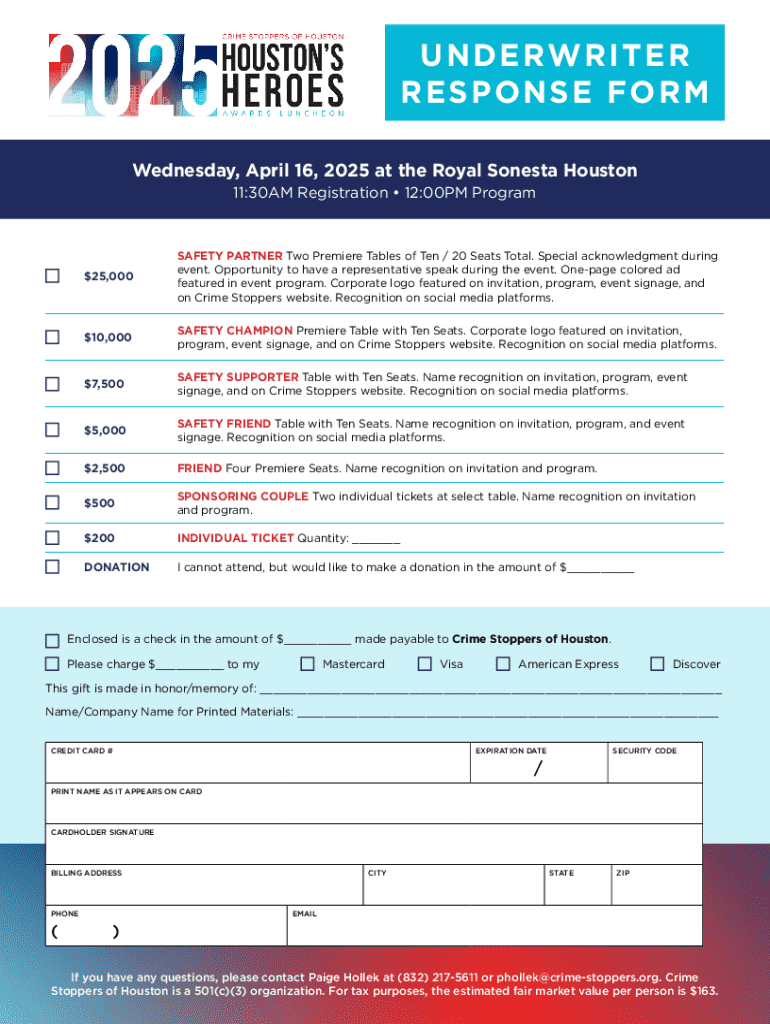

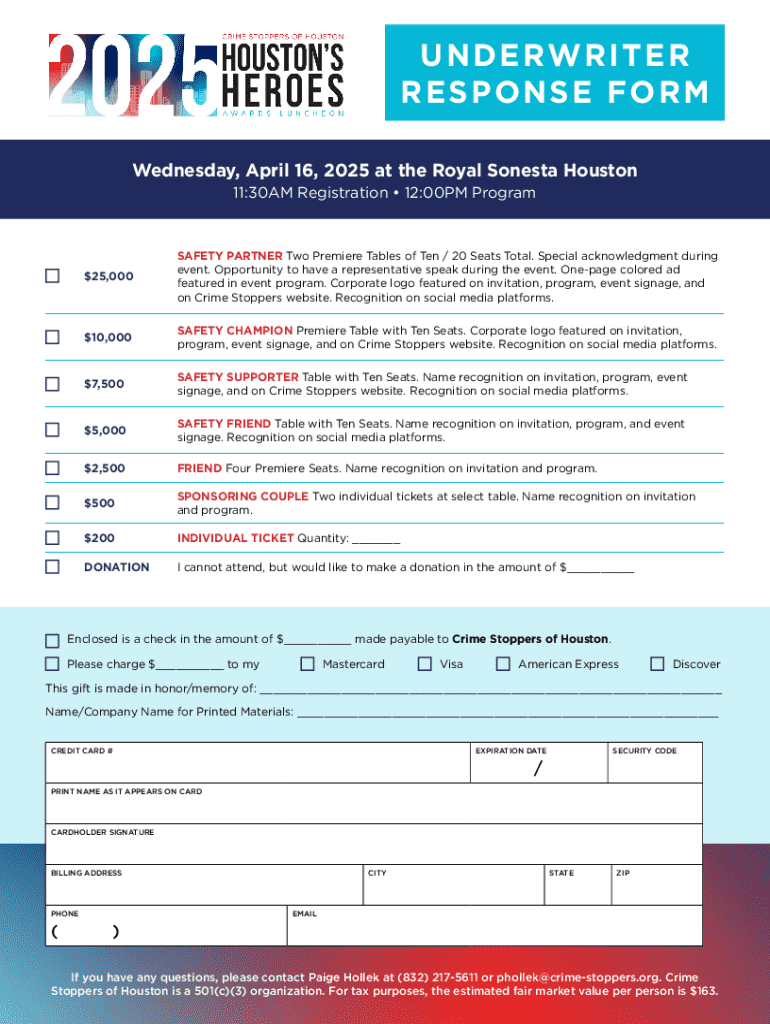

Get the free Underwriter Response Form

Get, Create, Make and Sign underwriter response form

Editing underwriter response form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out underwriter response form

How to fill out underwriter response form

Who needs underwriter response form?

Underwriter Response Form: A Comprehensive How-To Guide

Understanding the underwriter response form

The underwriter response form is a crucial document used in the financial industry, particularly in underwriting processes. Its primary purpose is to convey information, decisions, and any stipulations related to an underwriting request. These forms facilitate effective communication between parties involved in financial transactions, ensuring that all pertinent details are documented and addressed.

The significance of the underwriter response form lies in its role in document management. It not only serves as a formal response from the underwriter but also acts as a record that can be referenced in the future. This form often includes key components such as personal information, financial data, and other relevant documentation needed to assess a particular request.

When to use the underwriter response form

Utilizing the underwriter response form is essential in various scenarios. For instance, it is commonly required when a potential borrower or insurer submits a request for coverage, seeking a loan, or any significant financial transaction that necessitates underwriting judgment. Such situations mandate the form to ensure that all parties are aligned and informed.

Regulatory requirements often guide the usage of the underwriter response form. Specific financial transactions, particularly in real estate financing or insurance underwriting, must include this form to adhere to legal standards. Consequently, any financial transaction requiring a risk assessment or approval from an underwriter will likely involve the completion of the underwriter response form.

Accessing the underwriter response form

Accessing the underwriter response form is straightforward, as various reliable sources offer it for download. One of the best platforms for obtaining this form is pdfFiller. To access the form via pdfFiller, users can simply navigate to their website and search for the underwriter response form, where they will find a version ready for customization and completion.

Additionally, many institutions and financial organizations may provide their proprietary templates, so checking with them can yield specific versions tailored to their guidelines. This can enhance accuracy and compliance with any unique requirements they may have.

Detailed instructions for filling out the underwriter response form

Filling out the underwriter response form accurately is critical for a successful underwriting process. Begin by identifying the required information such as applicant details, loan amounts, property values, and risk factors. Each section of the form needs to be addressed thoroughly.

When filling out the form, users should proceed systematically: start with personal and company information, ensuring that all data is accurate. Next, submit the relevant financial data by providing detailed information about income, assets, and liabilities. Lastly, attach any additional documentation required to support the application.

Editing and customizing the underwriter response form

Once the underwriter response form has been obtained, users can utilize pdfFiller's extensive editing features to customize the document as needed. This includes options for text editing and formatting, which allow for clarity and professionalism in the presentation of information.

Users can also add annotations or comments directly on the form, which is particularly useful for collaborative scenarios where feedback is necessary. Implementing a review process ensures all data is accurate and complies with organizational standards before submission.

Electronic signing of the underwriter response form

Electronic signatures have become increasingly essential in today's financial marketplace. They provide a secure, efficient, and legally binding method for signing documents. With pdfFiller, signing the underwriter response form electronically streamlines the overall process.

To eSign the form, users can invite other parties to sign by providing their email addresses. This leads to an easy tracking mechanism where all parties can monitor the signature progress, ensuring timely completion of the transaction. The process is not only efficient but also enhances the security of sensitive data.

Collaborating on the underwriter response form

Collaboration is vital for effective document management, especially for teams handling multiple underwriting cases. With pdfFiller's platform, users can easily share the underwriter response form with team members. This feature allows for real-time collaboration, ensuring that all relevant stakeholders can provide input where necessary.

Moreover, collaborative editing tools promote transparency and enhance version control, allowing users to see all changes made by different collaborators. This ensures that everyone is on the same page and significantly reduces the risk of miscommunication during the underwriting process.

Best practices for managing underwriter response forms

To effectively manage underwriter response forms, adopting best practices is essential. Firstly, organizing and storing completed forms in a centralized digital space can significantly enhance accessibility and reduce the risk of loss. Utilizing a systematic naming and filing convention helps in quick retrieval during future underwriting processes.

Moreover, tracking and managing submission deadlines are vital to ensure compliance with underwriting timelines. Setting reminders and utilizing project management tools to manage deadlines helps keep the process running smoothly. Finally, always stay up to date on compliance regulations to make sure all documents are submitted following current standards.

Common mistakes to avoid

Completing the underwriter response form requires attention to detail, and avoiding common mistakes can greatly enhance the likelihood of approval. One prevalent pitfall is providing incomplete information, which can cause delays and lead to inefficient underwriting. It’s essential to double-check all entries and ensure that all required fields are filled out accurately.

Another common error is failing to adhere to deadlines for submissions. Late submissions can jeopardize the underwriting process and potentially harm relationships with lenders or insurers. Preventative measures, such as setting reminders and completing forms well in advance, can mitigate these risks.

Troubleshooting common issues

While using the underwriter response form may appear straightforward, users might encounter several common issues. Errors during form submission, such as incorrect or misaligned information, can lead to processing delays or denials. Recognizing these problems early can facilitate quicker resolutions.

If users face persistent issues, such as functionality or access challenges, reaching out to support via pdfFiller is advisable. Their customer service is equipped to handle technical inquiries related to form management and can provide guidance to ensure successful submissions.

Industry insights and trends

The world of underwriting is evolving, with emerging trends impacting how underwriter response forms are utilized. The integration of technology such as AI and machine learning is leading to more efficient underwriting processes, which automatically analyze applications and predict risk levels, enhancing decision-making.

Furthermore, ongoing changes in regulations are also influencing the structure and requirements of the underwriter response form. Staying informed about these trends not only better equips users for current compliance but can also help them anticipate future developments in underwriting practices.

Case studies: successful use of the underwriter response form

Real-world applications of the underwriter response form highlight its efficacy in facilitating smoother underwriting processes. For instance, a regional mortgage company improved its approval times by implementing a standardized underwriter response form, which ensured that all necessary information was captured efficiently from the outset.

Lessons learned from various industries emphasize the importance of clear communication and thorough documentation. In the insurance sector, companies that adopted comprehensive underwriter response forms reported fewer discrepancies, enhancing overall customer satisfaction and minimizing processing delays.

Testimonials and user experiences

Users of pdfFiller have shared positive feedback about the platform's functionality regarding the underwriter response form. Many appreciate the ease of editing and the intuitive interface that allows for seamless document completion. Simplifying the process has significantly improved workflow efficiency for numerous individuals and teams.

Success stories highlight how using pdfFiller has streamlined collaboration between underwriters and applicants, leading to faster turnaround times and increased accuracy in submitted information. User experiences consistently indicate that the platform empowers users to manage documents more effectively.

Future developments in underwriter documentation

As the financial sector progresses, we can anticipate significant changes in underwriting practices and documentation. Innovations such as blockchain technology may introduce a level of transparency and security previously unattainable, facilitating even more robust underwriting frameworks.

Additionally, as regulatory landscapes evolve, future underwriter response forms will have to adapt, incorporating advanced data elements that support enhanced risk assessment. The role of technology in these future documentation processes will likely be paramount, paving the way for efficiencies and improved user experiences.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit underwriter response form straight from my smartphone?

How do I edit underwriter response form on an iOS device?

How do I complete underwriter response form on an iOS device?

What is underwriter response form?

Who is required to file underwriter response form?

How to fill out underwriter response form?

What is the purpose of underwriter response form?

What information must be reported on underwriter response form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.