Get the free Form M23

Get, Create, Make and Sign form m23

Editing form m23 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form m23

How to fill out form m23

Who needs form m23?

A Comprehensive Guide to Form M23: Claiming a Refund for a Deceased Taxpayer

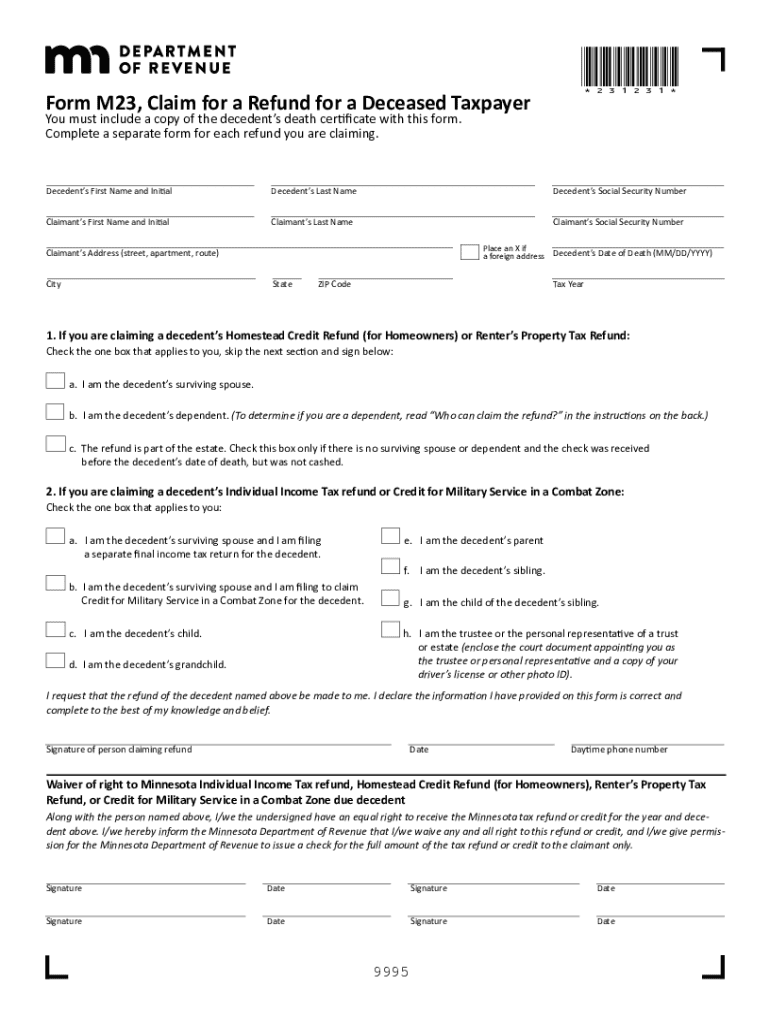

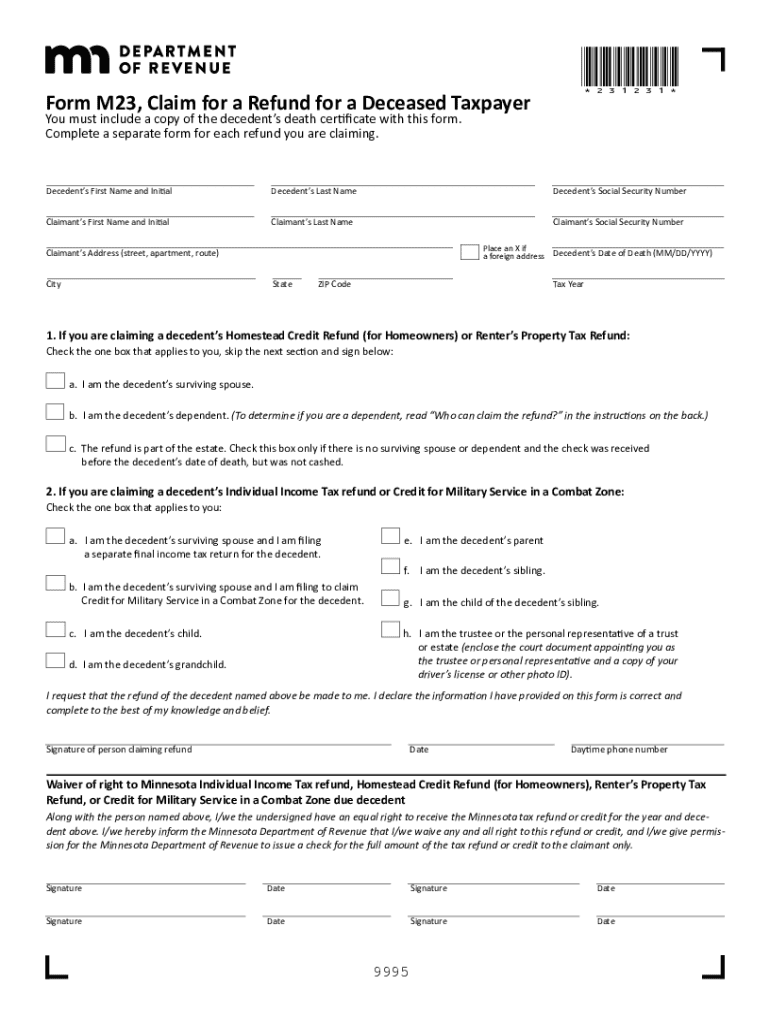

Understanding Form M23

Form M23 serves as an essential tool for executors and heirs looking to claim tax refunds for deceased individuals. Specifically, it is utilized to facilitate the process of obtaining a refund for any overpaid taxes by a taxpayer after their passing. This document not only streamlines the refund process but also ensures compliance with IRS regulations.

Filing Form M23 is vital as it allows executors to manage the financial affairs of the deceased effectively. Claiming a refund can alleviate the burden on heirs by recovering funds that may have otherwise remained unclaimed. Moreover, understanding the legal obligations related to filing the form protects the interests of both executors and beneficiaries in the estate.

Who should use Form M23?

Eligible parties for filing Form M23 include executors named in a will or individuals legally designated to handle the tax affairs of a deceased taxpayer. To file this form, there are specific requirements that individuals must meet, such as ensuring they have the proper documentation and the deceased’s Social Security Number.

Form M23 is particularly applicable in various scenarios, such as instances where the deceased made tax payments that exceed their actual tax liability, or when they qualified for tax credits and deductions that went unclaimed. Understanding these situations enables eligible individuals to navigate the complexities of tax refunds more easily.

Preparing to fill out Form M23

Before tackling Form M23, it’s crucial to gather all necessary documents to facilitate a smooth filing process. Key documents include the deceased’s last valid tax return, their death certificate, and any correspondence from the IRS, particularly regarding tax overpayments. Having these documents readily available not only expedites the completion of the form but also reduces the likelihood of delays.

To enhance efficiency while preparing, creating a checklist can significantly streamline the process. Ensuring all necessary documentation is accounted for prior to filling out the form can save time and frustration.

Step-by-step instructions for filling out Form M23

Filling out Form M23 involves several critical steps that require attention to detail. Start with the Taxpayer Information section, where you'll provide accurate details about the deceased tax filer. Ensure that the Social Security Number is correctly entered to avoid processing delays.

Avoiding common mistakes can significantly improve the likelihood of your form being processed quickly. Double-check for missing information or miscalculations, as these errors can lead to unnecessary delays or complications in the refund process.

Resources for managing Form M23 submissions

Utilizing platforms like pdfFiller can greatly enhance your experience when submitting Form M23. pdfFiller provides tools that allow users to edit the form directly online, ensuring all entries are accurate before submission. Their eSigning capabilities also simplify the process, allowing the executor to notarize the form digitally.

After submission, tracking your Form M23 is crucial. Use pdfFiller's status tracking features to monitor the progress of your claim. Knowing the status can provide peace of mind and help you stay informed about when funds can be expected to arrive.

Related forms and resources

Several other IRS forms may become pertinent when dealing with tax affairs post-mortem. For instance, Form 1040-X is often used for amending previous tax returns, while Form 56 may need to be filed to inform the IRS of the executor’s authority.

For additional information, the IRS website offers various resources and guides that can help manage estate taxes and understand the requirements for each form, helping executors navigate the complex landscape of posthumous tax obligations.

Frequently asked questions about Form M23

Individuals often have queries regarding the Form M23, including processing times and rectifying errors in submissions. Generally, the IRS processes tax refund claims in about 8 to 12 weeks, though this timeframe can vary based on accuracy and completeness.

If you find mistakes in your Form M23 submission, it’s imperative to contact the IRS immediately. Efficient communication can help mitigate any issues that may arise from incorrect filings.

Additional support tools

Leveraging online calculators can play a pivotal role in determining potential tax refunds. By inputting relevant financial information, you can expedite the calculation process and set realistic expectations concerning your refund.

Community forums and discussion boards can also be invaluable resources. Engaging with others who have navigated the filing of Form M23 allows you to share experiences and gather insights that may prove beneficial in your journey. Learning from case studies can offer practical examples of successful filings, providing real-world context to the filing process.

Recent changes to Form M23

It’s important to stay informed about any recent regulatory updates concerning Form M23. The IRS occasionally revises forms and guidelines, which can have significant implications for filing processes and requirements. Regularly checking the IRS website or reputable tax resources can ensure you are using the most current version of Form M23.

Understanding these changes contributes to a smoother filing process and may affect eligibility for certain tax refunds. Being proactive helps executors and heirs avoid potential pitfalls in navigating the tax refund process.

Featured categories

Exploring additional categories on pdfFiller can uncover more tools and resources related to document management and electronic signing solutions. Such tools can greatly enhance efficiency, providing better methods for handling tax forms and related documents in one centralized location.

Understanding these categories not only streamlines the process of managing Form M23 but also enhances overall efficiency in handling various document needs.

Important links

Direct links to download Form M23 or access e-filing options through pdfFiller can greatly simplify transactions. Transitioning to a digital document management system can further organize and optimize your filing experience, making it easier to maintain compliance with IRS requirements.

Leveraging these resources can significantly enhance your workflow and ensure efficient handling of Form M23.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute form m23 online?

How do I complete form m23 on an iOS device?

How do I complete form m23 on an Android device?

What is form m23?

Who is required to file form m23?

How to fill out form m23?

What is the purpose of form m23?

What information must be reported on form m23?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.