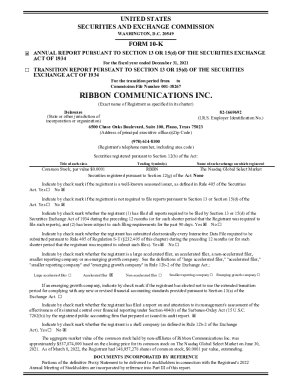

VA Auto Insurance Consumers Guide 2025 free printable template

Get, Create, Make and Sign VA Auto Insurance Consumers Guide

Editing VA Auto Insurance Consumers Guide online

Uncompromising security for your PDF editing and eSignature needs

VA Auto Insurance Consumers Guide Form Versions

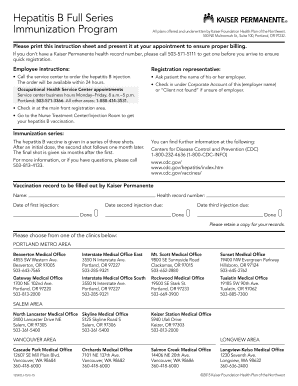

How to fill out VA Auto Insurance Consumers Guide

How to fill out virginia auto insurance consumer

Who needs virginia auto insurance consumer?

A Comprehensive Guide to the Virginia Auto Insurance Consumer Form

Understanding the Virginia Auto Insurance Consumer Form

The Virginia Auto Insurance Consumer Form is a pivotal document required for managing auto insurance matters in the state of Virginia. This form provides necessary information about the insured vehicle and its owner, serving a critical purpose in clarifying insurance policies and claims. Particularly for residents of Virginia, understanding how to accurately fill out this form is essential for achieving efficient insurance coverage and claims processing.

Residents frequently utilize the Virginia Auto Insurance Consumer Form in various contexts, including filing claims after accidents, verifying insurance coverage, or even in legal disputes. The importance of the form cannot be understated; it acts as a centralized document that helps streamline communication between insurance companies and consumers.

Eligibility for filing the Virginia Auto Insurance Consumer Form

Anyone who is a resident of Virginia and owns a vehicle can file the Virginia Auto Insurance Consumer Form. This eligibility extends not just to individual vehicle owners but also to teams or organizations that manage fleet insurance or vehicle arrangements. It's crucial to note that various types of vehicles can be covered under this form, including personal cars, trucks, motorcycles, and even commercial vehicles operated within Virginia.

Eligibility criteria generally include having a valid driver's license and currently active insurance coverage on the vehicle in question. Furthermore, those filing on behalf of a company or team must ensure that appropriate documentation of their authority to act on behalf of others is included to avoid delays in processing.

Detailed instructions for completing the Virginia Auto Insurance Consumer Form

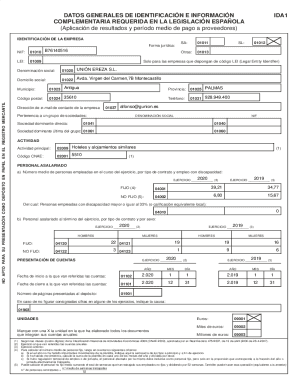

Filling out the Virginia Auto Insurance Consumer Form requires gathering all necessary information upfront to avoid mistakes. Start by collecting details like the vehicle's make, model, and year of manufacture. Next, gather personal identification, including driver's license numbers and Social Security numbers, as well as comprehensive information regarding your insurance policy, such as the provider's name and policy number.

When it comes to completing the form, following a section-by-section breakdown is effective. Fill in personal information accurately, ensuring that names and addresses match legal documents. For vehicle information, double-check details against registration documents to prevent discrepancies. Lastly, when detailing your insurance coverage, be thorough in providing all relevant policy information.

Editing and signing the Virginia Auto Insurance Consumer Form

Editing the Virginia Auto Insurance Consumer Form is more accessible with pdfFiller tools. Users can effortlessly upload and modify the document using customizable templates. It's crucial to ensure the information is accurate, which can be done by utilizing various editing features provided by pdfFiller. The platform supports electronic signatures, making it convenient to sign the document without the need for printing.

The built-in eSignature features save both time and hassle. Follow these steps to eSign the form: navigate to the 'Sign' section after completing your form, add your signature digitally, and ensure it's placed correctly. The ease of electronic signing enhances the filing process, ensuring you can submit documents quickly and efficiently.

Submitting the Virginia Auto Insurance Consumer Form

Once you have completed and signed the Virginia Auto Insurance Consumer Form, the next step is submission. Residents of Virginia have various options for submitting, including online submission through their insurance provider's portal, mailing the form to the address specified in the guidelines, or submitting in person at a local DMV office.

Processing times can vary depending on the submission method chosen. Generally, online submissions tend to be processed faster than those sent via mail. After submission, it’s wise to follow up: check the status of your form by contacting your insurer or review their response timeline which can often be tracked through their online portal.

Tips for effective management of your auto insurance documents

Managing your auto insurance documents effectively is paramount for ensuring compliance and organization. Start by organizing your insurance documents digitally, storing them securely in a cloud-based platform like pdfFiller. This not only secures your documents but also makes them easily accessible whenever needed.

Utilizing cloud storage allows for seamless collaboration, especially for teams or family accounts where multiple users can manage the same documents. This reduces confusion and streamlines communication when dealing with insurance matters.

Interactive tools to enhance the filing experience

pdfFiller offers various interactive tools designed to streamline the filing experience. For instance, pre-filled form options can help reduce errors and speed up the process of completing the Virginia Auto Insurance Consumer Form. Additionally, insurance calculators are available on the website, enabling users to estimate coverage needs and premiums.

If you encounter any issues while filling out your form or using the tools, pdfFiller provides customer support that can be reached efficiently through their website. Their support team is knowledgeable and ready to assist with any queries or technical challenges.

Special considerations for Virginia residents

Virginia residents must be aware of specific requirements related to auto insurance that may affect how they fill out the Virginia Auto Insurance Consumer Form. The state mandates certain coverage levels which must be verified on the form. Additionally, depending on the vehicle type, there may be additional forms or documents required, especially for commercial vehicles.

It’s advisable to review the Virginia Department of Motor Vehicles website for the most current regulations and requirements concerning auto insurance documentation. Staying updated helps ensure compliance with state laws and avoids complications during the claims process.

FAQs regarding the Virginia Auto Insurance Consumer Form

Several common concerns arise when dealing with the Virginia Auto Insurance Consumer Form. These include queries about how to correct errors after submission, how to initiate a dispute with an insurer, and what to do if your coverage was denied. Knowing the procedures for resolving these issues is essential.

Resources are available for consumers who encounter disputes with their insurers. The Virginia Bureau of Insurance provides guidance on filing complaints and additional steps to take if your insurance claim is unresolved. Being proactive about these concerns can significantly reduce stress during the insurance process.

Stay informed on insurance regulations in Virginia

Understanding local insurance laws is vital for Virginia residents. Regulations can change, affecting everything from minimum coverage amounts to filing processes. Keeping informed about legislative updates ensures you remain compliant and can navigate any complexities regarding the Virginia Auto Insurance Consumer Form.

Active engagement with resources such as state websites, local insurance forums, or community workshops can enhance your understanding of best practices in managing auto insurance within Virginia. Being proactive in education can save you from potential pitfalls and ensure you maximize your coverage.

Customer success stories

Users of pdfFiller have successfully managed the Virginia Auto Insurance Consumer Form, resulting in enhanced efficiency and greater peace of mind. Many have shared testimonials highlighting how utilizing pdfFiller helped streamline their document management processes, from filling out forms to submitting them electronically.

Case studies reveal that individuals and organizations using pdfFiller reported improvements in their interaction with insurance processes, leading to quicker resolutions and increased satisfaction. Such stories demonstrate the vital role of effective document management in achieving desired outcomes in auto insurance claims and communications.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify VA Auto Insurance Consumers Guide without leaving Google Drive?

How can I fill out VA Auto Insurance Consumers Guide on an iOS device?

How do I fill out VA Auto Insurance Consumers Guide on an Android device?

What is virginia auto insurance consumer?

Who is required to file virginia auto insurance consumer?

How to fill out virginia auto insurance consumer?

What is the purpose of virginia auto insurance consumer?

What information must be reported on virginia auto insurance consumer?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.