Get the free 01-924

Get, Create, Make and Sign 01-924

Editing 01-924 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 01-924

How to fill out 01-924

Who needs 01-924?

01-924 Form: A Comprehensive How-To Guide

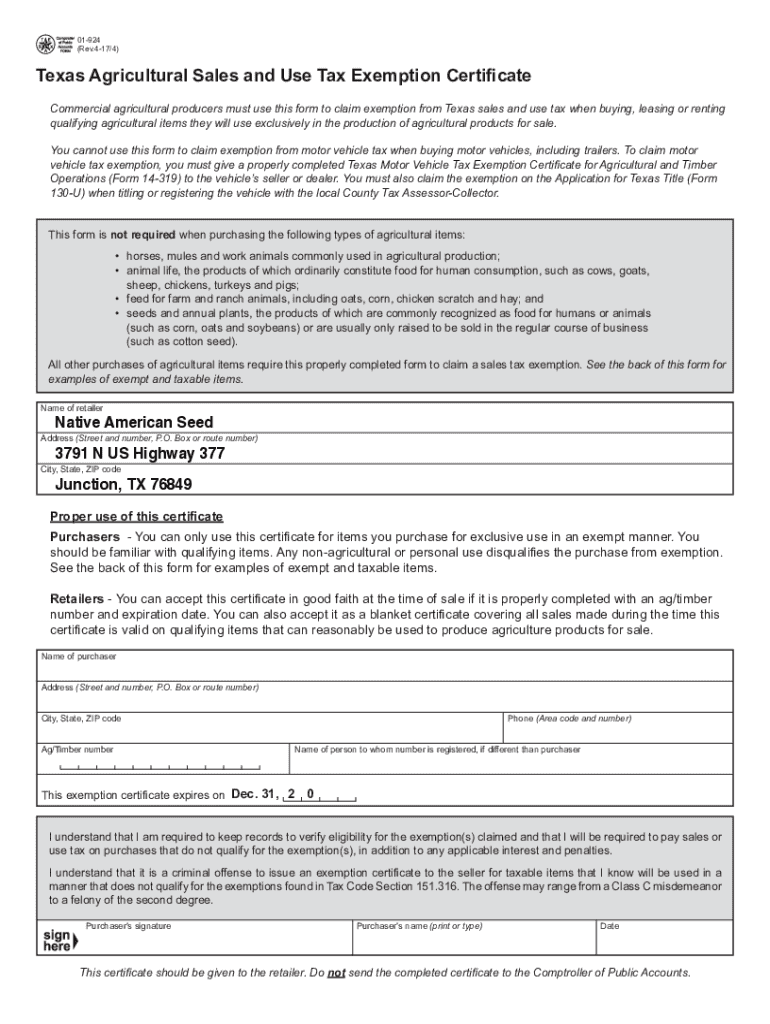

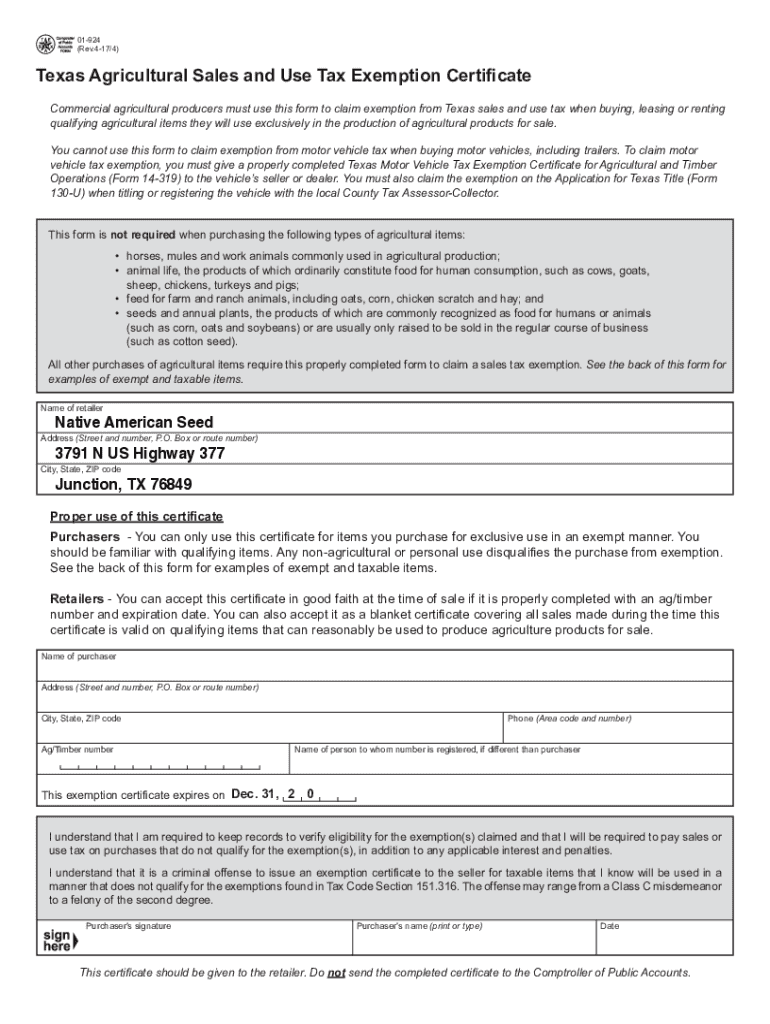

Overview of the 01-924 form

The 01-924 form is a crucial document used primarily to apply for tax exemptions. It serves as an official request submitted by individuals or organizations to claim benefits meant to alleviate financial burdens imposed by certain taxes. This form is vital for various stakeholders, including nonprofits, educational institutions, and other entities that qualify for tax relief. Understanding its importance not only aids in compliance but also maximizes the financial advantages available to eligible applicants.

When to use the 01-924 form

Understanding the right circumstances to utilize the 01-924 form is critical for ensuring claims are valid. This form should be filed when an individual or organization believes they qualify for specific tax exemptions based on their activities or purposes. Examples include those operating in charitable, educational, or specific governmental capacities. Individuals often have questions about eligibility, particularly regarding their organizational classification or financial status.

Neglecting to file the 01-924 form, when necessary, could lead to penalties or missed opportunities for tax savings. It's essential to stay compliant with regulations to avoid complications down the line.

Detailed instructions for completing the 01-924 form

Filling out the 01-924 form might seem daunting, but following a structured approach will alleviate confusion. Begin by providing thorough and accurate personal information, ensuring no section is left incomplete. Moving into Exemption Details, clearly specify what tax exemptions you’re applying for, and highlight any relevant codes or classifications. Lastly, attach any supporting documentation that proves your eligibility claims, as this can expedite the review process.

Common mistakes include overlooking required fields or failing to provide sufficient documentation. Always double-check entries or consult with professionals to avoid these pitfalls.

Editing and customizing the 01-924 form

Customizing the 01-924 form enhances its alignment with specific needs. Utilizing tools such as pdfFiller enables users to edit PDF forms easily, allowing for modifications to enhance clarity and fit particular organizational requirements. Changes may include altering text fields for better readability or adding logos for branding purposes.

Making these adjustments can significantly enhance the form’s effectiveness and ensure that all necessary information is prominently displayed.

eSigning the 01-924 form

Electronic signatures have become an accepted means of validating documents across various sectors, including tax forms. Using pdfFiller, users can easily eSign the 01-924 form, ensuring their submission is secure and legally binding. To eSign, simply navigate to the signature section of the form and follow the prompts.

Once signed, pdfFiller also offers tools for verifying signed documents, providing an extra layer of security against unauthorized changes.

Submitting the 01-924 form

Submitting the completed 01-924 form can be done through various channels. Users can opt to submit their forms online through dedicated tax channels, via mail, or in-person at designated offices. Be sure to follow the specific submission guidelines to ensure processing efficiency. After submission, tracking the status of your form is crucial for confirming that it has been received.

Processing times can vary significantly, so be prepared for a wait and check for confirmation receipt to verify successful submission.

Managing your 01-924 form and related documents

Keeping track of the 01-924 form and any related documents is essential for smooth tax management. pdfFiller offers robust organizational tools that allow users to categorize, tag, and store their forms securely in one place. This not only improves accessibility but also assists in collaborating with team members.

Effective document management ensures all necessary paperwork is in order, reducing the risk of filing errors or missed deadlines.

Frequently asked questions about the 01-924 form

Addressing common concerns about the 01-924 form can save potential issues down the line. Users frequently inquire about deadlines for submission, penalties for late filing, and requirements for various organizational types. The complexity of tax regulations means that staying informed is crucial to compliance.

For further assistance, consult with tax professionals or refer to your local tax authority's resources for detailed guidance.

Case studies and user experiences

Real-world applications of the 01-924 form demonstrate its effectiveness in achieving desired outcomes. Many users have shared their experiences with filing the form and successfully reducing their tax liabilities. Testimonials indicate that leveraging tools like pdfFiller has streamlined their process, improved accuracy, and enabled quicker submissions.

Such case studies highlight how understanding and utilizing the 01-924 form effectively can lead to improved financial outcomes.

Additional support and resources

Access to the latest legislative updates and resources is crucial for anyone dealing with the 01-924 form. Staying informed about changes in tax regulations can greatly impact how you prepare and file your forms. Websites dedicated to tax-related materials, including the official resources provided by tax authorities, can offer insightful information.

Investing time in research and education can improve your proficiency in navigating tax-related documentation and enhance compliance.

Related forms and other resources

In addition to the 01-924 form, understanding other related forms is beneficial. Users may frequently encounter similar documents that serve different purposes, such as the 01-925 which addresses different tax categories or exemptions. It’s advantageous to compare these forms to ensure that you are leveraging the most appropriate documentation for your needs.

Having a comprehensive toolkit ensures you are prepared for various tax situations and reduces the likelihood of documentation errors.

Interactive tools and calculators

pdfFiller provides a variety of interactive tools and calculators that are beneficial when working with tax exemptions. These tools assist users in determining potential savings and understanding how cumulative exemptions may affect financial standings. Utilizing these resources can enhance your overall tax strategy.

By leveraging these calculators effectively, users can make more informed financial decisions and optimize their tax filings.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 01-924 directly from Gmail?

How can I edit 01-924 from Google Drive?

How do I fill out 01-924 on an Android device?

What is 01-924?

Who is required to file 01-924?

How to fill out 01-924?

What is the purpose of 01-924?

What information must be reported on 01-924?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.