Get the free Payroll Deduction Authorization Form

Get, Create, Make and Sign payroll deduction authorization form

Editing payroll deduction authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out payroll deduction authorization form

How to fill out payroll deduction authorization form

Who needs payroll deduction authorization form?

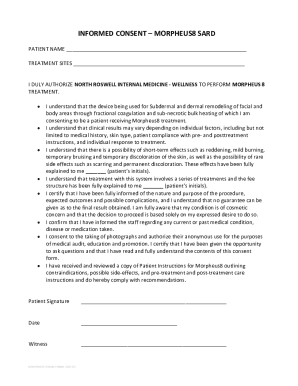

Comprehensive Guide to Payroll Deduction Authorization Forms

Understanding payroll deduction authorization forms

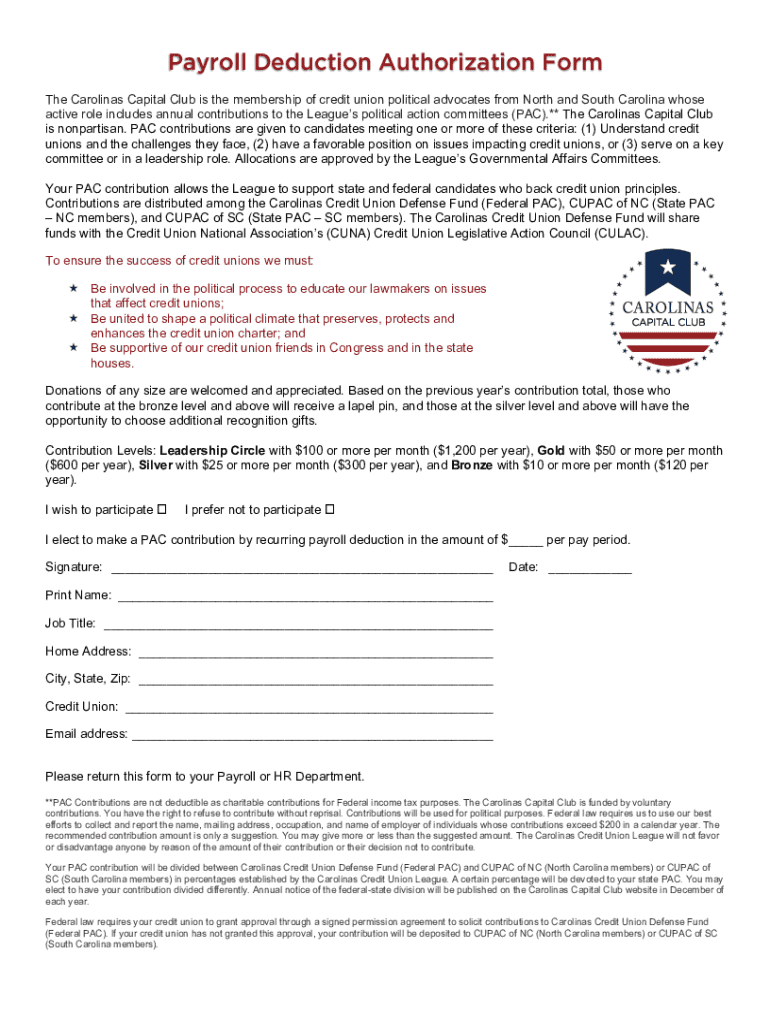

A payroll deduction authorization form is a crucial document that allows employers to withhold a portion of an employee's paycheck for specific purposes. The primary purpose of this form is to provide a structured way for employees to authorize various deductions from their pay, such as for health insurance, retirement plans, or charitable donations. This authorization is vital not only for ensuring that payroll processes run smoothly but also for maintaining transparency between the employer and employee.

Accurate completion of the payroll deduction authorization form is essential, as any errors can lead to discrepancies in paychecks. Common uses of this form include contributions to employee benefit programs like health insurance, retirement savings plans, and even contributions to charitable organizations. It's essential that both parties understand the implications of the deductions agreed upon.

Key components of a payroll deduction authorization form

To ensure clarity and prevent errors, understanding the key components of a payroll deduction authorization form is essential. These components typically include:

Step-by-step guide to completing the payroll deduction authorization form

Completing a payroll deduction authorization form might seem daunting, but following these steps can simplify the process.

Editing and customizing your payroll deduction authorization form with pdfFiller

pdfFiller offers an efficient platform to edit and customize your payroll deduction authorization form seamlessly. This tool provides interactive forms that are easily accessible. Users can utilize editable templates specifically designed for payroll deduction authorizations.

One of the standout features of pdfFiller is the ability to add digital signatures, facilitating quick approvals without the need for printing or scanning. Furthermore, collaboration with team members is highly streamlined. Users can share forms securely, co-edit in real-time, and track changes effectively, maintaining version control throughout the process.

Frequently asked questions (FAQs) about payroll deduction authorization forms

As you navigate the payroll deduction authorization form, you may have a few questions. Here, we answer some of the most commonly asked questions:

Considerations for employers regarding payroll deduction authorization forms

Employers play a key role in managing payroll deduction authorization forms responsibly. Best practices include thoroughly reviewing employee submissions for accuracy and ensuring that forms are stored securely. Proper handling minimizes risks and upholds employee trust.

Legal compliance is also paramount. Employers must adhere to relevant regulations when it comes to payroll deductions, ensuring that all necessary documentation is in order for record-keeping purposes. Transparent communication about the types of deductions and guidelines for making changes ensures employees remain informed and engaged.

Ensuring security and compliance in document management

In an era where data security is vital, secure handling of personal information is critical. pdfFiller protects user data through encryption and rigorous security protocols, ensuring that sensitive information is not at risk.

Employers also need to stay compliant with labor regulations. Familiarity with laws governing payroll deductions, including those relating to employee consent, helps maintain legal integrity and protects the organization from potential legal issues.

Advanced features of pdfFiller for efficient form management

pdfFiller enhances document management through a cloud-based solution, allowing users to manage forms from virtually any device. This flexibility ensures that employees can access and submit their payroll deduction authorization forms wherever they are.

Integration with payroll systems further streamlines processes, allowing deductions to be automated and reducing potential errors. Additionally, performance tracking and reporting features enable employers to monitor deduction statuses and participation, providing valuable insights into employee engagement.

Real-world examples and use cases of payroll deduction authorization forms

Real-life case studies illustrate how organizations benefit from effectively implementing payroll deduction authorization forms. Companies that have actively encouraged participation in benefit programs through these forms often witness increased employee satisfaction and engagement.

For instance, a mid-sized tech company successfully employed a streamlined process using pdfFiller, resulting in higher rates of participation in their retirement savings plan. Employee testimonials often highlight how easy it is to manage deductions digitally, leading to more transparent communication and a more cohesive workplace atmosphere.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send payroll deduction authorization form for eSignature?

Where do I find payroll deduction authorization form?

How do I edit payroll deduction authorization form on an iOS device?

What is payroll deduction authorization form?

Who is required to file payroll deduction authorization form?

How to fill out payroll deduction authorization form?

What is the purpose of payroll deduction authorization form?

What information must be reported on payroll deduction authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.