Get the free State of Tennessee's Beneficiary Mitigation Plan ...

Get, Create, Make and Sign state of tennessee039s beneficiary

Editing state of tennessee039s beneficiary online

Uncompromising security for your PDF editing and eSignature needs

How to fill out state of tennessee039s beneficiary

How to fill out state of tennessee039s beneficiary

Who needs state of tennessee039s beneficiary?

Understanding the State of Tennessee's Beneficiary Form

Understanding the beneficiary form

A beneficiary form is a crucial document that allows individuals to designate who will receive their assets upon their passing. This form plays a significant role in estate planning, providing clarity and direction to ensure that your wishes are respected after you're gone. In Tennessee, the requirements surrounding beneficiary forms have specific stipulations that residents need to be aware of when preparing their estate plans.

Properly executed beneficiary forms can streamline the process of asset distribution after death, often bypassing the lengthy probate process. Understanding the specific requirements outlined by the state of Tennessee is essential, as it ensures that your designations are valid and enforceable.

Types of beneficiary forms in Tennessee

In Tennessee, various types of beneficiary forms cater to different assets. These forms can be categorized primarily into financial accounts, real estate and property, and other relevant legal documents.

Key components of the Tennessee beneficiary form

There are essential components that every Tennessee beneficiary form must contain. These details ensure the form is valid and provides clear instructions for the distribution of assets.

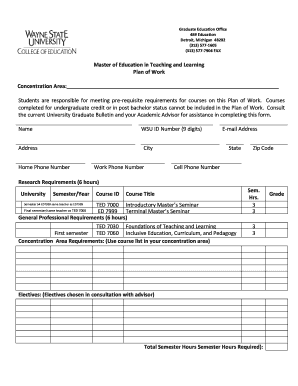

Step-by-step guide to completing the beneficiary form

Filling out the beneficiary form properly is crucial. Following a structured process will help in preventing issues later on.

Common mistakes to avoid when filing the beneficiary form

Filling out a beneficiary form may seem straightforward, but there are common pitfalls that individuals often face. Avoiding these mistakes is instrumental in ensuring your wishes are honored.

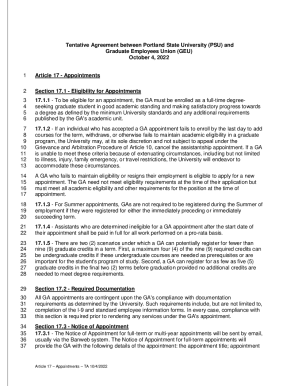

Electronic submission and management of beneficiary forms

Digitalization has transformed how we handle legal documents, and Tennessee’s beneficiary forms are no exception. With pdfFiller, users can conveniently manage these forms online.

Managing changes to your beneficiary form

Your life circumstances can change, thus necessitating updates to your beneficiary forms. It’s essential to stay proactive in managing these changes.

Resources for Tennessee residents

Tennessee residents looking to navigate the beneficiary form process can benefit from various state-specific resources and assistance options.

Frequently asked questions (FAQs) about Tennessee's beneficiary form

Understanding common questions can help clarify the process involved in filling out Tennessee's beneficiary forms.

Testimonials from users of pdfFiller

Users of pdfFiller have reported significant improvements in their documentation processes, especially concerning essential forms like the beneficiary form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send state of tennessee039s beneficiary for eSignature?

How do I execute state of tennessee039s beneficiary online?

How do I edit state of tennessee039s beneficiary online?

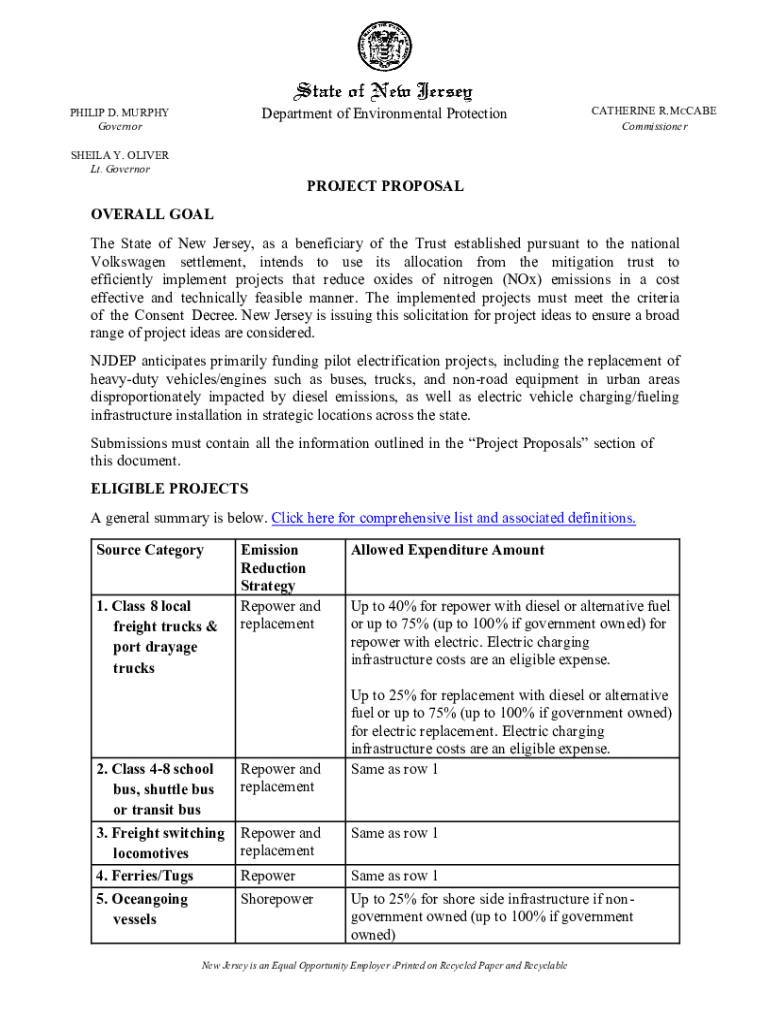

What is state of tennessee039s beneficiary?

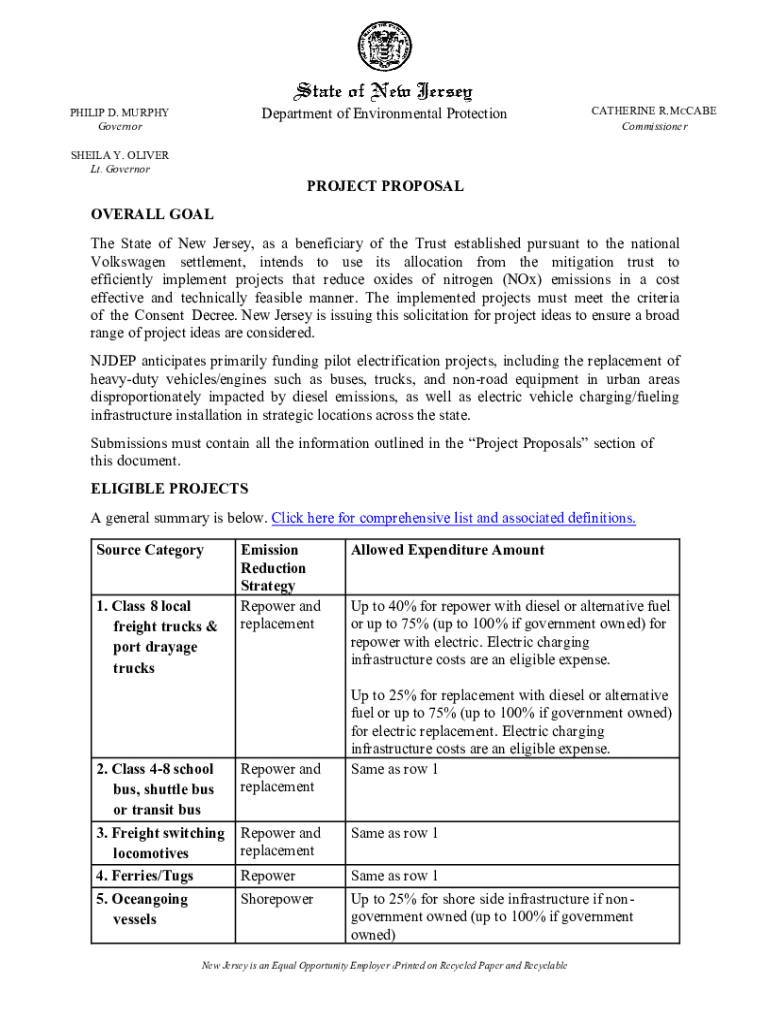

Who is required to file state of tennessee039s beneficiary?

How to fill out state of tennessee039s beneficiary?

What is the purpose of state of tennessee039s beneficiary?

What information must be reported on state of tennessee039s beneficiary?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.