Get the free Ef002

Get, Create, Make and Sign ef002

Editing ef002 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ef002

How to fill out ef002

Who needs ef002?

A comprehensive guide to the ef002 form

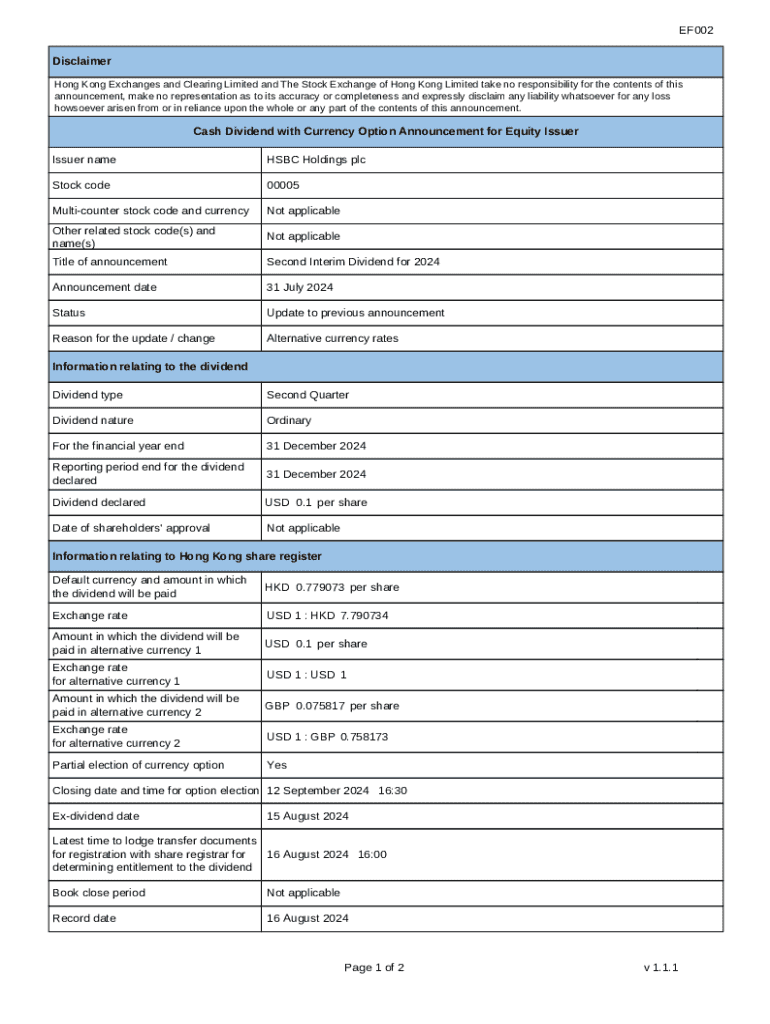

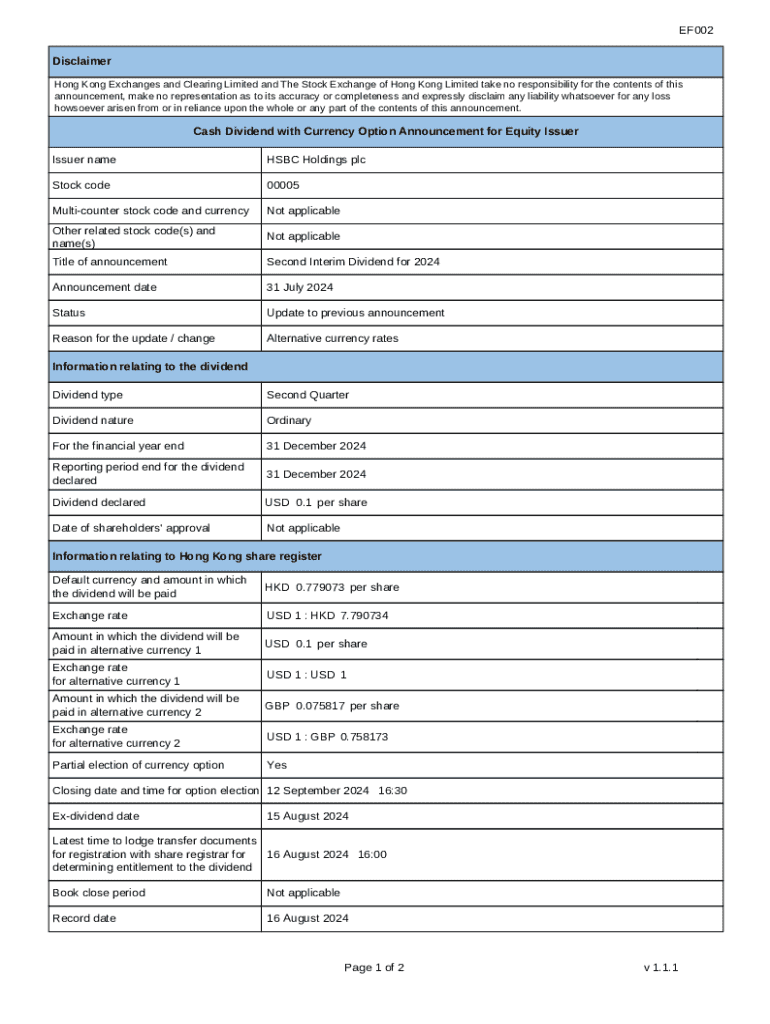

Understanding the ef002 form

The ef002 form is a crucial document primarily used in various financial and administrative processes. It serves as an official declaration, allowing individuals or businesses to report specific information required by regulatory bodies. The primary purpose of this form revolves around compliance, ensuring that users accurately submit necessary data and adhere to established regulations.

The key features of the ef002 form include its structured format, which facilitates easy input of information, and its provision for detailed financial reporting. Users benefit from utilizing this form as it streamlines the submission process, reduces errors, and helps maintain thorough records for personal or corporate use. Various industries, including finance, healthcare, and education, frequently rely on the ef002 form to ensure accurate documentation.

Preparing to use the ef002 form

Before diving into filling out the ef002 form, it’s essential to gather all necessary details and documentation required for successful completion. This means you should have your identification documents, financial statements, and any other relevant information on hand. Ensuring that you have everything you need in advance can lead to a faster, more efficient process.

Accuracy is vital when completing the ef002 form. Double-check your entries, and ensure that all data corresponds with official documents to avoid discrepancies later on. Keep an eye out for common pitfalls such as transposing numbers and leaving required fields blank, as these can cause delays in the processing of your form.

Understanding terminology

An understanding of key terms related to the ef002 form can greatly ease the process. Familiarize yourself with jargon such as 'net income,' which refers to the total income after taxes, and 'liabilities,' indicating what a company owes. Knowing these terms can aid in filling out the form correctly and efficiently, ensuring clarity in communication with regulatory bodies.

Step-by-step instructions for filling out the ef002 form

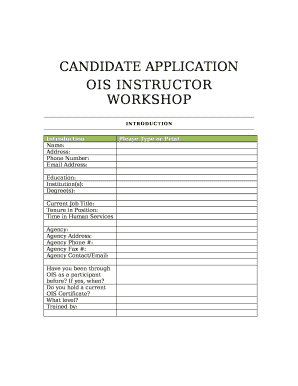

Section 1: Personal information

When entering personal information on the ef002 form, accuracy is paramount. Make sure to fill in your full name, address, and contact information precisely as they appear in your official documents. Any discrepancies can lead to delays or rejections of the form.

Common pitfalls include misspellings or outdated addresses. Double-check these details before submission to avoid unnecessary complications.

Section 2: Financial details

Financial information is crucial in the ef002 form. When filling in financial data, ensure that all amounts are clear and correctly add up. You may need to perform calculations, so consider using tools or calculators to verify your totals.

Best practices include laying out your financial documents in advance and double-checking the math involved.

Section 3: Additional documentation

In addition to the ef002 form itself, additional documentation may be needed, such as tax returns, bank statements, or identification. Collect these documents while completing the form to ensure a seamless submission.

Editing the ef002 form

Once your ef002 form is filled out, you may find the need to edit it before submission. Using pdfFiller’s robust editing tools makes this process straightforward. With features that allow you to easily modify text and adjust formatting, users can ensure their documents are presented perfectly.

It's essential to maintain document integrity during edits. After making changes, use the preview feature to review the entire form. This ensures that no critical information has been unintentionally erased or altered, providing peace of mind.

eSigning the ef002 form

Adding an electronic signature to your ef002 form is a simple yet essential step. Using pdfFiller, you can create a signature that meets legal requirements without the need for printing or physically signing the document. This not only saves time but also enhances the security of your documents.

However, it's important to be aware of potential legal considerations regarding eSigning. Ensure that your electronic signature complies with applicable laws and regulations, making the process legitimate and binding.

If you encounter issues while trying to eSign your form, refer to the troubleshooting guide available on pdfFiller to quickly identify and resolve common problems.

Collaborating on the ef002 form

Collaboration is made easy with pdfFiller’s sharing features. You can invite team members to review and edit the ef002 form, ensuring that all relevant stakeholders can contribute their insights seamlessly. Collaboration can enhance the accuracy of the document and expedite decision-making.

Maintaining version control is also critical. pdfFiller allows you to track changes made to the document, so you can revert to previous versions if necessary. This helps maintain document integrity as you collaborate.

Utilizing commenting features enables constructive feedback among team members, enriching the content and ensuring all viewpoints are considered.

Managing your ef002 form on pdfFiller

After successfully completing your ef002 form, organizing and storing it for easy access is critical. pdfFiller provides features that enable you to categorize and tag documents, making retrieval simple and efficient. You can create folders tailored to your needs and maintain a well-organized document system.

Choosing the right sharing options is also important for securely sending the ef002 form to others. Whether sharing via email or generating a shareable link, pdfFiller ensures that confidentiality and security are maintained throughout the sharing process.

Frequently asked questions about the ef002 form

Users often have questions about the ef002 form, especially regarding completion and submission. Common queries include inquiries about where to obtain the form, how to amend submissions, and which documents are accepted as supporting evidence.

Solutions to frequent troubleshooting problems can usually be found on the pdfFiller support page, which offers guidance and support for common issues users may face during the process.

Advanced tips and tricks for using the ef002 form

To maximize efficiency when working with the ef002 form, exploring lesser-known features of pdfFiller can be beneficial. For instance, utilizing automation tools can save time and reduce the risk of errors when filling out repetitive data.

Additionally, setting keyboard shortcuts within the platform can streamline your workflow, allowing you to navigate documents more quickly. This kind of optimization enhances your overall experience and productivity when using the ef002 form.

Future outlook: Updates and changes to the ef002 form

As regulations evolve, it is anticipated that updates to the ef002 form may occur, including potential changes to required fields and compliance standards. Staying informed about these changes is essential for ensuring continued compliance and successful document submission.

pdfFiller is committed to keeping users updated on any modifications regarding the ef002 form. Through their platform, users can receive timely notifications about changes and access resources to adapt their submissions accordingly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute ef002 online?

How do I fill out ef002 using my mobile device?

How do I edit ef002 on an iOS device?

What is ef002?

Who is required to file ef002?

How to fill out ef002?

What is the purpose of ef002?

What information must be reported on ef002?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.