Get the free Form 990

Get, Create, Make and Sign form 990

Editing form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Form 990 Form: A Comprehensive Guide

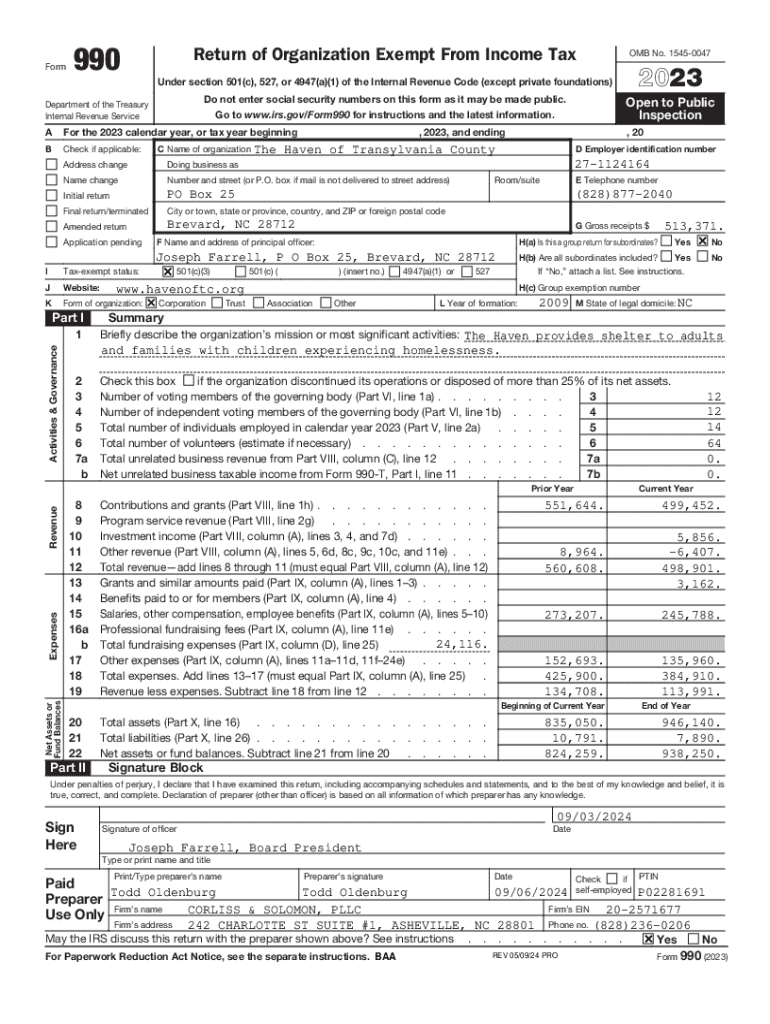

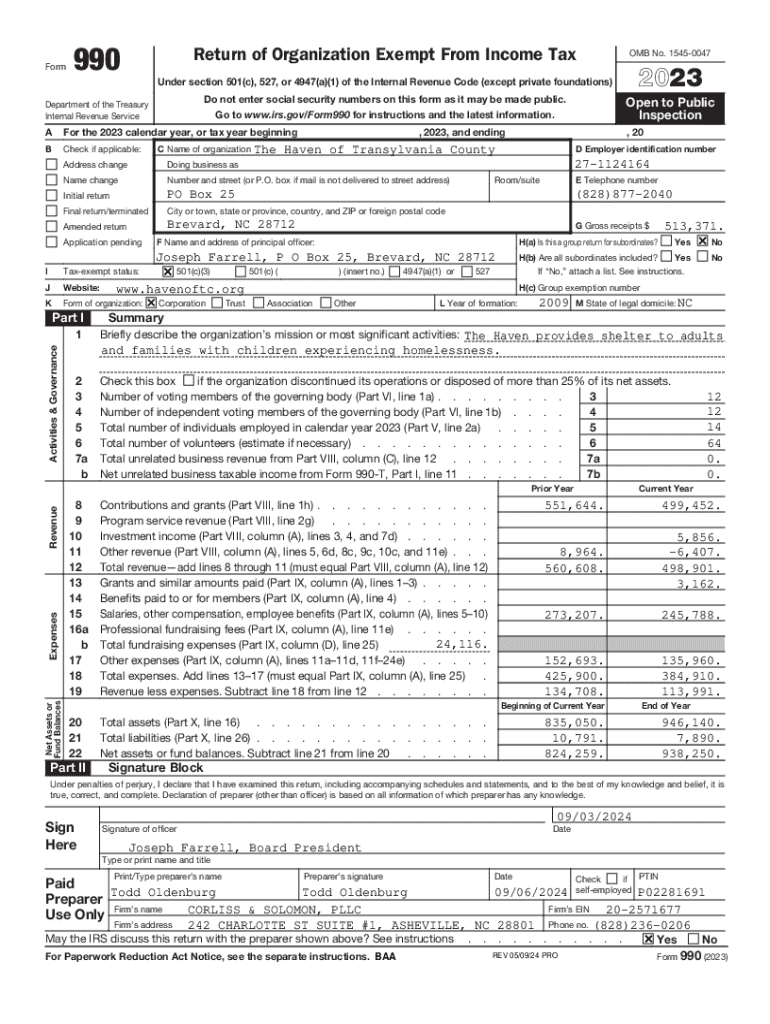

Understanding Form 990

Form 990 serves as the primary federal information return for tax-exempt organizations in the United States, including charities, foundations, and other non-profits. This form provides an overview of a non-profit's financial activity, governance, and program outcomes, playing a crucial role in enhancing transparency and accountability.

The importance of Form 990 cannot be overstated, as it helps the IRS monitor compliance with tax-exempt status, informs the public about an organization’s financial health, and helps stakeholders make informed decisions. Detailed financial data and organizational structure disclosed in Form 990 contribute to building public trust.

There are several types of Form 990, each tailored for different organizations based on size and revenue, including:

Who must file Form 990?

Not all organizations are required to file Form 990. Generally, 501(c)3 organizations and other tax-exempt entities fall under the obligation to file, but there are important exemptions. For example, religious and government entities typically do not have to file.

Eligibility criteria for filing depend on the organization's specific status and the annual income generated. Filing thresholds indicate that organizations exceeding threshold limits must comply, while smaller entities may be exempt. Here are the primary criteria:

Filing requirements for Form 990

Filings must be submitted annually, with specific deadlines typically due on the 15th day of the 5th month after the end of the organization’s accounting period. For many organizations, this means May 15 for a calendar year. Extensions can be requested using Form 8868, but penalties apply for late submissions.

The IRS requires supporting documentation for Form 990. Organizations must compile financial records, including income statements, cash flow statements, and balance sheets. Additionally, specific schedules tailored for different aspects of the organization must be completed. Key components often needed include:

Navigating the Form 990

Completing Form 990 can seem daunting, but breaking it down into sections can make the process manageable. Each section addresses different aspects of the organization’s operations and financials, such as revenue, expenses, assets, and functional expenses.

To help avoid pitfalls, organizations should ensure that all financial data is accurate and up-to-date. Common mistakes include underreporting income and misunderstanding nonprofit classifications. Here’s a brief breakdown of key sections for Form 990:

Filling out schedules accurately is critical, as Schedules A, B, and C each focus on distinct facets of nonprofit transparency and governance, presenting information that can help mitigate any scrutiny of the organization by stakeholders.

Electronic filing and submission

eFiling Form 990 through an IRS-approved provider is often the most efficient way to submit your forms. Organizations must choose compatible electronic filing options to ensure compliance. The step-by-step e-filing process typically involves preparing your information, logging onto the chosen e-filing system, and following the prompts to input your financial data.

pdfFiller offers an intuitive platform to guide users through the e-filing process. Ease of use is enhanced with features that allow for document creation, editing, and eSigning. Using pdfFiller, organizations can seamlessly navigate the complexities of Form 990, including:

Editing and managing Form 990

If corrections are needed after submitting Form 990, organizations can file Form 990-X to amend their return. Keeping an accurate record is essential, not only to maintain compliance but also to support future filings. Best practices for managing Form 990 and its records include maintaining digital copies and adopting consistent filing procedures.

Tracking past submissions is crucial for comparison and evaluation over time. Organizations can create templates of Form 990 to streamline future filings, which can assist in minimizing redundant work and ensuring thorough and accurate resubmissions.

Consequences of non-filing or inaccurate reporting

Failure to file Form 990 or providing inaccurate information can lead to significant fines and penalties. Organizations that neglect their reporting obligations can face fines of $20 per day, up to a maximum of $10,000, which can escalate if discrepancies are persistently reported.

Moreover, repeated non-compliance may jeopardize tax-exempt status, leading to severe consequences. Common mistakes organizations make often revolve around:

Public inspection and transparency

Form 990 is publicly available for inspection, reinforcing the commitment of nonprofits to transparency. Organizations are required to provide access to their Form 990 and other tax documents, which fosters public trust and confidence.

The information contained within Form 990 can also be a valuable tool for stakeholders and potential donors looking to evaluate the efficiency and effectiveness of a charity. Public access to this data allows for informed decision-making. Key areas of interest for potential funders include:

Historical context and evolution of Form 990

Form 990's history reflects evolving regulatory standards, with its origins tracing back to the Tax Reform Act of 1969, which aimed to enhance transparency for charitable organizations. Over the years, amendments and updates have evolved the form to better capture financial activities, improve clarity, and increase the utility of the information provided.

Noteworthy revisions include the introduction of various schedules, the push for electronic filing, and adaptations to improve the user experience for both nonprofits and the IRS. As sectors evolve, Form 990 continues to adapt to contemporary reporting needs and nonprofit developments.

Resources and tools for non-profits

Organizations often require additional support in navigating the complexities of Form 990 and related obligations. There are numerous professional organizations and consultancy services that specialize in nonprofit financial compliance. Furthermore, local community resources can provide educational opportunities via workshops and webinars.

Beyond pdfFiller, a variety of software solutions exist that offer document management and filing support tailored to nonprofit needs. Recommended resources include nonprofit associations, IRS assistance, and online forums where best practices and experiences can be shared among organizations.

Related forms and additional considerations

In addition to Form 990, organizations must be aware of other IRS forms that may apply, such as Form 1023 for obtaining tax-exempt status or Form 1099 for reporting payments made to non-employees. Understanding these forms and requirements is crucial for comprehensive compliance and sharper organizational strategy.

Strategic planning for future filings involves year-round preparation, ensuring that organizations stay organized, maintain accurate financial records, and incorporate Form 990 objectives into overall organizational strategy. Aligning financial goals with reporting requirements promotes clearer operational forecasting and donor communication.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my form 990 in Gmail?

Where do I find form 990?

How do I complete form 990 online?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.