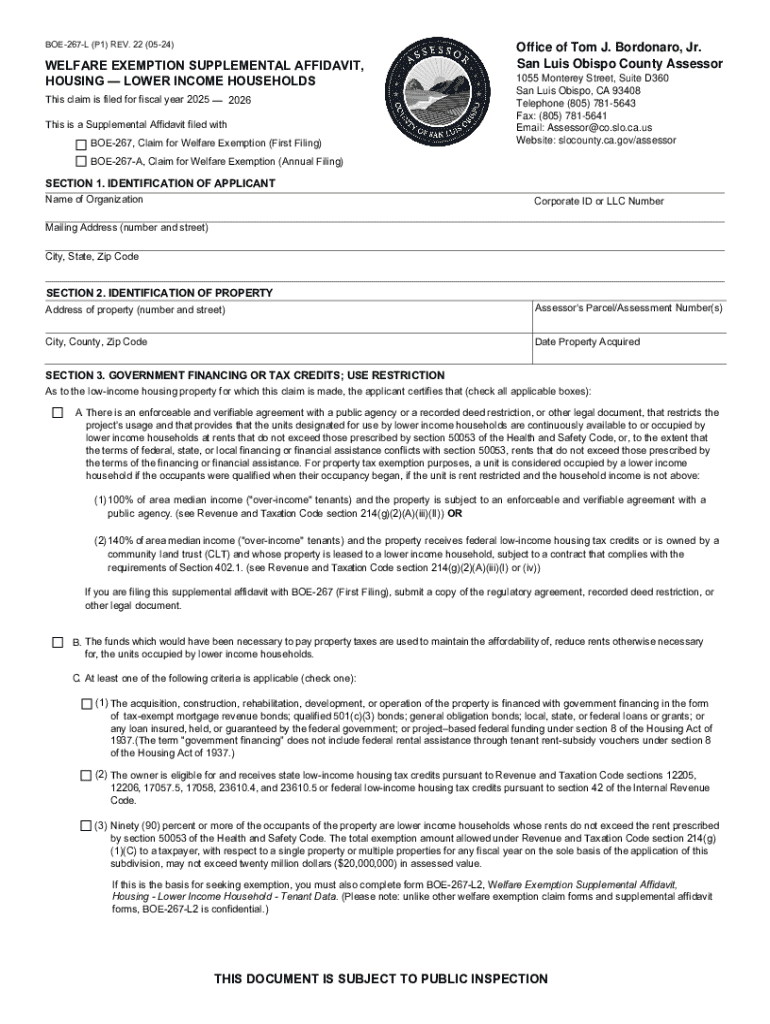

Get the free Boe-267-l (p1) Rev. 22 (05-24)

Get, Create, Make and Sign boe-267-l p1 rev 22

How to edit boe-267-l p1 rev 22 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out boe-267-l p1 rev 22

How to fill out boe-267-l p1 rev 22

Who needs boe-267-l p1 rev 22?

Comprehensive Guide to the BOE-267- P1 Rev 22 Form

Understanding the BOE-267- P1 Rev 22 Form

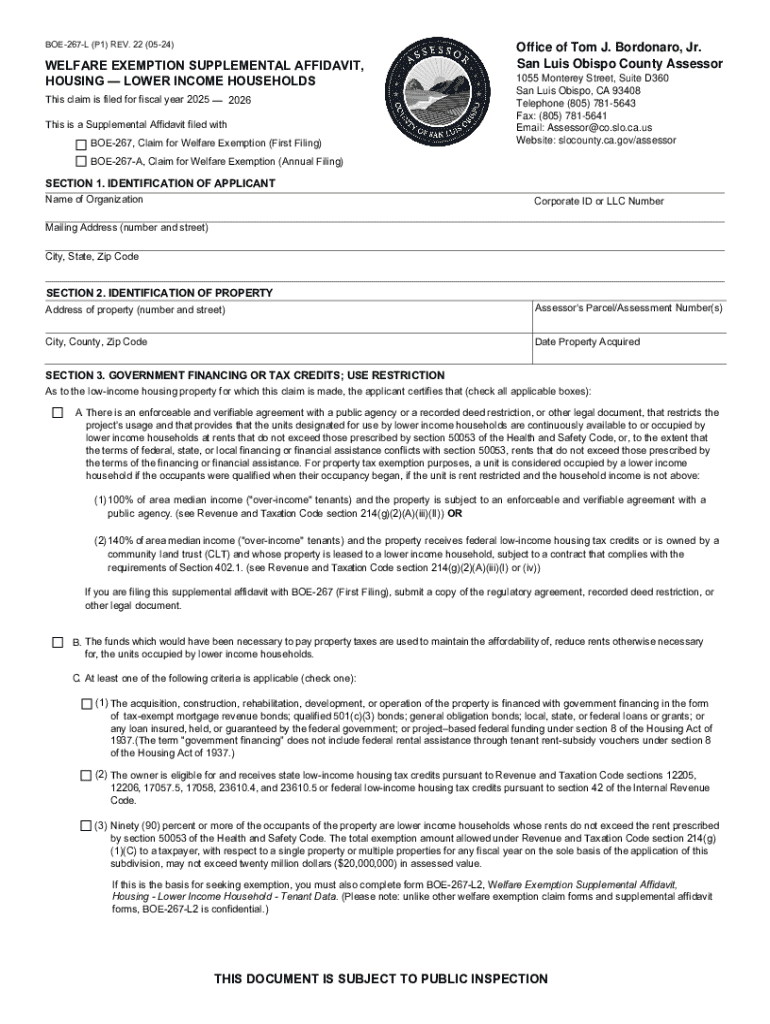

The BOE-267-L P1 Rev 22 form is a pivotal document used in California property tax administration. This form is specifically designed for the assessment of various property-related matters, especially concerning the ownership and transfer of property. Understanding this form is essential for individuals and entities dealing with property assessment or tax liabilities.

The primary purpose of the BOE-267-L P1 Rev 22 form is to collect information regarding property transfers. It serves as a tool for ensuring proper valuation and equitable taxation. With accuracy in reporting ownership changes, this form significantly reduces the risk of tax disputes and ensures compliance with state regulations.

Key terminology associated with the BOE-267-L P1 Rev 22 form includes terms such as 'transfer', 'assessment', 'property tax', and 'valuation'. Familiarity with these terms can aid users in accurately completing the form and understanding its implications in the broader context of California tax law.

Eligibility criteria

Eligibility to use the BOE-267-L P1 Rev 22 form extends to a variety of individuals and teams involved in property transactions. Whether you are an individual transferring property ownership or an organization managing multiple properties, this form is designed to accommodate your needs.

Individuals must ensure they are the legal owner of the property being transferred. Teams, which could include real estate companies or legal partnerships, can also utilize this form as long as they act collectively in accordance with legal regulations. Special circumstances, such as property being part of an estate sale or transferred between family members, may influence eligibility and require additional documentation.

Step-by-step instructions for filling out the BOE-267- P1 Rev 22 form

Filling out the BOE-267-L P1 Rev 22 form requires attention to detail, and breaking it into sections can simplify the process. Here’s how to navigate through each section effectively.

Section A: Basic Information

In Section A, you will need to provide fundamental identifying information, including your name, contact details, and the property address. Ensure that all information is accurate and matches records, as discrepancies can lead to delays or complications.

Section B: Financial Information

Section B focuses on financial data related to the transfer. You must document the purchase price, any liens on the property, and if applicable, any financial assistance received during the transaction. Accurate financial reporting not only aids in assessment but also plays a role in future property tax obligations.

Section : Additional Transfers or Sellers

If there are additional parties involved in the transfer, Section C is where you provide their details. It's crucial to include everyone participating in the transfer to maintain transparency and legal compliance.

Section : Supporting Documentation

Section D requires you to attach relevant supporting documentation. This could include a copy of the purchase agreement, previous property tax statements, or documentation showing any liens against the property. Ensuring you have all necessary paperwork attached seamlessly strengthens your submission and expedites processing.

Common mistakes and how to avoid them

Even minor errors in the BOE-267-L P1 Rev 22 form can lead to significant repercussions, including potential delays in processing. Some common mistakes include incomplete information, mismatched signatures, and neglecting to attach supporting documents.

To avoid these issues, double-check all entries for accuracy. Make sure all required fields are filled in, review the attached documents for completeness, and ensure that the signatories match those recorded on legal documents related to the property. Utilizing checklists can help in thoroughly reviewing each part of the form before submission.

Editing and managing your BOE-267- P1 Rev 22 form with pdfFiller

pdfFiller provides an intuitive platform for editing and managing the BOE-267-L P1 Rev 22 form. Users can access a suite of online editing tools that make filling out the form straightforward and user-friendly.

Once completed, saving and organizing your form securely is a breeze with pdfFiller. You can store documents in the cloud, ensuring they're accessible whenever needed. Additionally, collaboration features allow team members to input their data or review documents, making the process efficient and cohesive.

eSigning the BOE-267- P1 Rev 22 form

eSigning is increasingly necessary for legal compliance, and pdfFiller streamlines this process. By using pdfFiller, you can easily sign the BOE-267-L P1 Rev 22 form electronically, ensuring that all involved parties have completed their signatures before submission.

To eSign your form, simply upload the document to pdfFiller, follow the prompts to apply your signature, and send it off. Keeping track of signed documents is effortless; pdfFiller maintains a history of changes and signed versions, which can prove invaluable if disputes arise later.

FAQs about the BOE-267- P1 Rev 22 form

Many users have questions regarding the BOE-267-L P1 Rev 22 form. Addressing some of the frequently asked questions can enhance understanding and facilitate smoother submissions.

For any problems, users can refer to pdfFiller’s help center, which offers comprehensive guides and customer support, making it easier to resolve common issues.

Resources related to the BOE-267- P1 Rev 22 form

Accessing the right resources can make a significant difference in the experience of using the BOE-267-L P1 Rev 22 form. The California Board of Equalization provides official resources detailing the form's requirements and guidelines.

Additionally, local tax authorities can be contacted for specific queries or concerns related to your property's taxation. It's also wise to consult legal resources and real estate professionals when navigating complex situations.

Updates and changes to the BOE-267- P1 Rev 22 form

Keeping up with updates and changes to the BOE-267-L P1 Rev 22 form is crucial for users. Recent amendments can affect how the form is filled out and may introduce new legal requirements or conditions.

To stay informed, regularly check the official California Board of Equalization website or sign up for notifications about updates in property tax regulations. This proactive approach ensures compliance and prepares users for any upcoming changes.

Accessibility of the BOE-267- P1 Rev 22 form

Accessing and downloading the BOE-267-L P1 Rev 22 form through pdfFiller is straightforward. The platform enables easy downloads and can be accessed from various devices without compatibility issues, enhancing user flexibility.

To ensure accessibility, users are encouraged to utilize the mobile-friendly features of pdfFiller, making it possible to edit and sign documents on-the-go. This ensures that users can manage their forms anywhere, anytime.

Final checklist before submission

Before submitting the BOE-267-L P1 Rev 22 form, it's vital to review your document using a final checklist. Here are key points to verify:

Doing a thorough final review reduces the likelihood of having your submission rejected or delayed, ensuring a smoother property transfer process.

Using pdfFiller for other related forms

pdfFiller doesn’t just stop with the BOE-267-L P1 Rev 22 form; there are many other related tax forms available on the platform. Navigating to find additional resources is simple, allowing users to access the suite of necessary tax documentation without hassle.

Whether you are looking to complete tax returns, contracts, or other legal forms, pdfFiller provides a unified solution, making it a powerful tool for individuals and teams alike in managing their documentation needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the boe-267-l p1 rev 22 in Chrome?

Can I create an eSignature for the boe-267-l p1 rev 22 in Gmail?

Can I edit boe-267-l p1 rev 22 on an Android device?

What is boe-267-l p1 rev 22?

Who is required to file boe-267-l p1 rev 22?

How to fill out boe-267-l p1 rev 22?

What is the purpose of boe-267-l p1 rev 22?

What information must be reported on boe-267-l p1 rev 22?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.