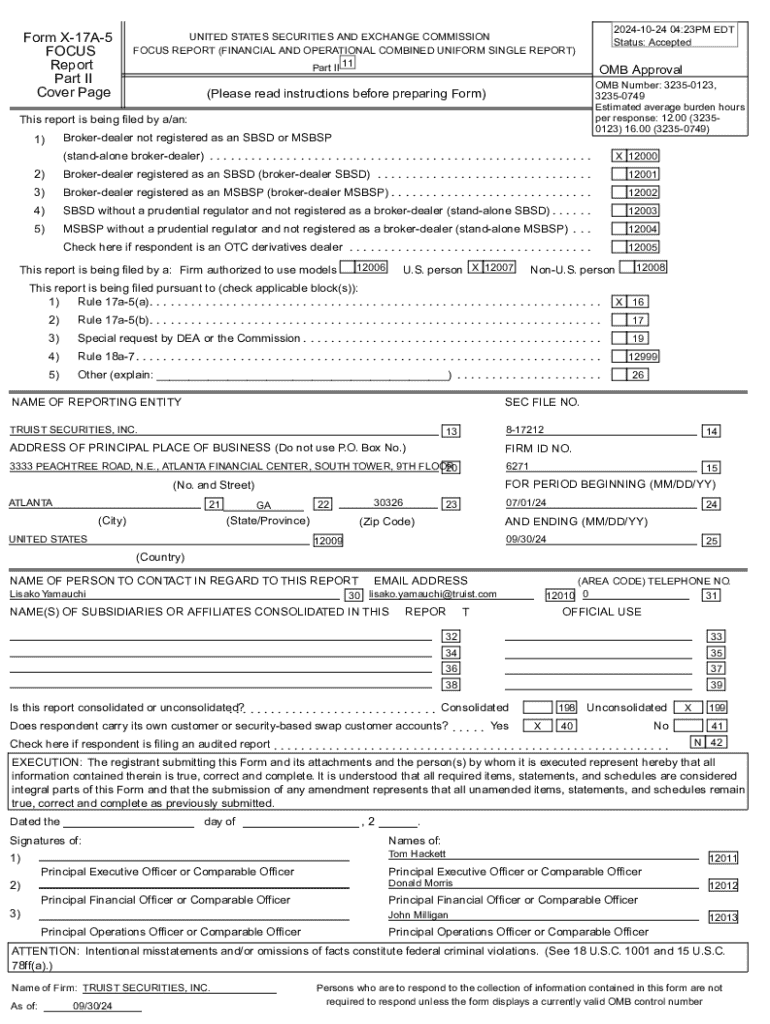

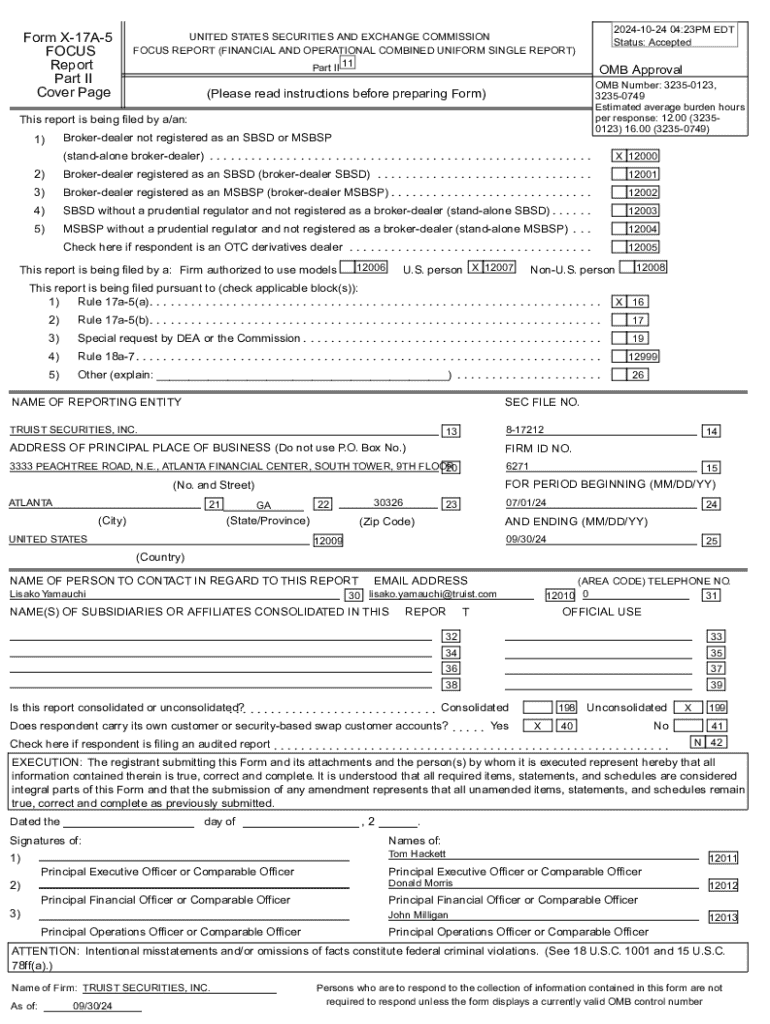

Get the free Form X-17a-5 Focus Report Part Ii Cover Page

Get, Create, Make and Sign form x-17a-5 focus report

How to edit form x-17a-5 focus report online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form x-17a-5 focus report

How to fill out form x-17a-5 focus report

Who needs form x-17a-5 focus report?

Form -17A-5 Focus Report Form - A How-to Guide

Overview of the Form -17A-5 Focus Report Form

The Form X-17A-5 Focus Report is a vital document used by financial firms to stay compliant with regulatory standards, particularly those set forth by the U.S. Securities and Exchange Commission (SEC). This form is primarily utilized by broker-dealers to report their financial condition and ensure transparency in financial practices. Proper completion of the form is critical to demonstrate financial health and stability, making it an essential tool for both regulatory bodies and the firms themselves.

Compliance with Form X-17A-5 not only safeguards a firm's operations but also fosters confidence among clients and stakeholders, as it reflects adherence to established financial practices. This report serves as a snapshot of a firm's financial position, capturing essential metrics that regulators analyze to ensure the stability and solvency of the financial system.

Understanding the structure of Form -17A-5

The Form X-17A-5 consists of several key sections, designated as A, B, C, and D. Each section serves a distinct purpose and requires specific data points to be completed accurately.

Key terms frequently encountered in the form include 'Net Capital', which reflects the company's total assets minus its total liabilities, and 'Aggregate Indebtedness', representing the total amount of liabilities a firm has at any given time. Understanding these terms is crucial for accurate form completion.

Step-by-step instructions for completing Form -17A-5

1. Preparing your documentation

Before diving into filling out the Form X-17A-5, it's essential to gather all necessary documentation. This step ensures that you have a comprehensive view of your firm’s financial status, aiding accuracy.

For accuracy, it is advisable to double-check that all financial data is aligned with your operational goals. Organizing your documentation prior to filling out the form saves time and reduces errors.

2. Filling out the form

Section A: Basic Information

When completing Section A, ensure to include the legal name of your firm, its main address, and the names of any partners or key executives. This section establishes your firm’s identity for regulatory purposes, so accuracy is imperative.

Section B: Financial Conditions

Section B requires a detailed account of your financial condition. Present your total assets, which may include cash, securities, and accounts receivable, and detail liabilities such as accounts payable and outstanding debts.

Section : Calculating net capital

To calculate Net Capital in Section C, take your total assets and subtract your total liabilities. This calculation helps provide a clear view of your financial cushion. Remember to include any haircuts on securities as required by regulatory guidelines.

Section : Additional remarks

In Section D, you have the opportunity to comment on your financial health or any exceptional circumstances that may affect your reporting. This is your chance to explain any figures that might raise questions, like unusual expenses or income fluctuations.

3. Reviewing your completed form

After completing the Form X-17A-5, review it thoroughly to ensure accuracy. This involves cross-referencing your numbers against your documentation and checking that each section is filled out completely.

Common mistakes include forgetting to account for all liabilities or misclassifying assets. Taking the time to review can save your firm from potential compliance issues down the line.

Submitting the Form -17A-5

Once you’re satisfied with your completed Form X-17A-5, it’s time to submit it. There are options available for filing, with electronic submission often preferred for its efficiency and tracking capabilities.

Check your specific deadline based on your reporting frequency—monthly, quarterly, or annually—to avoid penalties associated with late submissions. Penalties for late filing can be significant and impact your firm's reputation.

Maintaining compliance post-submission

Once your Form X-17A-5 is submitted, your responsibility to maintain compliance doesn't end. It’s crucial to stay updated on any changes in reporting requirements or regulations that could affect your next filing.

Failing to remain compliant can lead to severe repercussions, including fines and sanctions, which not only affect your finances but also can damage your company’s credibility and business opportunities.

Tools for seamless completion and management of Form -17A-5

1. Utilizing pdfFiller features

pdfFiller provides exceptional tools to assist in the editing and handling of the Form X-17A-5. The document editing features allow users to make changes directly on the digitally accessible form without the need for printing, thereby streamlining the process.

2. Collaboration tools

Collaboration becomes easier with pdfFiller’s features that permit multiple team members to review and edit the document simultaneously. This not only fosters teamwork but also supports timely submission.

3. Cloud-based access

One of the significant advantages of using pdfFiller is the accessibility it provides. With cloud-based access, you can manage your Form X-17A-5 from anywhere, ensuring you can make necessary changes or submit the form on time, regardless of your location.

FAQs about Form -17A-5

Addressing common questions about the Form X-17A-5 can help demystify any concerns. Here are several FAQs that individuals or firms often have.

Understanding these aspects can significantly simplify the form-filling experience and minimize compliance risks.

User testimonials

Many individuals and firms have benefitted from utilizing pdfFiller to manage Form X-17A-5. Users frequently share their positive experiences, emphasizing the platform's user-friendly features and efficiency.

These testimonials reflect the value pdfFiller brings to the table for firms in managing their regulatory documentation efficiently and effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the form x-17a-5 focus report in Chrome?

Can I create an electronic signature for signing my form x-17a-5 focus report in Gmail?

How do I complete form x-17a-5 focus report on an Android device?

What is form x-17a-5 focus report?

Who is required to file form x-17a-5 focus report?

How to fill out form x-17a-5 focus report?

What is the purpose of form x-17a-5 focus report?

What information must be reported on form x-17a-5 focus report?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.