Get the free Form Adv

Get, Create, Make and Sign form adv

Editing form adv online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form adv

How to fill out form adv

Who needs form adv?

A comprehensive guide to Form ADV

Understanding Form ADV

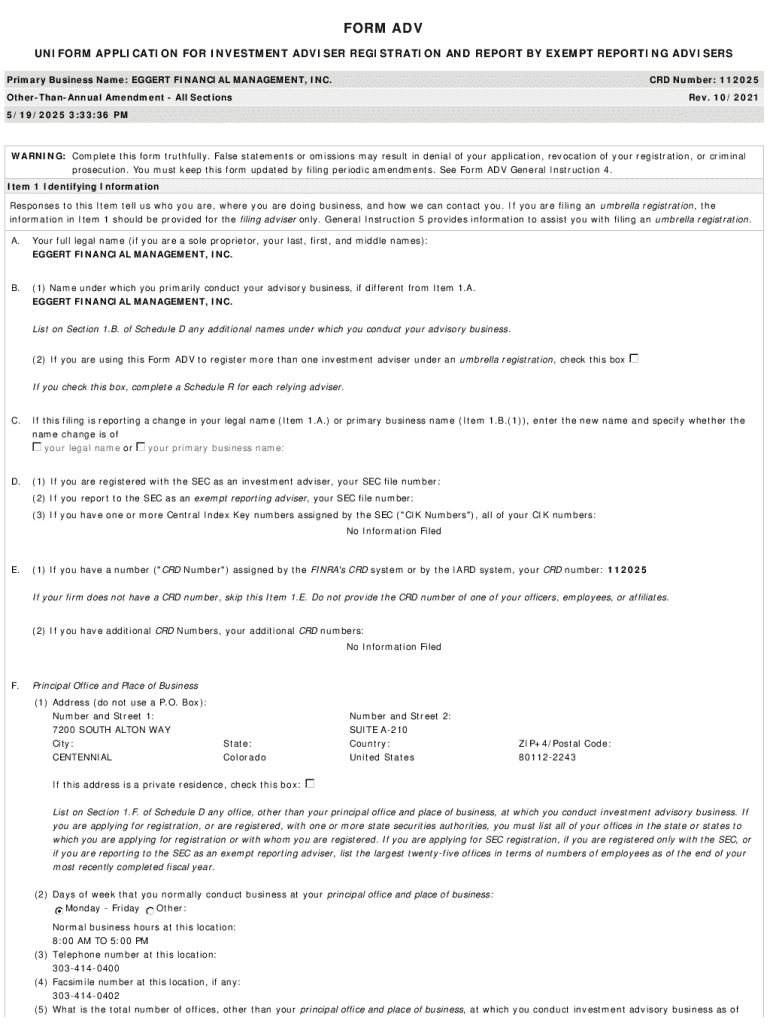

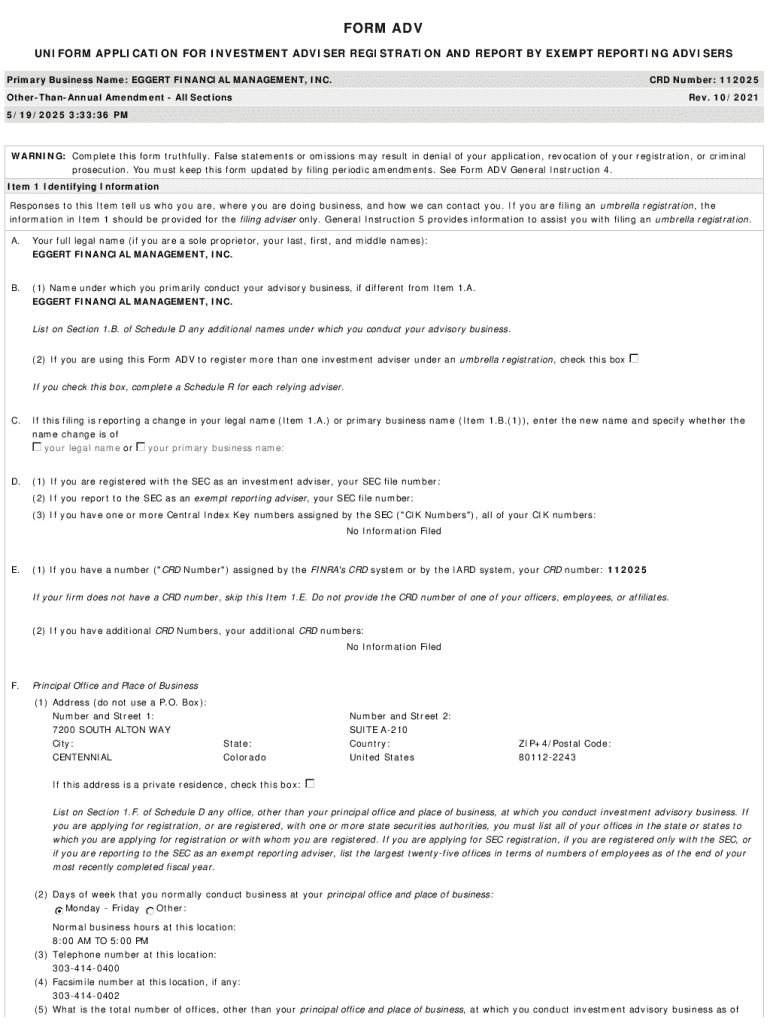

Form ADV is a crucial document used by investment advisers to register with the Securities and Exchange Commission (SEC) and state regulators. This form provides a comprehensive overview of the business practices and services offered by advisory firms. Its primary role is to disclose necessary information to clients and potential clients about the advisory firm's operations, ensuring transparency and establishing trust in the investment advisory industry.

The importance of Form ADV cannot be overstated; it serves as a key tool for client education and regulatory compliance. Clients can use the information disclosed in Form ADV to assess the qualifications, financial stability, and ethical standards of their potential advisers, thereby making informed investment decisions.

There are two main types of Form ADV: Part 1 and Part 2. Part 1 contains general information about the advisory firm, while Part 2 includes a brochure that describes services and fees in detail. This structure supports clarity and enhances the client's understanding of what to expect from their adviser.

Key components of Form ADV

Part 1 of Form ADV consists of an itemized list of required information. This includes essential details about the advisory firm, such as its legal structure, ownership, and the nature of its operations. It also mandates disclosure of any business practices that may impact clients, including disciplinary history and conflicts of interest. The clarity provided in this part is vital for reviewers assessing the adviser’s integrity and operational capabilities.

On the other hand, Part 2 focuses on client relationship details. It outlines the description of services offered, including investment strategies, whether the firm provides financial planning or wealth management services, and the types of clients served. Clients find this part particularly useful as it explicitly details the fees structure, including whether the firm charges flat fees, hourly rates, or performance-based fees. This transparency helps clients assess overall value and alignment with their investment needs.

Filling out Form ADV

Completing Form ADV requires careful attention to detail. Start by gathering necessary information which includes the firm’s legal structure, ownership details, and a comprehensive overview of business practices. Accurate completion of this form is critical to avoid compliance issues and ensure efficient registration.

When filling out Part 1, focus on accuracy in providing basic information about the advisory firm, including its history and services. Remember, any discrepancies or incomplete information might lead to regulatory scrutiny or delayed approval. It's advisable to double-check details before submission.

In Part 2, crafting an effective brochure is paramount. Make sure to highlight key client engagement strategies and articulate the firm's value proposition clearly. This part should not only inform clients but also persuade them of the quality of services provided. By focusing on transparency in fees and services, firms can foster trust and build productive client relationships.

Editing and managing Form ADV

Editing Form ADV submissions is a critical part of maintaining compliance. Utilizing document management tools can significantly streamline this process. Keep cosmetic changes minimal; concentrate instead on ensuring that factual and compliance standards are met in each version of the document.

Regularly revising Form ADV is necessary due to changes in business practices, client relationships, or regulatory requirements. Triggers for updates often include significant changes in the firm’s structure, adjustments in services offered, or newly conducted surveys during client interactions that could impact disclosures. Keeping accurate records during these changes is crucial for compliance and maintaining the integrity of client relationships.

eSigning and submitting Form ADV

In a world that's increasingly moving digital, the importance of digital signatures in the submission of Form ADV cannot be overlooked. Electronic signatures hold legal validity and simplify the signing process for both advisers and clients. By utilizing tools like pdfFiller, capturing eSignatures can be accomplished quickly and efficiently, enhancing the overall user experience.

Once the form is accurately completed, the submission process should follow the guidelines outlined by regulatory authorities. Submission is generally conducted online via the Investment Adviser Registration Depository (IARD). After submission, advisers should ensure confirmation of receipt from the regulatory body and establish follow-up procedures to address any potential queries regarding the submitted information.

Interactive tools for Form ADV

pdfFiller offers a range of interactive tools to make working with Form ADV more efficient. Key features include form filling automation, which saves time by reducing repetitive entries and streamlining administrative tasks. These capabilities offer users a seamless workflow that enhances accuracy, ultimately resulting in fewer compliance issues.

Moreover, real-time collaboration features enable teams to work together effectively on Form ADV, even when separated by great distances. This capability allows for simultaneous input from different team members, which is especially beneficial during the development and revision phases of the form. Implementing tracking changes and version controls is essential as well, ensuring a clear record of all edits made over time.

Managing client relationships with Form ADV

Form ADV can be a strategic asset in managing client interactions. By understanding what clients expect detailing firm services, advisers can clearly set client expectations and diminish miscommunications. An effectively crafted Form ADV can serve as a powerful marketing tool that positions the firm competently within the crowded advisory market.

Confidentiality is a significant consideration in handling Form ADV information, as it contains sensitive information about both the advisory practice and its clients. Maintaining compliance with confidentiality standards not only upholds regulatory requirements but also establishes a culture of trust within client relationships.

Common mistakes and misconceptions about Form ADV

Frequent errors in completing Form ADV often stem from omitting essential information or misinterpreting regulatory requirements. Common pitfalls include incomplete disclosures about fees or inaccuracies related to the firm’s disciplinary history. Avoiding these mistakes enhances the likelihood of regulatory approval and promotes a trustworthy relationship with clients.

Addressing misconceptions is equally important. Many advisers believe that disclosing performance-based fees is straightforward, while it requires careful placement within the context of the firm's overall fee structure. Clarifying fee arrangements to clients not only satisfies regulatory expectations but also prevents misinformation from tarnishing the firm's reputation.

The future of Form ADV in a digital world

As technology continues to reshape the investment advisory landscape, regulatory requirements are evolving, progressively moving towards a fully digital experience for processes like Form ADV registration. The inclusion of automated tools and artificial intelligence for filling out and managing forms signifies a crucial shift. This integration can enhance accuracy and efficiency while reducing the administrative burden on advisory firms.

Staying abreast of regulatory changes is essential for any advisory firm. Awareness of emerging trends and adjustments in compliance requirements related to Form ADV can equip firms to better adapt and thrive amidst these shifts, ensuring that they maintain their reputational integrity and provide enhanced service offerings to clients.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit form adv online?

How do I make edits in form adv without leaving Chrome?

How do I edit form adv straight from my smartphone?

What is form ADV?

Who is required to file form ADV?

How to fill out form ADV?

What is the purpose of form ADV?

What information must be reported on form ADV?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.