Understanding Schedule 1 and 2 Forms for Your Tax Filing

Understanding the Schedule 1 & 2 Forms

IRS Schedule 1 and Schedule 2 are crucial documents that play a significant role in the tax filing process. Schedule 1 is utilized for reporting additional income and adjustments to income, while Schedule 2 is focused on additional taxes owed. Filing these forms correctly can impact your overall tax liability, so understanding their purpose is paramount.

The importance of these forms stretches beyond mere compliance; they help taxpayers accurately report various streams of income and additional taxes that might not be captured on the standard Form 1040. While Schedule 1 adjusts your income, Schedule 2 calls attention to these extra tax responsibilities. The key difference between these forms lies in their respective focuses—one on income, the other on taxes.

Who needs to fill out Schedule 1 and Schedule 2?

It's important to determine who needs to fill out these schedules. Generally, taxpayers who have additional sources of income or specific deductions will find Schedule 1 necessary. This could include income from investments, unemployment, or self-employment. If you fall into one of these categories, you're mandated to report that income using Schedule 1.

On the other hand, Schedule 2 is required for individuals facing additional tax liabilities. This could encompass self-employment taxes, taxes on early IRA withdrawals, or penalties for unreported Social Security benefits. If your financial situation includes any of these factors, you will need to complete Schedule 2 as part of your tax return.

Schedule 1: Reporting additional income like investment returns or unemployment compensation.

Schedule 2: Reporting additional taxes, such as self-employment taxes or early withdrawal penalties.

Key sections of Schedule 1

Schedule 1 consists of several key sections where taxpayers must provide detailed information regarding additional income and deductions. Each line requires precise data that feeds into your overall tax situation. The lines on Schedule 1 focus on various income types, adjustments to income, and other facets that could influence your taxable income.

Particularly significant entries on Schedule 1 include Interest Income, Dividend Income, and other sources of income like unemployment compensation or gambling winnings. Accurately filling these fields is essential to avoid discrepancies.

Interest Income: Report any earnings from savings accounts, bonds, or other interest-bearing instruments.

Dividend Income: Include dividends from stocks or mutual funds.

Other Income: This includes unemployment compensation, royalties, babysitting, or gambling winnings.

Key sections of Schedule 2

Schedule 2 encompasses additional taxes that taxpayers may owe beyond what is calculated on the main return. This section requires taxpayers to understand which extra liabilities apply to their unique situations.

Key notable entries include self-employment tax, additional tax on early withdrawal from IRAs, and taxes due on unreported Social Security benefits. Having proper documentation is imperative to validate these additional taxes.

Self-employment tax: This applies if you're self-employed and can affect your overall tax liability significantly.

Additional tax on IRAs: Applicable if you take early distributions from your retirement accounts.

Tax on unreported Social Security benefits: This may be incurred if you fail to report all your Social Security income.

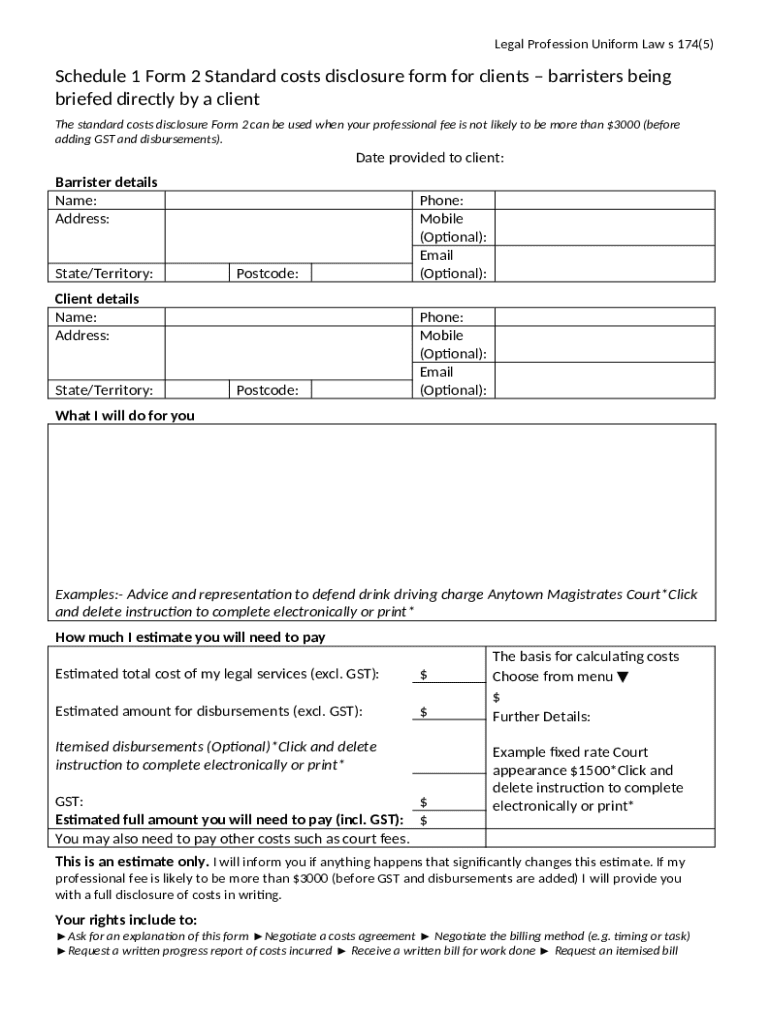

Filling out the Schedule 1 form

Filling out Schedule 1 is a multi-step process that requires careful entry of all required information. Begin by gathering your documentation that reflects additional income sources such as 1099 forms or bank statements. This will ease the transaction process as you list out your income and deductions.

Next, go line by line, ensuring that you enter accurate figures for each source of income or adjustment. Common mistakes include misreporting income or overlooking certain deductions that could reduce taxable income. To assist with this, keep your documents organized and double-check all calculations.

Use accurate sources: Ensure all income and deductions are reported from verified documents.

Check for arithmetic errors: Simple math mistakes can lead to discrepancies.

Review IRS guidelines: Stay updated with the current regulations which could affect your forms.

Filling out the Schedule 2 form

To accurately fill out Schedule 2, begin by assessing whether you have any additional taxes to report. Gather information related to self-employment income, IRA distributions, and any relevant IRS forms that can verify your entries.

Once you have your data, it’s essential to carefully complete each line, as mistakes can lead to penalties or fines. Documentation to support additional taxes is crucial; this includes previous tax returns, statements from employers, or bank records showing IRAs taken out early.

Double-check all entries: Ensure you’ve captured all relevant taxes owed accurately.

Keep supporting documents handy: Good records provide a fallback in case of audits.

Consult IRS publications: These provide useful examples for calculating additional taxes.

Interconnecting Schedule 1 & Schedule 2 with Form 1040

Understanding how to connect the dots between Schedules 1 and 2 with Form 1040 is essential for a complete tax submission. Schedule 1 affects line 8 of Form 1040, where total income is reported; any additional income from Schedule 1 should be included in that figure.

Similarly, the totals from Schedule 2 need to make their way to Form 1040. Specifically, the additional taxes calculated on Schedule 2 are reported on line 23. Ensuring these figures are accurate is critical as adding additional taxes can alter your refund status significantly.

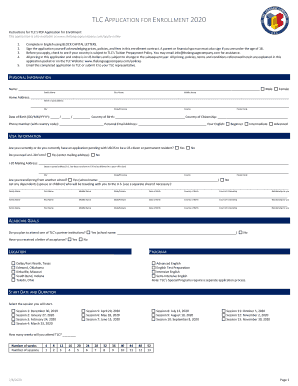

Interactive tools for managing your schedules

pdfFiller provides a robust platform for users who need to edit and manage their tax forms, including Schedule 1 and Schedule 2. Its user-friendly interface allows for easy navigation and modification of documents directly from any web browser.

Features such as the interactive document editor simplify the completion of tax forms. Users can fill in their information quickly, eSign documents, and share them securely with tax professionals. This cloud-based approach ensures that you can access your documents anywhere, enhancing the tax preparation process.

Edit documents easily: pdfFiller’s interface is designed for simplicity, making data entry straightforward.

eSign from anywhere: Effortlessly sign your forms online, reducing the need for printing.

Collaborate with professionals: Share your documents securely for consultation and advice.

Common FAQs related to Schedules 1 & 2

Navigating the complexities of tax forms can lead to many questions. Common FAQs surrounding Schedules 1 and 2 include queries about what qualifies as additional income and how to handle different types of taxes. Many taxpayers often wonder why it is essential to report all forms of income accurately.

Another frequent concern is related to the implications of underreporting income or taxes owed. This could lead to audits, penalties, and interest on overdue payments. Knowing when and how to file these forms allows taxpayers to file confidently and accurately, reducing the risks associated with tax preparation.

What counts as additional income: Understanding various income types that need reporting.

How additional taxes affect my refund: Recognizing how taxes owed influence your overall return.

Implications of misreporting: Learning the risks involved in inaccuracies.

Troubleshooting and best practices

If you run into issues while completing Schedule 1 or Schedule 2, having a systematic approach can alleviate confusion. Begin by revisiting your documentation to ensure that you have captured all necessary information accurately. If discrepancies arise, evaluating each entry step-by-step often reveals mistakes.

Implementing best practices like keeping records organized, using digital tools for calculations, and revisiting IRS instructions can reduce errors significantly. Staying proactive and informed is key to ensuring tax compliance.

Stay organized: Keep all income documents and previous returns well filed.

Utilize software: Tools available can help with calculations and tax laws.

Consult a professional if needed: When in doubt, seeking expert advice can clarify complex situations.

Resources for further assistance

When in doubt, reaching out for help can be invaluable. Resources for assistance in filling out Schedule 1 and Schedule 2 include visiting the IRS website for the latest instructions, utilizing pdfFiller’s customer support, or considering the expertise of tax professionals. Connecting with certified tax preparers can afford additional insights into your unique situation.

Further, engaging with community forums or local tax workshops can provide support from fellow taxpayers who have navigated similar pathways. Social media groups are also great platforms for discussing common issues, sharing experiences, and learning from one another.

Consult the IRS website: Direct and reliable source for up-to-date information on tax forms.

Utilize pdfFiller support: Access customer assistance to get help using pdfFiller tools.

Engage with tax professionals for tailored advice on complex situations.