8-k on an iOS device?

What is form 8-k?

Who is required to file form 8-k?

How to fill out form 8-k?

What is the purpose of form 8-k?

What information must be reported on form 8-k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.