Get the free Form 1-k

Get, Create, Make and Sign form 1-k

Editing form 1-k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 1-k

How to fill out form 1-k

Who needs form 1-k?

Form 1-K Form: A Comprehensive How-To Guide

1. Understanding Form 1-K: The Basics

Form 1-K is a critical document in the investment landscape, designed specifically for companies that are raising capital through crowdfunding offerings. By requiring detailed disclosures, its purpose is to provide investors with accurate information about the company's financial status, business strategy, and risk factors. This transparency is essential for informed decision-making by potential investors.

The importance of Form 1-K cannot be understated. Not only does it serve as a foundational document that portrays a company’s financial health, but it also enhances investor trust. By adhering to disclosure requirements, companies can establish credibility, making it easier to attract potential investors.

1.1 What is Form 1-K?

Form 1-K is mandated by the U.S. Securities and Exchange Commission (SEC) for companies conducting crowdfunding under Regulation Crowdfunding. It represents a company's annual report, detailing financial performance, management insights, and additional disclosures. The primary aim is to ensure that investors have the information necessary to make sound investment choices.

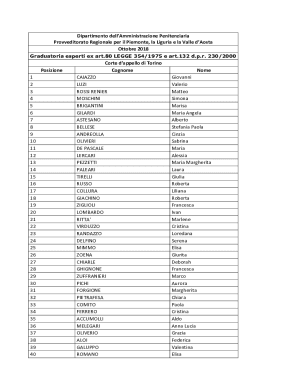

1.2 Who Needs to File Form 1-K?

All companies that utilize Regulation Crowdfunding and raise funds through this method are required to file Form 1-K. This includes businesses across various industries looking to expand through investor contributions. Not filing can lead to severe implications, including penalties and exclusion from future crowdfunding opportunities.

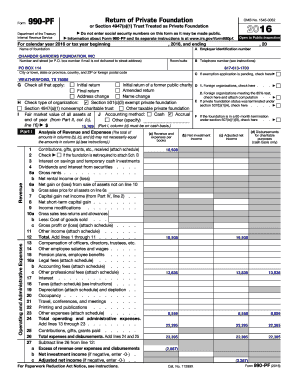

2. Key Components of Form 1-K

Form 1-K consists of several key components that need to be completed thoroughly and accurately. These sections collectively provide a comprehensive overview of the company's performance and future outlook. Understanding these sections is vital for both the filer and potential investors.

2.1 Overview of required information

Each section of Form 1-K covers different aspects of the company’s operations and financials. Key parts include:

2.2 Specific data points to include

For accurate reporting, specific data points must be included in each section:

2.3 Common errors to avoid

Filling out Form 1-K can be intricate, and common errors can arise, such as incomplete financial statements or vague descriptions. Here are some tips to help avoid these pitfalls:

3. Step-by-step guide to filling out Form 1-K

Filling out Form 1-K requires careful preparation and understanding. This step-by-step guide will walk you through the necessary documents, usage of tools, and detailed instructions for successfully completing the form.

3.1 Gathering necessary documents

Before starting, gather essential documents, including:

3.2 Utilizing pdfFiller's tools for completion

Utilizing pdfFiller can greatly simplify the process of filling out Form 1-K. This platform offers the following features:

3.3 Detailed instructions for each section

To facilitate accurate completion of Form 1-K, follow this structured approach:

4. Editing and signing your Form 1-K

After completing Form 1-K, the next important steps are editing and signing the document. This ensures accuracy and agrees upon the contents before submission.

4.1 Making edits with pdfFiller

Entering edits in Form 1-K is simple with pdfFiller. Users can utilize advanced editing tools to ensure accuracy and completeness.

4.2 How to eSign Form 1-K using pdfFiller

The eSignature integration is straightforward. Ensure all parties sign the form digitally, which streamlines the approval process substantially.

4.3 Collaborating with your team

Collaboration tools present in pdfFiller allow users to work seamlessly within teams, effectively addressing revisions or feedback on Form 1-K.

5. Submitting Form 1-K to regulatory bodies

Now that your Form 1-K is finalized, you need to prepare for submission. Failure to follow guidelines may lead to delays or rejections.

5.1 Understanding submission guidelines

Be aware of the submission guidelines stipulated by the SEC. Filers need to submit their Form 1-K electronically, ensuring that all information is presented clearly and accurately.

5.2 Deadlines and important dates

Key deadlines for submitting Form 1-K typically include:

5.3 What to do after submission

Once submitted, monitor for any feedback from the SEC. It is essential to address any questions or requests for additional information quickly.

6. Managing your Form 1-K after submission

Post-submission management is crucial for compliance and future filings.

6.1 Maintaining records for future reference

Organizing your filings effectively will assist with future disclosures. Create a filing system using pdfFiller to store your Form 1-K and related documents securely.

6.2 Responding to feedback from regulators

If regulators require further information or clarification, respond promptly. This demonstrates diligence and compliance.

6.3 Re-filing and amendments explanation

Changes may occur that necessitate amending your Form 1-K. Understanding the conditions for re-filing can save time and effort down the road.

7. Frequently asked questions about Form 1-K

Questions about Form 1-K often arise regarding its necessity and requirements. Here are some general queries and common misconceptions.

7.1 General questions and misconceptions

Investors sometimes wonder if Form 1-K is optional. It's critical to emphasize that it is mandatory for companies under Regulation Crowdfunding.

7.2 Filing specific inquiries

Companies regularly ask about filing procedures. Seeking information through the SEC’s official website or consulting legal professionals can provide clarity.

7.3 Technical support and troubleshooting tips

When using pdfFiller or submitting to the SEC, technical issues may arise—don’t hesitate to reach out to support resources available through pdfFiller.

8. Additional tools for document management with pdfFiller

pdfFiller offers several document management tools designed tailored for businesses seeking efficiency and accuracy.

8.1 Exploring pdfFiller’s document management features

From editing to storage and sharing, pdfFiller's comprehensive features make managing your Form 1-K seamless and effective.

8.2 Creating custom templates for future filings

Save time and exertion by creating custom templates. These can be reused for subsequent filings, minimizing the chance for errors.

8.3 Leveraging automation for your filing processes

Automation tools within pdfFiller can help streamline repetitive tasks, allowing businesses to focus on core activities.

9. Conclusion: The value of using pdfFiller for Form 1-K

Utilizing pdfFiller as a resource for preparing and managing your Form 1-K can enhance the filing experience. With its comprehensive tools, users are better equipped to ensure compliance.

9.1 Enhancing your filing experience

The platform's interactive features allow for an engaging experience that reduces anxiety around the complexities of filing.

9.2 Continuing support for your document needs

With continuous updates and features, pdfFiller remains a reliable ally in navigating document filing.

9.3 Ensuring compliance and confidence in your finances

Compliance with Form 1-K is essential for maintaining investor trust and positioning your company favorably in the market; using pdfFiller's tools, you can file with confidence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 1-k for eSignature?

How do I edit form 1-k in Chrome?

How do I edit form 1-k on an iOS device?

What is form 1-k?

Who is required to file form 1-k?

How to fill out form 1-k?

What is the purpose of form 1-k?

What information must be reported on form 1-k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.