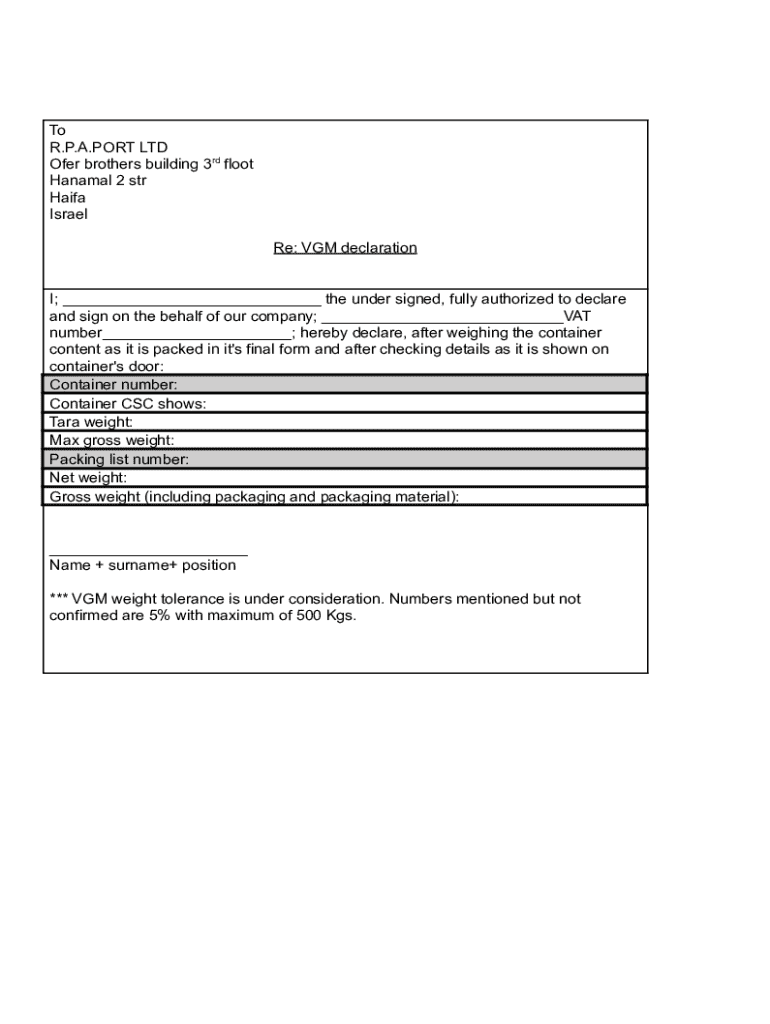

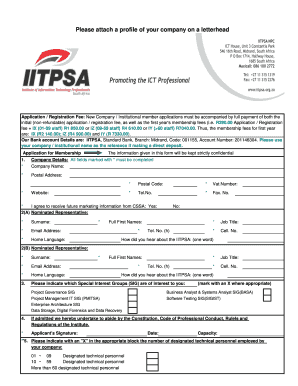

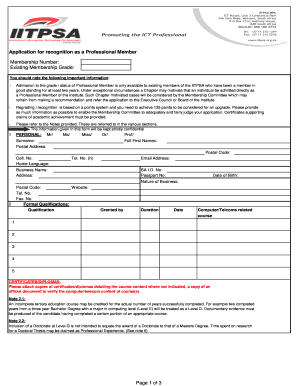

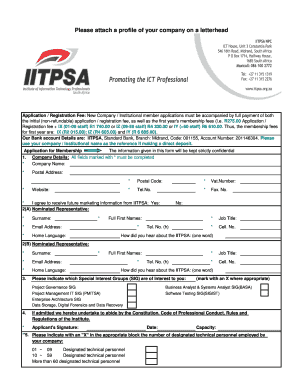

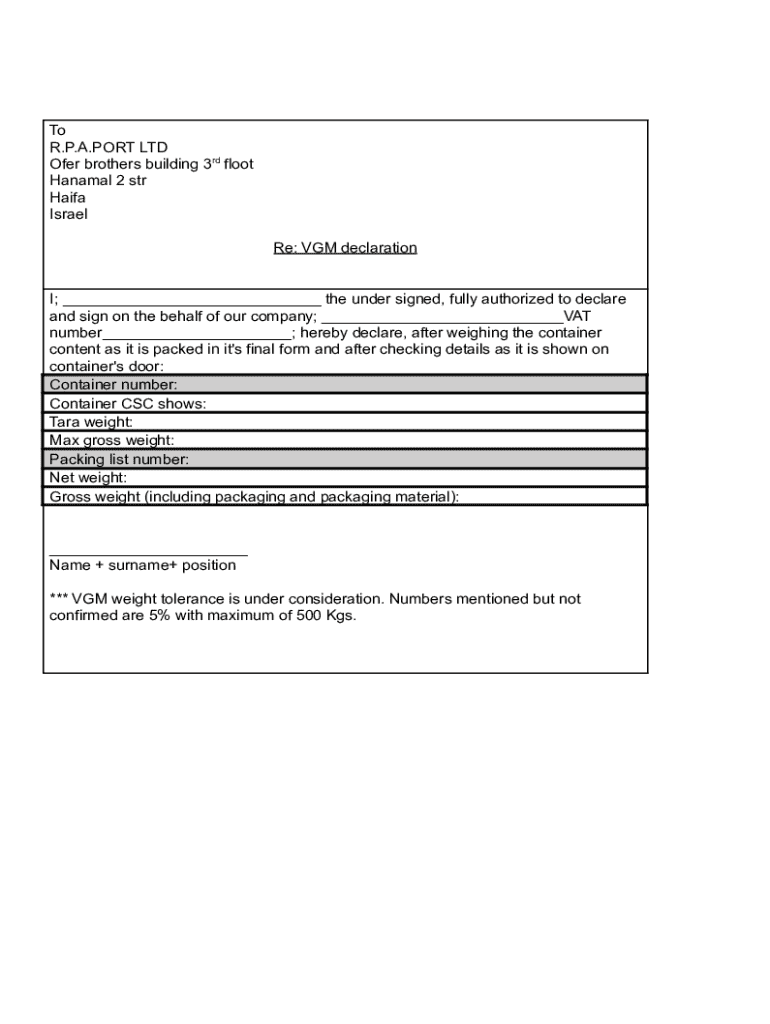

Get the free Verification of the gross mass of packed containers by sea

Get, Create, Make and Sign verification of form gross

How to edit verification of form gross online

Uncompromising security for your PDF editing and eSignature needs

How to fill out verification of form gross

How to fill out verification of form gross

Who needs verification of form gross?

Verification of Form Gross Form: A Comprehensive Guide

Understanding the gross form

The Gross Form is a crucial document utilized in various industries, encompassing essential data that impacts decisions, compliance, and accountability. This form serves as a formalized template for gathering necessary information, whether for transactions, administrative purposes, or regulatory compliance. Due to its significance, understanding its components and the importance of verifying its accuracy is paramount.

Key attributes of the Gross Form include clarity, precision, and the capacity for comprehensive data collection. Each field within the form has a designated purpose, and ensuring they are filled out correctly is essential for minimizing errors that can lead to significant repercussions. In the world of document management, verification of the Gross Form is a foundational aspect that preserves integrity and trust.

Verification plays a vital role in document management as it not only aids in maintaining accurate records but also enhances operational efficiency. By thoroughly reviewing submitted forms, organizations can prevent misunderstandings, financial discrepancies, and regulatory infractions. The process ultimately protects both the entity and its clients, building a more organized and lawful working environment.

Purpose of the gross form verification

Verification of the Gross Form matters significantly for various reasons. At its core, it ensures that the data presented in the form is accurate, complete, and compliant with applicable standards. Whether the form is utilized in financial reporting or compliance paperwork, inaccurate information can lead to costly mistakes. Therefore, effective verification processes are essential.

Common situations that necessitate the verification of the Gross Form include tax submissions, loan applications, and regulatory filings. Any deviation from the expected data can initiate audits, disputes, or financial penalties. Thus, proactive verification presents a safeguard against such unwanted consequences.

The benefits of accurate verification are multifold. Firstly, it enhances credibility, ensuring that stakeholders can trust the information provided. Secondly, it streamlines processes by reducing the need for corrections after submission. Finally, maintaining an organized system of verified documents fosters compliance and accountability, facilitating smoother operations.

Step-by-step guide to verifying the gross form

To efficiently verify the Gross Form, follow these straightforward steps:

Tools and features to enhance gross form verification

pdfFiller includes a range of interactive features designed to simplify the verification of the Gross Form. Real-time collaboration tools are particularly useful, enabling teams to work together on a single document from various locations. This significantly boosts efficiency and minimizes the chance of errors caused by miscommunication.

The auto-save and document management options allow users to manage their documents seamlessly. You can keep track of changes and revert to previous versions if necessary, ensuring that your content remains accurate over time. By utilizing templates within the platform, users can streamline the process, reducing redundancy and enhancing productivity.

Additionally, the cloud storage capabilities of pdfFiller offer users the advantage of accessing documents from anywhere at any time. This flexibility is essential in today’s fast-paced work environments, where remote work has become increasingly prevalent.

Common challenges in form verification and how to overcome them

Despite the systematic approach, challenges can arise during the verification process. Common mistakes often include incomplete fields, misinformation, or documents that lack the appropriate signatures. To address these issues, proactive measures must be taken.

Troubleshooting tips using pdfFiller entail utilizing its built-in validation checks that highlight inconsistencies in the submissions. Familiarizing yourself with the common pitfalls can further equip you to avoid them. If users encounter difficulties, pdfFiller offers support options, including tutorials, live chat, and a comprehensive help center.

Best practices for effective verification of gross forms

To ensure reliable verification of the Gross Form, adopting best practices is essential. Here are key strategies to consider:

Implementing these practices not only increases the accuracy of the verification process but also creates a more streamlined approach to document management, allowing organizations to respond efficiently to changes in requirements.

Conclusion and future considerations

The verification of the Gross Form is an evolving process. As compliance requirements shift and technology advances, staying informed on changes becomes imperative. Organizations must remain adaptable, continuously evaluating their verification methodologies and tools.

Moreover, leveraging platforms like pdfFiller will not only enhance current verification practices but also prepare users for future updates in form requirements, ensuring a proactive approach to document management.

Frequently asked questions about the gross form verification

Common queries regarding the verification of the Gross Form often stem from misunderstanding the requirements or the process itself. Here are some frequently asked questions:

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my verification of form gross in Gmail?

How can I modify verification of form gross without leaving Google Drive?

How do I execute verification of form gross online?

What is verification of form gross?

Who is required to file verification of form gross?

How to fill out verification of form gross?

What is the purpose of verification of form gross?

What information must be reported on verification of form gross?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.