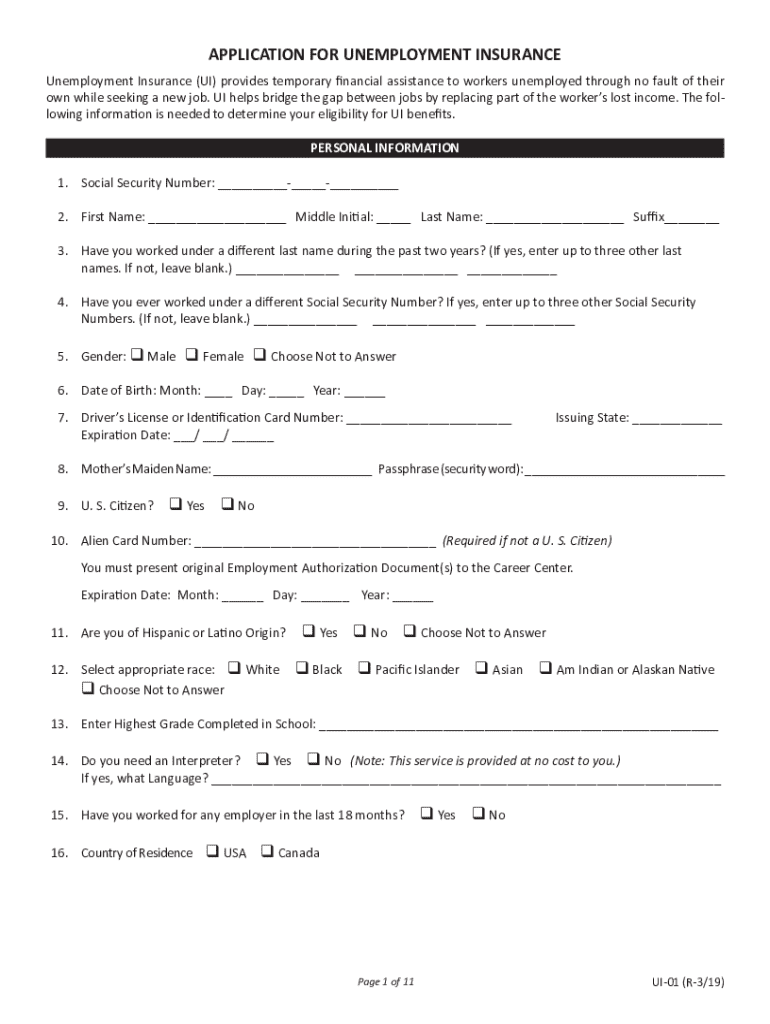

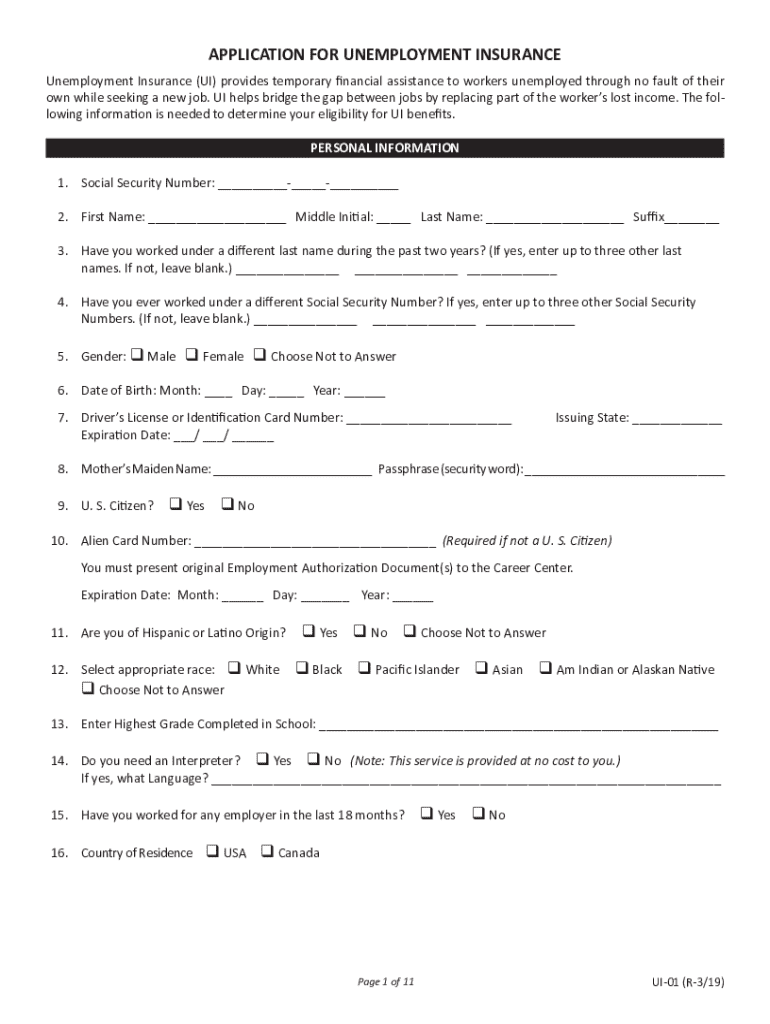

Get the free Application for Unemployment Insurance

Get, Create, Make and Sign application for unemployment insurance

How to edit application for unemployment insurance online

Uncompromising security for your PDF editing and eSignature needs

How to fill out application for unemployment insurance

How to fill out application for unemployment insurance

Who needs application for unemployment insurance?

Application for Unemployment Insurance Form: A Comprehensive Guide

Understanding unemployment insurance

Unemployment insurance is a government program designed to provide financial assistance to individuals who have lost their jobs through no fault of their own. The main purpose of this insurance is to offer temporary financial support while recipients search for new employment opportunities. This program is essential in stabilizing the economy, as it helps maintain consumer spending during economic downturns.

Key benefits of unemployment insurance include income support, access to job training programs, and assistance in finding new employment. When individuals receive benefits, they can focus on obtaining a new job rather than worrying about immediate financial pressures, resulting in a positive impact on both workers and the overall economy.

Eligibility requirements

To qualify for unemployment insurance, applicants must meet certain eligibility criteria. Generally, this includes having a sufficient employment history, the specific reason for separation from their job, and meeting the minimum earnings requirement. Each state may have variations on these requirements, so it is crucial for applicants to review their local guidelines.

Special circumstances may also affect eligibility. For instance, self-employed individuals or part-time workers might have different criteria, and recent graduates or first-time job seekers may need specific documentation proving their job search efforts. Understanding these details can significantly enhance an applicant's chances of securing benefits.

Steps to filing for unemployment insurance

Filing an application for unemployment insurance involves several crucial steps. Applicants need to prepare adequately to ensure a smooth process. Below are the steps to successfully file an unemployment insurance claim.

Common mistakes to avoid

Applying for unemployment insurance requires careful attention to detail. Many applicants unknowingly make mistakes that can delay their benefits. Here are some common pitfalls to avoid.

Navigating the appeals process

It's not uncommon for unemployment claims to be denied. Understanding the appeals process can be important for applicants seeking to overturn a denial. There are specific steps to follow to ensure the best chance of success.

First and foremost, assess the reason for your claim's denial. Once you understand the grounds for denial, gather relevant evidence that supports your case. Submitting thorough and detailed documentation is essential when filing an appeal, as it provides the necessary context for the reviewing body.

State-specific guidelines

Unemployment insurance policies and procedures vary significantly from one state to another. Understanding these differences is crucial for applicants to ensure compliance and maximize their chances of approval. Each state has its own unemployment office, which provides guidelines and resources.

To find your state's specific unemployment office, conduct a quick online search or visit the Department of Labor's website. There, you can access state-specific applications and resources that cater to your local regulations.

COVID-19 implications on unemployment insurance

The COVID-19 pandemic introduced significant changes to unemployment insurance, expanding eligibility and enhancing benefits for countless workers displaced by economic shifts. Under various legislative measures, individuals who previously did not qualify for benefits can now access support, including gig workers and those who are self-employed.

State and federal governments rolled out emergency relief programs tailored to provide immediate assistance. Applicants should keep abreast of these programs and their requirements, as many have specific deadlines and provisions to note.

Tools and resources for managing your application

Navigating the unemployment insurance application process can feel overwhelming, but utilizing the right tools can help. pdfFiller offers a user-friendly platform designed to streamline document management, including the application for unemployment insurance form.

One of the standout features of pdfFiller is its interactive document editing capabilities. Users can easily fill out, sign, and collaborate on forms directly within the platform, eliminating the hassle of printing and scanning. Tutorials and guides are also available to assist users through each step of the application process.

FAQs about the unemployment insurance application process

Many applicants have questions regarding the unemployment insurance application process. Addressing common queries can help alleviate confusion and ensure that potential applicants feel informed and ready to proceed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify application for unemployment insurance without leaving Google Drive?

How do I edit application for unemployment insurance in Chrome?

How do I complete application for unemployment insurance on an iOS device?

What is application for unemployment insurance?

Who is required to file application for unemployment insurance?

How to fill out application for unemployment insurance?

What is the purpose of application for unemployment insurance?

What information must be reported on application for unemployment insurance?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.