Get the free Sec Form 3

Get, Create, Make and Sign sec form 3

How to edit sec form 3 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sec form 3

How to fill out sec form 3

Who needs sec form 3?

Your Comprehensive Guide to SEC Form 3: Requirements and Filing Instructions

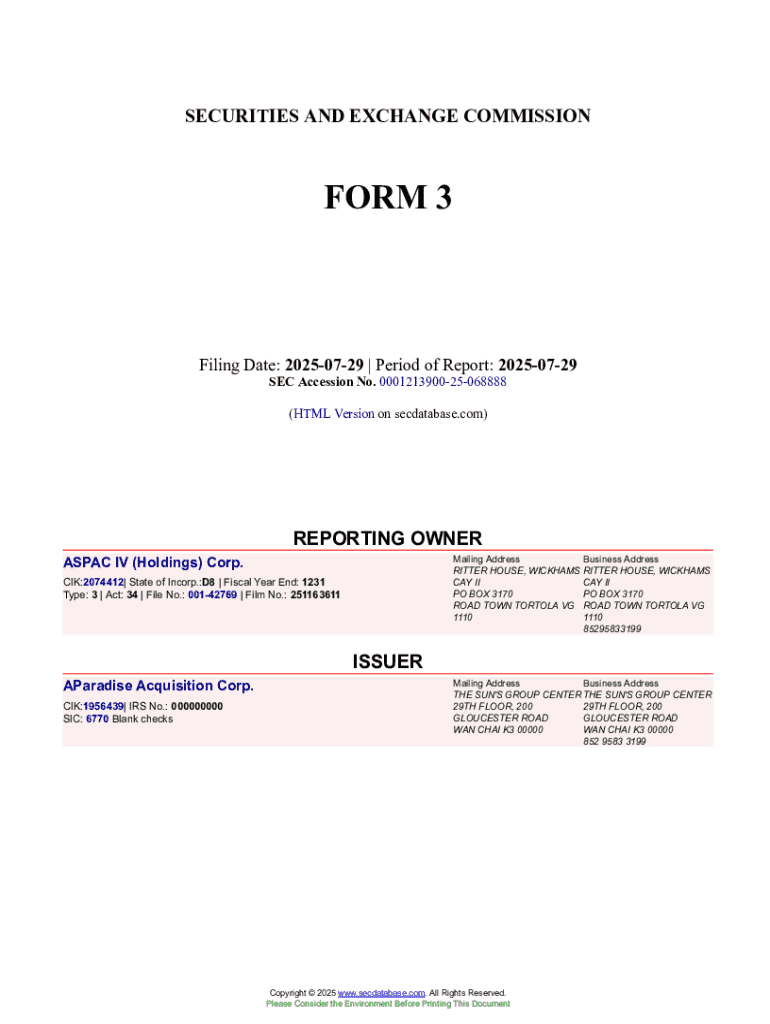

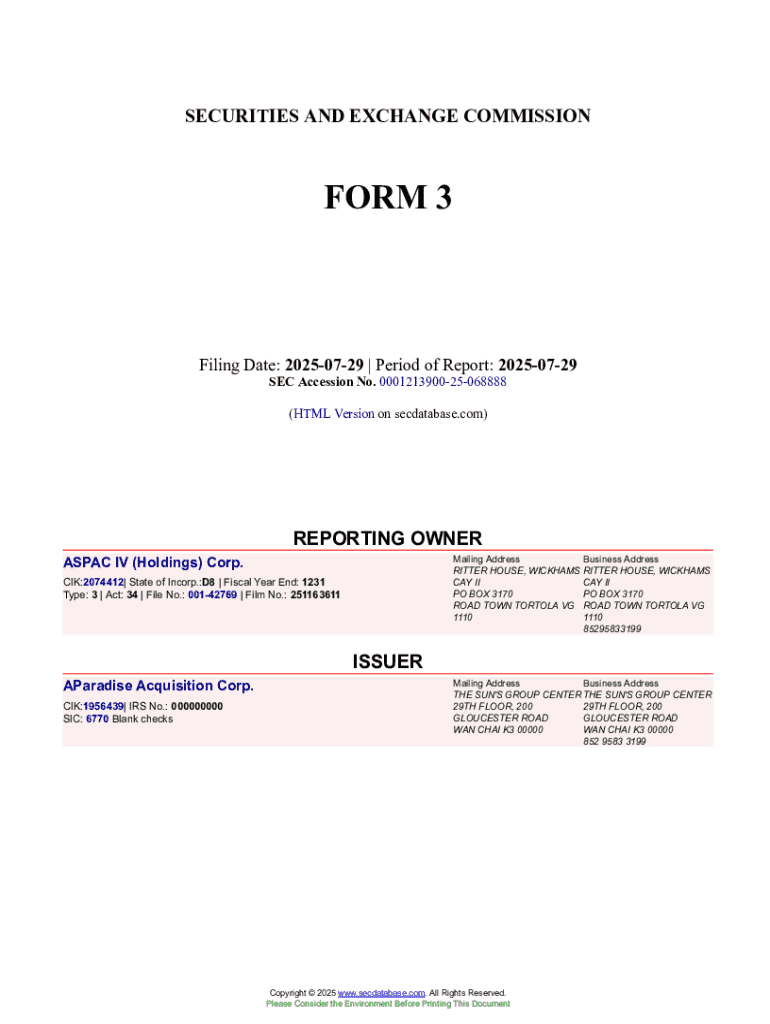

Overview of SEC Form 3

SEC Form 3 is a crucial document required under U.S. law for corporate insiders to disclose their ownership of company securities. This form is the first step for insiders to inform the Securities and Exchange Commission (SEC) about their positions in the company. By mandating transparency, SEC Form 3 plays a pivotal role in regulating securities markets and ensuring that all investors have access to essential information regarding insider ownership.

Understanding SEC Form 3 is vital not just for compliance purposes but also for fostering investor confidence. Whether you are an individual insider, part of a corporate team, or an executive in a publicly traded company, this form affects your financial dealings and regulatory obligations.

Who needs to fill out SEC Form 3?

Several stakeholders are obligated to complete SEC Form 3. Primarily, this includes corporate insiders such as directors, officers, and significant shareholders—those who own more than 10% of a company's stock. These individuals are considered insiders because they have access to confidential information about the company's performance and prospects, which could influence their trading decisions.

One key scenario where SEC Form 3 is filed is when an individual becomes an insider either by taking on a new role or by acquiring a significant stake in the business. Filing this form is not only a legal requirement but also a demonstration of accountability to other investors.

Understanding SEC Form 3 requirements

To successfully complete SEC Form 3, detailed information must be provided. Key fields required include the insider’s personal information such as name and address, as well as details about the issuing company. The relationship between the insider and the issuer needs to be clearly defined—this can include roles such as board member or executive officer. Additionally, it's crucial to report specifics about any share ownership, including the number of shares and types of securities.

The SEC possesses clear guidelines that govern the filing of Form 3. Adhering to these regulations minimizes risk and ensures that all disclosures are accurate and timely.

Step-by-step instructions to complete SEC Form 3

**Step 1: Gather necessary information**. Before tackling the form, ensure you have all necessary documents handy, including proof of ownership and personal identification. This step will help facilitate the process and ensure accuracy.

**Step 2: Completing the form**. Each section of the SEC Form 3 requires specific information:

**Step 3: Review and edit the form**. Proofreading is essential. Double-check your entries and ensure compliance with SEC regulations.

**Step 4: Filing the SEC Form 3**. You can file either online via EDGAR, the SEC’s electronic filing system, or send a physical copy by mail. Be conscious of filing deadlines, especially when you become an insider or make changes to your ownership.

**Step 5: Post-filing actions**. After submitting the form, retain a copy for your records and understand how this filing might impact your future trading options, as it becomes public information.

Common mistakes when filling out SEC Form 3

Several frequent errors can undermine the filing process. These include providing incomplete information, selecting incorrect filing methods, and overlooking critical deadlines.

To avoid these pitfalls, always ensure that your information is complete and accurate before submitting your form. Keep abreast of the filing timelines to ensure compliance with SEC regulations.

Tools for managing and editing SEC Form 3

pdfFiller offers a robust platform for editing SEC Form 3 with features that cater to your needs. The platform includes:

Frequently asked questions about SEC Form 3

Curious about the implications of SEC Form 3? Here are a few frequently asked questions:

External resources and links

For more detailed information, visit the official SEC website to access guidelines on SEC Form 3, as well as links to related forms such as SEC Form 4 and SEC Form 5. These resources will aid in your understanding of the filing process.

Contact an expert for assistance

Navigating securities regulations can be complex. We encourage consulting professionals who specialize in compliance for personalized guidance. Additionally, pdfFiller offers various services to assist with SEC Form 3 filing, streamlined through our platform.

Related content to explore

Explore further articles discussing tax forms relevant to insiders and delve into secondary discussions surrounding insider trading laws to deepen your understanding.

Final thoughts and considerations

The significance of transparency in the securities market cannot be overstated. Compliance with SEC Form 3 and other regulations fosters trust and stability in the financial landscape. It's essential for all stakeholders, including corporate insiders, to maintain proactive strategies for compliance and keep accurate records well into the future.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit sec form 3 online?

Can I sign the sec form 3 electronically in Chrome?

How do I edit sec form 3 on an Android device?

What is sec form 3?

Who is required to file sec form 3?

How to fill out sec form 3?

What is the purpose of sec form 3?

What information must be reported on sec form 3?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.