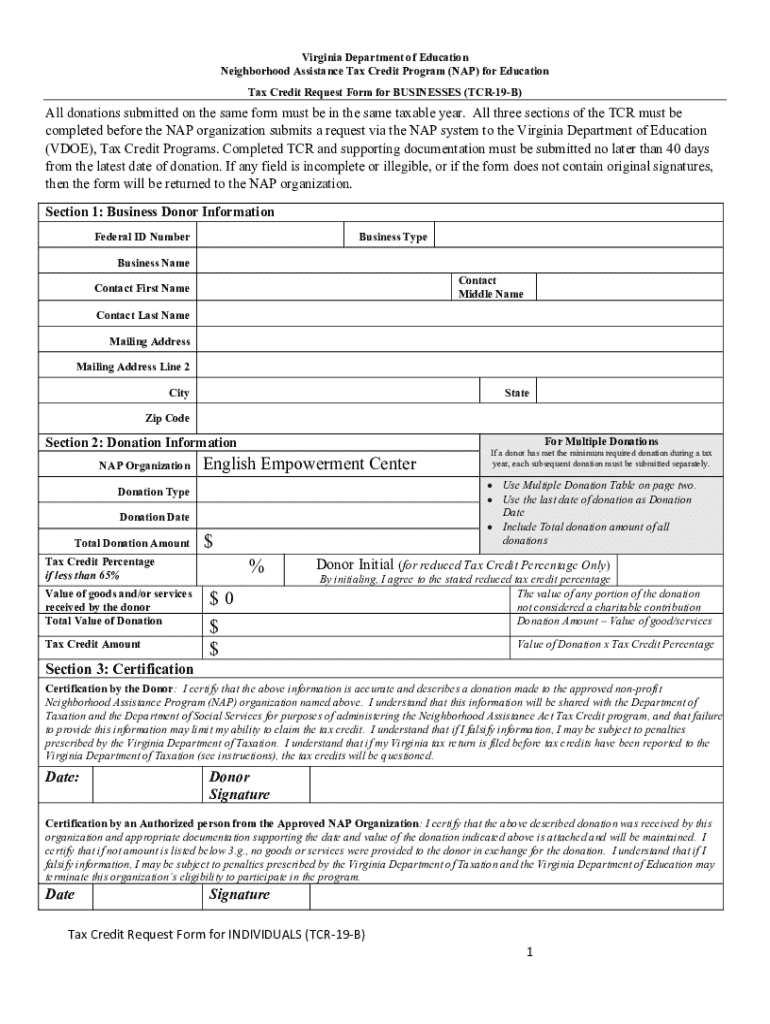

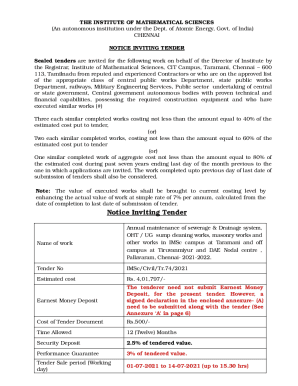

Get the free Tax Credit Request Form for Businesses (tcr-19-b)

Get, Create, Make and Sign tax credit request form

Editing tax credit request form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax credit request form

How to fill out tax credit request form

Who needs tax credit request form?

Tax Credit Request Form How-to Guide

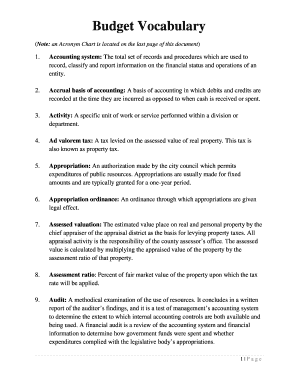

Understanding tax credits

Tax credits play a crucial role in reducing the amount of tax owed to the government, serving as a financial relief mechanism for individuals and businesses alike. Essentially, a tax credit is an amount deducted directly from the total tax bill. Unlike deductions, which reduce taxable income, tax credits offer a dollar-for-dollar reduction in tax liability, making them highly valuable.

There are two primary types of tax credits: refundable and nonrefundable. Refundable tax credits allow taxpayers to receive a refund if the credit exceeds their total tax owed. For example, if you qualify for a $1,200 refundable credit but owe only $1,000, the IRS will refund the remaining $200. Nonrefundable credits, on the other hand, only reduce your tax liability to zero; they do not generate refunds. Understanding these distinctions is vital for effective tax planning.

Requesting tax credits is essential not only for benefiting financially but also for encouraging various economic behaviors, such as education, energy efficiency, and family support. Properly submitting a tax credit request can result in valuable financial breaks, assisting taxpayers in alleviating their overall financial burden.

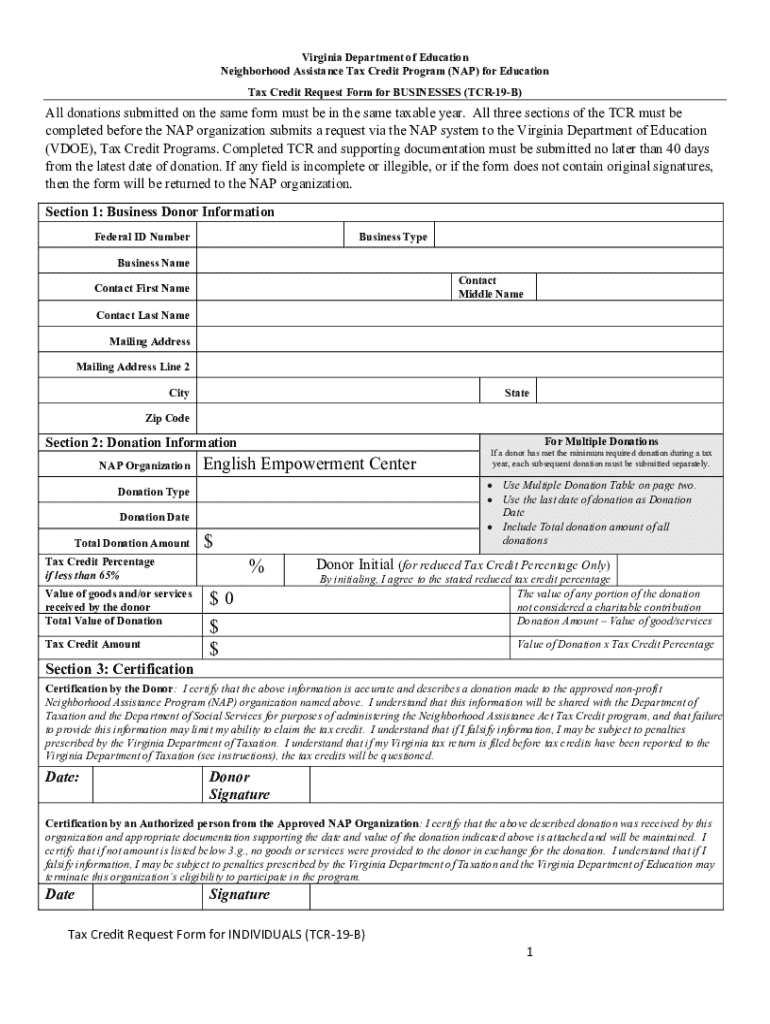

Overview of the tax credit request form

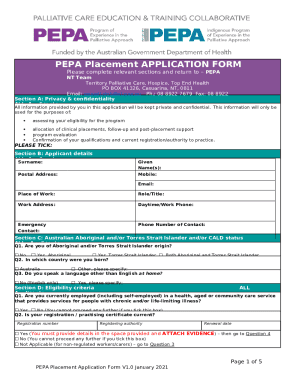

The tax credit request form is a specific document designed to facilitate the claiming of eligible tax credits. Tailored for ease of use, it includes sections that require personal and financial information, details regarding specific tax credits being claimed, and supporting documentation. This form is crucial for establishing eligibility and ensuring that the IRS can process requests accurately and efficiently.

This form is primarily intended for individuals and businesses seeking to claim tax credits to which they are entitled. It is crucial for anyone looking to minimize their tax burden to familiarize themselves with this form and its requirements. The eligibility criteria can differ based on the type of tax credit being claimed, but generally include factors such as income level, employment status, and specific qualifying activities like educational undertakings or adoption processes.

Preparing to fill out the tax credit request form

Before you start filling out the tax credit request form, it's vital to gather all necessary documentation. This will ensure a smooth submission process without any unnecessary delays. Key documents include income statements such as W-2s, 1099s, and proof of tax credit eligibility which may comprise school enrollment records, adoption certificates, or receipts for energy-saving improvements.

Moreover, supporting documents play an integral role in establishing your eligibility. The availability of a complete set of documents can simplify the process and enhance your credibility. One of the common mistakes to avoid when preparing these documents includes not thoroughly checking for accuracy, like ensuring all figures match your actual earnings or the figures listed on your tax returns.

Step-by-step instructions for filling out the form

Accessing the tax credit request form is the first crucial step in the application process. You can find it readily available online on the IRS website or via pdfFiller, where you can opt for a PDF download or edit directly in the browser. Having the form easily accessible will save you time and streamline the filling-out process.

Proceed to fill in your personal information diligently. Required fields typically include your name, Social Security Number, address, and filing status. Make sure all entries are accurate to prevent errors. After personal information, detail your income, ensuring to report all relevant earnings, including wages, interest, and other forms of income, while considering any applicable deductions.

Next, you must complete the section detailing the specific tax credits you are applying for. Depending on your personal circumstances and qualifications, this might involve inputting code numbers or amounts related to the tax credits you qualify for. Attention to detail is vital here; after completing the form, take the time to review all entries. This ensures all information is accurate and complete, preventing potential issues during processing.

Once you've reviewed your entries, it's necessary to sign the form. Depending on your method of submission, you'll have eSigning options available to you right through pdfFiller, allowing for a seamless digital signature process. Digital signatures are increasingly important, validating that the document was indeed reviewed and authorized by you.

Editing and managing your tax credit request form

Utilizing pdfFiller's features allows for efficient editing of your tax credit request form. Should you need to amend any part before submission, pdfFiller's editing tools enable you to make necessary corrections quickly and seamlessly. This ease of use is beneficial, particularly when working with tax advisors or teams, as collaboration can be achieved through sharing invites or comments directly within the platform.

Once your form is tailored to your specifications, ensure you save your work properly. pdfFiller allows you to store documents digitally, making them accessible whenever you need them. After saving, you have options for exporting your finished form into various formats for submission purposes. This streamlined process fosters organization and promotes efficiency in managing tax credit requests.

Submitting your tax credit request

The submission of your tax credit request can be done electronically or through traditional mail, depending on your preference and the specific requirements of the IRS form you are using. If you opt for online submission, ensure you do it before the established deadline to avoid penalties or attract unnecessary delays. Confirm that all supporting documentation is attached when submitting by mail.

Keeping track of your submission status is equally important after filing. Most online submissions will provide a confirmation receipt, but for mailed entries, consider using certified or trackable mail options. This will allow for precise tracking of where your submission stands and bring peace of mind, knowing that your application is actively under review.

Frequently asked questions about tax credit requests

Tax credit requests often bring about several common questions. For instance, if a request is denied, the best approach is to understand the reasons for denial through communication with the IRS. They typically provide an explanation which you can use to rectify any issues for potential re-application. Calculating tax credits can vary based on criteria defined for different credits, so utilizing tools or calculators available through the IRS can assist in accurate assessments.

Another common inquiry revolves around making amendments to submitted requests. Generally, you can amend your request, depending on the specific tax policies in effect. This will involve filing an amended return, similar to how you would for general income tax adjustments. Engaging with a tax professional may also provide clarity on complex scenarios surrounding amendments.

Tax credit resources and tools

Numerous resources are at your disposal when navigating tax credits. The IRS website serves as the primary source for guidelines and related forms, providing updates on current eligibility and requirements. Additionally, interactive tools available on platforms like pdfFiller can offer personalized assistance through calculations and document management tailored to your specific needs.

Utilizing these resources enhances your understanding and ensures you stay informed about potential changes that could impact your eligibility. There are also calculators designed specifically for evaluating various tax credit scenarios, which can simplify your planning process.

Support and help with tax credit requests

Support is critical in navigating the complexities of tax credit requests. Should you face difficulties, reaching out to pdfFiller's support can provide guidance tailored to your inquiries. Community forums also emerge as valuable for sharing experiences and advice, ensuring taxpayers can leverage collective knowledge.

Language assistance options are available for those who may require it, enabling non-native speakers to understand requirements clearly. This structured support network fosters an inclusive environment for all taxpayers.

Explore related tax credit forms

In addition to the main tax credit request form, numerous related forms may be applicable depending on your specific circumstances. For instance, child tax credit forms, education tax credits, or adoption credits each require unique documentation and procedures. Linking to these forms and features available on pdfFiller ensures you can navigate any additional processes easily while remaining organized.

Quick links to popular searches related to tax credits can streamline your research and ensure you have immediate access to essential information relevant to your filing year, enabling efficient navigation through the intricacies of tax credit applications.

Best practices for future tax credit requests

Successful navigation of tax credit requests often evolves from establishing best practices. One essential practice is to keep documentation organized throughout the year. This includes garnering receipts, tax return copies, and relevant records, ensuring you have everything when it's time to submit a request.

Employing reminders for annual submissions also proves beneficial, minimizing the likelihood of missed deadlines. Understanding changes in tax laws that may affect future requests will also empower you to adapt your strategies accordingly, ensuring you always maximize potential benefits from available credits.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the tax credit request form electronically in Chrome?

Can I create an eSignature for the tax credit request form in Gmail?

How do I fill out tax credit request form on an Android device?

What is tax credit request form?

Who is required to file tax credit request form?

How to fill out tax credit request form?

What is the purpose of tax credit request form?

What information must be reported on tax credit request form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.