Get the free Form 990

Get, Create, Make and Sign form 990

Editing form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Form 990 Form: A Comprehensive Guide

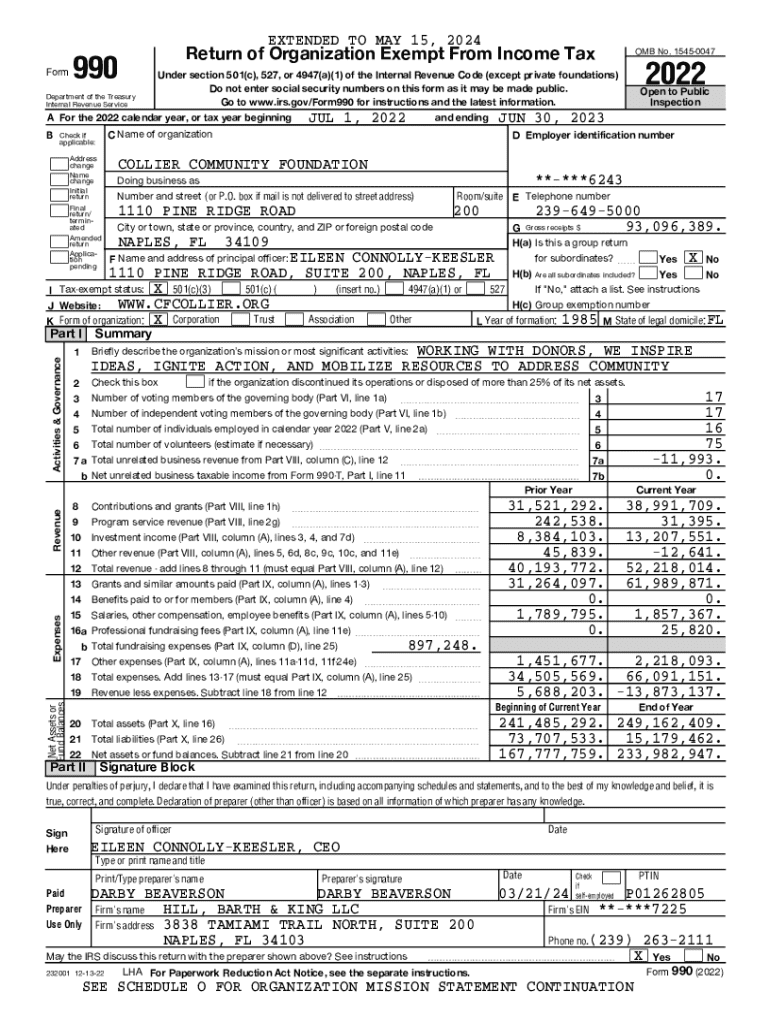

Understanding Form 990

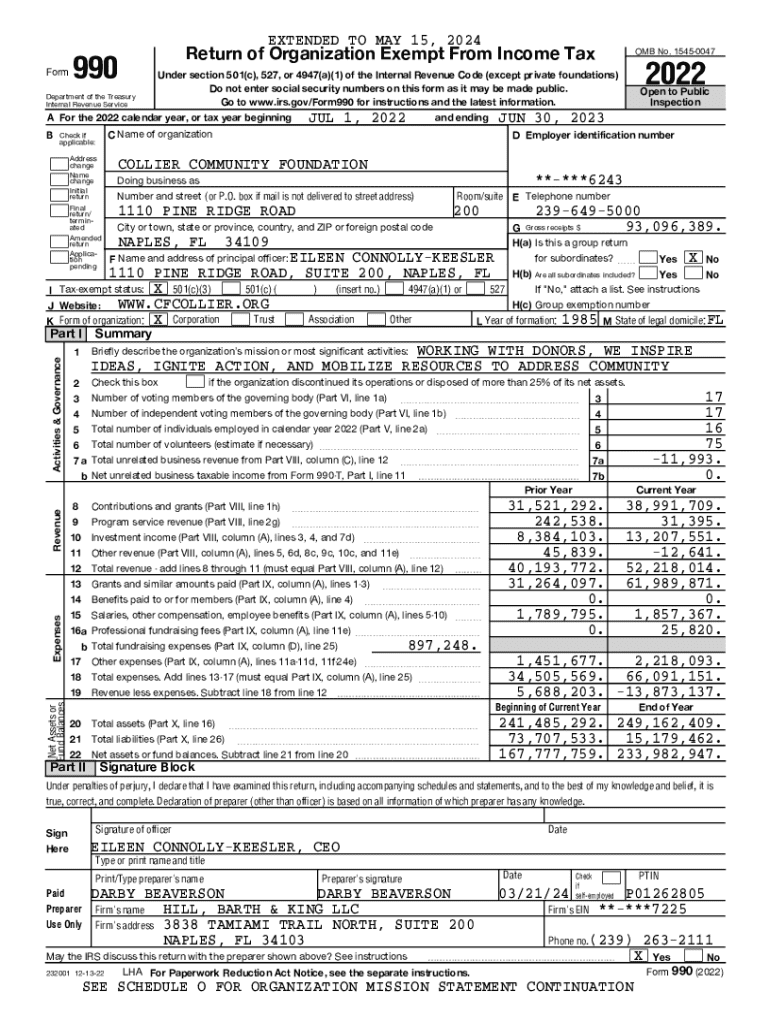

Form 990 is a crucial document in the non-profit sector, serving as the primary financial reporting tool for tax-exempt organizations in the United States. The form is vital for maintaining public trust, ensuring transparency, and fulfilling legal requirements mandated by the Internal Revenue Service (IRS). Non-profits utilize Form 990 to report their financial activities, governance details, and adherence to specific regulations.

Various versions of Form 990 exist, including Form 990-EZ for smaller organizations and Form 990-N, also known as the e-Postcard, for those with gross receipts below a certain threshold. Each variant is tailored to different types of organizations based on their financial circumstances and operational size.

Who must file Form 990?

Not every non-profit is required to file Form 990; rather, it depends on several criteria such as the type of organization and their financial thresholds. Most tax-exempt organizations, including charities, foundations, and other non-profits must file this form annually to maintain their tax-exempt status.

Certain organizations may be exempt from filing, including religious entities and those with gross receipts below a specified limit. For instance, organizations with less than $50,000 in gross receipts can file Form 990-N instead of the more comprehensive forms.

Key filing requirements

Form 990 comprises several sections, requiring detailed information about the organization’s governance, financial health, and operational activities. Filers must include basic information such as the organization’s name, address, tax ID number, and a description of its mission.

Financial statements form a core part of Form 990. Organizations need to provide a balance sheet, income statement, and a breakdown of revenues and expenses. Additionally, disclosures regarding governance practices, donor relationships, and operational challenges should also be presented.

Filing modalities

Organizations can submit Form 990 either electronically or via paper filing. The IRS encourages electronic filing due to its efficiency and reduced processing time. Various software solutions are available, including pdfFiller, which simplifies the process of filling out and submitting the form.

Filing deadlines typically fall on the 15th day of the fifth month after the end of the organization's fiscal year. Extensions can be filed to secure additional time, but this often requires completing specific forms and paying any associated fees.

Common mistakes to avoid

Filing Form 990 can be complicated, and organizations often make common mistakes that can lead to delays or penalties. One prevalent error is providing incomplete information, which can stem from misunderstanding what is required in each section of the form.

Another frequent issue is financial miscalculations, particularly in reporting revenues and expenditures. Organizations should double-check their figures and consider having a financial professional review the form before submission.

Understanding penalties for non-compliance

Failure to file Form 990 on time can result in substantial penalties. The IRS imposes fees that can accumulate quickly, especially for larger organizations. A late filing fee might start at $20 per day, capped at a specified maximum, increasing the potential financial burden for non-compliance.

Beyond immediate financial penalties, failing to submit Form 990 can jeopardize an organization’s tax-exempt status. Long-term consequences include a loss of public trust, difficulty attracting funding, and an increased risk of audits by the IRS.

Public inspection regulations

Form 990 must be made available for public inspection, reinforcing the principle of transparency in the non-profit sector. Organizations are legally required to provide copies of their Form 990 upon request, ensuring that stakeholders can evaluate financial and operational aspects freely.

The surrounding regulations emphasize the importance of public accountability, allowing donors, researchers, and the general public to assess the organization's effectiveness, funding sources, and overall stability.

The significance of Form 990 for charitable evaluation research

Researchers and potential donors leverage Form 990 extensively to analyze the viability and financial stability of non-profits. The detailed financial data helps assess comparative metrics, giving insight into how organizations allocate resources and their overall health.

For funders and grant makers, these forms are an essential tool for understanding the operational dynamics and where best to allocate their resources. In this manner, Form 990 serves as a bridge between non-profits and their supporters, ensuring resources are used effectively and responsibly.

Interactive tools for managing Form 990

pdfFiller offers a robust platform for completing, editing, and managing Form 990. Users can take advantage of step-by-step guidance, ensuring that each section is filled out accurately. The platform includes functionalities for electronic signatures, collaboration, and document storage, streamlining the entire filing process.

Case studies reveal that organizations utilizing pdfFiller have significantly reduced administrative burdens while enhancing compliance accuracy, ensuring they meet all necessary deadlines without sacrificing quality.

Historical context of Form 990

Form 990 has undergone significant evolution since its initial introduction. Over the years, the IRS has made changes to reflect the growing complexity of the non-profit sector and to demand greater accountability from organizations. This evolution has included updates to the reporting requirements and additional schedules for different types of organizations.

The impact of Form 990 on the non-profit sector is profound, serving as a mechanism for public oversight and fostering higher standards of transparency. As the landscape of non-profits continues to change, the form will likely adapt to meet new challenges and expectations.

Additional considerations and related forms

Organizations should also consider the relationships between Form 990 and other relevant forms, such as Form 1023, which is critical for obtaining tax-exempt status. Non-profits must understand when to transition between these forms, particularly as their financial status and operational strategies evolve.

Navigating the nuances of which form to file can be challenging, but access to resources and expert advice can significantly alleviate this burden, ensuring compliance across the board.

Best practices for maintaining compliance

To avoid pitfalls and ensure compliance, non-profit organizations should implement best practices that involve regular reviews of their financial activities and operational practices. Annual checks can help catch discrepancies early and keep the organization aligned with IRS expectations.

Staying informed about regulatory changes is equally important. Non-profits should leverage technology and platforms like pdfFiller to maintain accurate reporting and timely submissions, ensuring they meet evolving compliance standards.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get form 990?

How do I fill out the form 990 form on my smartphone?

How can I fill out form 990 on an iOS device?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.