Get the free Mastering Irs Collections

Get, Create, Make and Sign mastering irs collections

How to edit mastering irs collections online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mastering irs collections

How to fill out mastering irs collections

Who needs mastering irs collections?

Mastering IRS Collections Form: A Comprehensive Guide

Understanding IRS collections

The IRS collections process involves a series of actions taken by the Internal Revenue Service to collect unpaid taxes from individuals and businesses. When taxpayers fail to meet their obligations, the IRS initiates collection procedures that can culminate in various repercussions, such as wage garnishment or bank levies. Addressing IRS tax debt promptly is crucial to avoid severe penalties and escalating interest.

Understanding key terms associated with IRS collections is essential. Terms like 'levy', 'lien', and 'installment agreement' form the foundation of the tax collection landscape and help in navigating the complexities of IRS communications.

What is the IRS collections form?

The IRS collections form is a critical document designed to provide the IRS with comprehensive information about a taxpayer’s financial situation. This information is vital for the IRS to assess the viability of setting up payment plans or determining eligibility for other tax relief options.

There are primarily two types of IRS collections forms: Form 433-A, the Collection Information Statement for individuals, and Form 433-F, the Streamlined Collection Information Statement. The necessity of these forms generally arises during negotiations for payment arrangements or offers in compromise.

When is filing the IRS collections form necessary?

Filing the IRS collections form becomes necessary in several specific situations, such as when negotiating an installment agreement or when requesting an offer in compromise. By failing to submit these forms, taxpayers may be at risk of ineligibility for advantageous payment arrangements, leading to continued accumulation of penalties and interests.

Not filing can have severe implications, including enforced collection methods such as tax levies. Understanding the timeline and process for potential repayment agreements is crucial. The IRS allows taxpayers to maintain tax compliance via their collection practices, so addressing the situation head-on is always better than deferring.

Step-by-step guide to completing the IRS collections form

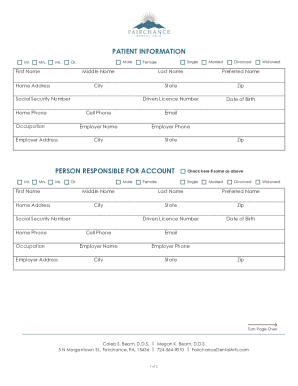

Before filling in the IRS collections form, it's essential to prepare adequately. Gathering necessary documents such as proof of income, bank statements, and details of monthly expenses will streamline the process significantly. Specifically, for Form 433-A, you must accurately fill out various sections regarding personal information, employment, income, and monthly expenses.

For example, Section A requires basic identification details, while Section D details your monthly income and expenses, which helps the IRS grasp your financial situation. For Form 433-F, which simplifies this process, focus on providing a snapshot of your finances without diving deeper into the complexities of your total financial picture.

Submitting the IRS collections form

Once you've completed the IRS collections form, it's essential to choose the correct submission method. The IRS provides a mailing address specific to the form type you're submitting or allows for electronic submissions in certain scenarios. Utilizing certified mail for physical submissions is crucial as it creates a record of your submission, providing you with peace of mind.

Ensuring that you have adhered to all submission guidelines will aid in processing your form efficiently. Always make sure to check IRS updates for any changes in address or submission protocol.

After submission: what to expect

After you've submitted the IRS collections form, understanding what happens next can alleviate anxiety. IRS processing times can vary widely, ranging from a few weeks to several months, depending on the number of current cases they have. During this period, it’s advisable to maintain good records and stay proactive.

If you don't hear back within the expected timeline, consider reaching out to the IRS for a status update. This communication is vital to ensuring that your payment negotiations or relief requests continue progressing.

Best practices for successful submission

Organizing your documentation before submission is one of the best practices for a successful filing. Ensure all supporting documents are clearly labeled and easy to reference, aiding both you and the IRS in the review process. Honesty and accuracy in reporting your financial situation are paramount to avoid costly mistakes or delays in processing your form.

If your case is complicated, or if you're unsure about how to portray aspects of your situation accurately, seeking professional assistance from a tax professional can save you time and reduce the risk of errors.

Navigating IRS collections: tips and strategies

Effective communication with the IRS is crucial for managing your tax-related issues. Establish a clear line of communication, whether through phone calls or written correspondence, ensuring that you note all interactions. Setting up a payment plan with the IRS may provide you with relief and avoid future complications. Ensuring you understand your rights as a taxpayer is also vital, as it empowers you to negotiate and advocate for your needs appropriately.

Comparative overview of IRS collections forms

Choosing between Form 433-A and Form 433-F is determined by the complexity of your financial situation. Form 433-A is generally required for individuals with more considerable assets and complicated finances, while Form 433-F is streamlined for those seeking efficient resolution without extensive documentation.

Common questions about IRS collections forms

It's common to have several questions regarding the IRS collections forms. Many ask whether they can submit the forms online; while some electronic submission options exist, traditional mail remains the most widely used method. Furthermore, neglecting to file these forms can lead to more significant issues, such as enforced collection actions. It’s also important to note that IRS processing times can vary, and if you need assistance filling out the form, utilizing a tax professional is always advisable.

Resources for further assistance

The IRS offers various resources for individuals facing collections issues, including guides and FAQs on their website. Additionally, many tax relief services exist that can provide support to those in need, helping to navigate the complexities of tax debt. Engaging with taxpayer advocacy groups can offer further assistance and community support for navigating these challenging situations.

Enhancing your document handling experience

Using a platform like pdfFiller can significantly streamline your document handling process. The ability to create, edit, and manage your IRS collections forms from a cloud-based platform makes the process accessible from anywhere at any time. Interactive tools allow for easy collaboration and signing, ensuring that you can address your tax situation efficiently and effectively.

Additionally, the cloud advantage allows you to access your documents on multiple devices, ensuring continuity and convenience throughout your tax resolution journey.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send mastering irs collections for eSignature?

Can I create an electronic signature for the mastering irs collections in Chrome?

Can I create an eSignature for the mastering irs collections in Gmail?

What is mastering irs collections?

Who is required to file mastering irs collections?

How to fill out mastering irs collections?

What is the purpose of mastering irs collections?

What information must be reported on mastering irs collections?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.