Get the free Annual Report

Get, Create, Make and Sign annual report

Editing annual report online

Uncompromising security for your PDF editing and eSignature needs

How to fill out annual report

How to fill out annual report

Who needs annual report?

Annual Report Form: A Comprehensive Guide

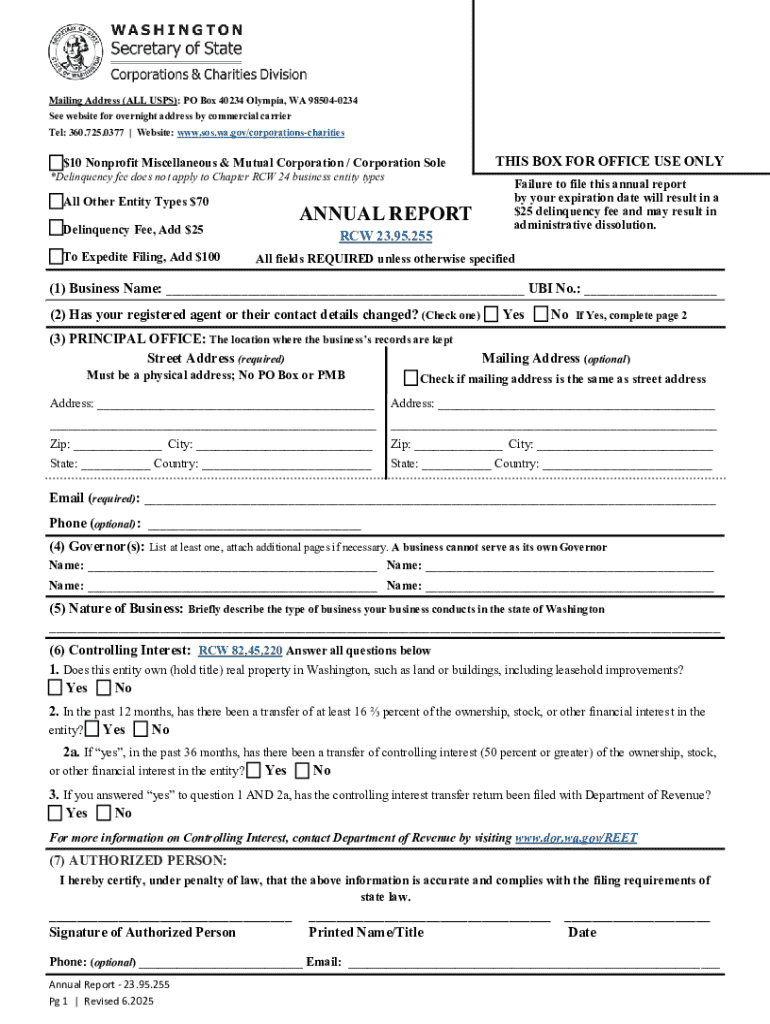

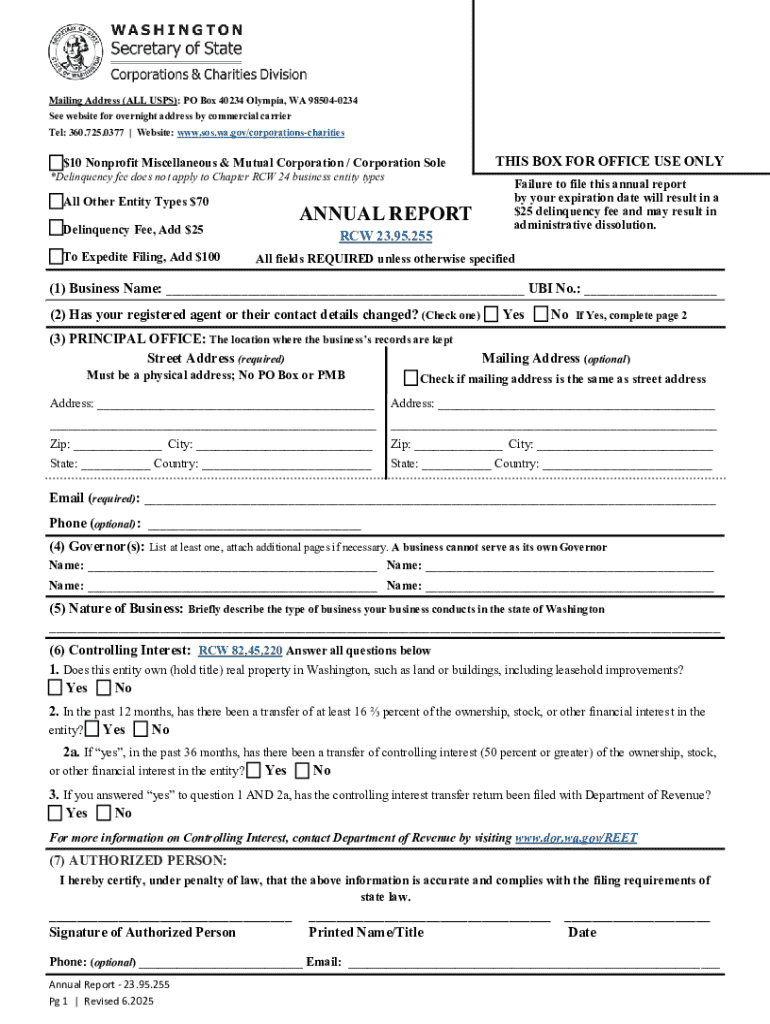

Overview of the annual report form

An annual report form is a document that organizations, particularly corporations and partnerships, are required to file periodically, informing stakeholders about their financial performance, strategic direction, and operational results. This form plays a crucial role in enhancing transparency and accountability within the business community.

The purpose of an annual report for businesses goes beyond just legal compliance; it serves as a tool to communicate the company's health and strategy to its stakeholders, which may include shareholders, employees, and regulatory bodies. A well-crafted annual report can influence the perception of the organization and support future fundraising efforts.

Understanding the annual report requirements

Businesses must navigate various legal obligations for filing an annual report. These requirements vary by jurisdiction, typically established by state laws or corporate governance regulations. Ensuring compliance is crucial not only to maintain operational legitimacy but also to avoid potential penalties.

Who must file an annual report? Generally, all corporations and limited liability companies (LLCs) are required to file annually. However, specific requirements may differ based on the state laws. It is essential to be aware of local regulations to avoid compliance issues.

Furthermore, states have specific nuances regarding what must be included in the report. For instance, some states require detailed financial data while others may only request basic information. For a comprehensive guide, consider checking the state-specific requirements via official state websites.

Detailed breakdown of the annual report form

Completing the annual report form requires careful attention to detail to ensure it meets all regulatory standards. Most forms will contain multiple sections that need to be accurately filled out. Common mistakes include leaving fields blank, providing outdated information, or making typographical errors that could lead to penalties.

The general structure typically includes various sections, starting with the identity of the firm and its contact persons. Each section serves a specific purpose and must capture critical information.

The remaining sections include details on audit clients, office affiliations, personnel, ownership relationships, and necessary certifications. Each part allows organizations to paint a clear picture of their operations over the last financial year.

Filing the annual report form

Filing can occur online, which is becoming the preferred method due to its speed and ease. For online filing, entities must navigate the e-filing system, ensuring they meet system requirements such as supported browsers and operating systems. Construction for each filing system might slightly differ but generally retain similar pathways.

Remember to keep all necessary documentation backed up, as electronic systems may sometimes fail or be subject to downtime. If you prefer traditional methods, mail-in requirements vary by state but are still an option for those hesitant about digital submissions.

Managing changes after submission

In some circumstances, it may be necessary to make changes to your submitted annual report form. Businesses can often request amendments, but must adhere to specific timelines. Understanding how to do this effectively can prevent additional penalties.

To initiate changes, reach out to your state’s filing office. These amendments generally involve detailing what information needs to be changed and providing supporting documents. Additionally, be aware that late submissions of amended reports may incur extra fees.

When businesses with annual reports lose their document number, it can seem daunting. However, states usually provide an online portal where business owners can retrieve this information by entering specific organizational details.

Consequences of late filing

Filing late can have serious repercussions on a business's standing and ability to operate legally. If a business files after key deadlines, such as May 1st, late fees will apply, and continued failures can lead to business dissolution in severe cases.

For businesses that close, the question arises: must they still submit an annual report? Generally, past due reports are still required until the company is officially dissolved according to state law. Non-filing can also lead to unexpected penalties or loss of business title.

Access to filed annual reports

Retrieving a copy of your filed annual report doesn’t have to be cumbersome. Most states allow businesses to access their previously filed reports through their business filing portal. Some may charge nominal fees based on document types or amounts of requests.

Keeping track of your filing history is vital. Not only does it serve as a reference for your own records, but it can also provide valuable information during audits or when seeking investments. Regularly check and back up these documents for smooth access.

FAQs about annual report form management

Managing the annual report form can raise several questions. Common inquiries include what payment options are available for filing fees. Typically, payment methods include credit cards, electronic transfers, and checks, depending on the state’s portal.

Regarding processing times, it may take from a few days to several weeks for an annual report to officially post depending on the state. For further assistance, state filing offices and professional advisors can greatly facilitate the filing process.

Related content of interest

Aside from the annual report, businesses must also be aware of various corporate compliance forms. Understanding how these documents interact can help create a more comprehensive view of a company’s obligations.

Moreover, nonprofit corporations have unique reporting requirements and navigating through those can be complex. Sustainability and impact reports are gaining traction and many stakeholders expect to see these documents integrated with the annual report.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my annual report in Gmail?

How can I edit annual report from Google Drive?

Can I create an electronic signature for the annual report in Chrome?

What is annual report?

Who is required to file annual report?

How to fill out annual report?

What is the purpose of annual report?

What information must be reported on annual report?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.