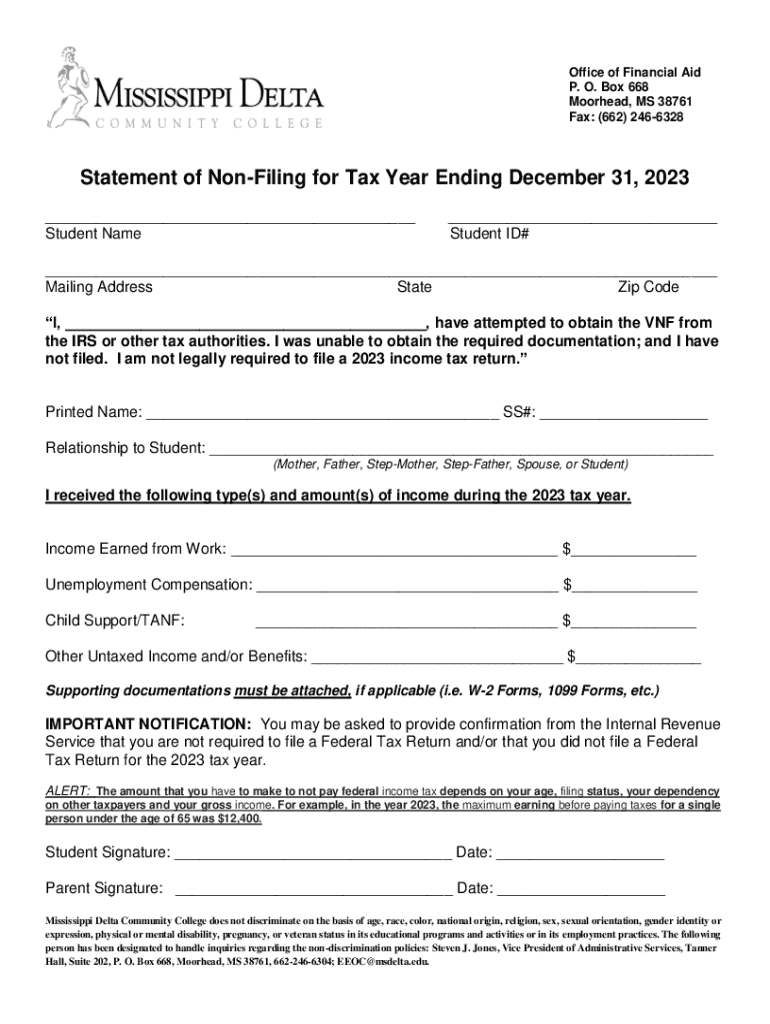

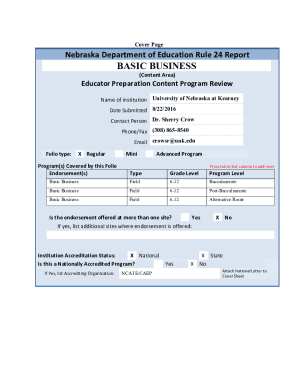

Get the free Statement of Non-filing for Tax Year Ending December 31, 2023

Get, Create, Make and Sign statement of non-filing for

How to edit statement of non-filing for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out statement of non-filing for

How to fill out statement of non-filing for

Who needs statement of non-filing for?

Everything You Need to Know About the Statement of Non-Filing for IRS Form

Understanding the statement of non-filing

A Statement of Non-Filing is an official document issued by the IRS that indicates an individual or business has not filed a tax return for a specified year. Unlike a tax return, which reports income and tax liability, the Statement of Non-Filing serves as proof that no return was submitted during that period. This document is often necessary when applying for financial aid, loans, or certain government benefits that require verification of your tax history.

The importance of the Statement of Non-Filing cannot be overstated; it provides verification for entities that need assurance regarding your tax status. It's a safeguard against fraudulent claims and helps ensure that all financial situations are transparent. The statement can come into play in common scenarios such as applying for student financial aid, securing loans, or clarifying tax obligations for audits.

Who needs a statement of non-filing?

Various groups may need a Statement of Non-Filing, each for different reasons. Individuals who have not filed taxes due to low income or absence of employment can benefit from this document. Business owners may require it to demonstrate a lack of financial activity or income generation. Understanding who needs this statement helps streamline the process of acquiring it and using it effectively.

Specific groups such as students who are applying for financial aid commonly require this statement to clarify their tax status to educational institutions. Likewise, low-income earners may find themselves needing the document when they apply for government assistance programs that require proof of non-filing as part of the eligibility assessment.

How to request a statement of non-filing

Requesting a Statement of Non-Filing can be done through several methods—online, via mail, or by phone. Each method has its own set of instructions and requirements. Knowing which method to use can save time and ensure you receive the document promptly.

Online request process

To request your Statement of Non-Filing online, follow these steps:

Requirements for using the online tool include having personal information such as your Social Security number, filing status, and the mailing address used on your last tax return.

Request via mail

If you prefer to request your Statement of Non-Filing via mail, here's what to do:

Request by phone

To request a Statement of Non-Filing by phone, follow these specific guidelines. Call the IRS at . Before making the call, have the following information ready:

Understanding the processing time

After submitting your request for a Statement of Non-Filing, it’s important to be aware of your waiting time. The expected processing time can vary, typically ranging from 5 to 10 business days for online requests. For mail requests, it may take between 10 to 30 days, considering postal delays and processing times.

Factors that influence processing times can include the volume of requests at the IRS, the specificity and accuracy of the information you provided, and whether additional verification steps are necessary. Consequently, ensuring you follow instructions carefully and submitting complete documentation can help mitigate delays.

Fees and charges

Obtaining a Statement of Non-Filing is generally free of charge. There might be fees associated with other forms or requests, but the non-filing statement itself does not incur a cost. Always consult the IRS website for the most current information regarding any potential fees especially if you require immediate service.

Payment methods are typically not applicable for the Statement of Non-Filing since it is provided for free. However, if you are submitting requests for other documents simultaneously, ensure you check the specified payment options for those.

Common issues and how to troubleshoot

Even with clear guidelines, issues may arise when seeking your Statement of Non-Filing. Address matching problems can occur if the personal information provided does not exactly match IRS records. To troubleshoot, verify that you entered your information correctly and consider contacting the IRS for clarification.

Inquiries about the application status can also be challenging. If you've submitted a request and haven't received your statement within the expected timeframe, you can call the IRS and provide them with your details. Additionally, if you disagree with your non-filing status or face other disputes, it’s advisable to follow up directly with the IRS to resolve these issues effectively.

Frequently asked questions (FAQs)

Here are some common questions that arise around the Statement of Non-Filing:

Related forms and documents

The IRS Form 4506-T, which you use to request a Statement of Non-Filing, is a vital document to understand. This form allows you to request not just your non-filing status but other tax transcripts as well. Familiarity with this form is key when needing various tax-related documents.

Other additional forms that may be relevant depending on your tax situation include Form 1040 for individual income tax returns and Form 941 for reporting payroll taxes. Understanding these forms and how they relate to your tax status is essential for navigating your financial responsibilities smoothly.

Important resources and contacts

For further assistance regarding your Statement of Non-Filing, the IRS offers extensive resources on their website, including detailed guidelines and telephone support. Additionally, many community organizations provide tax assistance services, making them a valuable resource for anyone navigating tax-related questions.

User-friendly IRS online tools can help you track forms, check your account status and verify your transcript history. Utilizing these resources can make the process of managing your tax documentation much easier.

Maximizing the use of your statement of non-filing

After obtaining your Statement of Non-Filing, it's crucial to know how to use it effectively. For financial aid applications, include this statement as required documentation, providing a clear picture of your tax status. Ensure that any documentation you submit is current and addresses all requested information.

To keep your documentation ever-reliable, create a personal checklist to ensure all necessary forms are collected, including the Statement of Non-Filing, whenever applying for loans or financial assistance. Keeping this document ready and accessible can alleviate stress and expedite application processes when needed.

Key takeaways for individuals and teams

To summarize, obtaining a Statement of Non-Filing is a straightforward process whether you choose to do it online, via mail, or by phone. Remember to check the IRS site for the latest procedures and to stay informed about your tax obligations. Having this statement on hand when needed can significantly aid in various financial processes, ensuring everything remains above board.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send statement of non-filing for to be eSigned by others?

How do I make edits in statement of non-filing for without leaving Chrome?

How do I edit statement of non-filing for on an Android device?

What is statement of non-filing for?

Who is required to file statement of non-filing for?

How to fill out statement of non-filing for?

What is the purpose of statement of non-filing for?

What information must be reported on statement of non-filing for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.