Get the free St-105

Get, Create, Make and Sign st-105

How to edit st-105 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out st-105

How to fill out st-105

Who needs st-105?

A Comprehensive Guide to the ST-105 Form: Your Key to Sales Tax Exemption

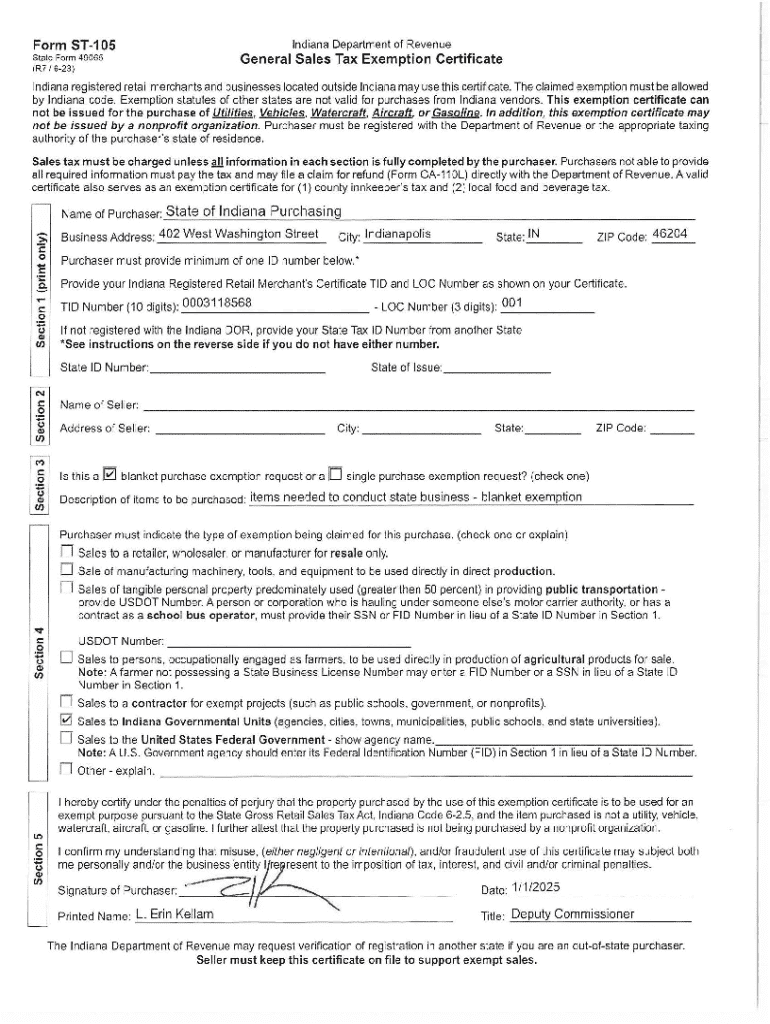

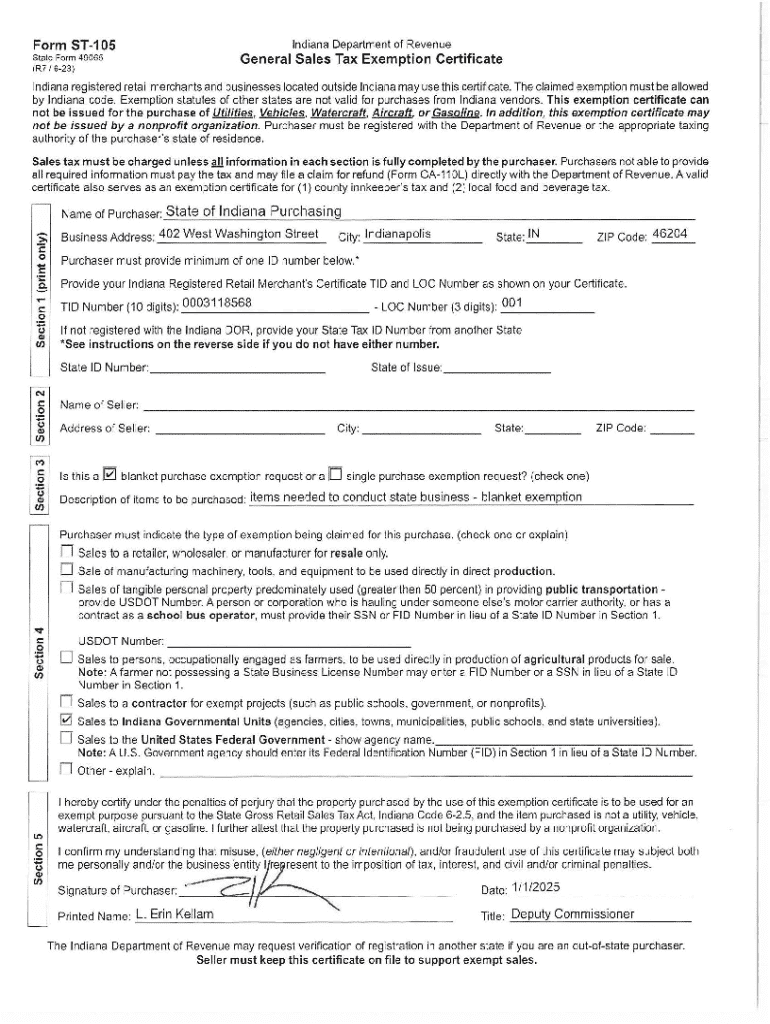

Understanding the ST-105 Form

The ST-105 form is a crucial document designed for claiming sales tax exemption in various business transactions. Primarily used in New York State, it serves as a way for qualifying purchasers to avoid being charged sales tax on certain goods and services when they meet specific criteria. Understanding its purpose is essential, not only for compliance with tax regulations but also for optimizing financial transactions.

The ST-105 form ensures that those who are eligible – such as resellers, manufacturers, and organizations operating under certain exemptions – do not incur unnecessary sales tax charges. By utilizing this form, businesses can improve their cash flow and maintain clear records for financial audits.

Key uses of the ST-105 Form

The ST-105 form finds its applications in diverse scenarios, primarily involving transactions that would otherwise incur sales tax. Individuals and businesses alike benefit from the exemption it provides, allowing for cost savings that can be beneficial across numerous industries. For instance, retail businesses often utilize this form for inventory purchases, while manufacturers may leverage it for raw materials that are integral to their production processes.

The advantages of using the ST-105 form go beyond mere cost savings. By properly documenting purchases and providing proof of exemption, businesses can minimize disputes with tax authorities, streamline accounting processes, and maintain organized financial documentation. This ensures compliance with tax laws and helps in managing overall operational efficiency.

Detailed breakdown of the ST-105 Form

When examining the ST-105 form, it is essential to understand its structure. The form comprises several key sections, each tailored to capture specific information needed to validate a claim for exemption. The key sections include the purchaser's details, the type of exemption, and the signature of the individual completing the form.

Common fields to be filled out include the purchaser’s name and address, along with the type of exempt use of the property purchased, whether it is for resale, production, or a specific exempt organization. Providing precise and accurate information in these sections is vital; inaccuracies could lead to a rejection of the exemption claim or even legal repercussions.

Eligibility criteria for using the ST-105 Form

To utilize the ST-105 form for sales tax exemption, specific eligibility criteria must be met. Primarily, the purchaser must be a registered entity engaged in the buying of goods or services eligible for exemption. This includes businesses classified as retailers, manufacturers, or other qualifying organizations.

Moreover, documentation such as a valid seller's permit or proof of exempt status is typically required. Appropriate documentation helps validate the claim being made on the ST-105 form and aids in avoiding potential issues during audits.

Step-by-step instructions for completing the ST-105 Form

1. Gather required information

Before starting the ST-105 form, it's crucial to assemble all necessary information. This includes the details of the purchaser, the nature of the purchase, and any relevant tax identification numbers. Pre-planning can streamline the process and significantly reduce the chances of errors.

Having documents related to previous purchases or tax exemption status handy can also provide clarity on what information needs to be filled out.

2. Fill out the ST-105 Form online

Using tools like pdfFiller simplifies the process of filling out the ST-105 form. With the ability to edit PDFs seamlessly, users can modify text, add signatures, and complete the document in real-time. The platform features user-friendly interactive tools that guide users through the process, ensuring all sections are properly filled out.

3. Review and edit your form

Once the form is filled out, reviewing it for accuracy is crucial. Key items to check include correctness of the purchaser's information, accuracy of the exemptions claimed, and ensuring that all required signatures are present. Utilizing editing tools provided by pdfFiller can help catch mistakes and ensure everything is in order prior to submission.

4. Signing the ST-105 Form

The final step before submission involves signing and dating the form. This confirms that the information provided is true and complete. pdfFiller allows users to eSign documents, making the completion process even more efficient. This capability facilitates a legally binding signature from any location.

5. Submitting the ST-105 Form

After signing, the ST-105 form needs to be submitted to the applicable vendor or tax authority. It's beneficial to verify submission success by asking for a confirmation receipt if sent electronically or following up with the recipient to ensure it was received and processed. This can help prevent any issues that may arise from misplaced or unacknowledged forms.

Managing your ST-105 Form with pdfFiller

Storing and accessing your forms

Local copies of documents can be vulnerable to being misplaced or damaged. By utilizing the cloud storage options in pdfFiller, users can continuously access their completed ST-105 forms. The document management features include organized folders and search functions that simplify locating specific forms when needed.

Collaborating with others

If you are part of a team, pdfFiller makes collaboration straightforward. The platform allows users to share the ST-105 form with team members, enabling real-time collaboration on document edits. This integrated method of teamwork ensures that everyone remains on the same page and reduces the likelihood of errors during the form completion process.

Troubleshooting common issues with the ST-105 Form

Common mistakes to avoid

Despite its straightforward nature, users can often overlook critical fields on the ST-105 form. A frequent mistake is neglecting to provide a clear and accurate description of the exemption type or failing to include a signature. Such oversights can lead to rejection during processing, causing unnecessary delays.

If the form is rejected, it is crucial to review the reason for rejection, often communicated by the vendor or tax authority. Correcting the highlighted mistakes and resubmitting promptly can help mitigate the issue and ensure proper processing of your exemption.

FAQs regarding the ST-105 Form

Users frequently have questions about the ST-105 form, including typical usage scenarios, eligibility, and submission processes. For example, many wonder where to find the form, what documentation is required alongside it, and how long they should expect the process to take. Resources like state tax websites and platforms like pdfFiller can provide comprehensive answers to these queries.

Related forms and templates

Other relevant sales tax forms

In addition to the ST-105 form, there are other notable sales tax exemption forms, such as the ST-101 and ST-102. Each serves specific purposes, differing in the types of exemptions they accommodate and the required conditions. For instance, while the ST-105 is widely used for resale exemption, the ST-101 is targeted towards non-profits, making it imperative to choose the correct form based on circumstances.

Understanding the distinctions between these forms helps ensure that businesses are compliant with tax regulations and that they do not incur unnecessary costs.

Additional tools from pdfFiller

pdfFiller offers a range of templates and forms that can facilitate various documentation needs beyond the ST-105. Users can explore numerous templates that enhance their document management experience. With additional features such as customizable fields and advanced document sharing options, pdfFiller empowers users to streamline their document workflows effectively.

Engaging with the community

User testimonials

Testimonials from individuals and teams highlight how the ST-105 form, when paired with pdfFiller, has revolutionized their document management process. Users have shared success stories detailing how easy handling the ST-105 and other forms have become, saving them time and reducing frustration during tax season.

Connect and share on social media

For ongoing tips, updates, and community engagement, following pdfFiller on social media is recommended. Users are encouraged to share their experiences and interact with peers, fostering a supportive network among those navigating the complexities of sales tax forms.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify st-105 without leaving Google Drive?

How can I edit st-105 on a smartphone?

How do I fill out st-105 using my mobile device?

What is st-105?

Who is required to file st-105?

How to fill out st-105?

What is the purpose of st-105?

What information must be reported on st-105?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.