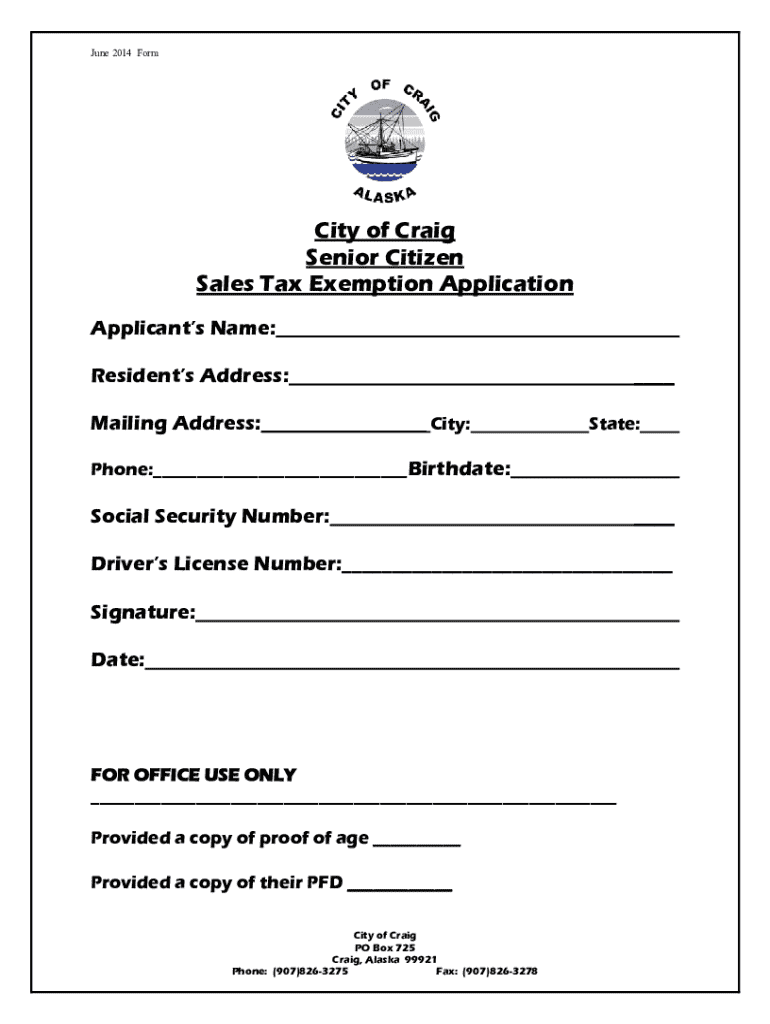

Get the free Senior Citizen Sales Tax Exemption Application

Get, Create, Make and Sign senior citizen sales tax

How to edit senior citizen sales tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out senior citizen sales tax

How to fill out senior citizen sales tax

Who needs senior citizen sales tax?

Senior Citizen Sales Tax Form: How-to Guide

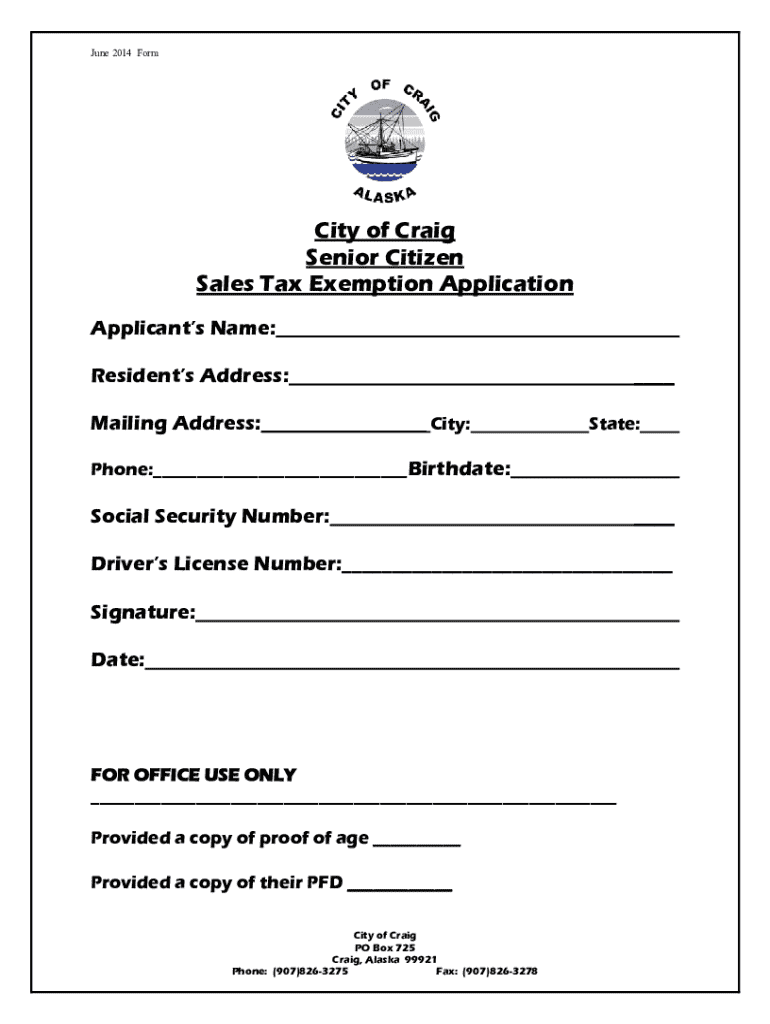

Understanding the senior citizen sales tax form

The Senior Citizen Sales Tax Form serves as a crucial document designed to assist eligible older adults in managing their finances effectively. Primarily, this form allows qualifying seniors to seek exemptions or reductions from state and local sales taxes on certain items, which can substantially lower their overall cost of living. To qualify, individuals typically need to meet specific age requirements—commonly 65 years or older—and, in many jurisdictions, must prove a limited income or financial need.

This form's role extends beyond mere financial relief; it plays a part in fostering community support for senior citizens. By providing tangible tax relief, local governments acknowledge the contributions of older adults while helping them maintain a sustainable standard of living.

Key features of the senior citizen sales tax form

An overview of the Senior Citizen Sales Tax Form reveals a user-friendly layout structured to simplify the application process for seniors. The form typically includes sections for personal information, income disclosure, and applicable deductions or credits that may impact tax liabilities. By employing clear headings and straightforward instructions, the form aims to minimize confusion and facilitate ease of use for its audience.

In terms of required documentation, seniors must present identification, proof of income, and any additional papers that validate their eligibility. This could include bank statements, tax returns, or documentation of retirement benefits.

Step-by-step guide to completing the senior citizen sales tax form

Completing the Senior Citizen Sales Tax Form requires careful attention to detail. Start by gathering necessary information, which includes not only personal details but previous tax returns and a summary of your financial situation. This foundational step ensures that you can provide accurate information when filling out the form.

While filling out the form, there are common mistakes to avoid. Ensure all sections are completed; double-check personal details for accuracy, and confirm your eligibility for any deductions before claiming them. Once the form is completed, review it thoroughly to ensure there are no clerical errors.

After preparing your form, you can submit it via various methods: online through designated government portals, by mail, or in person at local tax offices. Be mindful of the deadlines, as late submissions may result in the forfeiture of potential tax benefits.

Interactive tools for managing your returns

In today’s digital age, tools are available to streamline the completion of your Senior Citizen Sales Tax Form. One such resource is pdfFiller, which allows users to create and customize their tax forms effortlessly. With pdfFiller, seniors can fill out their forms using an intuitive interface that simplifies the process, making it accessible to all age groups.

Using pdfFiller not only saves time but also ensures your documents are completed accurately, making the entire tax filing process seamless and efficient.

Troubleshooting common issues

Despite the straightforward nature of the Senior Citizen Sales Tax Form, some users may encounter common issues when filling it out. Errors might arise from misunderstanding income categories or incorrectly applying tax credits. To resolve such errors, it is beneficial to revisit the instructions provided with the form and consult local tax assistance resources.

For specific inquiries, frequently asked questions (FAQs) can be a helpful resource. They often address common concerns, providing clarity on eligibility, submission procedures, and other essential details.

Staying informed on tax changes

Tax legislation continually evolves, meaning that understanding the latest updates impacting senior citizens is essential. Recent changes may include adjustments to minimum income thresholds for tax exemptions or alterations to the types of goods eligible for tax relief. By staying informed, seniors can effectively navigate their financial responsibilities and ensure they take full advantage of available benefits.

Being proactive about tax education empowers seniors not only to save money but also to avoid penalties that may arise from being uninformed.

Related forms and resources

For senior citizens, the Senior Citizen Sales Tax Form is just one of several tax-related documents they may encounter. Other relevant forms include property tax exemptions, income tax returns, and state-specific rebates that might further alleviate their tax burden. Understanding each form's unique requirements can aid in maximizing overall tax savings.

Consulting resources on reliable websites can simplify understanding these documents, enhancing overall tax literacy among seniors.

Contacting support for further assistance

Navigating the complexities of tax forms can be challenging, and assistance is often a crucial aspect of the experience. pdfFiller provides various support options to aid users in managing their Senior Citizen Sales Tax Form. Whether it's through live chat, detailed FAQs, or responsive email support, there are multiple avenues for resolving inquiries quickly.

Engaging with support resources not only enhances confidence but also ensures seniors can complete their forms accurately and without undue stress.

Understanding the broader implications of sales tax for senior citizens

Sales taxes can significantly impact the financial landscape for senior citizens, particularly those on fixed incomes. These taxes may consume a notable portion of their disposable income, leading to difficult choices regarding essential versus discretionary spending. Understanding how sales tax affects different income brackets enables seniors to advocate for necessary policy changes to retain their financial stability.

Ultimately, understanding the implications of sales taxes empowers seniors to take a proactive stance in addressing their financial needs and advocating for their rights.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find senior citizen sales tax?

Can I create an electronic signature for the senior citizen sales tax in Chrome?

How do I edit senior citizen sales tax on an iOS device?

What is senior citizen sales tax?

Who is required to file senior citizen sales tax?

How to fill out senior citizen sales tax?

What is the purpose of senior citizen sales tax?

What information must be reported on senior citizen sales tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.