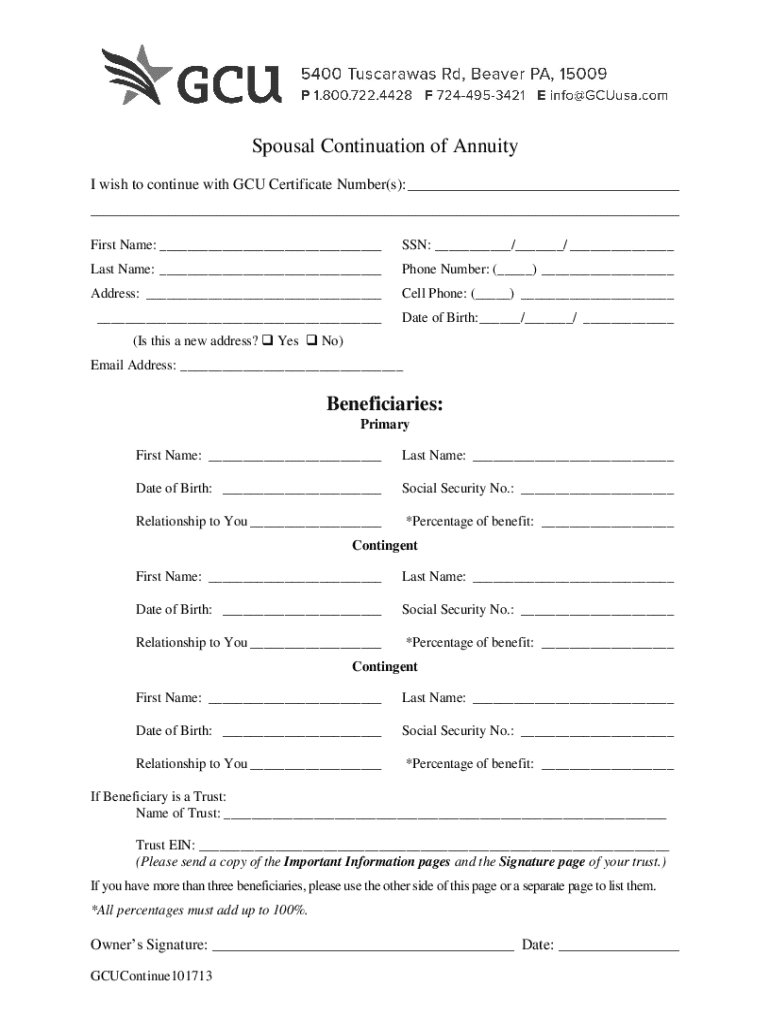

Get the free Spousal Continuation of Annuity

Get, Create, Make and Sign spousal continuation of annuity

Editing spousal continuation of annuity online

Uncompromising security for your PDF editing and eSignature needs

How to fill out spousal continuation of annuity

How to fill out spousal continuation of annuity

Who needs spousal continuation of annuity?

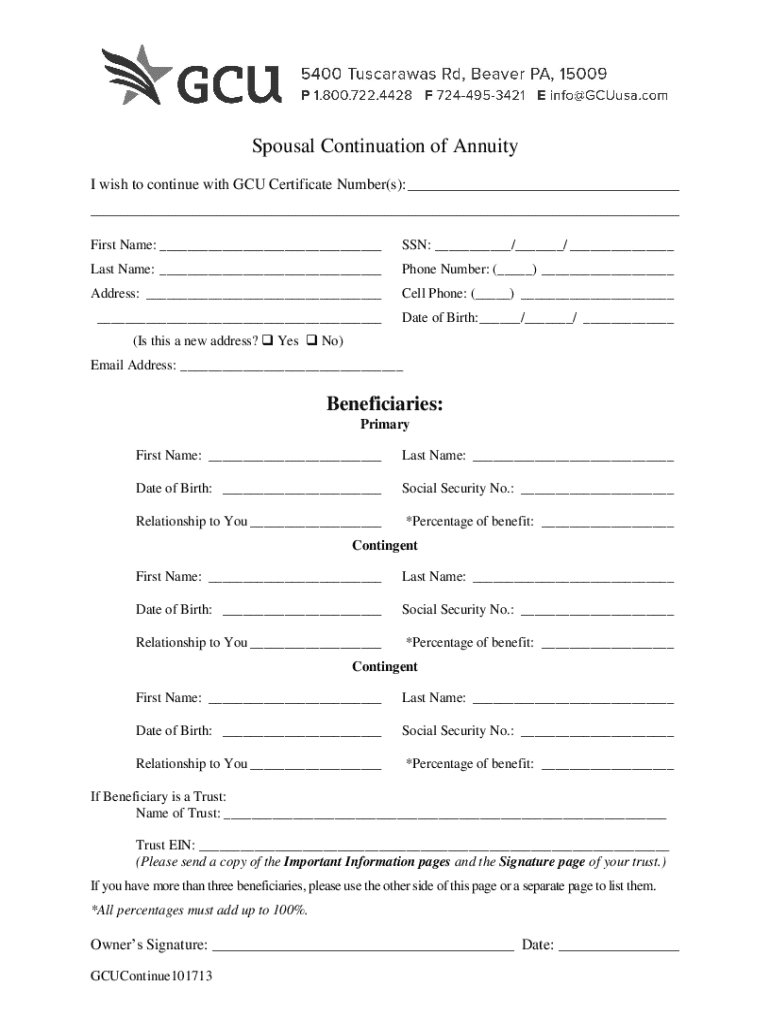

Understanding the Spousal Continuation of Annuity Form

Understanding spousal continuation of annuities

The spousal continuation of annuity refers to the ability of a surviving spouse to receive benefits from an annuity contract after the death of the original owner. This provision ensures that the financial security of the surviving spouse is preserved, making it a crucial element in retirement planning.

In retirement planning, spousal continuation is essential because it allows the remaining partner to maintain a steady income stream, avoiding financial hardships that can accompany the loss of a spouse. Choosing spousal continuation over other options, such as lump-sum payouts or transferring the annuity to another party, allows for a more stable transition during a difficult time.

Eligibility criteria for spousal continuation

Determining eligibility for spousal continuation of annuities largely hinges on several key factors. Primary among these is the relationship status of the applicant, specifically whether the applicant was legally married to the original annuity owner at the time of the owner’s passing.

In general, the surviving spouse must meet specific eligibility requirements outlined by the annuity provider, which may include condition-specific criteria related to the type of annuity held. It's crucial for applicants to check their individual circumstances, as guidelines can vary significantly across providers.

The spousal continuation benefits explained

Spousal continuation provides several benefits, paramount among them being financial security for the surviving spouse. When a spouse passes, the continuation option allows the other partner to receive regular payments from the annuity, ensuring they do not face an abrupt loss of income. This structured support can be a significant relief during an extremely challenging emotional period.

Transitioning from an individual to a joint annuity can offer additional peace of mind. Essentially, spouse continuation enables the remaining partner to maintain the intended structure of financial benefits without significant changes to the payout dynamics. Compared to other beneficiary options that may lead to a one-time lump-sum payout, spousal continuation can be more advantageous for long-term financial wellness.

How spousal continuation works

Understanding the step-by-step process of initiating a spousal continuation of an annuity is critical for those navigating this transition. The process begins with an initial assessment of the existing annuity, ensuring that all terms are clear and that the surviving spouse is eligible.

Next, determining the right type of annuity is essential, as this impacts future payouts and conditions attached. Following this, clear communication with the annuity provider about the types of documents required is needed before completing the spousal continuation form. Finally, after filling out the form correctly, submitting it along with necessary documentation for review is crucial.

Examples of spousal continuation scenarios

To better understand spousal continuation, consider the following scenarios: A couple holds a joint annuity plan where upon the passing of one spouse, the surviving spouse continues receiving monthly income rather than transitioning to a one-time payout. Another scenario could involve a single-owner annuity where the designating spouse opts for the spousal continuation, allowing ongoing payments to support longevity in retirement.

It's also important to evaluate how different annuity types impact the continuation process. Fixed annuities may have different implications and structures than variable annuities regarding payout options and stability. Also, understanding annuity payout structures helps predict how they affect the overall financial picture of the surviving spouse after the transition.

Frequently asked questions about spousal continuation

Many individuals seeking information about spousal continuation of annuities have common concerns and questions. One frequent myth is that the annuity automatically closes upon the annuity owner's passing. In fact, many providers allow for a seamless transfer into spousal continuation without losing benefits.

If the annuity owner passes away, the surviving spouse generally stands to benefit from the scheduled payments as long as the correct actions are taken timely. Moreover, it's essential to understand the difference between spousal continuation and joint annuities. Joint annuities often share income between partners during their lifetimes but may differ in terms of security for the surviving spouse should one partner pass.

Utilizing pdfFiller for spousal continuation applications

Using pdfFiller simplifies the process of managing the spousal continuation of annuity form. The platform allows users to easily edit, sign, and submit their annuity-related documents from any location, ensuring quick and efficient processing. This is especially beneficial for individuals or families coordinating efforts during a challenging time.

Accessing the spousal continuation of annuity form on pdfFiller is straightforward. Users can follow step-by-step instructions to fill out the form correctly. The platform also offers editing tools, digital signing capabilities, and options to collaborate with financial advisors or family members, reinforcing their support system.

Importance of professional guidance

Consulting a financial advisor when navigating spousal continuation options is essential. A qualified advisor can offer personalized insight into the best annuity options based on individual circumstances, investment goals, and tax implications. Often, they can also help clarify any uncertainties related to eligibility, forms, and necessary documentation.

Additionally, estate planners play a critical role in ensuring that annuity benefits align with overall estate plans, facilitating the smooth transfer of assets as per the deceased's wishes. Finding the right professionals to guide you through this process can significantly impact the financial stability of the surviving spouse.

Future considerations and trends in annuity plans

The landscape of annuity plans is constantly evolving, affected by legislative changes and market trends. Staying informed about potential alterations in laws surrounding spousal continuation is crucial. Such changes can significantly impact how benefits are distributed and taxed, emphasizing the need for ongoing education regarding annuity options.

Moreover, understanding emerging trends in annuity products can empower individuals to make informed investment decisions. Factors like rising interest rates or changes in consumer preferences can affect an annuity's structure, thus requiring adaptations in retirement planning strategies.

Feedback and user experiences

Encouraging users to share their experiences with spousal continuation can provide valuable insights for others navigating similar paths. This exchange of personal stories regarding the spousal continuation of annuities can foster community support, enhancing understanding of the process and outcomes.

User feedback is crucial for resources like pdfFiller, where multiple perspectives can improve the platform’s functionality and user interface. Learning from those who have trodden the path of spousal continuation can help refine processes and introduce new tools that can benefit future users.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send spousal continuation of annuity for eSignature?

How do I edit spousal continuation of annuity online?

Can I sign the spousal continuation of annuity electronically in Chrome?

What is spousal continuation of annuity?

Who is required to file spousal continuation of annuity?

How to fill out spousal continuation of annuity?

What is the purpose of spousal continuation of annuity?

What information must be reported on spousal continuation of annuity?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.