Get the free 990-ez

Get, Create, Make and Sign 990-ez

How to edit 990-ez online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 990-ez

How to fill out 990-ez

Who needs 990-ez?

Comprehensive Guide to Filling Out the 990-EZ Form

Understanding the 990-EZ Form

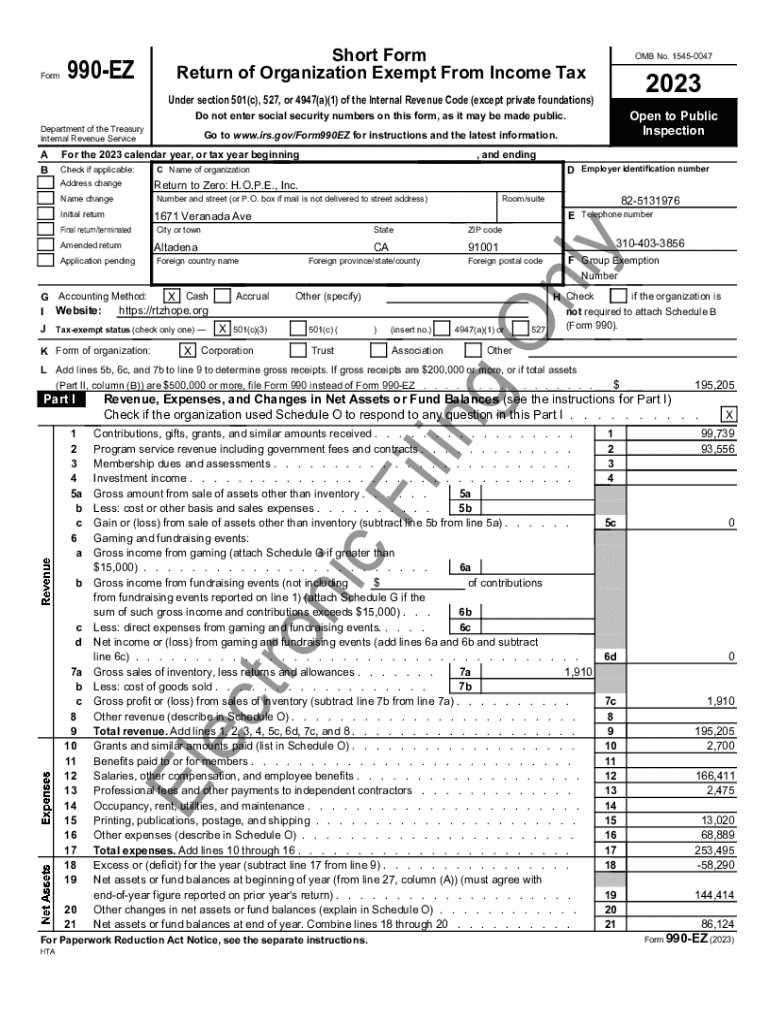

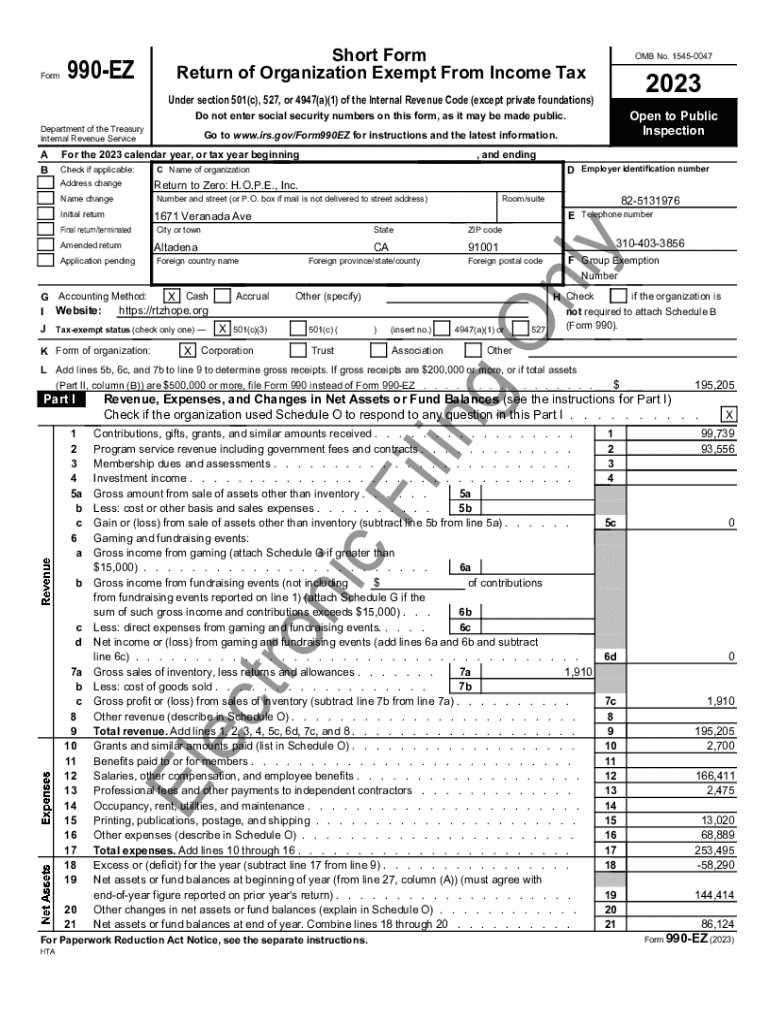

The 990-EZ form is a short version of the Form 990, used primarily by small to mid-size tax-exempt organizations to report their financial information to the IRS. This form serves a dual purpose: it ensures compliance with federal tax regulations while providing an overview of the organization’s financial health. Accurately filling out the 990-EZ form is crucial for maintaining your organization's tax-exempt status and continuing to receive public support.

For many community-based and regional organizations, the 990-EZ form represents an essential step in transparency and accountability. Beyond just a filing requirement, it communicates an organization's impact and effectiveness to donors, stakeholders, and the community at large.

Who must file the 990-EZ?

Eligibility to file the 990-EZ form is primarily determined by the organization's gross receipts and asset thresholds. Organizations with gross receipts less than $200,000 and total assets under $500,000 in the previous tax year can file this streamlined version, avoiding the complexity associated with the longer Form 990.

On the other hand, organizations that surpass these thresholds are required to file the full Form 990. Knowing your organization’s financial status is fundamental, as failing to file the correct form could result in penalties and loss of tax-exempt status.

Differences between Form 990 and 990-EZ

When determining whether to file the 990-EZ or the full Form 990, several key differences come into play. Generally speaking, smaller organizations that meet the specified gross receipts and asset limits will find the 990-EZ to be more manageable due to its brevity. However, organizations with larger financials must be prepared to provide more comprehensive details.

Essential filing information for the 990-EZ form

Filing deadlines for the 990-EZ are typically on the 15th day of the 5th month after the end of your organization’s fiscal year. For example, if your fiscal year ends on December 31, your filing deadline would be May 15 of the following year. It's a standard protocol for non-filing organizations to apply for an extension using Form 8868, granting them an additional six months to submit their paperwork.

To complete the 990-EZ, you will need specific organizational details, including your name, address, and EIN (Employer Identification Number), as well as financial data such as total income, expenses, and current assets. Accurate financial accounting and record-keeping are essential for this task, as discrepancies can lead to compliance issues.

Step-by-step instructions for filling out the 990-EZ

Filling out the 990-EZ involves several sections, each requiring specific information. The first part addresses your organization’s revenue and expenses, where you'll report your total revenue, contributions, and program service income against your total expenses, including administrative costs and fundraising activities.

To ensure accuracy and compliance, it's essential to avoid common pitfalls such as incomplete information or misreporting numbers. Double-checking entries, maintaining clear records, and adhering to financial reporting best practices will bolster your organization's credibility.

Common use cases for the 990-EZ form

The 990-EZ form is the preferred choice for many small nonprofits and charitable organizations. These entities typically operate with limited annual budgets and can responsibly report their financial information through this simplified format without incurring the unnecessary burden of lengthy reporting requirements associated with the longer Form 990.

Common examples of organizations that often file the 990-EZ include local charities, small environmental advocacy groups, and community service organizations. Under specific scenarios, these groups might need to opt for the full Form 990, notably when their revenue grows or they engage in activities that necessitate detailed disclosures.

Utilizing pdfFiller for efficient 990-EZ form management

Navigating the 990-EZ form can be streamlined through the use of pdfFiller, a robust platform for document management. To access the 990-EZ form on pdfFiller, users can navigate through an intuitive interface that facilitates locating the specific form needed for filing.

pdfFiller also provides interactive tools, including editing features that allow users to fill in the form directly, as well as eSignature capabilities that enable easy signing of documents electronically. Additional collaboration features facilitate team participation, allowing seamless cooperation among team members involved in filling out the form.

Resources for filing the 990-EZ form

As organizations venture into filing the 990-EZ, it's vital to access resources that clarify common questions and provide guidelines. Many websites, including the IRS's official page, offer FAQs about the filing process, helping organizations understand their requirements in detail.

Additionally, users can benefit from engaging in webinars and video tutorials available on various platforms, providing practical demonstrations of the filing process. Integrating these educational resources can enhance your understanding and confidence, ensuring your filings are accurate.

Understanding your filing obligations

Organizations must take their filing obligations seriously, as the consequences of non-compliance can be severe. Late or incorrect filings can lead to financial penalties and may risk your organization’s tax-exempt status. It's essential to keep abreast of filing deadlines and adjust your processes to prevent lapses.

Moreover, maintaining compliance goes beyond submitting the 990-EZ. Organizations should establish a consistent record-keeping system for receipts, minutes from board meetings, and other relevant documents, ensuring that everything is readily available in case of an audit.

Key considerations after submitting the 990-EZ form

Once the 990-EZ form has been filed, organizations can expect confirmation from the IRS. This acknowledgment should be retained as proof of submission. Establishing a habit of maintaining records for at least three years post-filing is recommended, as this aligns with IRS guidelines.

In preparing for future filings, organizations should track changes in revenue and other financial metrics actively. Adjusting plans and budgets in response to such changes ensures accurate filing and keeps stakeholders informed about the state of the organization.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit 990-ez on a smartphone?

How do I fill out the 990-ez form on my smartphone?

Can I edit 990-ez on an iOS device?

What is 990-ez?

Who is required to file 990-ez?

How to fill out 990-ez?

What is the purpose of 990-ez?

What information must be reported on 990-ez?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.