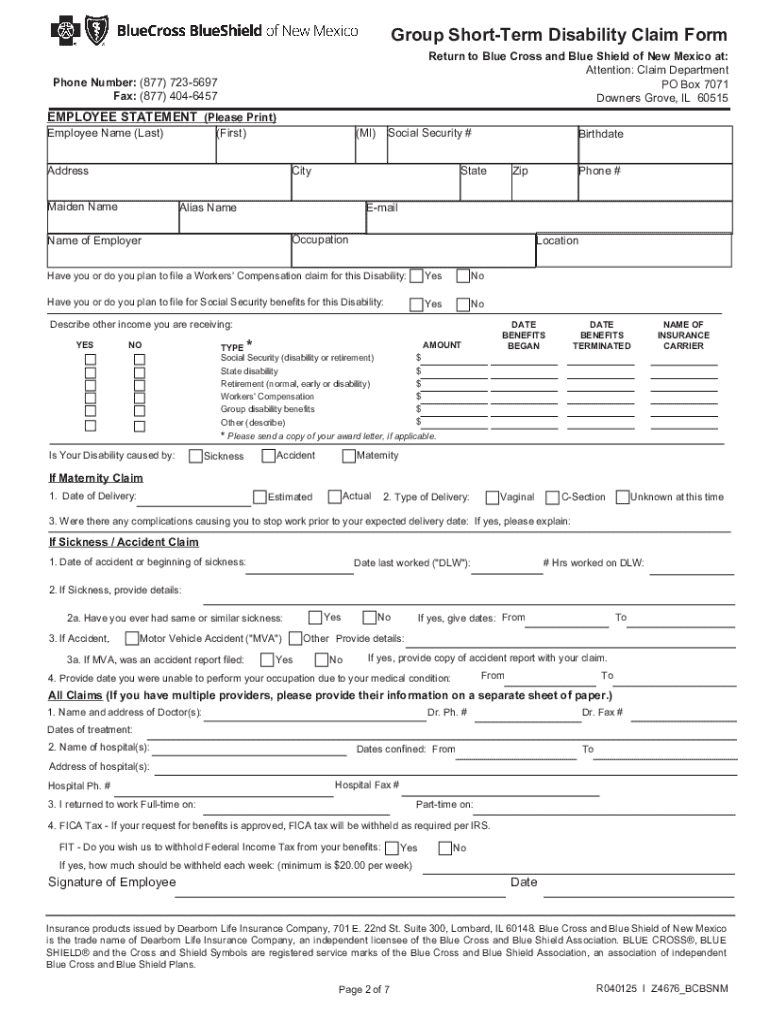

Get the free Group Short-term Disability Claim Form

Get, Create, Make and Sign group short-term disability claim

How to edit group short-term disability claim online

Uncompromising security for your PDF editing and eSignature needs

How to fill out group short-term disability claim

How to fill out group short-term disability claim

Who needs group short-term disability claim?

Group Short-term Disability Claim Form: Your Comprehensive Guide

Welcome to the Group Short-term Disability Claims Center

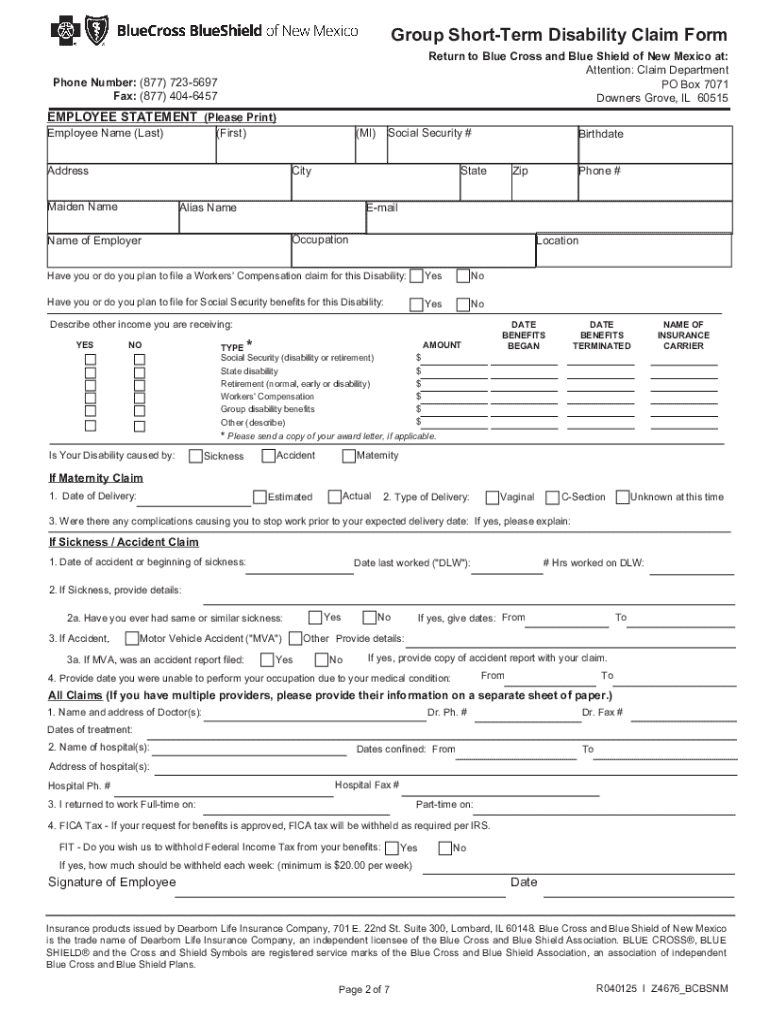

Navigating the intricacies of group short-term disability claims can be complex, but with the right information and resources, the process becomes much more manageable. Short-term disability insurance is crucial for employees, as it provides financial support during temporary periods of incapacity due to a medical condition. Understanding how to fill out the group short-term disability claim form correctly is essential for maximizing your benefits.

Proper documentation and timely submission of your claim not only ensure the prompt processing of benefits but also help prevent potential delays or denials. Let’s delve into the steps you need to take to file your claim seamlessly.

Preparing to file a group short-term disability claim

The first step in the claims process is determining your eligibility for benefits. Not everyone qualifies; therefore, understanding the criteria is crucial.

Next, gather all necessary documentation to support your claim. This typically includes:

To obtain a physician's statement, it's advisable to schedule an appointment promptly after realizing your incapacity. Keep your employer informed of your situation and request a confirmation of your employment status as soon as possible.

Filling out the group short-term disability claim form

Having gathered your documents, it’s time to complete the claim form. This form requires specific information that must be filled out accurately. The form typically consists of the following sections:

To avoid common mistakes, double-check the form for completeness and accuracy. Missing or incorrect information can delay your benefits. Utilize interactive tools available on pdfFiller to auto-populate sections or streamline your edits, ensuring efficiency.

Submitting your group short-term disability claim

Once your claim form is completed, the next step is submitting it for processing. Online submission is typically the quickest and most efficient method. Ensure that you follow the platform’s guidelines for uploading your completed forms and documentation.

If you prefer alternative methods, many employers allow claims to be submitted via postal mail. However, timelines may vary compared to online submissions. Always track your claim with submission confirmation as proof of your application.

Tracking your group short-term disability claim status

After submitting your claim, it’s important to stay informed about its status. Most employers provide an online portal where you can check the progress of your claim. Here are some steps to follow:

During the review process, the insurance provider may communicate with you or your healthcare provider to request additional information. Be proactive and responsive to ensure a smooth review.

Frequently asked questions (FAQs) about group short-term disability claims

You may have several questions as you navigate the group short-term disability claims process. Here are answers to some common inquiries:

Special cases and considerations

There are unique situations that may impact how you file your claim. For instance, if you are submitting for a disability related to a Family Medical Leave (FMLA), ensure that both claims are aligned to avoid interference. Similarly, claims related to maternity leave may involve specific documentation to demonstrate your condition.

If you are working part-time and earn income during your disability period, reporting your earnings accurately is essential, as they may impact your benefits amount. Always clarify these terms when discussing your claim with HR or your insurance provider.

Customer support for group short-term disability claims

If you encounter challenges during the claims process, customer support can guide you through the maze. Most employers offer multiple contact options, such as phone numbers, email, or chat support for assistance.

Reaching out early and doing so through the proper channels can make a significant difference when questions arise.

Additional tools and resources

pdfFiller offers a wealth of resources designed to facilitate your claim process. You'll find how-to videos that provide visual guidance each step of the way, especially for form submission and checking your claim status. Moreover, accessing legal resources can help clarify your rights as a policyholder.

Engage in community support forums where shared experiences can offer insights and advice. These platforms are invaluable for connecting with others who have been through similar situations.

Transitioning to long-term disability

If your disability extends beyond the duration of your short-term benefits, it’s crucial to understand how to transition to long-term disability coverage if applicable. The rules governing these benefits may differ significantly.

Key differences include the duration of benefits and the way they are calculated. You’ll want to familiarize yourself with these distinctions to ensure continued support. Understanding when to initiate the transition and the specific documentation required can prevent lapses in financial coverage.

Make sure to communicate with your employer and insurance provider regarding this transition to navigate successfully into the next phase of your disability benefits.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send group short-term disability claim for eSignature?

How do I complete group short-term disability claim online?

Can I create an electronic signature for the group short-term disability claim in Chrome?

What is group short-term disability claim?

Who is required to file group short-term disability claim?

How to fill out group short-term disability claim?

What is the purpose of group short-term disability claim?

What information must be reported on group short-term disability claim?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.