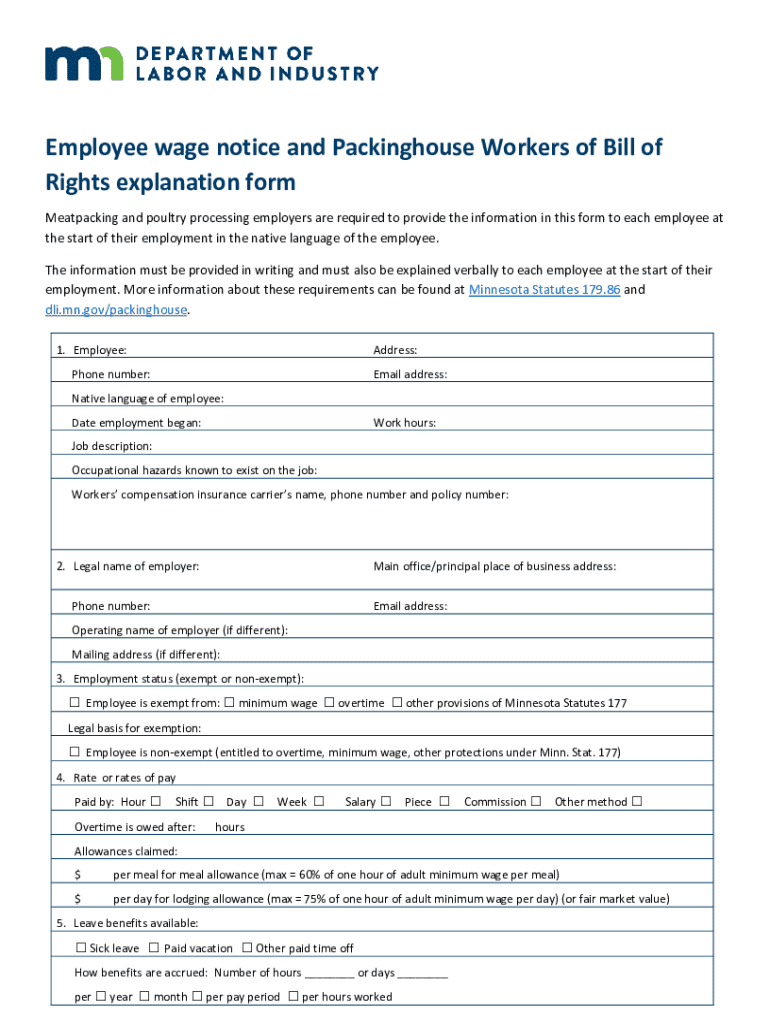

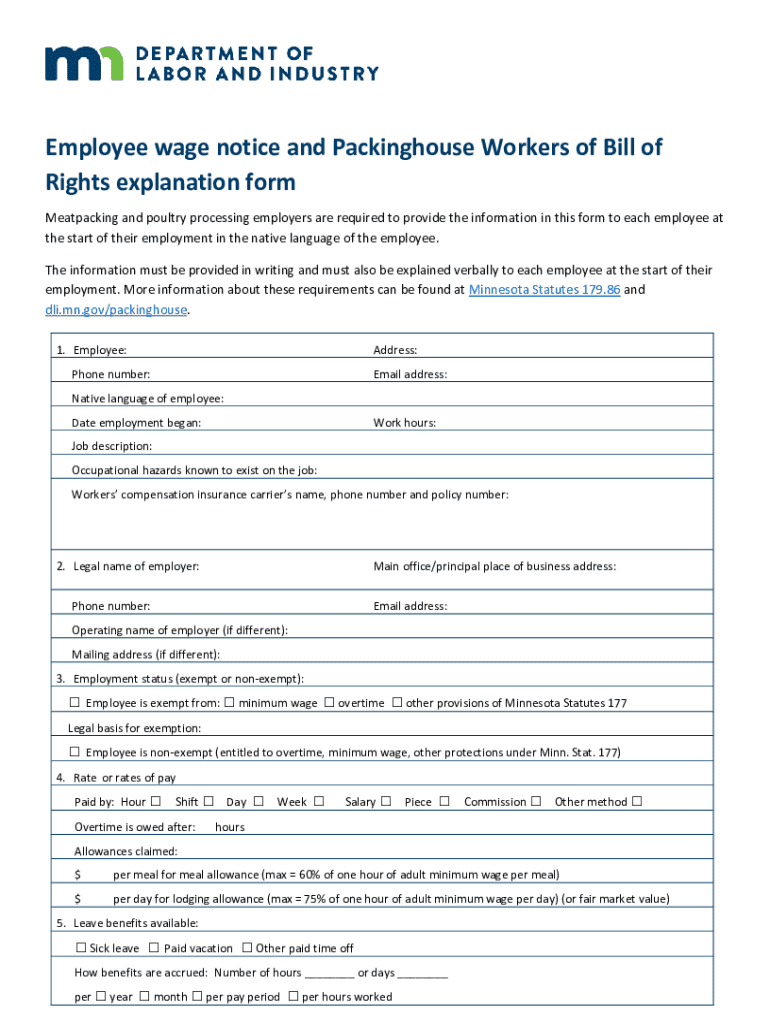

Get the free Employee wage notice and Packinghouse Workers of Bill of Rights explanation form

Get, Create, Make and Sign employee wage notice and

How to edit employee wage notice and online

Uncompromising security for your PDF editing and eSignature needs

How to fill out employee wage notice and

How to fill out employee wage notice and

Who needs employee wage notice and?

Employee Wage Notice and Form: A Comprehensive Guide

Understanding employee wage notices

Employee wage notices serve as official documentation that outlines the wage details provided to employees by their employers. These notices are integral in fostering transparency and trust in the employer-employee relationship. Furthermore, they play a crucial role in helping employees understand their remuneration structure and rights.

Legal requirements for wage notifications vary across jurisdictions. Many states mandate that employers provide wage notices before or at the time of a new hire and whenever there are changes to an employee's compensation. This safeguarding of employee interests is crucial for compliance and avoids potential disputes.

However, there are common misconceptions surrounding wage notices. Many believe that these forms are solely for hourly employees, neglecting salaried positions or exempt employees. Understanding the scope and intent of wage notices is key to leveraging this tool effectively.

Components of an employee wage notice

A well-crafted employee wage notice contains several key elements that provide comprehensive information about the employee's compensation. Ensuring all required details are included minimizes the risk of misunderstandings.

These components must be personalized based on the employee's contract and state regulations. Accurate information enables efficient payroll processing and ensures compliance with labor laws.

Types of employee wage notices

Employee wage notices can generally be categorized into standard and special types. Each serves different needs depending on employment status and industry.

Understanding the varieties of wage notices ensures employers provide accurate information suitable for each employee's work context, fostering compliance and clarity in wage communication.

State-specific wage notice requirements

Wage notice requirements can differ significantly by state, reflecting local labor laws and regulations. Therefore, employers must stay informed about the requirements in their specific state.

Regulatory bodies like the Department of Labor oversee these mandates, ensuring employers comply with wage requirements. For example, states like New York have stringent guidelines about wage notifications, while in California, the law requires additional details about meal and rest breaks for employees.

Being aware of these variances is fundamental for employers, as non-compliance can result in fines or legal challenges.

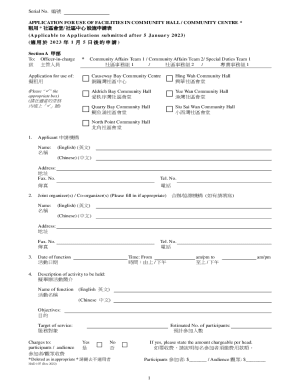

Filling out the employee wage notice form

Filling out the employee wage notice form correctly is critical in ensuring compliance and providing essential information to employees. Here is a step-by-step guide to streamline the process.

For compliance and accuracy, double-check all information and avoid common errors such as misspellings, incorrect wage rates, or omitted signatures.

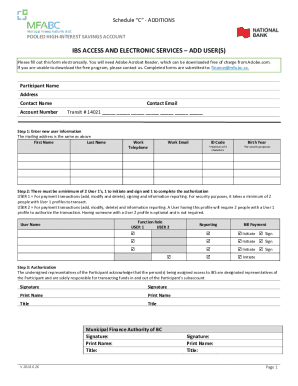

Interactive tools available on pdfFiller

Utilizing the tools available on pdfFiller can greatly enhance the efficiency of managing employee wage notices. The platform offers customizable features that cater to diverse needs.

These interactive tools not only save time but also ensure that the forms reflect the most current and accurate information required by law.

Best practices for managing wage notices

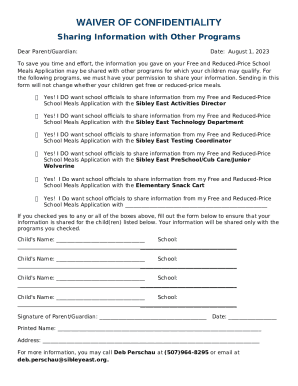

Managing employee wage notices effectively involves strategic record-keeping and regular updates. Keeping copies of all notices is paramount for both employers and employees.

Proper management of wage notices not only complies with legal standards but also reinforces a healthy work environment based on transparency and communication.

FAQs regarding employee wage notices

Common questions about employee wage notices often arise around their purpose, the information required, and submission processes. Understanding these FAQs helps clarify any potential confusion for both employers and employees.

For further assistance, employees can reach out to their HR department or relevant labor organizations if they have additional questions.

Additional forms related to employee wage notices

In addition to the wage notice form, various associated documents may be needed depending on employment types and specific circumstances. Understanding these forms contributes to better payroll and compliance management.

All these forms can be efficiently managed using pdfFiller, ensuring accessibility and compliance across the board.

Stay informed

Staying informed about any changes in labor laws is vital for both employers and employees. Being proactive allows both parties to adapt efficiently and remain compliant.

Empowering yourself with knowledge effectively ensures that all parties are adequately informed and compliant.

Contact and support

For any questions or support regarding employee wage notices and forms, pdfFiller's customer support team is ready to assist. Accessing help ensures you navigate through all documentation smoothly.

Connecting with support resources guarantees that you have all necessary tools and guidance at your disposal.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my employee wage notice and directly from Gmail?

Can I create an electronic signature for signing my employee wage notice and in Gmail?

How do I edit employee wage notice and on an Android device?

What is employee wage notice?

Who is required to file employee wage notice?

How to fill out employee wage notice?

What is the purpose of employee wage notice?

What information must be reported on employee wage notice?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.