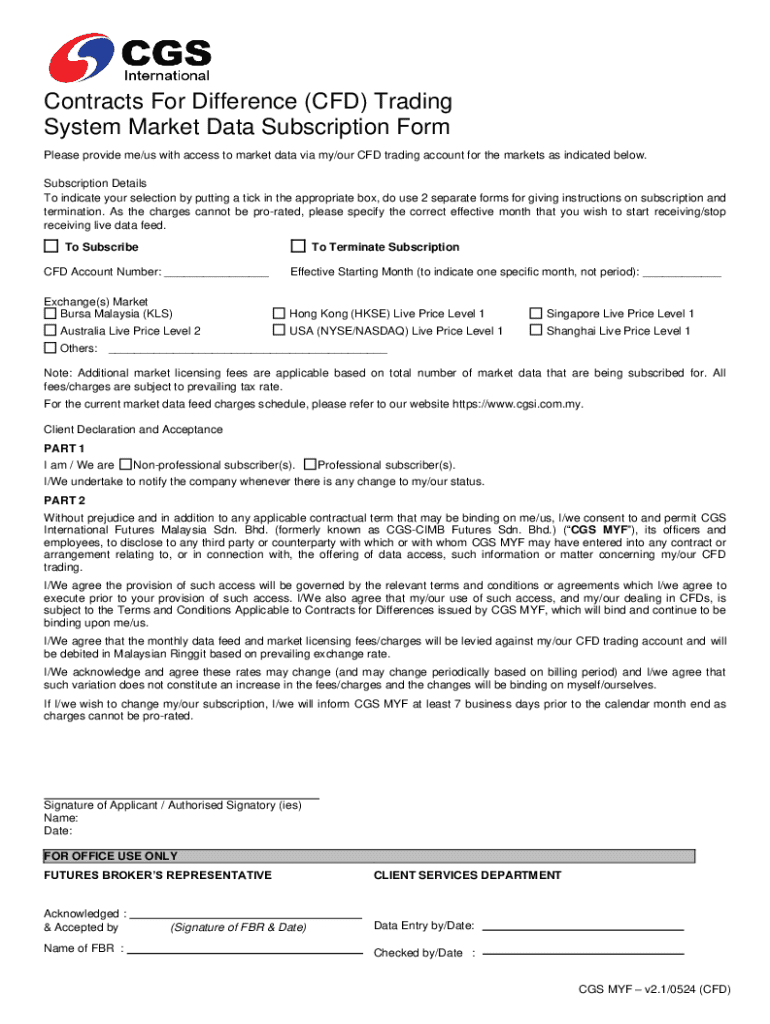

Get the free Contracts for Difference (cfd) Trading System Market Data Subscription Form

Get, Create, Make and Sign contracts for difference cfd

How to edit contracts for difference cfd online

Uncompromising security for your PDF editing and eSignature needs

How to fill out contracts for difference cfd

How to fill out contracts for difference cfd

Who needs contracts for difference cfd?

Contracts for Difference (CFD) Form – How-to Guide

Overview of contracts for difference (CFD)

Contracts for difference (CFD) are financial derivatives that allow traders to speculate on the price movement of assets without owning the underlying assets. CFDs facilitate trading on margin, meaning traders can open larger positions with less capital than the full value of the trade.

The flexibility of CFDs has made them a popular choice for both individual and institutional traders. They offer access to a range of asset classes, including stocks, commodities, currencies, and indices. Unlike traditional investments, which require direct ownership and longer commitment, CFDs enable quick market entry and exit, thus appealing to active traders.

CFDs contrast with traditional investment methods in several key areas. While traditional trading necessitates purchasing assets outright, CFDs permit speculation on price movements without actual ownership. This leveraged approach means that traders can amplify profits but also come with significant risks.

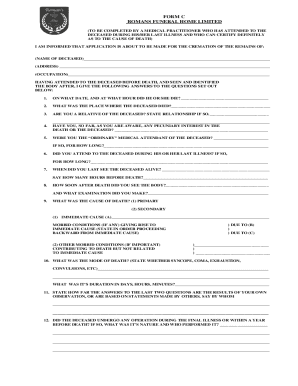

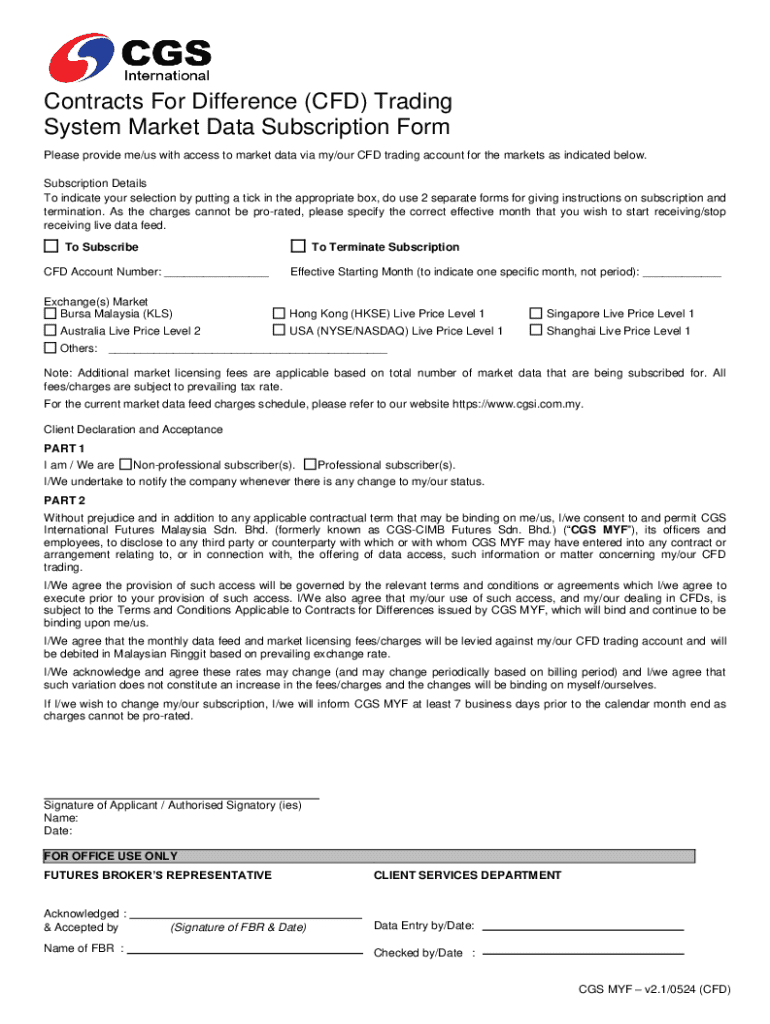

Understanding the CFD form

The CFD form is crucial in executing trades as it captures essential information for processing the trade. Understanding its components ensures traders accurately submit their intentions and comply with regulations.

Key components of the CFD form include the following:

The CFD form acts as both a contract and a record of the trade, which is essential for compliance and analytical purposes.

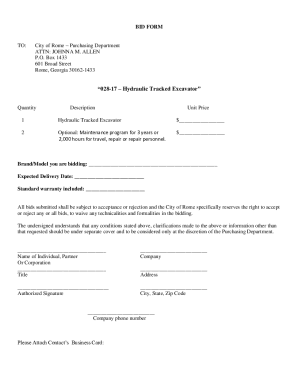

Step-by-step guide to filling out the CFD form

Filling out the CFD form is a straightforward process, but preparation is key. Before you begin, conduct thorough research on the asset you wish to trade. Familiarize yourself with market conditions, as this knowledge can significantly influence your trading decision.

Here's a detailed walkthrough of filling out the CFD form:

Editing and signing the CFD form

Editing a CFD form is essential for traders who want to revise their initial details. With pdfFiller, you can easily edit your CFD form. Simply upload the document to the platform, make necessary changes, and save.

Signatures are crucial for validating the CFD contract. Electronic signatures through pdfFiller make this process simple and legally binding. Ensure compliance with digital signing laws, which vary by region but generally uphold the validity of electronic signatures in contracts.

Managing your CFD documents

Effective document management is vital in CFD trading. Organizing and securely storing your CFD forms allows for quick access to critical documents when needed.

Utilizing pdfFiller's features can significantly enhance your document management:

Additional features of pdfFiller for CFD traders

pdfFiller offers advanced features tailored to CFD traders seeking efficiency and accessibility. Its cloud-based platform allows you to access your CFD documents anytime, anywhere, enabling flexible trading and document management.

Moreover, traders can benefit from interactive tools that assist in analyzing CFD performance, as well as customizable templates for repetitive use, saving time on form filling.

Common issues and troubleshooting

When filling out the CFD form, issues can arise, mainly due to missing information or incorrect data entry. Such errors can have significant consequences, including trade delays or financial losses.

Here’s a guide on frequently encountered problems and best practices for resolving them:

Legal considerations in CFD trading

CFD trading is regulated in many jurisdictions, which imposes specific legal obligations on traders. It’s crucial to familiarize yourself with these regulations, including the conditions under which CFDs can be traded, to remain compliant and protect your rights.

Understanding the legal obligations when signing a CFD form ensures that you acknowledge the terms and conditions of the contract. Being well-informed about your rights as a trader, including withdrawal rights and responsibilities, is essential for any trading strategy.

Related terms and definitions

To navigate CFD trading successfully, it's important to be familiar with key terms related to the industry. Understanding these concepts will enhance your trading experience.

A glossary of terms can be beneficial for quick reference as you engage in CFD trading.

Industry insights and trends

The CFD trading landscape is rapidly evolving, influenced by technological advancements and changing market conditions. Current trends show increased use of algorithmic trading and enhanced analytical tools, offering traders new ways to optimize their strategies.

Market sentiment plays a key role in CFD trading. By understanding overall trader sentiment and potential future price movements, CFD traders can better position themselves in the market. Keeping up with industry news, analyses, and predictions is essential for sustained success.

Frequently asked questions (FAQs)

As a CFD trader, you may have questions about the form and trading process. Here are some common queries:

Support and assistance

If you face difficulties while filling out or managing your CFD forms, accessing support is straightforward. pdfFiller offers a range of help options, including tutorials, customer service, and user forums.

For personalized assistance, you can contact pdfFiller’s support team. Additionally, explore the platform's resource section for guides and tips that can enhance your understanding and use of CFD forms.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my contracts for difference cfd in Gmail?

How can I send contracts for difference cfd for eSignature?

Can I edit contracts for difference cfd on an iOS device?

What is contracts for difference cfd?

Who is required to file contracts for difference cfd?

How to fill out contracts for difference cfd?

What is the purpose of contracts for difference cfd?

What information must be reported on contracts for difference cfd?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.