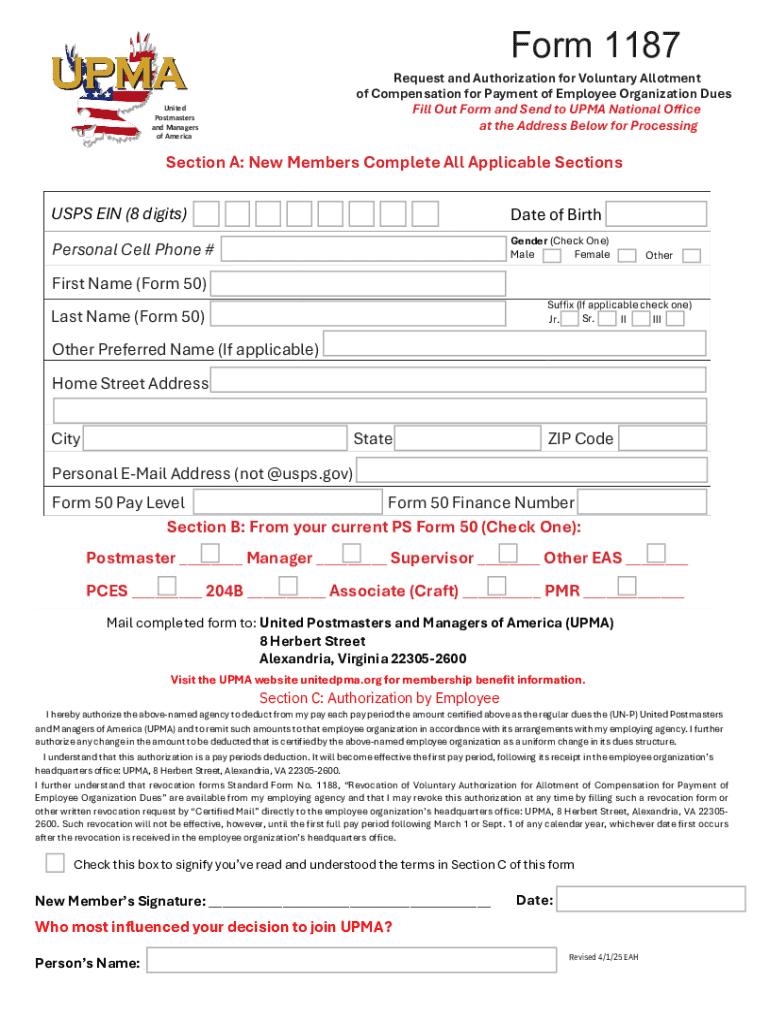

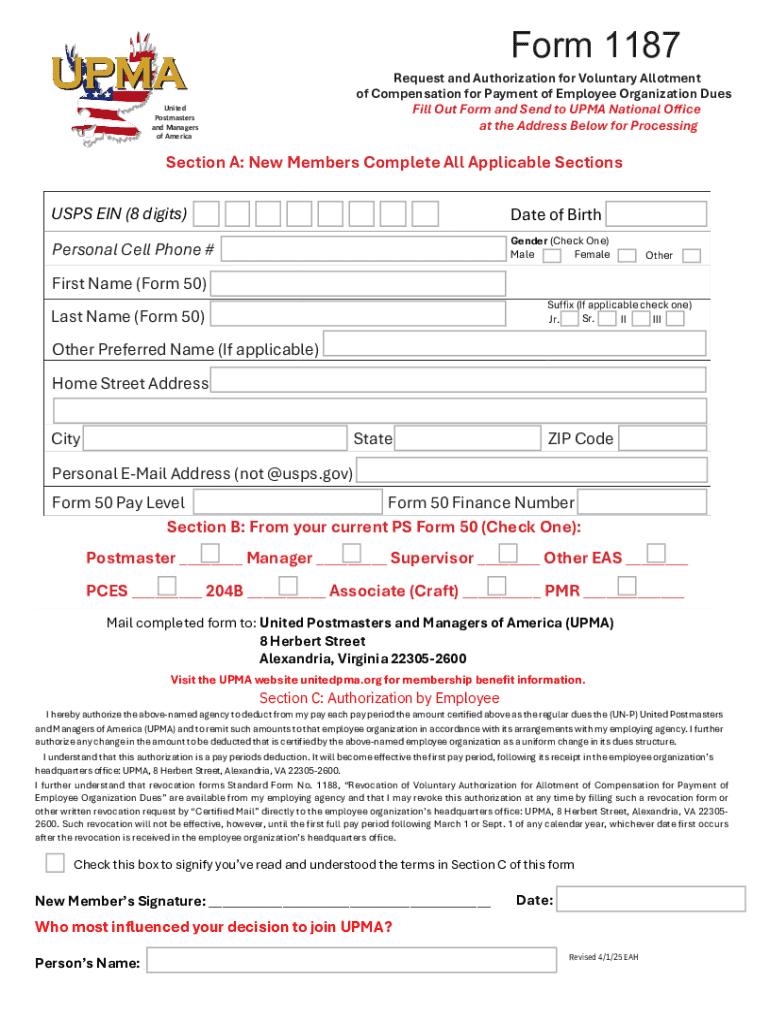

Get the free Form 1187

Get, Create, Make and Sign form 1187

Editing form 1187 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 1187

How to fill out form 1187

Who needs form 1187?

Form 1187 form: Your comprehensive how-to guide

Overview of Form 1187

Form 1187 serves as a critical tool in the realm of labor organizations, especially in the context of employee union membership and payroll deductions. This form is primarily used by employees to authorize their employers to deduct union dues directly from their paychecks. Its significance lies in the facilitation of seamless financial operations between members and their corresponding labor unions.

Essential features of Form 1187

Form 1187 is structured into key sections that capture vital information necessary for processing union dues. Each section has its specific focus, ensuring thorough information collection required by the involved parties.

Form 1187 not only stands alone but often integrates with other forms to provide a more comprehensive understanding of the employee's relationship within the labor organization.

Step-by-step instructions for completing Form 1187

Completing the Form 1187 accurately is crucial for ensuring that your payroll deductions are processed correctly. Let's break down the process into manageable steps.

Editing and modifying Form 1187 using pdfFiller

When it comes to modifying Form 1187, pdfFiller offers a user-friendly interface that simplifies the editing process. Its editing capabilities allow users to make changes swiftly and efficiently.

E-signing Form 1187

E-signatures have become increasingly essential in the electronic submission of documents like Form 1187. Utilizing pdfFiller for e-signing enhances the security and efficiency of document management.

Frequently asked questions (FAQs) about Form 1187

Navigating questions surrounding Form 1187 can help alleviate uncertainties about its usage and processing. Here are some common queries and their answers.

Tips for managing your Form 1187 documents

Effectively managing your Form 1187 and associated documentation is paramount for a smooth operational experience with payroll deductions. Follow these practical tips to stay organized.

Legal considerations and compliance related to Form 1187

Understanding the legal landscape surrounding Form 1187 is crucial for compliance and rights awareness. Labor laws are often complex, but they play a vital role in how unions operate.

Conclusion: Maximizing the benefits of using pdfFiller with Form 1187

Using pdfFiller alongside Form 1187 enhances the efficiency of your documentation processes. Through a cloud-based solution, users can easily collaborate, edit, and manage their forms, regardless of their location.

The importance of accurate form management cannot be overstated in maintaining a professional workforce. Insights gained from streamlined documentation lead not just to smoother operations but also foster better relationships between employees and unions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get form 1187?

How do I complete form 1187 online?

Can I create an electronic signature for signing my form 1187 in Gmail?

What is form 1187?

Who is required to file form 1187?

How to fill out form 1187?

What is the purpose of form 1187?

What information must be reported on form 1187?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.