Get the free Critical Illness Insurance Claim

Get, Create, Make and Sign critical illness insurance claim

How to edit critical illness insurance claim online

Uncompromising security for your PDF editing and eSignature needs

How to fill out critical illness insurance claim

How to fill out critical illness insurance claim

Who needs critical illness insurance claim?

Navigating the Critical Illness Insurance Claim Form: A Complete Guide

Understanding critical illness insurance

Critical illness insurance serves as a financial safety net during challenging health crises. This insurance product provides a lump-sum payment upon the diagnosis of specific life-altering illnesses, helping you manage medical expenses, care needs, and everyday living costs, maintaining financial stability for you and your family.

Importance cannot be overstated when planning for potential health risks. Rather than relying solely on health insurance, which may cover only a fraction of costs, critical illness insurance can provide comprehensive coverage that aids recovery without the burden of financial stress.

Common conditions covered by critical illness insurance include heart attack, stroke, cancer, and more. These illnesses not only affect your health but can also have substantial financial implications, thus justifying the purchase of this type of insurance.

Preparing for the claim process

Before submitting a claim, ensure you understand your policy's terms and conditions. Ensuring your situation qualifies under your policy is integral, as different insurers may have varying definitions and covered conditions.

Gathering necessary documentation is crucial for a smooth claim submission. Start collecting key documents such as medical records, policy documents that clearly outline your coverage, and proof of identity. All these elements reaffirm your qualifications for the claim.

How to submit a critical illness insurance claim

Initiating the claim process begins with contacting your insurance provider. This can usually be done via phone or online. In our technologically advanced era, many providers also allow downloading the critical illness insurance claim form directly from their websites.

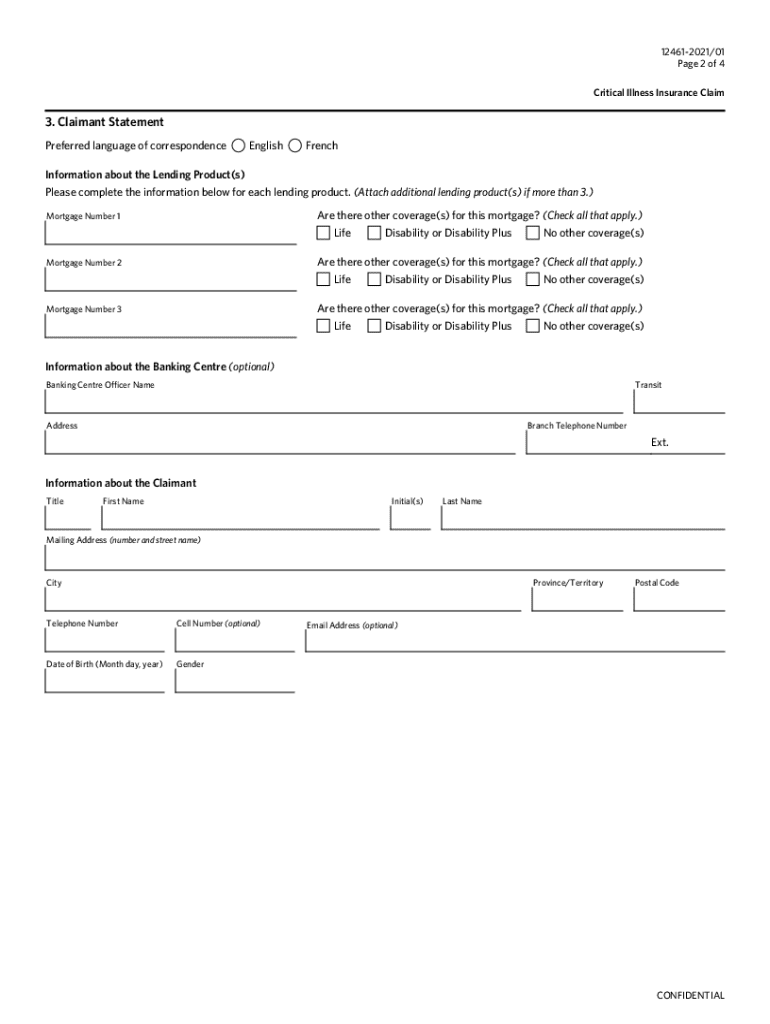

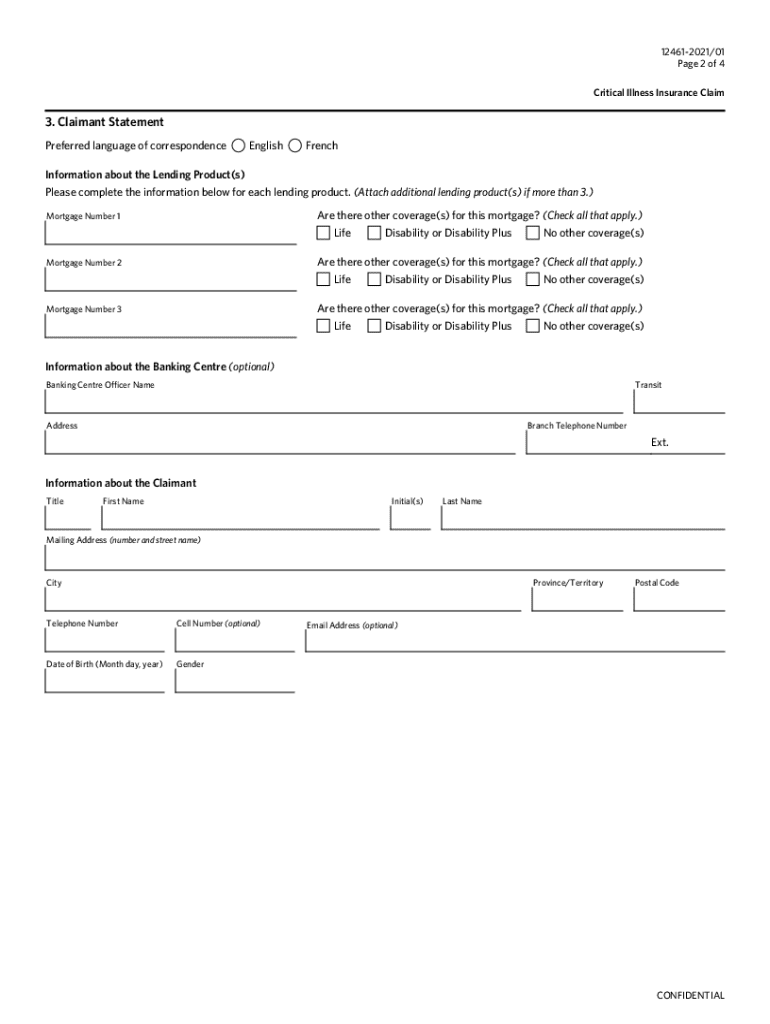

Completing the claim form can be straightforward if you follow the steps outlined below.

Common mistakes to avoid include omitting vital information or failing to adhere to the format specified by your insurer, as clarity and completeness are paramount in claim submissions.

After completing the form, your next step is to submit your claim through your preferred method. This could involve online submission, where utilizing tools like pdfFiller allows for quick and efficient processing, or through mail—be sure to use a method that provides tracking.

Finally, confirm receipt of your claim with your provider, ensuring all documentation reached them in proper order.

Utilizing pdfFiller for claim management

pdfFiller simplifies the management of your critical illness insurance claim form significantly. By utilizing pdfFiller, you can edit the claim form easily.

Tips for adding and modifying information include checking your entries for accuracy and using features like dropdowns for consistent answers.

E-signing your claim form is a breeze with pdfFiller, facilitating the submission process without postal delays. Additionally, the platform’s collaborative features enable sharing the form with trusted advisors or family members, ensuring all necessary parties are informed and involved.

Navigating the claims processing timeline

After submission, understanding what to expect is crucial. Generally, claims are processed within 10 to 30 days, depending on the insurer’s workload and the complexity of the claim.

Following up on your claim status can save you from unnecessary anxiety. Knowing how to contact customer service effectively can help you get updates on your claim.

Being informed about common delays, such as missing paperwork or needing additional medical verification, allows you to mitigate frustrations.

Customer resources and support

Many insurers provide comprehensive FAQ sections, which can help clarify common queries regarding claims. Don’t overlook these valuable resources.

In addition, live chat and email support features can be a tremendous help, allowing for real-time assistance rather than waiting for callback from customer service.

Community forums often contain shared experiences that can provide insight and reassurance as you navigate the claims process, helping you feel connected to others who have faced similar hurdles.

Insights from industry professionals

Experts suggest being proactive in gathering necessary documents. Starting this process sooner than later can alleviate stress when the time to file your claim arrives.

Common pitfalls include submitting claims hastily without reviewing all details thoroughly. Take your time to double-check, as this minimizes the chances of delays or denials.

Real-life case studies reveal that successful claims often stem from complete and accurate documentation along with consistent communication with insurers.

Legal information regarding claims

Understanding your rights as a policyholder is essential. Familiarize yourself with your policy’s terms to establish a firm footing during the claim process.

Should your claim be denied, knowing the appeal process is crucial. Engaging legal advisors can provide insights on whether pursuing an appeal is warranted, representing your interests effectively.

Tips for future insurance planning

Evaluating your insurance coverage needs involves assessing your family's financial circumstances, current health status, and potential risks associated with your lifestyle.

Choosing the right critical illness policy requires careful consideration of what conditions are covered, waiting periods, and benefit amounts to ensure they align with your financial capability and health needs.

The role of financial planning cannot be understated when it comes to healthcare management. Having a comprehensive planning approach helps ensure peace of mind during both healthy and challenging times.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my critical illness insurance claim in Gmail?

How can I edit critical illness insurance claim from Google Drive?

Can I create an electronic signature for the critical illness insurance claim in Chrome?

What is critical illness insurance claim?

Who is required to file critical illness insurance claim?

How to fill out critical illness insurance claim?

What is the purpose of critical illness insurance claim?

What information must be reported on critical illness insurance claim?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.