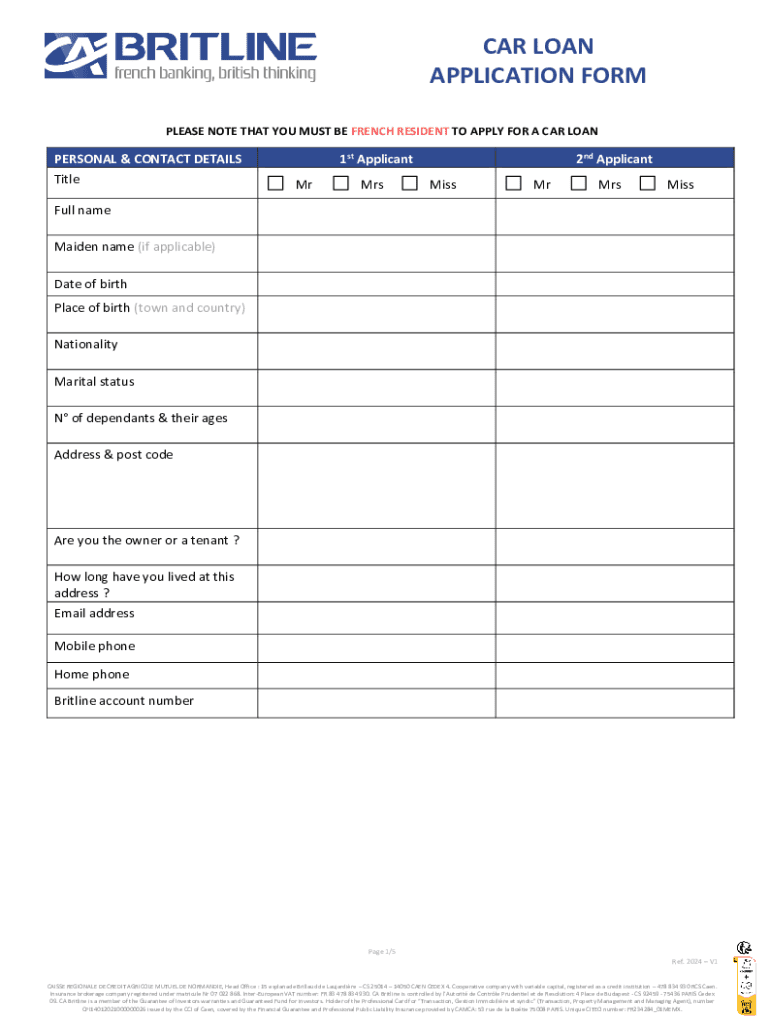

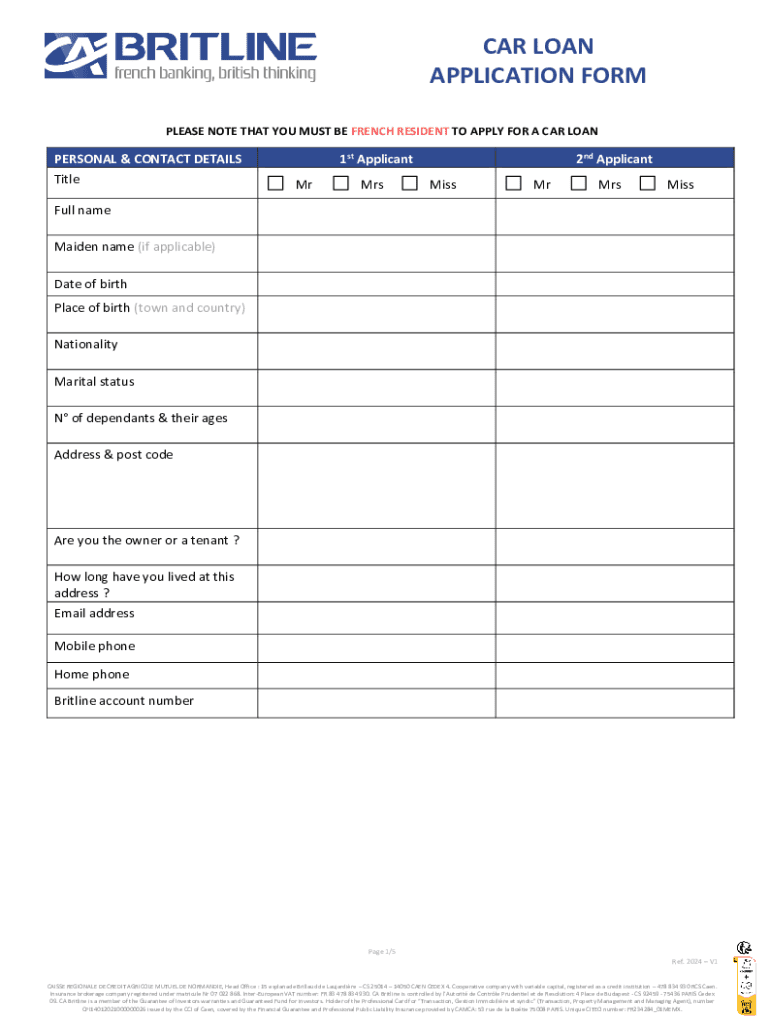

Get the free Car Loan Application Form

Get, Create, Make and Sign car loan application form

How to edit car loan application form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out car loan application form

How to fill out car loan application form

Who needs car loan application form?

A comprehensive guide to the car loan application form

Understanding the car loan application process

A car loan application form is a crucial document required by lenders to assess your eligibility for financing a vehicle. This form collects information about your personal, financial, and employment background, allowing loan providers to make informed decisions regarding approval and terms.

Completing the car loan application accurately is more than just a formal requirement; it directly impacts your chances of receiving favorable loan terms. Lenders rely on the information provided to evaluate risk, determine interest rates, and outline repayment plans.

As you prepare to fill out your car loan application form, familiarizing yourself with common terminology is key. Terms like APR (Annual Percentage Rate), down payment, and repossession will frequently appear on loan documents and discussions.

Preparing for your car loan application

Before completing your car loan application form, gather the necessary personal information. This includes your full name, mailing address, and contact details. You must also provide your Social Security number or its equivalent, alongside employment and income details.

Financial documents play a crucial role in validating your application. Be prepared to submit recent pay stubs, bank statements, and tax returns. These documents help lenders assess your financial health and capacity to repay the loan.

Assessing your credit score

It's advisable to check your credit score prior to applying for a car loan. Understanding your credit score allows you to assess the likelihood of loan approval and potential interest rates. Generally, a score above 700 is considered good, making you a more attractive candidate for lenders.

Filling out the car loan application form

When it comes to filling out the car loan application form, a step-by-step approach can simplify the process. Start with the personal information section where you'll enter your name, address, and contact details.

The employment information section requires you to provide details about your job, including the name of your employer, your position, and duration of employment. Be honest and accurate, as lenders will often verify this information.

Next, the financial information section asks for your income, expenses, and any existing debts. Being thorough is critical because lenders wish to ensure that you can make timely loan payments.

Specifics on vehicle information

It's also vital to provide precise vehicle details. You'll need to list the car’s make, model, year, and the vehicle identification number (VIN). Lenders use this information to determine the loan amount based on the car's appraised value.

Additionally, be prepared to disclose the loan's purpose and any down payment you'll make upfront, as this influences both approval and financing terms.

Tips for editing and signing your application form

Once you've completed your car loan application form, editing it is essential. pdfFiller provides interactive editing tools that allow users to review and refine their documents seamlessly. Make sure your entries are consistent and correct, as errors can delay the approval process.

After editing, signing the application electronically can save time. eSigning is often faster and more convenient than traditional methods, with the added benefit of easy verification of your signature's authenticity.

Submitting your car loan application

Choosing the right lender is essential in your car loan application journey. Consider factors such as interest rates, loan terms, and customer reviews when selecting a provider. Comparing multiple offers can help secure the best deal.

Submit your application either online or in-person, depending on your preference. Online submissions are generally quicker and allow for easier tracking of your application status. Be mindful of timelines for processing your application; lenders typically take anywhere from a few hours to several days to respond.

After submission: What to expect

Post-submission, you can anticipate a loan approval process that may last several days. During this time, lenders may request additional information or documentation to complete your application review. Being responsive to these requests can expedite the process.

Upon approval, it's crucial to understand your loan agreement fully. Review the terms and conditions, including interest rates and repayment schedules, before proceeding. If your application is denied, seek feedback to understand why and work on improving your eligibility for future applications.

Managing your car loan from start to finish

After securing your car loan, it's essential to remain proactive in managing it. Track your loan progress through your lender's platform. Staying informed about approval status and being responsive to any communication will help you navigate potential challenges.

Setting up a payment schedule is crucial for maintaining good standing on your loan. Consider automating payments to avoid missed deadlines, and keep tabs on your due dates to manage your cash flow effectively.

FAQs related to car loan applications

Many individuals have questions about the car loan application process. Some common inquiries revolve around eligibility criteria, required documents, and timelines for approval. Taking the time to research these aspects can prepare you for a smoother experience.

Clarifications on terms and conditions are also vital. Don’t hesitate to reach out to your lender for detailed explanations regarding any points of confusion. Various online resources and lenders' customer service may provide additional support and guidance.

Best practices for future loan applications

Maintaining a good credit score is crucial for future loan applications. Regularly check your credit report, pay bills on time, and avoid taking on excessive debt. These practices can significantly enhance your borrowing capabilities and ensure favorable terms.

Preparing for future loan applications involves a proactive stance on monitoring your financial health. Keep all necessary documents organized and updated. pdfFiller can assist in managing these documents efficiently, helping you access and prepare important files whenever needed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find car loan application form?

Can I create an electronic signature for the car loan application form in Chrome?

How do I fill out car loan application form on an Android device?

What is car loan application form?

Who is required to file car loan application form?

How to fill out car loan application form?

What is the purpose of car loan application form?

What information must be reported on car loan application form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.